The Most Memorable Jewelry Auction Moments of 2023

From record-setting gems to celebrities and controversy, Associate Editor Lauren McLemore looks back on the year’s most intriguing sales.

Since April, I’ve written about all sorts of auction activity, from highly anticipated pieces that were pulled from the lineup to large jewels that seemed to vanish mid-sale.

It was difficult to narrow it down to a short list, but some sales did stand out more than others this year.

Here are my six most memorable jewelry auction moments of 2023.

The Bidding Wars I Wished I Had Witnessed

Auctions generally aren’t known as nail-biter events, save for a few remarkable offerings here and there. However, there’s an exciting energy that permeates the room when bidders get competitive.

At Sotheby’s “Magnificent Jewels and Noble Jewels” auction in Geneva in May, an 11.16-carat fancy vivid blue diamond was all the rage.

The “Bulgari Laguna Blu” was presented as the final lot of the jewelry auction’s second session and quickly became the subject of a four-minute bidding war between one buyer who was present and three on the phone.

In the end, the diamond sold for $25.2 million (a touch above its $25 million estimate) and found its first new owner in 50 years.

It is the most valuable gem set into a piece of Bulgari jewelry ever sold at auction, Sotheby’s said.

Another blue diamond prompted seven minutes of bidding before eventually selling at Christie’s Geneva jewelry sale in November.

The 17.61-carat pear-shaped “Bleu Royal” diamond eventually went for $44 million, in the middle of its estimated range of $35 million to $50 million.

The auction house said the Bleu Royal is the largest IF fancy vivid blue diamond ever to come to auction and one of only three fancy vivid blues weighing more than 10 carats ever to appear at a Christie’s sale.

The Record-Breaking Double Whammy

Speaking of big, juicy gemstones, Sotheby’s sold two for more than $30 million each on the same day—a first for any auction house—at its June “Magnificent Jewels” auction.

Less than a year after it was mined, a Mozambiquan ruby dubbed the “Estrela de Fura 55.22” sold for $34.8 million (estimate $30 million). It set a world record for a ruby and any colored gemstone at auction and was bought by a private collector from the Middle East.

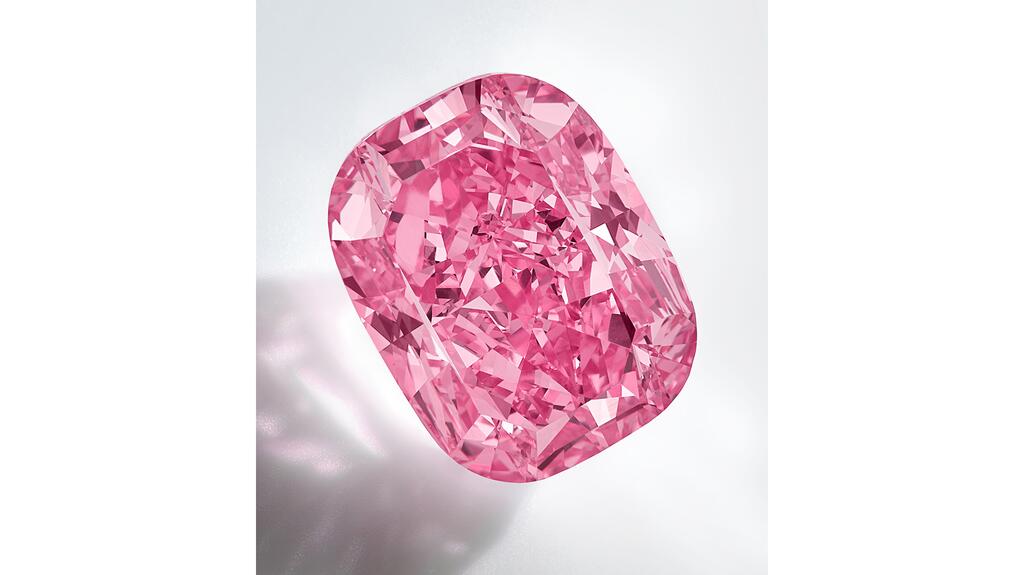

A 10.57-carat fancy purplish-pink diamond, “The Eternal Pink,” also sold for $34.8 million, setting a world auction record for a fancy purplish-pink diamond and a new price-per-carat record for the color grade.

Total sales at the auction added up to $95.9 million (estimate $87.9 million– $99.1 million), setting yet another record as the highest ever total for any jewelry auction ever staged at Sotheby’s in New York.

The previous record of $65.1 million was set in April 2015.

The Other Notable Record-Setting Sale … With A Side of Controversy

This next sale I didn’t personally cover, but I’d be remiss to not include it in this memorable auction moments wrap-up.

When Christie’s announced in March it was offering the 700-piece collection of late Austrian billionaire Heidi Horten, the largest and most valuable private jewelry collection ever to come to auction, I was already locked in to Associate Editor Lenore Fedow’s coverage.

The auction house estimated “The World of Heidi Horten” would surpass the record set by the sale of renowned jewelry lover Elizabeth Taylor’s private collection in 2011 (total: $137.2 million).

