Set in a Tiffany & Co. necklace, it sold for $4.2 million, the highest price and price per carat paid for a Paraíba tourmaline at auction.

10-Year Rewind: The Biggest Developments of the Decade

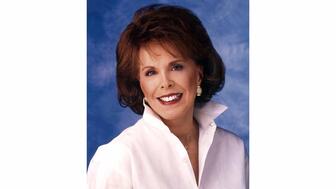

Editor-in-Chief Michelle Graff recounts the stories and trends of 2010-2019 that had the greatest impact on the fine jewelry industry.

I didn’t think about the fact that we are ending a decade until I saw the lists start popping up online—the best albums of the 2010s, the best movies, the worst fashion trends, the most unexpected celebrity breakups.

So, I decided to play along. Instead of doing my usual end-of-year article on the biggest stories of the past year, I expanded my scope.

With the help of a handful of retailers and others, I compiled a list of the developments that had the biggest impact on the fine jewelry industry between 2010 and 2019.

Here they are, presented in chronological order.

1. Instagram Launched

It’s strange to think about now but, back in 2010, Facebook (the open-to-everyone version) and Twitter were only 4 years old, the iPad was brand-new and there was no Snapchat, Uber, Alexa or Apple Watch.

And, until October of that year, there was no Instagram.

It did not take the photo-sharing app long to state its case as a social media platform with potential, and people took notice.

Less than two years after its launch, Facebook Inc. forked over $1 billion to own Instagram.

Today the photo-sharing app is, arguably, the most important social media platform for jewelry designers and retailers.

View this post on InstagramA post shared by National Jeweler (@nationaljeweler) on Dec 11, 2019 at 11:06am PST

Because they know what I do for a living, my friends constantly ask for my opinion on different pieces of jewelry or jewelry designers (yes, they like and wear jewelry, but they won’t find you if you’re not in the right places.)

When I ask where they saw a certain piece or became familiar with a designer, the answer is always Instagram.

Instagram is easy and fun, and has avoided becoming the cesspool of negativity, partisan political discourse and fake news that have turned people off sister site Facebook.

Its importance to brands and retailers will only continue to increase as it creeps closer to letting users shop directly on the platform.

Being able to shop on one’s smartphone from Instagram or other apps, known as mobile commerce or m-commerce, will play an even bigger role in the coming decade.

2. De Beers Shut Down the Diamond Promotion Service

It’s hard to believe this happened in the past decade, as the Diamond Promotion Service, or DPS, seems like a stone that’s been buried for a billion years.

I couldn’t find National Jeweler’s story on the closure, but I did find this mention of my story

The shuttering of De Beers’ U.S.-based marketing arm, which stoked diamond jewelry demand for generations with ad campaigns like “Shadows” and beacon programs like “Journey,” heralded the start of a dilemma that plagued the jewelry industry throughout the 2010s.

There wasn’t enough advertising for diamond jewelry, or any jewelry really. This, coupled with changing consumer style and desires, caused the industry to lose ground to electronics, handbags, cosmetics and experiences.

In 2015, the world’s biggest diamond miners finally got it together and formed the Diamond Producers Association, which has been developing marketing campaigns for natural diamonds.

And Jewelers of America is spearheading a consumer-facing marketing campaign designed to get consumers, particularly women who buy jewelry for themselves (more on that below), engaged with all types of jewelry.

It will be interesting to see what impact these campaigns have in 2020 and beyond.

3. Signet Bought Zale, LVMH Bought Tiffany

I started working on this blog post in early November and had a clear, single-story entry for No. 3—Signet Jeweler’s Ltd. 2014 purchase of Zale Corp.

Then a few weeks pass and, suddenly, Signet is forced to share.

Luxury Paris-based behemoth LVMH announced Nov. 25 it was acquiring iconic New York retailer Tiffany & Co. in a deal valued at $16.5 billion, for various reasons.

These two billion-dollar deals are the standout headlines in a decade during which consolidation and shrinkage were continual storylines for the U.S. jewelry industry.

Consider this: At the end of 2010, the Jewelers Board of Trade had the size of the North American jewelry industry pegged at 31,623—23,680 retailers, 4,543 wholesalers and 3,400 manufacturers.

Fast-forward to the third quarter 2019, and the JBT’s count has shrunk nearly 18 percent to 26,092—19,738 retailers, 3,777 wholesalers and 2,577 manufacturers.

