Chris Blakeslee has experience at Athleta and Alo Yoga. Kendra Scott will remain on board as executive chair and chief visionary officer.

Column: The price of integrity

Whether retailers choose to discount or not, it is vitally important that they have integrity in their pricing, columnist Peter Smith writes.

In visiting some retail stores in recent weeks, I have noticed a disturbing pattern on pricing.

The premise of marking up to discount has, of course, been around for many years. I was first introduced to it in the early to middle 1980s, when I spent a few years working for the now defunct Whitehall Jewellers (they used the English spelling.)

Having worked in the jewelry business for many years before my Whitehall stint, I was not a novice to discounting per se. However, my previous experience in the old country (Ireland) had always been, well, legitimate. If we offered discounts at McGowan’s Jewellers (Irish spelling) it was for a limited time--post-Christmas sale or on products that we were trying to liquidate. We had never used pricing to convince the customer that they were getting a deal unless they were, quite honestly, getting a deal.

In my most recent visit to a retail partner, I discovered that they had marked up products from my company far beyond the recommended retail price points, which provided healthy retail margins as it was. The prices were high enough that any reasonably well-informed customer would likely question the viability of the pricing not just on those items, but across the entire store. In fact, at a recent trunk show, one of our team had personally witnessed three separate examples of customers reacting viscerally, and very negatively, to the grossly inflated pricing that the retailer had put on the products.

Despite his embarrassment, knowing as he did what we had sold the products for and what the recommended retail pricing should have been, there was nothing our guy could do to convince the customer to refrain from completely disengaging while he “checked in with the owner” as to what might be done about the price.

The damage had been done and those customers at that particular trunk show had a very sobering introduction to the notion of pricing integrity. They knew that something didn’t smell right and the retailer’s intent to use the artificially and unreasonably high ticket prices as

As I mentioned, we also saw other cases of retailers who had previously enjoyed very good sell-through with our product only to have the sales hit a brick wall for “no apparent reason.” In each case, of course, we discovered that they had made the decision to extend the mark-up far beyond what was recommended and what was reasonable. As soon as the conversations were had, and the retail tickets changed to reflect the more appropriate retail pricing, the sell-through recovered and the damage was reversed. Or was it?

One can debate the merits of discounting versus not discounting but there are, of course, no absolute right or absolute wrong answers. Each retailer must embrace openly and honestly the practice that they believe is right for their business. If you believe that discounting is the way to compete, and you can run a healthy business on the margins you make, then who is to say that strategy is wrong? If you choose to price your products appropriately and sell on value, knowing that you won’t win the customer who is hell-bent on getting a “deal,” than you owe no apology to anyone for that strategy.

No matter which of the aforementioned approaches you deem best for you, what is vitally important is that you have integrity of pricing.

The earlier mentioned and now-closed Whitehall Jewellers had a pricing model that was based on illusion. The company was able to effect a sizable expansion by convincing customers that they were getting a great deal. The ubiquitous 50/60/70 percent off (retail) banners hung from the rafters and enough people seemed to buy into the illusion of value for about a decade.

Having spent a few years working behind the counters in different Whitehall stores, my own inclination was that customers didn’t really believe that they were getting 60 percent off the original price at all. They knew that those discounts were a sham, but for some period of time enough of them were still willing to believe that even if the “original price” was bogus, they were still getting a deal. The model, ultimately, failed.

I personally am not a fan of discounting because it presumes one of three things:

1. The customer is getting a real deal, in which case I wonder where the margins will come from to run the business. Good for the consumer, bad for the store.

2. That you can compete long term on a “lowest price” model. There’s generally only one winner in that game.

3. Or, as mentioned, the pricing model is actually misleading and illusionary. There likely would be enough customers who are smart enough to see through that, and ultimately it will reflect very poorly on the store in the short and long term.

Martin Lindstrom, the author of Buy-ology: Truths and Lies About Why We Buy, cites multiple studies about the long-term costs of discounting. Lindstrom writes that the studies show that it takes seven years for a brand to recover its value in the minds of consumers when it has been discounted.

