Associate Editor Natalie Francisco highlights her favorite jewelry moments from the Golden Globes, and they are (mostly) white hot.

What retailers should know about the chip card switch

With the deadline approaching for retailers to switch their credit card readers to accept the new EMV chip cards, National Jeweler speaks with one expert about what retailers need to do to prepare.

New York--After the many security breaches that plagued a number of large retailers in the holiday season and throughout the winter months, a switch is being made that aims to give consumers better protection against counterfeit fraud.

A new type of credit card is being issued across the country, equipped with chips that are much harder to counterfeit than the credit cards with magnetic strips on the back that currently are in the market.

The nationwide shift to using EMV--which stands for Europay, MasterCard and Visa--cards is well underway. Many credit card issuers have already begun making the switch, and Bob Legters, senior vice president of payment products at banking and payment technology provider FIS Global, said that there are several hundred thousand cards in the market already, if not millions.

For retailers, the big key is the October deadline--after the end of the month, if they don’t have the technology to accept the new chip cards, the liability for fraud lies with them. For jewelry retailers, who have higher tickets than the average retailer, this could be a major problem.

“Counterfeit fraud typically targets the highest dollar transaction that you can get away with, so if a jewelry store is taking cards, this is a huge potential risk after October if they’re not equipped because the losses could be great,” Legters said.

National Jeweler spoke with him further about what the change means for retailers and how they should be preparing for it in their store.

National Jeweler: What are these new chip cards and what’s different about them?

Bob Legters: The new chip card is called EMV, which actually stands for Europay, MasterCard and Visa. It was introduced originally in foreign countries where the communication system struggled, and so what had to happen was that if you couldn’t connect to a network and authorize a card, there had to be a way for the card to work independently. The chip contains all of the information from the card--it keeps the current balance and all of the parameter settings and details about the consumer.

One of the very important byproducts of that is that the chip itself is an encrypted chip that’s very secure, so unlike the magstripe that’s on the back of most of our plastics, the chip offers an additional layer of security in addition to the normal security that comes with a

NJ: Will most of the credit card issuers make the switch?

BL: There are several hundred thousand cards in the market already, if not millions, and the estimates right now are that almost everybody that has a card in their wallet will be carrying an EMV card over the next 36 months. What most are doing is, as cards expire, they’re replacing them with new chip cards, so it’s a migration to be sure, but we are seeing some issuers who are just wholesale reissuing all of their plastics and sending out all new plastics to all of their customers all at the same time, versus waiting to do it when their cards expire. That’s expensive for the issuer but the potential is to reduce fraud. While the focus internationally and in the early days might’ve been poor communication networks, the focus here domestically has everything to do with fraud and security.

NJ: Why is the switch to these types of cards being made?

BL: The United States market has held off on this for quite some time, until the brands--Visa and MasterCard--mandated it. Now we have our October date for the majority of retailers, which is a date when something very significant happens: it’s a shift from the bank to the retailer for liability of fraud. So the driving purpose for everyone to participate in this is that shift in liability. In today’s world, the regulations associated with Visa and MasterCard provide protection for the consumer and for the retailer in that the issuer of the card--the bank--is responsible for any fraud that takes place, as long as they follow certain guidelines. The issuer of the card has the choice; they don’t have to offer a card with a chip in it. But if they do, they get the benefit of more security for their consumer. In the event that a retailer is not using an EMV terminal that’s able to accept a chip card and there’s fraud, then the retailer has to take the loss. That should be significant for (retail jewelers) because obviously the average ticket price in the jewelry space is a lot higher than the average ticket price in, let’s say, the quick service restaurant or the small convenience store.

What we’re seeing is, especially in the area of higher ticket items, the chip prevents the type of fraud we call counterfeit fraud. That’s where I get your number, manufacture a fake card, and when I come into the store, I’ve got a card with my name on it that matches my ID but really it’s swiping your information. It looks like I’m me but I’m actually counterfeiting myself as you. The chip eliminates that because even if I steal all of your information, I cannot create a chip. There’s a lot of technology behind that, but really what it does is allows for an encrypted image of the consumer to be protected against counterfeiting.

NJ: What is the deadline for retailers to switch to accept the new cards?

