Chicago police and members of the U.S. Marshals Service tracked down the 35-year-old suspect earlier this week in St. Louis.

5 Takeaways from De Beers’ Diamond Insight Report

Relationships may evolve but diamonds are forever, according to De Beers.

New York—De Beers Group published its sixth Diamond Insight Report last week, presenting its findings to press, sightholders, vendors and industry executives at the Four Seasons in New York.

The theme of this year’s report was the role diamonds continue to inhabit as symbols of love and commitment, even as society and relationships evolve.

“It’s not that love somehow goes away. It’s just that it changes the way people relate to diamonds,” Esther Oberbeck, head of group strategy at De Beers, said in an interview with National Jeweler.

Here are five takeaways from the research and insight from a chat with Oberbeck.

1. An increasing number of women are buying their own engagement rings.

The growing trend of women buying jewelry for themselves has permeated the commitment jewelry space, too.

The percentage of U.S. women who bought their own engagement rings has doubled to 14 percent within a five-year period, according to the report.

“These are women who are very successful in their careers and want to mark this occasion with something meaningful and, perhaps, have taken on the role of head of household,” said Oberbeck.

When women buy their own rings, they spend on average 33 percent more than men—$4,400 compared with $3,300.

De Beers interpreted this data as a sign of “increasing female purchasing power and the continuing evolution of financial dynamics within modern relationships.”

2. Relationships may be changing, but diamonds remain a constant.

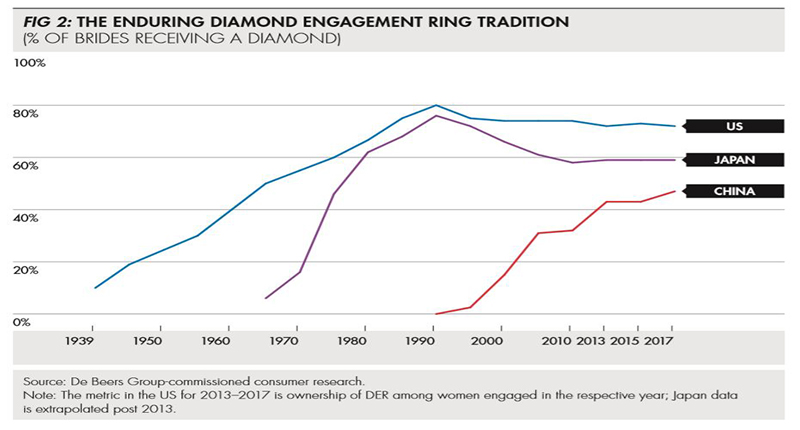

While the marriage rate in the United States is on the decline and engagement periods have lengthened, diamonds are still the top choice for engagement rings.

In the U.S., nine out of 10 engagement rings and eight out of 10 wedding bands feature diamonds.

Modern-day couples see engagement and marriage as part of a journey, rather than the beginning, Oberbeck said.

“They are still embracing the tradition of marriage and engagement, but they are also looking to express themselves in a much wider way than just the traditional, romantic, old-fashioned way.”

Oberbeck said De Beers is moving away from the idea of diamonds for just bridal to the broader concepts of exchanging diamonds for all types of commitments and as expressions of love.

“In

3. For the first time, same-sex couples were interviewed for the report.

De Beers surveyed same-sex couples and found, unsurprisingly, that expressions of love and commitment didn’t differ greatly from those of male-female pairs.

The survey included 124 individuals in same-sex relationships in the United States and 175 in China, but did not include non-binary couples, or couples including people who do not identify as male or female.

More than 70 percent of people in same-sex relationships said diamonds were an important aspect of celebrating their relationship and special events.

When purchasing diamond jewelry, the survey found same-sex couples lean toward modern designs and eschew gender-specific styles.

“The desire for custom and unique ring design is driven by a shortage of appropriate products on offer—female designs are too feminine, while men’s rings are too plain and masculine,” the report states.

Same-sex couples have a higher average income than different-sex couples—$56,000 compared with $46,000—and tend to spend more on commitment jewelry.

The reported also noted that same-sex couples favor stores that make them feel welcome or have ties to the LGBT+ community and are drawn to brands that spread a message of inclusivity, like Forevermark and Tiffany & Co., as well as designers on Instagram.

“They require more inclusivity. They want to see same-sex couples in marketing materials, etc., and I think the industry must respond,” Oberbeck said.

4. Interest in brands continues to grow.

Brands are taking a bigger piece of the pie, representing two-fifths of sales of commitment jewelry in the U.S.

International luxury jewelry and designer brands together represented 41 percent of sales value of diamond engagement rings in the U.S. in 2017, compared with 29 percent in 2015.

Same-sex couples in the U.S. are especially interested in brands, with 60 percent of couples purchasing a branded engagement ring. Male couples were more likely than female couples to buy a branded piece of jewelry, according to the report.

Millennials also have a strong interest in brands, noted De Beers.

“Brands are successful in the commitment segment when they approach the market with a deep understanding of millennials’ attitudes to true love and the changing nature of committed relationships,” the report states.

