Family-owned jewelry and watch retailer Deutsch & Deutsch has stores in El Paso, Laredo, McAllen, and Victoria.

Rocks On: Turquoise’s upward trend

The latest installment in the Rocks On series examines current supply and demand for turquoise and displays several pieces of jewelry that highlight the stone’s hues.

Already limited in supply because of its makeup--it’s only found in a few places on Earth, dry, barren regions where copper-rich groundwater seeps down and reacts with minerals to form it--the gemstone is becoming even rarer, as demand continues to grow while supply shrinks.

Turquoise is relatively soft, making it ideal for carving, so it’s not only a good gemstone for jewelry but also for ornamental purposes.

And fittingly, the gem has an important place in history. Its earliest appearances date back to ancient civilizations, from the tombs of Egypt’s pharaohs to being gifted from Aztec emperor Montezuma to Spanish conquistador Hernán Cortés.

Though it remains popular today, it’s more recent history has been a bit rocky.

Following a turquoise craze in the 1970s, it was a number of years before interest in the stone peaked again, according to Richard Shull of Out Of Our Mines, a company that deals in colored gemstones.

It was due to a number of factors that consumers began to look at it again, including a growing interest in its cultural significance and innovative jewelry design. The idea of the stone’s rarity after the closure of a few mines, including Arizona’s Sleeping Beauty, also increased interest. “Collectability tends to drive the high-end market,” Shull said.

The turquoise market has been increasing at a healthy pace since the 1990s, with buyers becoming more educated about what’s on the market.

But the supply of natural turquoise, including both material that needs to be enhanced and that which is naturally hard enough to be gemstone quality, has dwindled in the past few years.

Domestic challenges

One of the top-producing mines, the Sleeping Beauty Mine in Globe, Ariz., which consistently produced large quantities of turquoise with no matrix (the dark veins that run through it) and was considered one of the gemstone’s most important sites, no longer is producing turquoise.

Deriving its name from the fact that that the mine is said to resemble a woman in slumber, the Sleeping Beauty Mine closed in 2012. Within months of its closure, rough from the

Sleeping Beauty turquoise is one of the most valued varieties of the gemstone due to the fact that is has no matrix and is a very clean stone.

When Sleeping Beauty turquoise was in great supply, it was possible to get large high-quality pieces of rough, said Ken Leung of Gleam Gems. Now, since the mine is no longer in operation, anything of that caliber on the market is likely coming from a supplier’s inventory.

Where beads greater than 6 millimeters in size are now considered large, Leung said they used to be able to obtain round beads upwards of 16, 18 or even 20 mm. The mine also was able to serve a variety of markets and price points, providing large quantities of turquoise suitable for treatment as well as natural gem-quality stones.

“We’re not currently aware of another source at this time for this kind of turquoise, so unless something changes and a new supply is found, this will become a lost material, a collector’s item,” Leung said.

Gleam Gems is able to offer Sleeping Beauty turquoise because they have built up a stockpile. But Leung adds that most of the company’s demand these days is coming from overseas, as American consumers are less likely to pay the higher prices that the high-end turquoise gems now demand.

A foreign approach

As domestic supply in the U.S. started drying up, the industry began looking at foreign sources, particularly China. But even these sources are putting less newly mined material into the market today.

Up until about four or five years ago, the turquoise coming from China was both plentiful and relatively inexpensive, according to Shull. Since then, however, little Chinese product has been hitting the market.

Some turquoise still is coming out of China, along with Egypt, Iran and Mexico, in commercial quantities. These days, however, the mining focus mainly is on the southwestern United States

Though it’s of a different variety, much of what is hitting the market as newly mined material currently comes from the deposits of Kingman, Ariz.--though Shull said even that’s mostly enhanced material that needs treatment to be hard enough to be used as gemstones--and a small number of mines still are in production in Nevada.

Maturing markets

The diminishing supply of turquoise in the U.S. and China has led to a “maturing” of the market, as Shull refers to it, with different types of looks being appreciated by various consumer groups as the market slowly moves past fashion-oriented trends.

He adds that they are seeing that European and Middle Eastern buyers generally prefer gem-grade “clear” turquoise while in the U.S. and, to some extent, Japan, the stones with a matrix are preferred.