BL: October is the first major shift. There are some specific industries that are delayed like fuel pumps and things like that, but for the most part, (retailers) will have a liability switch if they aren’t able to accept chip cards after October 31.

If they’re not equipped by then, they will have to accept the liability--only in the case where the consumer has a chip card and they can’t accept it. If somebody comes in without a chip card, that’s not going to change anything.

NJ: What exactly has to be done on the retailer’s side to make the switch?

BL: The change for retailers isn’t as much about the point-of-sale system as much as it is their card reader. If the retailer has a POS system and they’re working with their merchant processor--they’re probably using a VeriFone or Ingenico terminal or something like that--those providers have alternatives that are chip readers as well. This happens to come at a good time because updating the terminals to accept the chip cards also allows them to update the terminals to accept NFC (near field communication), which is used for Apple Pay and Samsung Pay. The POS might be a little more complex than just the terminal that accepts the payment, and in many cases it’ll just be an equipment upgrade.

NJ: Are there any problems or challenges that retailers might encounter along the way?

BL: The only problem or challenge that the retailer has to face is that both the consumer and the cashier are going to be experiencing a new thing. We spent the last 20 years teaching people how to use a credit card and teaching people behind the counter how to take a credit card. Now that experience is going to change, because instead of me walking up the counter, taking my credit card and swiping it or handing it over and someone keying it in, it’s going to have to be inserted and it’s going to clamp down. The terminals walk you through it, but it’s going to be a little “human clunky” for a while. So the most important thing is training your staff, making sure that you use it and get used to how it works.

The Latest

Yantzer is remembered for the profound influence he had on diamond cut grading as well as his contagious smile and quick wit.

The store closures are part of the retailer’s “Bold New Chapter” turnaround plan.

Criminals are using cell jammers to disable alarms, but new technology like JamAlert™ can stop them.

Through EventGuard, the company will offer event liability and cancellation insurance, including wedding coverage.

Chris Blakeslee has experience at Athleta and Alo Yoga. Kendra Scott will remain on board as executive chair and chief visionary officer.

The credit card companies’ surveys examined where consumers shopped, what they bought, and what they valued this holiday season.

How Jewelers of America’s 20 Under 40 are leading to ensure a brighter future for the jewelry industry.

Kimberly Miller has been promoted to the role.

The “Serenity” charm set with 13 opals is a modern amulet offering protection, guidance, and intention, the brand said.

“Bridgerton” actresses Hannah Dodd and Claudia Jessie star in the brand’s “Rules to Love By” campaign.

Founded by jeweler and sculptor Ana Khouri, the brand is “expanding the boundaries of what high jewelry can be.”

The jewelry manufacturer and supplier is going with a fiery shade it says symbolizes power and transformation.

The singer-songwriter will make her debut as the French luxury brand’s new ambassador in a campaign for its “Coco Crush” jewelry line.

The nonprofit’s new president and CEO, Annie Doresca, also began her role this month.

As the shopping mall model evolves and online retail grows, Smith shares his predictions for the future of physical stores.

The trade show is slated for Jan. 31-Feb. 2 at The Lighthouse in New York City's Chelsea neighborhood.

January’s birthstone comes in a rainbow of colors, from the traditional red to orange, purple, and green.

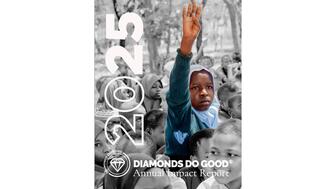

The annual report highlights how it supported communities in areas where natural diamonds are mined, crafted, and sold.

Footage of a fight breaking out in the NYC Diamond District was viewed millions of times on Instagram and Facebook.

The supplier has a curated list of must-have tools for jewelers doing in-house custom work this year.

The Signet Jewelers-owned store, which turned 100 last year, calls its new concept stores “The Edit.”

Linda Coutu is rejoining the precious metals provider as its director of sales.

The governing board welcomed two new members, Claire Scragg and Susan Eisen.

Sparkle with festive diamond jewelry as we celebrate the beginning of 2026.

The master jeweler, Olympian, former senator, and Korean War veteran founded the brand Nighthorse Jewelry.

In its annual report, Pinterest noted an increase in searches for brooches, heirloom jewelry, and ‘80s luxury.