The credit card companies’ surveys examined where consumers shopped, what they bought, and what they valued this holiday season.

Column: Looking Back and Thinking Forward, Part II

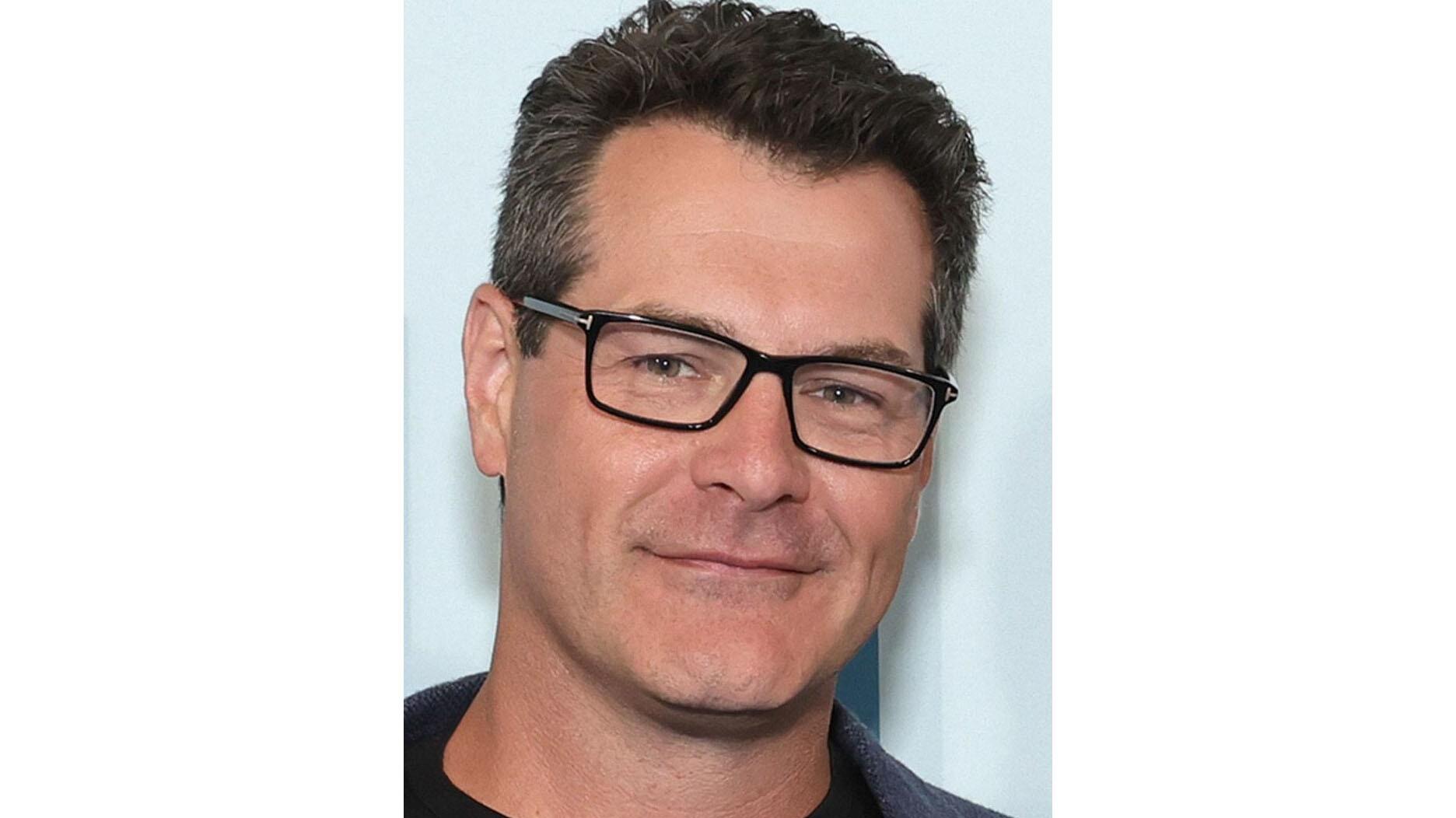

Reflecting on the closing of his jewelry manufacturing firm in the 1980s, columnist Jan Brassem shares four personal observations about the current state of the jewelry industry.