Before any of the auctions began, The New York Times published details on how Heidi’s husband, Helmut Horten (the late German billionaire behind the now-closed Horten’s chain of department stores) built his empire by buying businesses from Jewish business owners forced to sell their companies for almost nothing by the Nazis.

In response to the controversy, Christie’s said it would donate a “significant” portion of the final sale proceeds to an organization that furthers Holocaust research and education, but Jewish organizations still objected to the sale to (almost) no avail.

The auction house continued with the May sale, with the collection bringing in a record-breaking $156 million in the first part, and an added total of nearly $200 million by the end of the second sale.

The final segment of the auction, scheduled for November, was ultimately canceled.

The Celebs-Supporting-Celebs Moment

It’s not too often that we get to know who buys the pieces we fall in love with from afar, so when a buyer is revealed, it’s a bit of a treat.

Drake took the cake for me this year when he revealed himself as the buyer of Tupac Shakur’s self-designed crown ring, which he wore in his last public appearance in 1996.

At Sotheby’s July auction of hip-hop memorabilia, the gold, ruby and diamond piece blew its $200,000 estimate out of the water, garnering more than $1 million from the rapper.

The ring was the only hip-hop artifact in the sale to surpass $1 million, according to Sotheby’s.

I also enjoyed the moment Kim Kardashian was revealed as the buyer of Princess Diana’s cross necklace, which appeared in Sotheby’s online “Royal & Noble” sale back in January.

She paid nearly $200,000 for the piece (estimate $96,000—$144,000).

The Piece I Would’ve Taken Home

Speaking of celebrities … as a certified, die-hard Swiftie, I was completely smitten when this starfish brooch, designed by Spanish surrealist artist Salvador Dalí, hit the auction block.

The “Étoile De Mer” sold for $982,000 at Christie’s June Magnificent Jewels auction in New York, and although it fell below its $1 million-1.5 million estimate, some wagered it was the most valuable piece of jewelry by the artist ever sold at auction.

If you’re wondering what this has to do with Taylor Swift, stick with me.

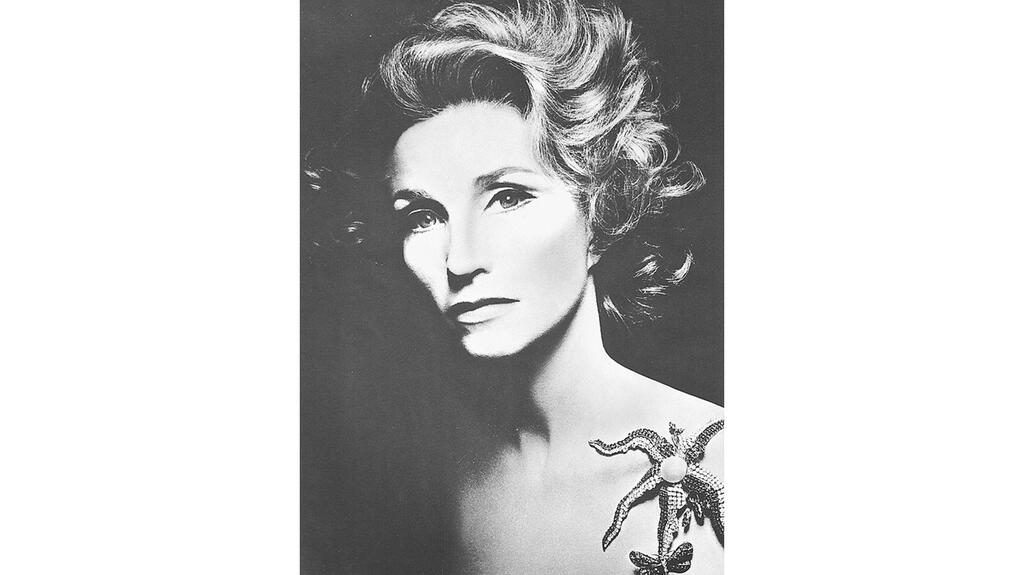

The brooch once belonged to the eccentric Rebekah Harkness, a composer, socialite, sculptor, dance patron, and philanthropist who founded Harkness Ballet.

In 1947, Harkness married Standard Oil heir William Hale Harkness. The couple purchased a mansion in Watch Hill, Rhode Island, they named Holiday House, where they threw raucous parties featuring high-society guests, which continued even after William died in 1954.

Dalí frequented the gatherings and helped with sets for Rebekah’s ballet; the two were friends.

Swift found a muse in the rebellious heiress, introducing Harkness to younger generations in a song from her “Folklore” album, “The Last Great American Dynasty.”

She even alludes to the socialite’s friendship with Dalí, recounting in the song how Harkness, “Blew through the money on the boys and the ballet / And losin’ on card game bets with Dalí.”

Oh, and she also bought Holiday House.

The Lot That Revealed New Royal History

My final favorite auction moment of the year is one I didn’t expect to be so invested in.

