4 Predictions for the Diamond Market in 2023 and Beyond

Experts and Editor-in-Chief Michelle Graff share views on natural diamond prices, lab-grown supply, and diamond jewelry sales in 2023.

So, what will this year hold?

I consulted industry analyst Paul Zimnisky and De Beers’ 2022 Diamond Insight Report as well as reporting from around the trade to make predictions about diamond supply, demand and consumer behavior in 2023 and beyond.

1. Natural diamond price and supply

To understand the current state of natural diamond supply, one needs to rewind about a year, to the date of the Russian invasion of Ukraine, Feb. 24, 2022.

Immediately following the invasion, the United States began levying sanctions on Russia in an effort to restrict its resources. Alrosa, one of the two biggest diamond producers in the world, was included in these efforts, as the Russian government holds a 33 percent stake in the company.

Initially, the sanctions targeted U.S investment in Russian companies but the government ratcheted them up over the next couple months, with President Joe Biden signing an executive order March 11 banning the import of non-industrial Russian diamonds and Alrosa landing on the U.S. Treasury Department’s Specially Designated Nationals list a month later.

Despite the sanctions, manufacturers were still able to process Russian diamonds purchased before Feb. 24.

Industry analyst Paul Zimnisky said manufacturers had a 3- to 6-month supply on hand. That was enough to carry them through to August, which is when demand for diamond jewelry started to slow down, helping to alleviate any potential pressure on the supply chain.

Also aiding was De Beers Group, which increased production to 34.6 million carats, and its highest production volume since 2018 and pretty close to maximum capacity for the diamond miner.

Zimnisky said De Beers “clearly benefited” from the sanctions on Russian goods, a fact the company acknowledged in its own roundabout way in its Q4 and full-year production report, noting the appeal of its “proposition of provenance-assured diamonds” in 2022, i.e., diamonds that clearly weren’t mined in Russia.

“The industry really hasn’t felt the expected shortage in goods that was speculated at this time last year,” he said.

However, in 2023, if demand increases and, as expected, the U.S. and Europe ban together to stop the flow of Russian diamonds into Western markets, it will put further pressure on supply.

Sara Yood, deputy general counsel of the Jewelers Vigilance Committee, said they expect to have additional guidance should the U.S. and E.U. agree on further restrictions.

In the meantime, Yood said the JVC recommends smaller players “get comfortable” asking their suppliers questions about how they are sourcing goods. She said businesses should be following due-diligence standards for sourcing for high-risk areas, like those laid out by the OECD.

“It is certainly possible that some suppliers are still importing Russian goods due to the ‘substantial transformation’ [U.S.] Customs rulings, and therefore it is vital that smaller players in the market are very, very clear with their suppliers that they do not want to purchase these goods,” she said.

Zimnisky predicts the disruption in the supply of natural diamonds will be more significant in 2023, pushing up prices.

Higher natural prices theoretically will benefit lab-grown diamonds, though that segment of the market is expected to face its own challenges this year.

“You are starting to hear some retailers say they are less motivated to sell lab-grown because the prices continue to fall. I think you are going to see a real shift there, led by the retailers who are seeing their top lines soften.” — Paul Zimnisky, industry analyst

2. Lab-grown price and supply

There are a number of people who seem to think 2023 could be a tough turning point for the non-branded segment of the lab-grown diamond market and I don’t disagree.

The market, as JCK News Director Rob Bates opined in his November 2022 editorial, could be headed for a “shakeout” in the near future.

With more and more players entering the market, supply is growing at a faster pace than demand—interestingly, Zimnisky noted this is particularly true for larger stones—and prices are going to continue to drop.

According to the sampling of lab-grown diamond prices the analyst included in his State of the Diamond Market report for February 2023, the price of a 1-carat lab-grown diamond in Q1 2023 stands at $1,450, sliding 27 percent in two years (Q1 2021 price: $1,980).

The drop in price for larger goods has been more precipitous, Zimnisky’s data shows. The price of a 3-carat lab-grown diamond has dropped by more than half between Q1 2021 ($20,565) and Q1 2023 ($9,305).