4. There Was a Pitch to Ditch ‘Semi-Precious’

There have been a couple columns that have caused me to change how I approach my job at National Jeweler, and Monica Stephenson’s February 2015 InStore article advocating for elimination of the term semi-precious is one of them.

In it, the Anza Gems owner wrote there are many beautiful gemstones that could be considered both precious and rare that aren’t one of the “big four”—diamond, sapphire, ruby and emerald.

After I read her column, I instructed National Jeweler’s editors to stop using the term (which is not to say one or two mentions didn’t slip through the cracks over the years).

Monica is right, and her ahead-of-the-times column was the forerunner to a couple trends that will continue to impact the industry in the next decade—the rising popularity of color and the evolving conversation about the value of gemstones, both diamonds and colored.

5. The Casual Revolution Continued

There’s no specific date for this development, but I’ve decided to place it between Monica’s column (2015) and the industry’s marketing revelation because of the year in which the term “athleisure” was officially added to the dictionary—2016.

Athleisure refers specifically to clothing that, years ago, you would you have worn only to the gym.

It’s rise in popularity in recent years is the culmination of a larger, long-term cultural shift in the United States—people don’t “dress up” as much as they used to, whether they’re in the office, at the theater or out to dinner.

Retired Ohio jeweler Jim Alperin, who now resides in Florida, listed the casual revolution as one of the three main factors that’s going to impact the industry going forward.

“I get a television station that shows old shows, ‘Charlie’s Angels,’ ‘The Andy Griffith Show,’ ‘Gomer Pyle, U.S.M.C.’ etc. It’s amazing to see how styles have changed. Men were wearing three-piece suits to go to a ball game!” he wrote.

“The trend seems to be continuing and once the styles of old are lost, they will never return. I think that holds true for classic fine jewelry as well. Very few people go to a grand ball today or have reason to wear a diamond collar … it sits in the drawer or the bank.”

It’s an evolution that has jewelry companies and designers rethinking what kind of jewelry they make and considering what people are going to be doing when they wear it.

6. The Industry Had a Marketing Revelation

Former JCK Editor-in-Chief Hedda Schupak was writing about the importance of marketing fashion pieces to women buying jewelry for themselves in the early aughts, so it was no surprise the current editor of the Centurion newsletter listed the following among her top five most important developments of the decade.

At No. 4, she put: “The industry finally, FINALLY starting to acknowledge how important it is to sell jewelry as fashion to a female self-purchase audience.”

Like the casual-dressing revolution, it’s tough to pin an exact date on this one, though it’s worth noting De Beers made women buying their own jewelry the focus of its Forevermark marketing blitz in 2018.

Women also were the stars of the Diamond Producers Association’s “For Me, From Me” campaign that launched in early 2019, and they are the focal point of “Another Piece of Your Story,” the industry-led marketing campaign that just concluded its trial run.

7. ‘Where Was This Made’ Became a Big Conversation

At some point in the past decade, I was at a trade show somewhere (it all blends together after a while, no?) and I heard a De Beers executive say how at one point in time, the company never would have considered talking about its mines in marketing diamond jewelry.

The imagery surrounding mines—piles of dirt and clunky metal machinery—was not what De Beers wanted consumers calling to mind when they thought of luxurious, beautiful diamonds.

Fast-forward to the 2010s, and origin is all anyone wants to talk about it seems.

Consumers want to know where the gold, diamonds and colored gemstones in their jewelry come from, and the industry—including big players like De Beers, Tiffany and even the Gemological Institute of America—is telling them and utilizing new technologies, like blockchain, to help do so.

The issue of ethical sourcing and social responsibility are so big, in fact, they spawned a couple new events in an industry already over-scheduled with trade shows and conferences.

The Jewelry Industry Summit, an interactive forum on responsible sourcing, held its first event in New York City in March 2016 and has had several iterations since then, with its next planned for L.A. in March.

Meanwhile, the first Chicago Responsible Jewelry Conference took place in 2017 and, according to the organization’s website, plans for its fourth edition in 2020 are already underway.

8. De Beers Started Selling Lab-Grown Diamond Jewelry

Almost every single individual I reached out to for this story listed lab-grown diamonds—specifically, the ability to produce colorless or near-colorless diamonds in commercially viable quantities—as one of, if not the, biggest development of the past 10 years.

The decade’s tipping point with man-made diamonds came in May 2018, when De Beers announced it would begin selling inexpensive fashion jewelry set with blue, white and pink diamonds grown in its factory in the U.K.

