Jewelers Using Payment Apps Should Know This New Tax Rule

For tax year 2022, the IRS has substantially lowered the threshold for receiving a 1099-K for business transactions made via payment apps.

A new IRS tax reporting rule, effective as of Jan. 1, requires payment app providers to issue users and the IRS a form 1099-K if the user’s business transactions total more than $600 per year.

Previously, payment app providers would need to send a 1099-K only if a user had more than 200 business transactions in a year that totaled at least $20,000.

A business transaction means any payment, including tips, for goods and services.

The rule applies to purchases made via a payment app both in store and online, like through Instagram, eBay, Etsy, or any other selling platform.

The rule does not apply to personal transactions, like splitting dinner with a friend or sending birthday money.

App users won’t pay any additional taxes for purchasing goods or services.

The change was signed into law last year as part of the American Rescue Plan, the $1.9 trillion stimulus bill passed, in part, to provide COVID-19 relief, but it also amended parts of the Internal Revenue Code.

The law will apply to tax year 2022, so those eligible for these 1099-Ks will receive them starting in 2023.

The reporting requirement is new, but the tax isn’t.

For this year, individuals are still required to report taxable income received through these platforms on their income tax return.

“Third-party information reporting has been shown to increase voluntary tax compliance and improve collections and assessments within [the] IRS,” said the agency in the FAQ section of its website about the change.

Payment providers like Cash App, PayPal, and Venmo have added updated guidance to their websites.

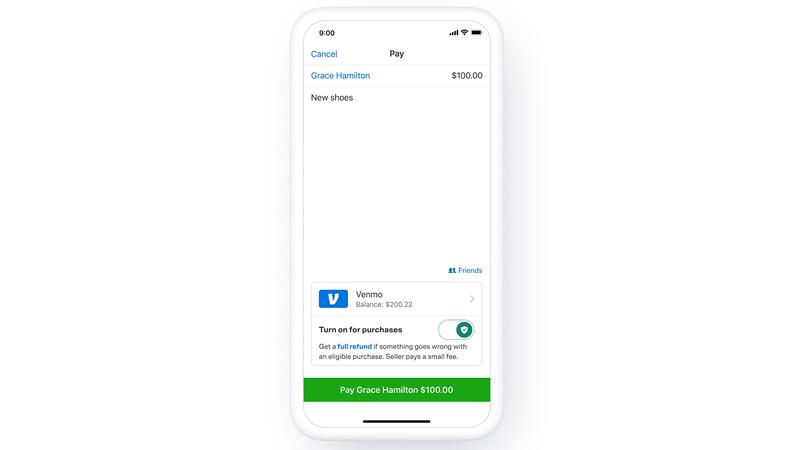

Users are encouraged to select “goods and services” when they are sending someone money to purchase an item. Doing so also makes these transactions eligible for coverage under PayPal and Venmo’s purchase protection program.

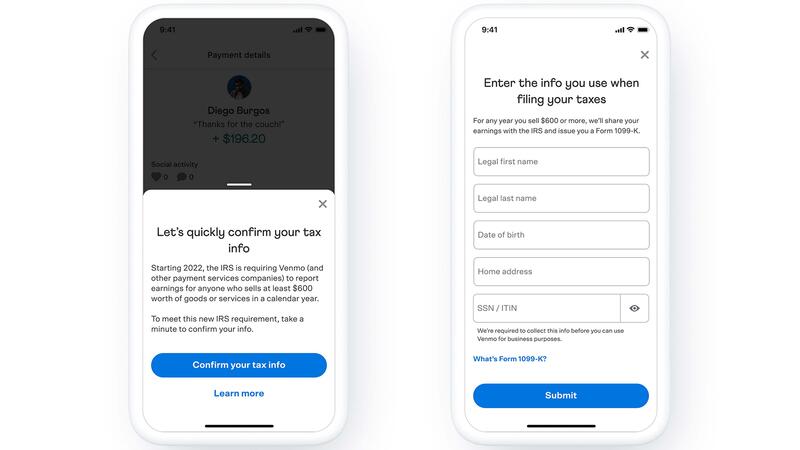

In its FAQ section, Venmo noted that customers may receive an in-app notification or email asking them to confirm information they use when filing taxes, like a social security number and address.

