After the Supreme Court struck down the IEEPA tariffs, President Trump imposed a 10 percent tax on almost all imports via a different law.

Tiffany, Cartier, Swarovski Among the Smartest Online

They ranked at the top of the 2018 Digital IQ Index for watches and jewelry.

New York--L2 has released its annual report ranking the digital competency of some of the world’s biggest watch and jewelry brands, and two familiar names are at the top.

L2 is a New York-based consulting firm that specializes in benchmarking the digital performance of consumer brands across various markets and then providing marketers with research insights to help them grow their businesses.

Part of this research is the firm’s “Digital IQ” indices, which evaluates and ranks brands in various industries, like hotels, activewear, restaurants, and watches and jewelry.

The 2018 Digital IQ Index for watches and jewelry examined 70 brands and scored them based on the following four factors: website and e-commerce, which includes site load speed, product pages, the e-commerce experience, and online customer support; digital marketing, such as search visibility, email open rates and earned (not paid for) media mentions; mobile, meaning load speed on devices, mobile search capabilities and m-commerce; and social media.

After being scored, the brands are put into one of five intelligence-related categories: Genius (140 + points), Gifted (110-139), Average (109-90), Challenged (89-70) and Feeble (<70).

The only jewelry or watch brands labeled Genius by L2 were Tiffany & Co. (144) and Cartier (140).

L2 cited Tiffany’s best-in-class product pages, which give it strong organic Google search visibility, its mentions in publications like Vogue and Elle and expertise on social media as being among the factors that make it Genius.

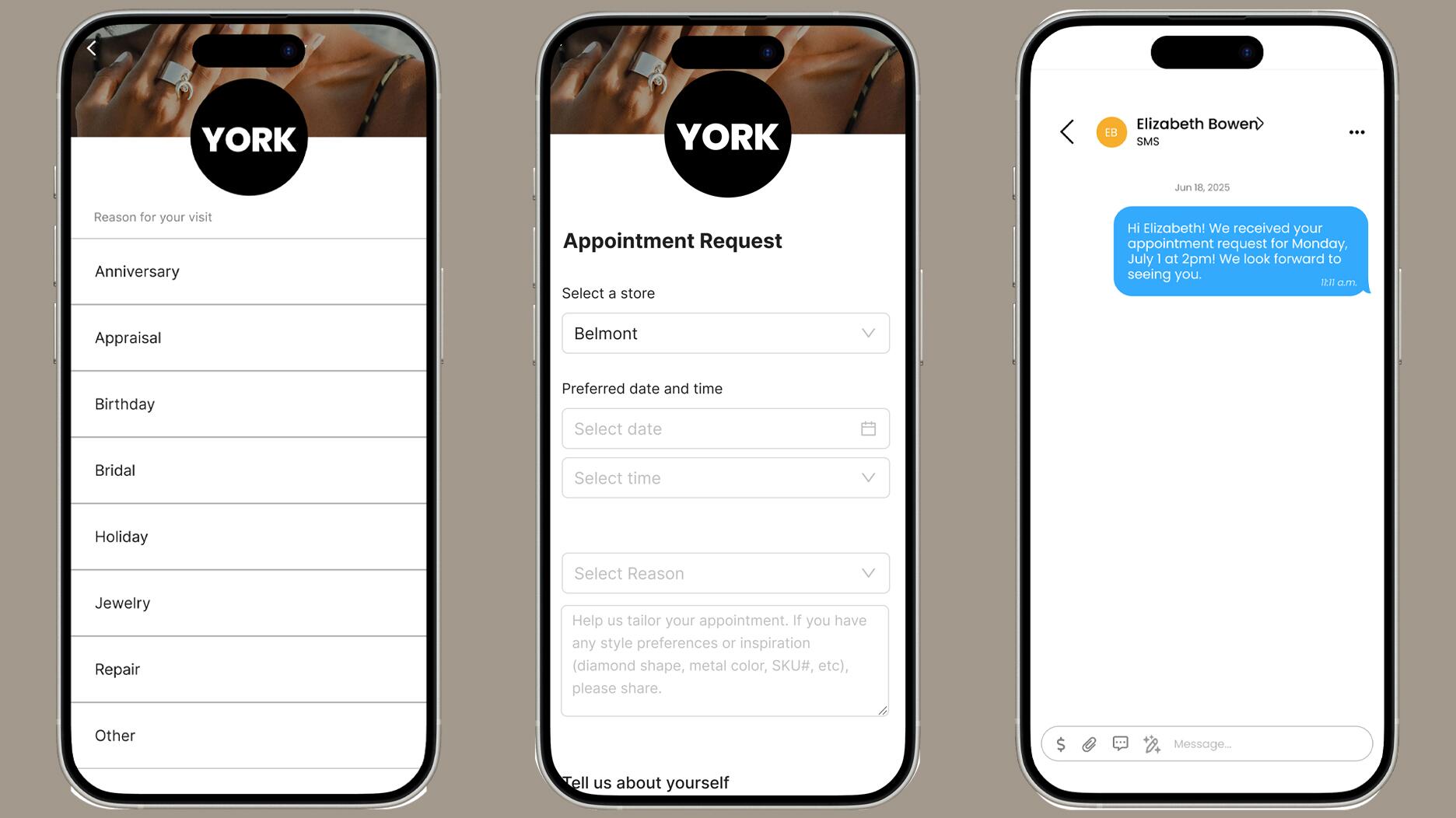

Cartier, meanwhile, received points for its easy online appointment booking, 360-degree views of product, and strong YouTube and Instagram presence.

