Pete’s boundless curiosity extended beyond diamond cut and he was always eager to share his knowledge with others, no matter the topic.

Gold Price Expected to Continue to Climb in 2020

The latest Reuters poll has the metal averaging more than $1,400/oz. next year, while some analysts predict the spot price could hit $2,000.

New York—Gold is expected to average more than $1,400/oz. next year, up from $1,360 this year, a recent Reuters poll shows.

Reuters publishes a precious metals price poll every quarter, combining predictions from two dozen or more analysts.

In the latest poll, done at the beginning of September, analysts predicted gold would average $1,393/oz. in the third quarter, $1,416 in the fourth quarter and $1,360 for the entire year.

The 2020 average for gold is forecast to rise to $1,425/oz.

The Reuters poll represents averages, not the actual price gold hits at any point during the day, and includes predictions from more than 30 participants, which is why it is less bullish than the note released by Citi analysts in mid-September, which predicted spot gold prices could top $2,000 an ounce in the next year or two.

Still, both sources point toward the gold price going up.

Unlike other metals, which are tied to market fundamentals such as supply and demand, gold is “very responsive” to certain macro-economic developments, said Johann Wiebe, a lead metals analyst on the GFMS team at Refinitiv.

Currently, those include the Federal Reserve lowering interest rates and the ongoing U.S.-China trade war.

“People are uncertain; that’s why the gold price goes up,” he said, noting the best example of gold prices reacting to macro-economic conditions was when it skyrocketed during the 2008 financial crisis, as investors lined up to buy gold investment bars and coins amid the global financial meltdown.

In the jewelry industry, the high price of gold led retailers to push buyback programs while swapping out gold for silver in display cases.

While Wiebe recognizes there is a lot of uncertainty in the world right now, he said Refinitiv is more modest in its exact forecast for gold and will need to see economic factors take a firmer hold before it predicts gold will breach $2,000 an ounce.

Platinum and Palladium Prices

Wiebe said platinum will remain less expensive than gold for the foreseeable future, though the Reuters poll has the white metal’s price rising next year too.

In the third quarter, the poll has platinum averaging $858/oz. and climbing to $880 in the fourth quarter, finishing the year with an average of $851.

In 2020, the poll has the average platinum price at $926/oz.

Analysts are also bullish on palladium.

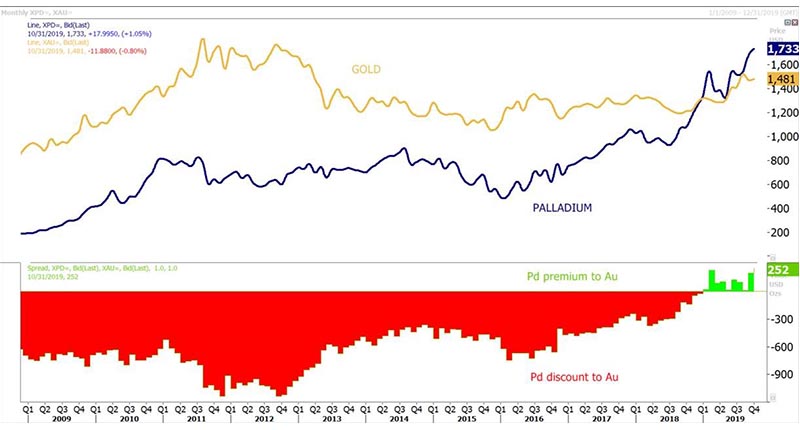

Ten years ago, the white metal averaged around $300/oz., data supplied by Refinitiv shows (see chart below).

Supply is just not high enough, Wiebe said, and the market is in repeated, severe deficit.

In the Reuters poll, analysts predicted palladium will average $1,478 in the third quarter and $1,465 in the fourth, finishing the year at $1,448/oz. The predicted average for 2020 is only slightly lower, at $1,444.

Silver Shadows

The price of silver is expected to mirror that of gold in the near term, rising in the fourth quarter and again next year.

The Reuters poll has silver averaging $15.79 an ounce in the third quarter before increasing to $16.13 in the fourth. The metal’s average for 2019 is expected to land at $15.59.

Next year, the price of silver is expected to increase to an average of $16.73.

The Latest

Cartier, Van Cleef & Arpels, Buccellati, and Vhernier had another successful holiday season, Richemont reported this week.

Our Piece of the Week is Lagos’ “Bee” brooch that was seen on the red carpet for the first time on Sunday.

Criminals are using cell jammers to disable alarms, but new technology like JamAlert™ can stop them.

Trevor Jonathan Wright led a crew in a string of armed robberies targeting South Asian-owned jewelry stores on the East Coast.

The program recognizes rising professionals in the jewelry industry.

A new lifestyle section and a watch showcase have been added to this year’s event.

How Jewelers of America’s 20 Under 40 are leading to ensure a brighter future for the jewelry industry.

Avocados From Mexico is celebrating those who love to double-dip in game day guacamole with a 14-karat yellow gold tortilla chip necklace.

Petra Diamonds unearthed the 41.82-carat, Type IIb blue diamond at the Cullinan Mine.

The brand is trading its colorful fabric cords for Italian leather in its “Lasso” baby locket bracelets.

National Jeweler and Jewelers of America’s popular webinar series is evolving in 2026.

The department store chain owes millions to creditors like David Yurman, Roberto Coin, Kering, and LVMH.

The award-winning actor’s visionary approach and creativity echo the spirit of Boucheron, the brand said.

Edge Retail Academy honored Burnell’s Fine Jewelry in Wichita, Kansas, with its annual award for business excellence.

In a market defined by more selective consumers, Sherry Smith shares why execution will be independent jewelers’ key to growth this year.

The family-owned jeweler’s new space is in a former wholesale produce market.

Ivel Sanchez Rivera, 52, has been arrested and charged in connection with the armed robbery of Tio Jewelers in Cape Coral, Florida.

The supplier’s online program allows customers to search and buy calibrated natural and lab-grown diamond melee, including in fancy shapes.

The new show will take place Jan. 23-25, 2026.

A monthly podcast series for jewelry professionals

Associate Editor Natalie Francisco highlights her favorite jewelry moments from the Golden Globes, and they are (mostly) white hot.

Yantzer is remembered for the profound influence he had on diamond cut grading as well as his contagious smile and quick wit.

The store closures are part of the retailer’s “Bold New Chapter” turnaround plan.

Through EventGuard, the company will offer event liability and cancellation insurance, including wedding coverage.

Chris Blakeslee has experience at Athleta and Alo Yoga. Kendra Scott will remain on board as executive chair and chief visionary officer.

Kimberly Miller has been promoted to the role.