5. Millennial interest in diamonds is strong, but they wear them differently.

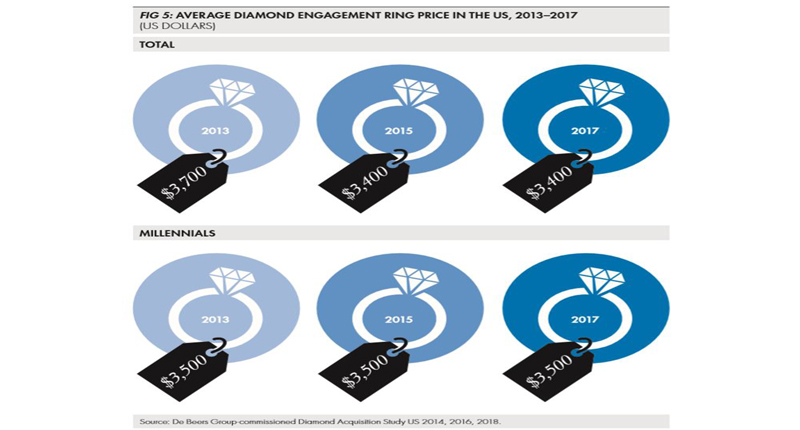

Branded or unbranded, millennials’ interest in diamonds is strong and they spend more than other couples on engagement rings.

The average amount spent on engagement rings by millennials in the U.S. is slightly higher than the overall average spend on engagement rings in the U.S.

Millennials spent an average of $3,500 on engagement rings in 2017, compared with the overall average spend of $3,400.

However, the report also notes there has been a slight decline in the average price paid for diamond engagement rings over the last five years.

Retailers looking to meet demand for a lower price points have begun to include smaller center stones and use diamond melee to create the illusion of a larger diamond.

RELATED CONTENT: Kirk Kara Targets Millennials with Minimal, Low-Cost Bridal“The price sensitivity of millennial consumers and jewelers’ willingness to respond to the needs of this younger generation by changing the mix of diamonds used in engagement rings have led to heavier design and greater total diamond content,” De Beers said.

While the average size of the main stone is declining, the overall diamond weight is on the rise.

In 2017, 28 percent of engagement rings had a center stone that was a quarter-carat or less, up from 18 percent in 2013. Engagement rings with a center stone weighing more than 1 carat fell to 33 percent in 2017, compared with 42 percent in 2013.

Meanwhile, the total carat weight of diamond engagement rings in the U.S. has risen in that five-year period, from 1 carat to 1.70 carats.

Looking at the report as a whole, Oberbeck said the U.S. is “a very resilient market, but also a market that requires the traditional retail trade to look out into new ways of expression as well if this is to be maximized in the future.”

The Latest

Owners of the Ekapa Mine reportedly filed for liquidation about a week after a mudslide trapped five workers who have yet to be found.

A 10-year alliance has also begun to address the shortage of bench jewelers through scholarships, enhanced programs, and updated equipment.

Every jeweler faces the same challenge: helping customers protect what they love. Here’s the solution designed for today’s jewelry business.

The “Splendente” collection has evolved to feature hardstone letter pendants, including our Piece of the Week, the onyx “R.”

The jewelry collection belonged to “one of society's most glamorous and beautiful women of the mid-20th century,” said the auction house.

The update came as Anglo took its third write-down on the diamond miner and marketer, which lost more than $500 million in 2025.

With refreshed branding, a new website, updated courses, and a pathway for growth, DCA is dedicated to supporting retail staff development.

Emmanuel Raheb discusses the rise of “GEO” and the importance of having well-written, quality content on your website.

Each received around four years for burglarizing a jewelry store and a coffee shop in Simi Valley, California, last May.

Catherine Aulick, a GIA graduate, received the ninth and final Gianmaria Buccellati Foundation Award for Excellence in Jewelry Design.

We asked a jewelry historian, designer, bridal director, and wedding expert what’s trending in engagement rings. Here’s what they said.

Experts from India weigh in the politics, policies, and market dynamics for diamantaires to monitor in 2026 and beyond.

Beth Gerstein discusses the vibe of the new store, what customers want when fine jewelry shopping today, and the details of “Date Night.”

Are arm bands poised to make a comeback? Has red-carpet jewelry become boring? Find out on the second episode of the “My Next Question” podcast.

The Swiss watchmaker is battling declining sales amid a rapid retail expansion, according to a Financial Times report.

The campaign celebrates Giustina Pavanello Rahaminov, the co-founder’s wife and matriarch of the family-owned brand, for her 88th birthday.

Rachel Bennett, a senior jeweler who has been with Borsheims since 2004, earned the award.

After the Supreme Court struck down the IEEPA tariffs, President Trump imposed a 10 percent tax on almost all imports via a different law.

The industry veteran, who was with The Edge Retail Academy for 14 years, joins her husband at the company he founded in 2022.

The vintage signed jewelry retailer chose Miami due to growing client demand in the city and the greater Latin American region.

Former Flight Club executive Jin Lee will bring his experience from the sneaker world to the pre-owned watch marketplace.

Sakamoto, who died in mid-January following a sudden illness, is remembered for his humility and his masterful, architectural designs.

The April event will feature a new VIP shopping day requiring a special ticket.

Bulgari chose the British-Albanian singer-songwriter for her powerful and enduring voice in contemporary culture, the jeweler said.

In a 6-3 ruling, the court said the president exceeded his authority when imposing sweeping tariffs under IEEPA.

Smith encourages salespeople to ask customers questions that elicit the release of oxytocin, the brain’s “feel-good” chemical.