Chris Blakeslee has experience at Athleta and Alo Yoga. Kendra Scott will remain on board as executive chair and chief visionary officer.

Squirrel Spotting: Why I Don’t Worry About Brick-and-Mortar Retail

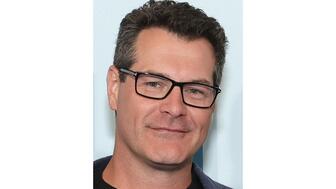

Peter Smith says the idea that people will want to continue to do everything online post-pandemic is “complete and utter rubbish.”

There is a maxim that says, if customers don’t want to come nothing will stop them.

As maxims go, it’s about as topical as any in a retail environment that has seen foot traffic, or footfall, as my friends across the pond like to say, continue to decline.

That years-long trend, exacerbated by the disruption of COVID-19, might give one pause in projecting sunny days for brick-and-mortar retail.

Lord & Taylor, the first department store in the United States, went out of business just a few years shy of its 200th anniversary.

Pier 1, which started in 1962 as Cost Plus, took their 900 stores into bankruptcy in May, just three months or so after attempting to survive by announcing that they would close half of their stores.

Sur La Table, Brooks Brothers and Modell’s Sporting Goods also went Chapter 11, and Neiman Marcus has gone in and out of bankruptcy since the arrival of COVID-19.

So, what exactly is going on? What are we to make of the evolving retail landscape, particularly as it relates to brick-and-mortar stores?

Amid the flood of retail bankruptcies and the ongoing saga of stores like J.C. Penney, Sears, J. Crew, Express, etc., one thing is patently clear: Retail is overbuilt in the U.S., with more than 1,100 shopping malls and more than 23.5 square feet of shopping per person.

For context, Canada has 16.8, Australia has 11.2 and the United Kingdom has 4.6 square feet of shopping per person.

In “The Convenience Revolution,” Shep Hyken wrote: “Friction is a hassle in your customer’s world. Anything that removes friction, regardless of the source, is likely to improve your relationship with the customer.”

It would be difficult to make the case that visiting any of those 1,100 malls provides a frictionless experience.

We are seeing many of the Class C and D malls go away, or repurposed to the point they are unrecognizable.

That retail catharsis will likely continue for years to come.

If you have stores in those malls, even a great store, you’re going to find out what having the best house on the worst street is all about.

The transformation of those low-experience malls is neither a negative in and of itself, nor a de-facto reflection on the overall health of physical retail. It is an essential retail catharsis.

Additionally, we have the specter of online shopping and, understandably, the fear

But has it?

There is no doubt whatsoever that retail stores, no matter how small, must have an online presence to be relevant, particularly when you consider that 80 percent of consumers begin their shopping journeys online.

But lest we think the pandemic has delivered a mortal blow to physical stores, consider that during the apex of the shutdown, in April, May and June, when one might have expected the vast majority of retail shopping to have taken place online, the number was actually 15 percent, according to the U.S. Department of Commerce.

While statistically impressive, especially when compared to the 11 percent of online retail business in 2019, it is infinitely less than one might have expected given the weeks-long shutdown for many stores.

In “Consumer Neuroscience,” by Moran Cerf and Manuel Garcia-Garcia, it states: “The social pressure of the in-store environment means that people are less likely to pull out of a purchase once it has been started, whereas the absence of this in an online context means basket abandonment is a huge challenge for e-commerce.”

In fact, according to data from Listrak, a retail marketing firm that tracks shopping cart abandonment, the rate at which consumers abandon their shopping carts online without completing their purchases is 81 percent.

As critical as it is to be able to easily conduct e-commerce when that is what the customer wants, the combination of no human interaction, and no ability to experience the tactility that comes from in-store shopping, means quality brick-and-mortar environments will continue to have the lion’s share of the retail pie.

One of the great misconceptions of pandemic purgatory, as we’ve all learned to work remotely, have our groceries delivered, eat out less, and eschew the joys of attending live sporting events, concerts and movie theaters, is that we will be satisfied living in that kind of world post-pandemic.

That notion is complete and utter rubbish.

While commercial real estate is certain to take a hammering, as more and more companies realize that remote work can play a role post-pandemic, and restaurants will, no doubt, take more than their share of casualties, new businesses and new initiatives will fill those spaces.

