The Texas-based jeweler has also undergone a brand refresh, debuting a new website and logo.

Mall Owner Simon Wants Out of Taubman Deal

Simon Property Group is scrapping plans to buy its rival due to the effect of the coronavirus on Taubman’s malls.

Indianapolis—Simon Property Group has abandoned plans to buy rival mall owner Taubman Centers, a deal valued at $3.6 billion, the company announced Wednesday.

The terms of the merger agreement allowed Simon to terminate the deal “in the event that a pandemic disproportionately hurt Taubman,” according to a press release.

Simon filed an action in the Sixth Judicial Circuit of Oakland County, Michigan against Taubman, requesting a declaration that Taubman has suffered “a material adverse event” and breached its obligations regarding its business operations.

The complaint states the COVID-19 pandemic has had a “unique” and “disproportionate” effect on Taubman compared with others in the retail real estate industry.

The mall operator has several factors working against it, said Simon—a significant number of enclosed retail properties, and malls located in major metropolitan areas that depend on domestic and international tourists and showcase high-end stores.

Taubman has not yet publicly commented on Simon’s desire to terminate the merger agreement, and did not immediately respond to request for comment from National Jeweler.

Taubman owns, manages or leases 26 shopping centers in the United States and Asia, including the Beverly Center in Los Angeles and The Mall at Short Hills in New Jersey, as well as shopping centers in Xi’an, China and Hanam, South Korea.

Simon’s portfolio includes several upscale shopping venues, including Copley Place in Boston and The Forum Shops at Caesars Palace in Las Vegas, as well as shopping centers across Europe and Asia.

Looking to Taubman’s business operations, Simon claimed the mall owner failed to protect itself against the impact of the pandemic or take cues from others in the industry, including by not making “essential cuts” to its operating expenses and capital expenditures.

But in Taubman’s recent first-quarter results, the mall owner said it expects to reduce its operating expenses by approximately $10 million for the year. It also deferred between $100 million to $110 million of planned capital expenditures.

Taubman closed all but two of its U.S. shopping centers on March 19, with the other two closing shortly after that.

Simon closed its shopping centers around the same time, but began reopening select locations in May.

Simon Property Group was recently part of another major deal.

Alongside fellow mall owner Brookfield Property Partners and licensing company Authentic Brands Group, the group reached a deal to buy Forever 21 for $81 million after the fast-fashion retailer filed for bankruptcy.

The Latest

The single-owner sale will headline Sotheby's inaugural jewelry auction at the Breuer building, its new global headquarters, this December.

From sunrise yoga to tariffs talks, these are some events to check out at the upcoming inaugural event.

With their unmatched services and low fees, reDollar.com is challenging some big names in the online consignment world.

Smith recalls a bit of wisdom the industry leader, who died last week, shared at a diamond conference years ago.

The “Victoria” necklace features a labradorite hugged by diamond accents in 18-karat yellow gold.

Two lower courts have moved to block the import taxes, which will remain in place as the legal battle continues.

Jewelers of America is leading the charge to protect the industry amidst rising economic threats.

The Kansas City Chiefs quarterback shares Hublot’s dedication to pursuing greatness, the Swiss watchmaker said.

The Type IIa stone, recovered from Botswana’s Karowe diamond mine last month, features unique coloration.

Breitling is now the NFL’s official timepiece partner, a move that puts the brand in front of the millions of Americans who watch football.

NYCJAOS is set for Nov. 21-23 in New York City’s Chelsea neighborhood.

U.S.-based investment company SMG Capital LLC is the new owner of the luxury brand.

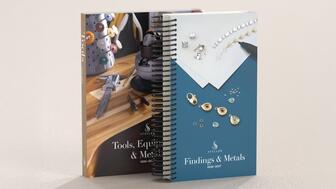

The new catalogs are “Tools, Equipment, & Metals” and “Findings & Metals.”

Sapphire’s variety of colors make it the perfect birthstone for September.

The retailer has raised its guidance after seeing total sales increase 3 percent in the second quarter, beating expectations.

Niccolò Rossi di Montelera, executive chairman of the board, was appointed as interim CEO.

The three-floor space also features the jeweler’s largest VIP salon in Japan and offers an exclusive diamond pendant.

The collection is a collaboration between Stephanie Gottlieb Fine Jewelry and Oak and Luna, focusing on understated essentials.

The highlight of a single-owner jewelry and watch collection, it’s estimated to fetch up to $7 million at auction this December.

CEO Efraim Grinberg noted a resurgence in the fashion watch market.

The “Bullseye” necklace, with vintage bakelite and peridot, August’s birthstone, is the perfect transitional piece as summer turns to fall.

Sponsored by Clientbook

It will classify lab-grown stones into one of two categories, “premium” or “standard,” in lieu of giving specific color and clarity grades.

President Duma Boko addressed the country’s medical supply chain crisis in a recent televised address.

Former Free People buyer Afton Robertson-Kanne recently joined the retailer.