The following is the second part of the history of the author’s U.S. jewelry manufacturing company, which experienced several simultaneous industry disruptions in the ‘70s and ‘80s.

Part I of Looking Back and Thinking Forward, which detailed the boom time for jewelry manufacturers up until the 1980s, ran last week on National Jeweler.

By 1980, the disruptions were being felt quickly.

Best Products, a well-known national catalog showroom and our largest customer, was one of the first to change its format. Unable to meet competitive margins, they stopped selling popularly priced jewelry. Ultimately, the catalog showroom channel, including Service Merchandise, stopped selling jewelry altogether.

The Embassy Group, our consortium of 23 wholesalers, stopped selling jewelry after their customer, the independent jeweler, complained about their 50 percent markup. Evidently, the baby boomers and Gen Xers were looking elsewhere for affordable jewelry--imported goods, silver or costume trinkets--or just stopped buying jewelry.

Direct-mail “flyers” were next. Once considered an efficient jewelry channel (although they did clog mailboxes), they usually start price wars, proving that only consumers benefit. It’s not surprising that both warring parties lose market share, or worse.

Wait, there’s more.

While this was going on, computers were making inroads and, not surprisingly, quickly penetrated the industry. Implementing a computer operating system on a factory floor is challenging. Our installation was similar to a square-wheeled rollout.

Adding to the disruption, President Ronald Reagan’s economic recessions struck in 1980 and again in 1981. By now, discretionary consumer products, like jewelry, became difficult to sell.

Looking back on this difficult period, I’ve narrowed my experience into a number of personal observations. Here are four of them.

--Generational management. Successful jewelry firms that were marketers (IBGoodman), or manufacturers (Mercury Ring, The Aaron Group), or sold pearls (Mastoloni), or manufactured and marketed wedding rings (Frederick Goldman), were mostly family businesses. They generally weathered the storm.

Family-owned companies seemed to be stronger and more able to adjust to market complexities. Whether it’s because of family management cynosure--deeper experiences passed down from earlier generations--greater financial resources or something else is not clear.

It looks inward for answers, instead of outward for innovation.

Here are a few outward-facing, consumer-focused marketing strategies that entered my imagination. There are, of course, hundreds more.

1) Create a “New York Jewelry Week” with a glamorous red carpet (flash bulbs, limos and all) and a consumer product partner (i.e., luxurious watch, automotive, hotel or clothing company).

2) Negotiate with a major newspaper to have a page in their Sunday edition matching jewelry with celebrity outfits. (Note: Very little jewelry is shown--or worn--by celebrities and trend-setters in any national newspaper.)

3) Attend the annual South by Southwest Conferences and Festivals in Austin, Texas. Develop relationships with tech leaders and discover new ways to blend jewelry, or jewelry distribution channels, with technology that has consumer appeal. Has the innovative wearable technology movement already bypassed the industry? Was anyone watching?

--Mergers and acquisitions. Major changes--i.e., globalization, tech advances, price changes, management weakness and thin margins--are confronting today’s jewelry leaders. How to meet these problems should be one of management’s notable challenges.

Mergers or acquisitions occur when two or more organizations decide their combination will create greater value than if they did not combine their companies. The economic gains from these combinations, called synergistic gains, can be substantial. Please remember, M&A is the fastest way to grow a jewelry firm, diversify or acquire a competitor’s brand, compared to the traditional organic approach

Sherwood Management, for example, started with three family stores in southern California and, through a strategic M&A strategy, has grown to 72 stores. Sherwood, also known as The Daniels Company, is by no means unique. There are literally hundreds of U.S. and foreign jewelry firms that have grown from one independent unit to a business with multiple locations through M&A.