Venmo noted that some amounts may be excluded from gross income, and therefore not subject to income tax, like if a user sells a personal item at a loss.

“We encourage customers to speak with a tax professional when reviewing their 1099-K forms to determine whether specific amounts are classified as taxable income,” said Venmo in a statement on its website.

Notably, payments for a good or service made via Zelle, which sends money between U.S. bank accounts, are not subject to this reporting rule.

Zelle would not need to provide a 1099-K because while it facilitates the sending of money between financial institutions, it doesn’t hold that money or participate in settling the funds.

The change to the reporting rule follows the announcement of a plan from the U.S. Treasury to close the “tax gap,” meaning the difference between what the government is owed and what it receives in taxes.

The American Families Plan Tax Compliance agenda, announced in May 2021, aims to raise an additional $700 billion over the next decade through new tax compliance measures.

“These unpaid taxes come at a cost to American households and compliant taxpayers as policymakers choose rising deficits, lower spending on necessary priorities, or further tax increases to compensate for the lost revenue,” said the department in its plan.

The treasury found the tax gap was nearly $600 billion in 2019.

“Working to close the tax gap reflects a commitment to ending our two-tiered tax system, one where most American workers pay their full obligations, but high earners who accrue income from opaque sources often do not,” said the treasury.

For more information about changes to tax reporting rules and the 1099-K form, visit the IRS website.

The Latest

The ever-growing collection, which just expanded with the addition of Olga of Kyiv, features cameos of 12 women from history.

We asked a jewelry historian, designer, bridal director, and wedding expert what’s trending in engagement rings. Here’s what they said.

The annual event will be held in Orlando, Florida, from Sept. 14-17.

Every jeweler faces the same challenge: helping customers protect what they love. Here’s the solution designed for today’s jewelry business.

The “Outlander” star modeled for the digital cover of the magazine’s spring issue, which features a story on her relationship with jewelry.

This year’s annual congress, which will mark the confederation’s 100th anniversary, will take place this fall in Italy.

Beverly Hills was chosen as the location for the brand’s first store, designed as a “private residence for modern monarchs.”

With refreshed branding, a new website, updated courses, and a pathway for growth, DCA is dedicated to supporting retail staff development.

Beth Gerstein discusses the vibe of the new store, what customers want when fine jewelry shopping today, and the details of “Date Night.”

Nearly half of buyers are prioritizing silver and fashion collections this season, organizers said.

The “Live Now. Polish Later.” campaign features equestrians wearing the brand’s jewels while galloping across the icy plains of Kazakhstan.

The precious metals provider has promoted Jennifer Ashworth to the role.

Nelson will be honored as the inaugural grant winner at the Gem Awards gala on March 13.

Experts from India weigh in the politics, policies, and market dynamics for diamantaires to monitor in 2026 and beyond.

The American precious metals refiner’s day-to-day operations remain the same post-acquisition.

These aquamarine jewels channel the calming energy of the March birthstone.

The “Innovative Design” category and award will debut in the Spectrum division of this year’s AGTA Spectrum & Cutting Edge Awards.

Diamond jewelry was the star of the event formerly known as the SAG Awards.

Consumers were somewhat less worried about the future, though concerns about rising prices and politics remained.

Foerster is this year’s Stanley Schechter Award recipient.

Sponsorships and tickets to the annual fundraising event, set for May 31, are available now.

Chicago police and members of the U.S. Marshals Service tracked down the 35-year-old suspect earlier this week in St. Louis.

Owners of the Ekapa Mine reportedly filed for liquidation about a week after a mudslide trapped five workers who have yet to be found.

A 10-year alliance has also begun to address the shortage of bench jewelers through scholarships, enhanced programs, and updated equipment.

The “Splendente” collection has evolved to feature hardstone letter pendants, including our Piece of the Week, the onyx “R.”

The jewelry collection belonged to “one of society's most glamorous and beautiful women of the mid-20th century,” said the auction house.

The update came as Anglo took its third write-down on the diamond miner and marketer, which lost more than $500 million in 2025.