The brand name for the line is Lightbox.

Originally, it was only sold online, but De Beers was clear from the outset that it wanted to take the line into brick-and-mortar retail as well.

This fall, Bloomingdale’s and Reeds Jewelers became the first physical retailers to carry Lightbox.

Following De Beers’ announcement, more and more retailers picked up lab-grown diamond lines—most significantly Signet—which now sells them at all its major U.S. jewelry banners, JCK’s Rob Bates reported.

Lab-grown diamonds aren’t going away, and they will be an integral part of the coming decade too as their place in the industry solidifies.

What will be their market share?

What will consumers buy them for, exactly? (Hedda wrote lab-grown diamonds “will probably replace the ‘frozen-spit’ category of mined diamonds in lower-end or discount jewelry.”)

How are they going to impact the value of natural diamonds?

And, how are they going to affect consumer perception of natural diamonds?

As my retired retailer friend Jim put it: “You may not like man-made diamonds … but they are a part of today and tomorrow’s jewelry industry.”

Normally, I would end a blog post like this with something along the lines of, “I’m sorry if I’ve missed something.” But I won’t because eliminating unnecessary apologizing is one of my resolutions for 2020.

Happy holidays to all! See you next year.

The Latest

The jeweler’s “Deep Freeze” display showcases its iconic jewelry designs frozen in a vintage icebox.

Take luxury gifting to new heights this holiday season with the jeweler’s showstopping 12-carat sphene ring.

How Jewelers of America’s 20 Under 40 are leading to ensure a brighter future for the jewelry industry.

This year's theme is “Unveiling the Depths of the Ocean.”

In its annual report, Pinterest noted an increase in searches for brooches, heirloom jewelry, and ‘80s luxury.

Starting Jan. 1, customers can request the service for opal, peridot, and demantoid garnet.

Roseco’s 704-page catalog showcases new lab-grown diamonds, findings, tools & more—available in print or interactive digital editions.

The 111-year-old retailer celebrated the opening of its new location in Salem, New Hampshire, which is its third store in the state.

The new catalog features its most popular chains as well as new styles.

The filmmaker’s personal F.P. Journe “FFC” prototype was the star of Phillips’ recent record-setting watch auction in New York.

The new location in the Design District pays homage to Miami’s Art Deco heritage and its connection to the ocean.

Inflations, tariffs, and politics—including the government shutdown—were among consumers’ top concerns last month.

“Longtime favorite” presenters, as well as first-time speakers, will lead talks and workshops at the annual event in Tucson next year.

Silas Smith of Meridian Metalworks won the challenge with his pendant that blends Australian and American landscapes.

The sale of the 31.68-carat, sunset-hued stone was part of Sotheby’s first series of events and auctions in Abu Dhabi.

Most customers who walk into your store this month have made up their minds. Your job is to validate their choice, Emmanuel Raheb writes.

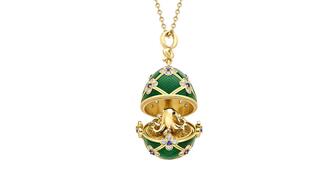

The collection features characters and motifs from Ukrainian folklore, including an enchanted mirror and a magic egg.

MatrixGold 3.11, the newest version of the jewelry design program, offers more flexibility, precision, and creative control.

The pavilion will be part of the 2026 JA New York Spring show, scheduled for March 15 to 17.

Kadet, a 1994 National Jeweler Retailer Hall of Fame inductee, helped grow the family-owned retailer in the Chicago area and beyond.

Billed as the world’s smallest wearable, Lumia Health’s new smart earrings have a health tracker subtly embedded in the back.

Don’t let those with December birthdays feel blue. Help them celebrate their month with blue zircon, turquoise, and tanzanite.

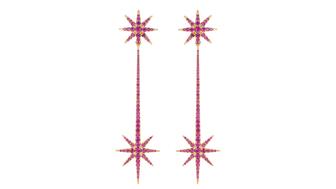

The new pink sapphire version of the piece dances with its wearer in the brand’s “Icons After Dark” holiday campaign.

A choice that’s generated a lot of commentary, Pantone says “Cloud Dancer” marks a fresh start and encourages relaxation and creativity.

The manufacturer’s holiday campaign features a gift guide filled with trending designs and jewelry that can be personalized.

The man was charged with theft, accused of ingesting the necklace while in a jewelry store in Auckland, New Zealand.