Once you’re involved in the M&A process, you’ll have moved away from your comfort zone of diamonds, gold and showroom décor and be transformed into a dynamic and enthusiastic strategic thinker. You will possess a new and exciting outlook on life.

--The industry needs leadership; a bona fide federation of trailblazers. With all the store closings, sales declines and inventory cutbacks, etc., it seems obvious that our industry has lost its ability to do things differently, its innovative focus. Gone are the days we can look to De Beers for a “A Diamond is Forever” consumer campaign or to anyone else, for that matter, to rescue the floundering industry.

What’s needed, simply, is a group of people, a committee of sorts, to look at the industry and shake it up to stop the negative “bleeding.” They will develop fresh initiatives, perspectives and, if necessary, replicate how things are done in industries that had similar issues.

The “Rainmaker Committee” is a properly funded organization and led by a non-jewelry executive who’s been through these issues in the past.

Here are a few of my “new guard” nominations. You should have others.

-- Chairperson: Martin Lindstrom, revolutionized supermarket industry

-- Andrea Hill: e-commerce and social media expert

-- Andrea Hanson: big-picture thinker, branding expert

-- Mindy Grossman: CEO, HSN

-- Paola de Luca: global trend forecaster

-- Harvey Kanter: CEO, Blue Nile

Jan Brassem is a senior partner at MainBrace Global Partners, a global jewelry advisory and M&A firm with offices in New York and Hong Kong. You can e-mail him at Jan-at-MainBraceGlobalPartners.com.

The Latest

Kimberly Miller has been promoted to the role.

The “Serenity” charm set with 13 opals is a modern amulet offering protection, guidance, and intention, the brand said.

How Jewelers of America’s 20 Under 40 are leading to ensure a brighter future for the jewelry industry.

“Bridgerton” actresses Hannah Dodd and Claudia Jessie star in the brand’s “Rules to Love By” campaign.

Founded by jeweler and sculptor Ana Khouri, the brand is “expanding the boundaries of what high jewelry can be.”

The jewelry manufacturer and supplier is going with a fiery shade it says symbolizes power and transformation.

Roseco’s 704-page catalog showcases new lab-grown diamonds, findings, tools & more—available in print or interactive digital editions.

The singer-songwriter will make her debut as the French luxury brand’s new ambassador in a campaign for its “Coco Crush” jewelry line.

As the shopping mall model evolves and online retail grows, Smith shares his predictions for the future of physical stores.

The trade show is slated for Jan. 31-Feb. 2 at The Lighthouse in New York City's Chelsea neighborhood.

January’s birthstone comes in a rainbow of colors, from the traditional red to orange, purple, and green.

The annual report highlights how it supported communities in areas where natural diamonds are mined, crafted, and sold.

Footage of a fight breaking out in the NYC Diamond District was viewed millions of times on Instagram and Facebook.

The supplier has a curated list of must-have tools for jewelers doing in-house custom work this year.

The Signet Jewelers-owned store, which turned 100 last year, calls its new concept stores “The Edit.”

Linda Coutu is rejoining the precious metals provider as its director of sales.

The governing board welcomed two new members, Claire Scragg and Susan Eisen.

Sparkle with festive diamond jewelry as we celebrate the beginning of 2026.

The master jeweler, Olympian, former senator, and Korean War veteran founded the brand Nighthorse Jewelry.

In its annual report, Pinterest noted an increase in searches for brooches, heirloom jewelry, and ‘80s luxury.

Executive Chairman Richard Baker will take over the role as rumors swirl that a bankruptcy filing is imminent for the troubled retailer.

Mohr had just retired in June after more than two decades as Couture’s retailer liaison.

Shekhar Shah of Real Gems Inc. will serve as president of the Indian Diamond & Colorstone Association in 2026.

This year’s good luck charm features the mythical horse Pegasus, and is our first Piece of the Week of the new year.

Articles about crime, engagement rings, and a necklace worn in the World Series generated the most interest among readers.

As part of the leadership transition, Sherry Smith will take on the role of vice president of coaching strategy and development.