The November Sotheby’s Geneva auction “Vienna 1900: An Imperial and Royal Collection” featured almost 250 priceless historical treasures from Europe’s greatest princely families.

The event received attention for being a white-glove sale and for being the largest collection of imperial and royal jewelry ever put up for auction, according to the auction house.

The sale featured jewels found in worn travel bags stashed in a German bank safe, undiscovered, and undisturbed, for more than half a century.

The bags contained some jewels deposited in 1948 and others deposited in 1968, linking two women with a shared destiny in the tumultuous world of 20th-century imperial Europe: Princess Eudoxie of Bulgaria and Archduchess Maria Immaculata of Austria-Tuscany. (I’ll spare you the riveting details of their vast family tree.)

Princess Eudoxie’s story begins during World War II in 1944, when the Red Army was preparing to enter Bulgaria. Realizing the monarchy was in its final hours, she sewed her family jewels into pieces of fabric and buried them in her garden.

When she later found herself under house arrest, a prisoner of the Soviets, the princess secretly dug up the jewels and was able to transfer them to her sister-in-law Giovanna of Savoy, wife of Tsar Boris III of Bulgaria.

In 1946, the country’s communist leaders, wanting to do away with the monarchy for good, allowed the last members of the royal family to go.

The women fled to Germany, and the jewels eventually were deposited into the bank vault.

A young Archduchess Maria Immaculata of Austria-Tuscany left Vienna for Germany decades after marrying Duke Robert of Württemberg, and she took mementos of her imperial past with her.

After the death of her husband, she spent her final years compiling the history of her jewels before also leaving her collection in the family vault in 1968.

When her jewels were recovered, each was still preserved in its original box, and many had accompanying handwritten notes describing their provenance.

Philipp von Württemberg, who, through his company Philipp Württemberg Art Advisory GmbH, helped organize the auction, was left speechless at the initial opening of each box and was visibly moved when recounting that moment for the press.

Over two sessions, hundreds of bidders globally “fought over” every lot, said Sotheby’s, with many pieces garnering interest from more than five bidders.

So, I suppose this sale also is deserving of an honorary spot in my “bidding wars” category.

On that note, here’s to more incredible stories and edge-of-my-seat auction moments in the new year.

After all the excitement of this year, I can’t wait to see what the auction houses have in store for 2024.

The Latest

Bulgari named Gyllenhaal as its brand ambassador for his embodiment of artistic depth, intellectual curiosity, and warmth.

Awards were given to four students, one apprentice, and an emerging jeweler.

The top jewelry lot of the late model’s estate sale, hosted by John Moran Auctioneers, was an Oscar Heyman & Brothers for Cartier necklace.

Every jeweler faces the same challenge: helping customers protect what they love. Here’s the solution designed for today’s jewelry business.

Moses, who started at GIA’s Santa Monica lab in 1976, will leave the Gemological Institute of America in May.

Increased competition, falling lab-grown diamond and moissanite prices, and the rising cost of gold took a toll on the moissanite maker.

The earrings, our Piece of the Week, feature pink tourmalines as planets orbiting around an aquamarine center set in 18-karat rose gold.

With refreshed branding, a new website, updated courses, and a pathway for growth, DCA is dedicated to supporting retail staff development.

“The Price of Freedom” campaign video for International Women’s Day confronts the quiet violence of financial control.

Also, a federal judge has ordered that companies that paid tariffs implemented under the IEEPA are entitled to refunds.

The ever-growing collection, which just expanded with the addition of Olga of Kyiv, features cameos of 12 women from history.

We asked a jewelry historian, designer, bridal director, and wedding expert what’s trending in engagement rings. Here’s what they said.

The annual event will be held in Orlando, Florida, from Sept. 14-17.

The “Outlander” star modeled for the digital cover of the magazine’s spring issue, which features a story on her relationship with jewelry.

This year’s annual congress, which will mark the confederation’s 100th anniversary, will take place this fall in Italy.

Beverly Hills was chosen as the location for the brand’s first store, designed as a “private residence for modern monarchs.”

Kering, Apple, and other retailers have reportedly temporarily closed stores in the Middle East region in light of the recent conflicts.

Nearly half of buyers are prioritizing silver and fashion collections this season, organizers said.

The “Live Now. Polish Later.” campaign features equestrians wearing the brand’s jewels while galloping across the icy plains of Kazakhstan.

The precious metals provider has promoted Jennifer Ashworth to the role.

Nelson will be honored as the inaugural grant winner at the Gem Awards gala on March 13.

Experts from India weigh in the politics, policies, and market dynamics for diamantaires to monitor in 2026 and beyond.

The American precious metals refiner’s day-to-day operations remain the same post-acquisition.

These aquamarine jewels channel the calming energy of the March birthstone.

The “Innovative Design” category and award will debut in the Spectrum division of this year’s AGTA Spectrum & Cutting Edge Awards.

Consumers were somewhat less worried about the future, though concerns about rising prices and politics remained.

Foerster is this year’s Stanley Schechter Award recipient.