Chris Blakeslee has experience at Athleta and Alo Yoga. Kendra Scott will remain on board as executive chair and chief visionary officer.

Steady Colored Gemstone Demand Gives Gemfields a Boost

The colored stone miner said revenue increased 13 percent to $193.1 million while net profit after taxes nearly doubled.

London--Gemfields PLC reported Monday that revenue rose 13 percent in fiscal year ended June 30 as demand for colored stones remains strong and it continues its marketing push.

Net profit after taxes soared 91 percent year-over-year to $23.5 million.

At the Kagem mine in Zambia, production of rough emerald and beryl remained essentially flat this year at 30 million carats. The average grade also stayed level at about 241 carats per ton.

Operating costs from Kagem were up 6 percent to $47.3 million from increased exploration activities and commencing continued waste stripping at one of the pits, while revenue from the four auctions of material mined at the site held throughout the year totaled $101.2 million.

Meanwhile, production at the Montepuez ruby mine in Mozambique was up from 8.4 million carats last year to 10.3 million carats in 2016, a 23 percent increase that exceeded the company’s initial guidance for the mine.

A higher grade also was achieved during the full year, at 35 carats per ton, compared with 26 million carats in 2015. Gemfields also reported a 68 percent increase in the recovery of higher-quality rubies.

Operating costs were also up at Montepuez, increasing 21 percent to $26.2 million in 2016.

Gemfields held two auctions during the 2015-2016 year to sell rubies and corundum. They sold an average of 95 percent by weight between them, generating revenues of $73.1 million, with an average per-carat price of $45.50.

The company has said it plans to expand both of these operations. It secured $65 million in financing in July, the majority of which will be used to increase annual production at the Montepuez mine to approximately 20 million carats within the next three years.

This joined an existing revolving credit facility of $30 million with Barclays Bank in Zambia for Kagem, to aid in the expansion to more than 40 million carats over the next three years.

Fabergé, which Gemfields acquired in 2013, saw revenue increase 33 percent to $11.8 million as it continued to expand its global presence and number of agreements with multi-brand retail partners.

The brand is focused on its medium-term goal of becoming a standalone profitable business within the company. As of June 30, its products were available in 14 countries, with the total number of Faberge outlets having increased from 20 to 32 throughout the fiscal year.

Gemfields is leveraging the luxury brand to help drive demand

The company also has been putting a lot of emphasis on its marketing efforts this year to drive consumer demand for color in general.

This includes its global marketing campaign to drive demand for rubies. Launched in late June, “Ruby Inspired Stories” is comprised of a triptych of films featuring three up-and-coming talents that explore the hidden meaning behind the gemstone (passion, protection and prosperity).

Gemfields also partnered with New York Fashion Week on multi-platform initiatives and with renowned New York retailer Bergdorf Goodman to celebrate its renovated jewelry salon with 50 pieces of jewelry from designers set with gemstones from Gemfields’ mines.

CEO Ian Harebottle noted in the company’s financial results that they continue to see opportunities for new and existing markets for “further price escalation;” Gemfields has a number of projects in the works to increase business going forward.

Operations commenced at the Dogogo south block in Ethiopia to provide the company with another supply of emeralds. And it moved into the next phase of development on its sapphire project in Sri Lanka, putting a call out to local mining companies to create a supply chain in the country.

In its fiscal year results, Gemfields also provided an update on its projects in Colombia.

In September 2015, the company announced the binding-but-conditional agreement to acquire controlling interests in two emerald projects.

But the acquisition of a 70 percent interest in the Coscuez emerald mine in the Boyacá state is being held up by a dispute between the current owners of the license and the Colombian government. Initially, Gemfields thought that this would be settled in March, but discussions are ongoing. They are expected to be resolved in the second quarter of the 2016-2017 fiscal year.

The second project includes licenses and contracts covering approximately 20,000 hectares (77 square miles) in the Boyacá state and other areas. Eight of the new license applications and assignments to existing contracts have been approved and issued; the remaining currently are being reviewed by the Colombian Mining Agency.

The Latest

The credit card companies’ surveys examined where consumers shopped, what they bought, and what they valued this holiday season.

Kimberly Miller has been promoted to the role.

How Jewelers of America’s 20 Under 40 are leading to ensure a brighter future for the jewelry industry.

The “Serenity” charm set with 13 opals is a modern amulet offering protection, guidance, and intention, the brand said.

“Bridgerton” actresses Hannah Dodd and Claudia Jessie star in the brand’s “Rules to Love By” campaign.

Founded by jeweler and sculptor Ana Khouri, the brand is “expanding the boundaries of what high jewelry can be.”

Roseco’s 704-page catalog showcases new lab-grown diamonds, findings, tools & more—available in print or interactive digital editions.

The jewelry manufacturer and supplier is going with a fiery shade it says symbolizes power and transformation.

The singer-songwriter will make her debut as the French luxury brand’s new ambassador in a campaign for its “Coco Crush” jewelry line.