“You are starting to hear some retailers come out and say they are less motivated to sell lab-grown because the prices continue to fall. That is happening,” Zimnisky said. “I think you are going to see a real shift there, led by the retailers who are seeing their top lines soften.”

So, who will thrive?

“The only companies that are going to be safe are companies that have a brand,” Zimnisky said. “I think lab[-grown] diamonds fit Pandora like a glove.”

He and I have talked before about what a smart move it was for Pandora to launch a collection of lab-grown diamond jewelry. The retailer has a solid distribution network, the price points are right for its customer base, and the design is good—not so basic that it’s boring, yet not so edgy that it alienates customers.

Indeed, Pandora noted in its most recent earnings report that its lab-grown line, “Diamonds by Pandora,” which made its North American debut in 2022, has attracted new customers in the market, with its lab-grown diamond rings a particular draw.

3. Sales: Up, Down, or Flat?

“It’s a big macroeconomic question,” Zimnisky said.

Historically, diamond sales and prices trend in lockstep with global GPD; as a discretionary purchase, they do well when the economy does well and, as everyone who made it through the Great Recession can attest, not so well when the economy slows.

The economy was running hot in 2021 with global diamond jewelry sales reaching record levels and not falling off as much as many might have expected in 2022, despite a slowdown in sales in the second half of the year.

Toward the end of 2022, the overwhelming feeling in the market was the global economy was going to slip into a recession in 2023.

“Anytime the sentiment is so universal, it is usually wrong,” Zimnisky observes. “Right now, it does not seem that [a recession] is going to happen.”

The narrative has swung from dire, the-world-is-ending chatter to an overall feeling that the economy will slow down enough to quell inflation in 2023 and allow the high-flying economy to have a soft landing.

This is good news for diamond jewelry sales, which could be up by a low single-digit percentage year-over-year due to continuing above-average inflation, Zimnisky predicts.

This is, of course, barring any major—though not entirely unthinkable—geopolitical storms, like World War III or the spread of another virus like COVID-19.

4. Societal shifts

Last fall, I had the chance to chat with De Beers Group’s Esther Oberbeck and Marc Jacheet, the former Tiffany executive who took over for the retiring Stephen Lussier last year, about De Beers’ 2022 Diamond Insight Report.

During our conversation, we discussed two groups of consumers who will impact diamond jewelry demand and sales for the longer term, in 2023 and beyond—those who buy diamond jewelry for themselves and members of Generation Z.

Gen Z, a.k.a. the zoomers, is the generation immediately following the millennials, generally defined as individuals born in the mid- to late ‘90s through the early 2010s.

Jacheet said Gen Zers place great importance on brand. According to the Diamond Insight Report, 76 percent of diamond jewelry purchased by consumers in this age group was branded, more than any other generation.

They are also more interested in products’ social impact than previous generations.

Fifty percent of Gen Zers surveyed for the report said they are likely to buy or buy more when they know the positive impact natural diamonds have had in the communities where they are mined.

“We are equipped to really do well by telling stories about [the good diamonds do],” Oberbeck said.

It’s a claim De Beers has made numerous times in recent years—when the 2021 Diamond Insight Report came out, the company said we’d reached the “sustainability tipping point”—but how do they respond to retailers who say, my customers never ask about where their diamonds come from?

Jacheet points to general shifts in behavior, like the growing use of reusable water bottles, and changes seen in other consumer-facing industries, like restaurants listing the farms their food came from on the menu, as evidence consumers are becoming more conscious about the impact and origin of the products they buy and consume.

“It’s inevitable,” he said. “It’s our role to lead the industry not to where we want to lead it or steer it, but where it is [going anyway].”

And Oberbeck pointed out that customers may not be asking many questions when they come into a jewelry store not because they’re not interested, but because they’ve already done their research online.

“By the time you are in the store, there is so much that has already happened. There is a whole discovery journey,” she said.

As for individuals who buy diamond jewelry for themselves, a.k.a. self-purchasers, Oberbeck said De Beers views it as one of the longer-term trends in the diamond industry, fueled mainly by women’s increased purchasing power.

Women today are able to spend more, yes, but I think the rise in self-purchases also speaks to changing attitudes and social mores around marriage and traditional relationships.