Michael Raynor and Mumtaz Ahmed wrote in their book, The Three Rules: How Exceptional Companies Think, that extensive research shows that companies that devoted their energies and resources to the “non-price value” ultimately ended up far better off than companies that chased a “price” value strategy.

Again, retail stores will choose the best course for them, be it price value or non-price value, but whichever direction one chooses, it ought to have at its core the basic premise of price integrity.

The illusionary approach may appear to be working in the short-term, but it is not a sound strategy for long-term growth or for customer loyalty.

Peter Smith, author of Hiring Squirrels: 12 Essential Interview Questions to Uncover Great Retail Sales Talent, has spent more than 30 years building sales teams at retail and at wholesale. He is president of Vibhor Gems and he has previously worked with companies such as Tiffany & Co., Montblanc and Hearts On Fire. Email him at peter@vibhorgems.com, dublinsmith@yahoo.com or reach him on LinkedIn.

The Latest

The credit card companies’ surveys examined where consumers shopped, what they bought, and what they valued this holiday season.

Kimberly Miller has been promoted to the role.

How Jewelers of America’s 20 Under 40 are leading to ensure a brighter future for the jewelry industry.

The “Serenity” charm set with 13 opals is a modern amulet offering protection, guidance, and intention, the brand said.

“Bridgerton” actresses Hannah Dodd and Claudia Jessie star in the brand’s “Rules to Love By” campaign.

Founded by jeweler and sculptor Ana Khouri, the brand is “expanding the boundaries of what high jewelry can be.”

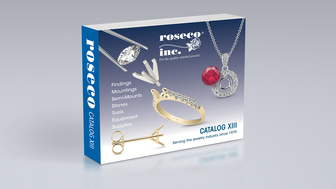

Roseco’s 704-page catalog showcases new lab-grown diamonds, findings, tools & more—available in print or interactive digital editions.

The jewelry manufacturer and supplier is going with a fiery shade it says symbolizes power and transformation.

The singer-songwriter will make her debut as the French luxury brand’s new ambassador in a campaign for its “Coco Crush” jewelry line.

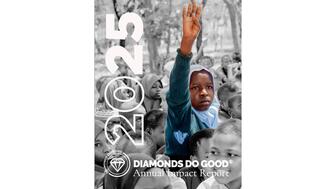

The nonprofit’s new president and CEO, Annie Doresca, also began her role this month.

As the shopping mall model evolves and online retail grows, Smith shares his predictions for the future of physical stores.

The trade show is slated for Jan. 31-Feb. 2 at The Lighthouse in New York City's Chelsea neighborhood.

January’s birthstone comes in a rainbow of colors, from the traditional red to orange, purple, and green.

The annual report highlights how it supported communities in areas where natural diamonds are mined, crafted, and sold.

Footage of a fight breaking out in the NYC Diamond District was viewed millions of times on Instagram and Facebook.

The supplier has a curated list of must-have tools for jewelers doing in-house custom work this year.

The Signet Jewelers-owned store, which turned 100 last year, calls its new concept stores “The Edit.”

Linda Coutu is rejoining the precious metals provider as its director of sales.

The governing board welcomed two new members, Claire Scragg and Susan Eisen.

Sparkle with festive diamond jewelry as we celebrate the beginning of 2026.

The master jeweler, Olympian, former senator, and Korean War veteran founded the brand Nighthorse Jewelry.

In its annual report, Pinterest noted an increase in searches for brooches, heirloom jewelry, and ‘80s luxury.

Executive Chairman Richard Baker will take over the role as rumors swirl that a bankruptcy filing is imminent for the troubled retailer.

Mohr had just retired in June after more than two decades as Couture’s retailer liaison.

Shekhar Shah of Real Gems Inc. will serve as president of the Indian Diamond & Colorstone Association in 2026.

This year’s good luck charm features the mythical horse Pegasus, and is our first Piece of the Week of the new year.