Close behind Cartier was Austrian crystal brand Swarovski (139), followed by Alex & Ani (138) and David Yurman (136).

Rounding out the top 10 were Pandora, two LVMH-owned brands, Bulgari and TAG Heuer, Swatch Group-owned Longines, and Montblanc, which is a Richemont brand. All had scores that fell into the Gifted range.

The report noted that more watch and jewelry brands are embracing either direct-to-consumer e-commerce or partnering with sites like Net-a-Porter, which Richemont has bid to take full control of, and Hodinkee, in an effort to push down resale and gray market listings online.

But, L2 said, jewelry brands still face challenges as “digital upstarts” and “disruptors”—the report names specifically Brilliant Earth, Rare Carat and now-Signet-owned James Allen—edge out brands evaluated on the index when consumers are using Google to search for diamonds. In addition, they are beginning to lose search visibility ground to resale sites like TrueFacet and Tradesy, L2 said.

Watch

The L2 report said Tiffany “over-indexes” on social media platforms, particularly Instagram, where it posts Stories and is quick to try new features, like polls.A post shared by Tiffany & Co. (@tiffanyandco) on Jan 11, 2018 at 8:22am PST

Other areas of improvement for both jewelry and watch brands cited by L2 included email marketing.

Only 67 percent of the 70 brands evaluated on the index sent any marketing emails in 2017, despite 81 percent of them offering email sign-up on their website.

Jewelry and watch companies are “missing a crucial opportunity to engage with customers directly to improve retention,” L2 said.

While Tiffany and Cartier ranked as Genius and 17 other brands were labeled as Gifted, there were 22 watch and jewelry brands that rated as Average, 14 as Challenged and 15 as Feeble.

The bottom five brands, all labeled Feeble, were Swatch Group-owned Jaquet Droz (56), Richemont’s A. Lange & Söhne (54), Wellendorf (47), Kering watch brand JeanRichard (38) and Richemont’s Giampiero Bodino (23).

A few other brands that ranked as Feeble included Fabergé (68), which is owned by Gemfields; Movado Group watch brand Ebel (67); Buccellati (63), which was purchased by a Chinese company last year; and Graff (58).

The Latest

The industry veteran, who was with The Edge Retail Academy for 14 years, joins her husband at the company he founded in 2022.

The vintage signed jewelry retailer chose Miami due to growing client demand in the city and the greater Latin American region.

With refreshed branding, a new website, updated courses, and a pathway for growth, DCA is dedicated to supporting retail staff development.

Former Flight Club executive Jin Lee will bring his experience from the sneaker world to the pre-owned watch marketplace.

Sakamoto, who died in mid-January following a sudden illness, is remembered for his humility and his masterful, architectural designs.

The April event will feature a new VIP shopping day requiring a special ticket.

Launched in 2023, the program will help the passing of knowledge between generations and alleviate the shortage of bench jewelers.

Bulgari chose the British-Albanian singer-songwriter for her powerful and enduring voice in contemporary culture, the jeweler said.

In a 6-3 ruling, the court said the president exceeded his authority when imposing sweeping tariffs under IEEPA.

Smith encourages salespeople to ask customers questions that elicit the release of oxytocin, the brain’s “feel-good” chemical.

JVC also announced the election of five new board members.

The brooch, our Piece of the Week, shows the chromatic spectrum through a holographic coating on rock crystal.

Raised in an orphanage, Bailey was 18 when she met her husband, Clyde. They opened their North Carolina jewelry store in 1948.

Material Good is celebrating its 10th anniversary as it opens its new store in the Back Bay neighborhood of Boston.

The show will be held March 26-30 at the Miami Beach Convention Center.

The estate of the model, philanthropist, and ex-wife of Johnny Carson has signed statement jewels up for sale at John Moran Auctioneers.

Are arm bands poised to make a comeback? Has red-carpet jewelry become boring? Find out on the second episode of the “My Next Question” podcast.

It will lead distribution in North America for Graziella Braccialini's new gold pieces, which it said are 50 percent lighter.

The organization is seeking a new executive director to lead it into its next phase of strategic growth and industry influence.

The nonprofit will present a live, two-hour introductory course on building confidence when selling colored gemstones.

Western wear continues to trend in the Year of the Fire Horse and along with it, horse and horseshoe motifs in jewelry.

![A peridot [left] and sapphires from Tanzania from Anza Gems, a wholesaler that partners with artisanal mining communities in East Africa Anza gems](https://uploads.nationaljeweler.com/uploads/cdd3962e9427ff45f69b31e06baf830d.jpg)

Although the market is robust, tariffs and precious metal prices are impacting the industry, Stuart Robertson and Brecken Branstrator said.

Rossman, who advised GIA for more than 50 years, is remembered for his passion and dedication to the field of gemology.

Guthrie, the mother of “Today” show host Savannah Guthrie, was abducted just as the Tucson gem shows were starting.

Butterfield Jewelers in Albuquerque, New Mexico, is preparing to close as members of the Butterfield family head into retirement.

Paul Morelli’s “Rosebud” necklace, our Piece of the Week, uses 18-karat rose, green, and white gold to turn the symbol of love into jewelry.