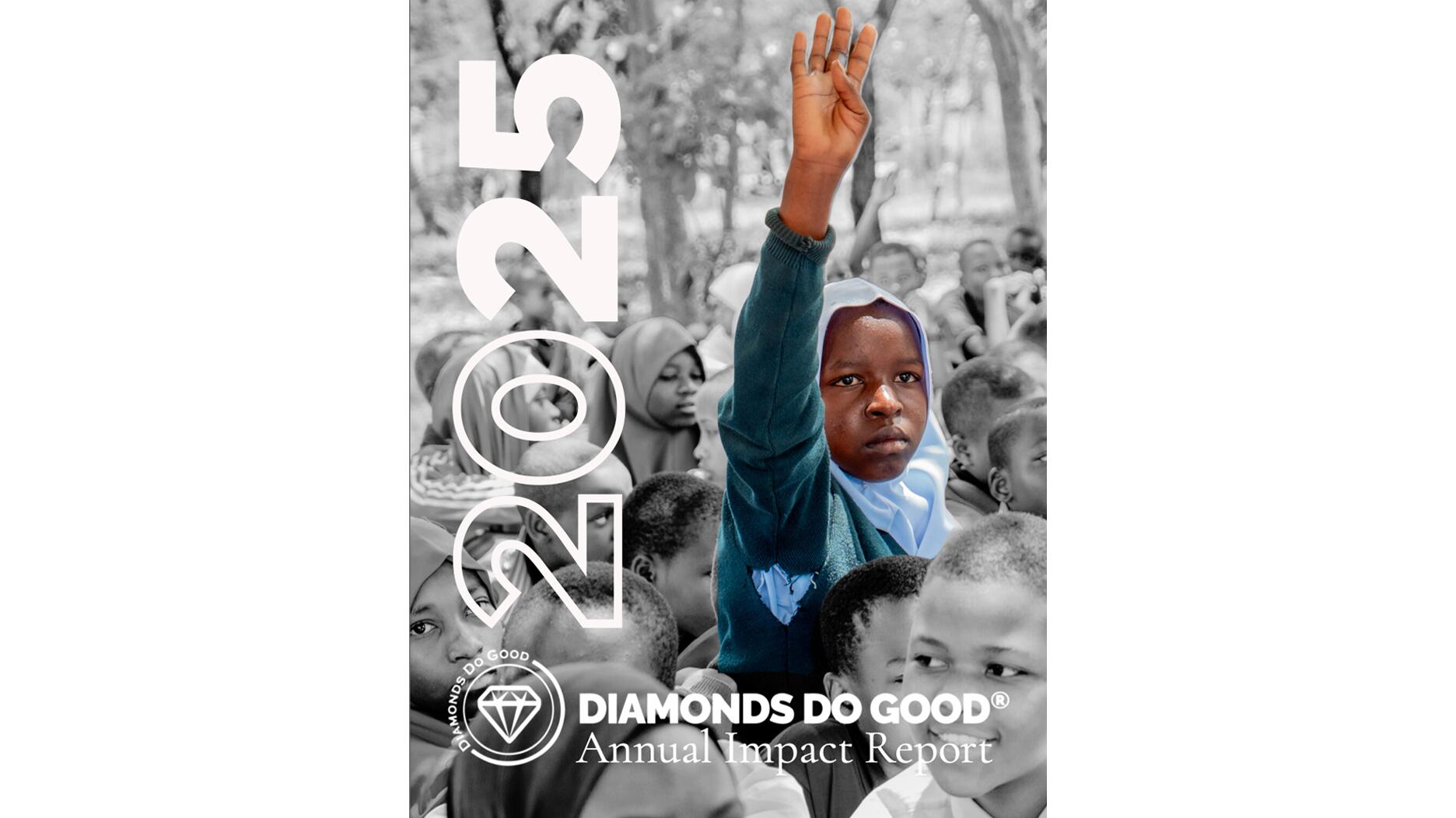

The nonprofit’s new president and CEO, Annie Doresca, also began her role this month.

As the shopping mall model evolves and online retail grows, Smith shares his predictions for the future of physical stores.

The trade show is slated for Jan. 31-Feb. 2 at The Lighthouse in New York City's Chelsea neighborhood.

January’s birthstone comes in a rainbow of colors, from the traditional red to orange, purple, and green.

Footage of a fight breaking out in the NYC Diamond District was viewed millions of times on Instagram and Facebook.

The supplier has a curated list of must-have tools for jewelers doing in-house custom work this year.

The Signet Jewelers-owned store, which turned 100 last year, calls its new concept stores “The Edit.”

Linda Coutu is rejoining the precious metals provider as its director of sales.

Sparkle with festive diamond jewelry as we celebrate the beginning of 2026.

The master jeweler, Olympian, former senator, and Korean War veteran founded the brand Nighthorse Jewelry.

In its annual report, Pinterest noted an increase in searches for brooches, heirloom jewelry, and ‘80s luxury.

Executive Chairman Richard Baker will take over the role as rumors swirl that a bankruptcy filing is imminent for the troubled retailer.

Mohr had just retired in June after more than two decades as Couture’s retailer liaison.

Shekhar Shah of Real Gems Inc. will serve as president of the Indian Diamond & Colorstone Association in 2026.

This year’s good luck charm features the mythical horse Pegasus, and is our first Piece of the Week of the new year.

Articles about crime, engagement rings, and a necklace worn in the World Series generated the most interest among readers.

As part of the leadership transition, Sherry Smith will take on the role of vice president of coaching strategy and development.