In my early days at National Jeweler, I remember interviewing another industry analyst, Ken Gassman, about the expected boom in weddings as millennials, the shadow generation of the 70 million-plus baby boomers, reached marriage age.

But that boom’s turned out to be more of a blip.

Last year was predicted to be a record year for weddings in the United States, but that’s largely because of pent-up demand from the pandemic, The Wedding Report’s Shane McMurray told me in an interview early last year.

Data from the Centers for Disease Control and Prevention shows that the U.S. marriage rate—meaning the ratio of marriages to the entire population—has been flat or declining since the mid-1980s.

More recently, Senior Editor Ashley Davis addressed this trend when writing about rapper Drake’s massive new diamond necklace.

The Canadian-born entertainer made what was likely one of the biggest self-purchases of 2022—a necklace set with 42 diamonds weighing a total of more than 350 carats.

Each of the diamonds is said to symbolize a past relationship for the Canadian rapper that, ultimately, did not end in a proposal. But the fact that he never found “the one” didn’t stop Drake from wanting, buying and celebrating himself with diamonds.

It’s a trend the diamond industry needs to embrace going forward for, as Ashley so astutely pointed out, both women and men.

The Latest

IGI is buying the colored gemstone grading laboratory through IGI USA, and AGL will continue to operate as its own brand.

The Texas jeweler said its team is “incredibly resilient” and thanked its community for showing support.

The medals feature a split-texture design highlighting the fact that the 2026 Olympics are taking place in two different cities.

Launched in 2023, the program will help the passing of knowledge between generations and alleviate the shortage of bench jewelers.

From tech platforms to candy companies, here’s how some of the highest-ranking brands earned their spot on the list.

The “Khol” ring, our Piece of the Week, transforms the traditional Indian Khol drum into playful jewelry through hand-carved lapis.

The catalog includes more than 100 styles of stock, pre-printed, and custom tags and labels, as well as bar code technology products.

Criminals are using cell jammers to disable alarms, but new technology like JamAlert™ can stop them.

The chocolatier is bringing back its chocolate-inspired locket, offering sets of two to celebrate “perfect pairs.”

The top lot of the year was a 1930s Cartier tiara owned by Nancy, Viscountess Astor, which sold for $1.2 million in London last summer.

Any gemstones on Stuller.com that were sourced by an AGTA vendor member will now bear the association’s logo.

The Swiss watchmaker has brought its latest immersive boutique to Atlanta, a city it described as “an epicenter of music and storytelling.”

The new addition will feature finished jewelry created using “consciously sourced” gemstones.

In his new column, Smith advises playing to your successor's strengths and resisting the urge to become a backseat driver.

The index fell to its lowest level since May 2014 amid concerns about the present and the future.

The new store in Aspen, Colorado, takes inspiration from a stately library for its intimate yet elevated interior design.

The brands’ high jewelry collections performed especially well last year despite a challenging environment.

The collection marks the first time GemFair’s artisanal diamonds will be brought directly to consumers.

The initial charts are for blue, teal, and green material, each grouped into three charts categorized as good, fine, and extra fine.

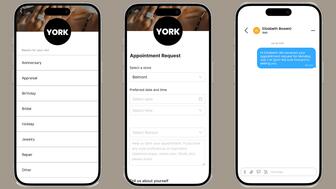

The new tool can assign the appropriate associate based on the client or appointment type and automate personalized text message follow-ups.

Buyers are expected to gravitate toward gemstones that have a little something special, just like last year.

Endiama and Sodiam will contribute money to the marketing of natural diamonds as new members of the Natural Diamond Council.

The retailer operates more than 450 boutiques across 45 states, according to its website.

The new members’ skills span communications, business development, advocacy, and industry leadership.

The jeweler’s 2026 Valentine’s Day campaign, “Celebrating Love Stories Since 1837,” includes a short firm starring actress Adria Arjona.

The new features include interactive flashcards and scenario-based roleplay with AI tools.

Family-owned jewelry and watch retailer Deutsch & Deutsch has stores in El Paso, Laredo, McAllen, and Victoria.