Entrepreneurs will step in, and stores and restaurants will emerge from the ashes of those unfortunate businesses that ultimately succumbed to the pandemic with new and vibrant retail stories.

COVID-19, in effect, will not so much have killed healthy business but accelerated unhealthy and declining business.

What won’t change is our desire for human contact and the reassuring sense of community that comes from attending in-person events and shows, and from experiential shopping.

We will be less likely to frequent undifferentiated shopping malls—a trend accelerated during the pandemic, but long in the cards—but the dopamine rush that comes from meaningful experiences and in-person shopping will not abate.

Independent retailers have a huge advantage in the evolving retail story. They are not tethered to dying malls, corporate policy or outright indifference.

They can shift on a dime to deliver meaningful experiences to their customers by connecting on an emotional level and by engaging their customers’ senses with relevant and differentiated products in exciting retail spaces.

As Michael Dart and Robin Lewis wrote in “Retail’s Seismic Shift,” their 2017 book: “For retailers the next steps for success are clear. Pick your niche. If you are massive, get rid of the mass by fragmenting into niches. Create differentiation and awesome experiences for each niche.”

Seems like a reasonable plan to me.

The Latest

The credit card companies’ surveys examined where consumers shopped, what they bought, and what they valued this holiday season.

Kimberly Miller has been promoted to the role.

How Jewelers of America’s 20 Under 40 are leading to ensure a brighter future for the jewelry industry.

The “Serenity” charm set with 13 opals is a modern amulet offering protection, guidance, and intention, the brand said.

“Bridgerton” actresses Hannah Dodd and Claudia Jessie star in the brand’s “Rules to Love By” campaign.

Founded by jeweler and sculptor Ana Khouri, the brand is “expanding the boundaries of what high jewelry can be.”

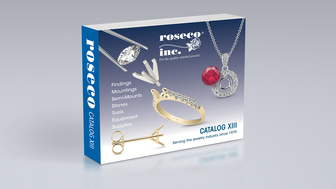

Roseco’s 704-page catalog showcases new lab-grown diamonds, findings, tools & more—available in print or interactive digital editions.

The jewelry manufacturer and supplier is going with a fiery shade it says symbolizes power and transformation.

The singer-songwriter will make her debut as the French luxury brand’s new ambassador in a campaign for its “Coco Crush” jewelry line.

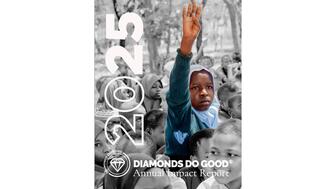

The nonprofit’s new president and CEO, Annie Doresca, also began her role this month.

The trade show is slated for Jan. 31-Feb. 2 at The Lighthouse in New York City's Chelsea neighborhood.

January’s birthstone comes in a rainbow of colors, from the traditional red to orange, purple, and green.

The annual report highlights how it supported communities in areas where natural diamonds are mined, crafted, and sold.

Footage of a fight breaking out in the NYC Diamond District was viewed millions of times on Instagram and Facebook.

The supplier has a curated list of must-have tools for jewelers doing in-house custom work this year.

The Signet Jewelers-owned store, which turned 100 last year, calls its new concept stores “The Edit.”

Linda Coutu is rejoining the precious metals provider as its director of sales.

The governing board welcomed two new members, Claire Scragg and Susan Eisen.

Sparkle with festive diamond jewelry as we celebrate the beginning of 2026.

The master jeweler, Olympian, former senator, and Korean War veteran founded the brand Nighthorse Jewelry.

In its annual report, Pinterest noted an increase in searches for brooches, heirloom jewelry, and ‘80s luxury.

Executive Chairman Richard Baker will take over the role as rumors swirl that a bankruptcy filing is imminent for the troubled retailer.

Mohr had just retired in June after more than two decades as Couture’s retailer liaison.

Shekhar Shah of Real Gems Inc. will serve as president of the Indian Diamond & Colorstone Association in 2026.

This year’s good luck charm features the mythical horse Pegasus, and is our first Piece of the Week of the new year.

Articles about crime, engagement rings, and a necklace worn in the World Series generated the most interest among readers.