Though the presence of a matrix in turquoise can lower its value, according to the GIA’s Gem Encyclopedia, stones with the spider-web look still are valued and desired by consumers and designers in certain markets.

Sara Freedenfeld, the designer behind the Amali jewelry line, echoed this sentiment, saying that many of her customers love the look of the Persian turquoise with its very natural matrix.

“First and foremost, I love turquoise because it is such a beautiful color. It’s playful, vibrant, and youthful,” she said. “I think most people associate it with silver, so I love working with it in gold designs because it’s a little unexpected.”

The classic blue turquoise currently is both the most recognized and most popular, especially in the commercial market. Blue-green and green turquoise also has been trending upward as it starts to get used in more designs.

While the high-quality, untreated turquoise that is clean and clear can demand a certain price in today’s market, the untreated gemstones with an even black spider-web matrix also are fetching high prices. Turquoise from some of the Nevada mines, for example, are going for more than $300 per carat, according to Shull.

The gemstone’s future likely depends on many of these smaller mines that still are producing, supplying a variety of quality and types for a wide consumer market, as well as the latest jump in prices somewhat stabilizing itself.

“With certain qualities being relatively inexpensive for many years, many are reluctant to invest the money to carry turquoise in their inventory,” Shull said. “The biggest opportunity is that an increasingly educated public is likely eager to purchase quality turquoise jewelry for its lore as well as its attractive color.”

The Latest

The Italian luxury company purchased the nearly 200-year-old Swiss watch brand from Richemont.

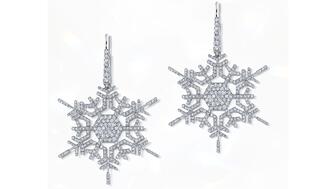

Micro-set with hundreds of diamonds, these snowflake earrings recreate “winter’s most elegant silhouette,” and are our Piece of the Week.

Criminals are using cell jammers to disable alarms, but new technology like JamAlert™ can stop them.

Ella Blum was appointed to the newly created role.

Sponsored by RapNet

Investment firm Enhanced Retail Funding, a division of Gordon Brothers, was the successful bidder.

How Jewelers of America’s 20 Under 40 are leading to ensure a brighter future for the jewelry industry.

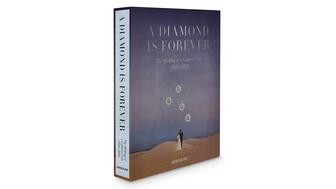

It explores the history of the iconic tagline and the company’s strategy to redefine the role of diamonds in society.

Retail veteran Sindhu Culas has stepped into the role.

Taylor Burgess, who has been at Stuller since 2013, was promoted to the newly created role.

Was 2025 a good year for jewelers? Did lab-grown diamonds outsell natural? Find out on the first episode of the “My Next Question” podcast.

Whether you recognize their jewels or are just discovering them now, these designers’ talent and vision make them ones to watch this year.

Buyers are expected to gravitate toward gemstones that have a little something special, just like last year.

Plus, JSA’s Scott Guginsky discusses the need for jewelers to take more precautions as the gold price continues to climb.

Morris’ most cherished role was being a mother and grandmother, her family said.

“Vimini” is the first chapter of the “Bulgari Eternal” collection that merges archival pieces with modern creations.

The third edition will be held in Half Moon Bay, California, in April.

The grant is in its first year and was created to recognize an exceptional fine jewelry designer whose star is on the rise.

Data built on trust, not tracking, will be key to success going forward, as the era of “borrowed attention” ends, Emmanuel Raheb writes.

Heath Yarges brings two decades of experience to the role.

Pete’s boundless curiosity extended beyond diamond cut and he was always eager to share his knowledge with others, no matter the topic.

Cartier, Van Cleef & Arpels, Buccellati, and Vhernier had another successful holiday season, Richemont reported this week.

Our Piece of the Week is Lagos’ “Bee” brooch that was seen on the red carpet for the first time on Sunday.

Trevor Jonathan Wright led a crew in a string of armed robberies targeting South Asian-owned jewelry stores on the East Coast.

The program recognizes rising professionals in the jewelry industry.

A new lifestyle section and a watch showcase have been added to this year’s event.