From tech platforms to candy companies, here’s how some of the highest-ranking brands earned their spot on the list.

Analysis: The State of the Diamond Industry

It is an industry in a period of flux, with changes, shifts and challenges assailing it from all directions.

Those who are purchasing luxury goods constantly see advertising from other product categories with impeccably crafted and well-considered marketing campaigns that have the potential to leave the diamond industry in the dust. Think: technology (Apple) and handbags (Louis Vuitton, Chanel).

After years of company-specific over industry-specific marketing, the newly formed Diamond Producers Association (DPA) is rolling out a marketing campaign aimed at increasing consumer desire for diamonds, specifically targeting the desirable millennial demographic.

The “Real is Rare. Real is a Diamond.” promotion, the first industry-wide marketing campaign in more than five years, is a result of DPA research on millennials, which revealed that while younger buyers see the appeal of diamonds, it takes more than a catchy tagline to propel them to buy.

“We are creating a new language and conversation around diamonds, much closer to the reality of today’s consumers, while remaining aspirational,” explains DPA CEO Jean-Marc Lieberherr.

“It is time for us to rebuild the diamond brand in a way that maximizes its relevance for younger generations and will ensure that promotional investments then generate the right returns because they are made on fertile grounds … Of course, other aspects of the diamond experience also need to be reviewed, from product designs to communication and critically the in-store experience,” he admits.

“Every year that passes makes it more expensive to rebuild eroding brand equity. It is a dangerous lose-lose cycle. What the industry has to do now is to focus on building a strong diamond equity base, create an emotional connection, and divert some investment from short to longer term.”

The Great Lab-Grown Debate

Despite the unified marketing front, external forces could also sour the diamond dream.

According to Bain & Company Inc.’s December 2015 Luxury Goods Worldwide Market Study, real luxury spending has slowed. “The slowdown,” the report states, “confirms a shift to a ‘new normal’ of lower sales growth in the personal luxury goods market.”

Among specific categories of personal luxury goods, hard luxury, which includes jewelry, contracted by 3 percent. Perhaps the only good news is that jewelry led the hard luxury sector, growing at 6 percent at constant exchange rates.

SEE: The 2016 $100 Million Supersellers list

One of the problems, concludes Bain, is that price-conscious luxury shoppers are “struggling to reconcile the price of luxury products with their real value.”

No wonder some younger buyers see better value in lab-grown over mined diamonds.

While millennials crave what the DPA research termed “real connections,” “real” does not necessarily mean mined when it comes to diamonds.

This younger, information-savvy demographic is more willing to look at alternatives to diamonds, which some perceive to be environmentally harmful or unethical. Despite the work of the Kimberley Process and organizations within the industry in almost completely stamping out the trade in conflict diamonds, some of the bad press from the Blood Diamond era lingers.

In its Game of Stones – Lab vs. Pipe research analysis, Morgan Stanley projects that lab-grown diamonds could have a 7.5 percent share in sales of larger diamonds by 2020.

However, it is unlikely the lab-grown market will manage to disrupt the mined industry in a serious way.

“The most likely scenario is that the lab-grown diamond market finds its own niche, increasing the diamond jewelry market and taking limited share from miners,” says Neri Tollardo, an analyst with Morgan Stanley’s Europe, Middle East and Africa Metals & Mining research team, which compiled the research.

The DPA’s Lieberherr agrees, and dismisses the idea that lab-grown diamonds and mined diamonds are competing for the same dollar.

“To reduce a diamond to its molecular composition and suggest that magic and lasting value can be created in a press is a deception that consumers will not fall for,” he says. “As is the case for all technology-driven, man-made products, the value of synthetic diamonds will fall year by year. They are neither rare nor precious and as production capacity builds up in China in particular, the cost of production will continue to plummet … Our research shows that the majority of consumers considering lab-grown diamonds do so for economic reasons. It is going to be a price game. Diamonds are about emotion and value.”

But, it is also about giving the customer what he or she wants.

“The product is here, whether anyone likes it or not. I realize that it raises questions and concerns for some people, not knowing what this means for the future of our industry. By our being active and involved in lab-grown diamonds, we can have some influence in creating the best outcome for our customers.” --Stanley Zale, Stuller

Manufacturer and supplier Stuller Inc., which recently joined the 21-member International Grown Diamond Association, now sells both mined and lab-grown stones.

“I see it more as a way to expand our industry,” says Stanley Zale, vice president of diamonds and gemstones at the Lafayette, La.-based company, in explanation of the company’s decision to diversify its product offering.

“This is about offering choices to our customers. Lab-grown diamonds are a product at a different price point that enables the end consumer to either spend less, or even buy a bigger diamond for the same money.”

The lab-grown debate has been a major topic of discussion this year, and it “elicits a lot of emotion,” says Zale. After assuaging concerns that lab-grown and mined products would get mixed up, he says there has been greater acceptance of the company’s strategy.

“The product is here, whether anyone likes it or not. I realize that it raises questions and concerns for some people, not knowing what this means for the future of our industry,” he says. “By our being active and involved in lab-grown diamonds, we can have some influence in creating the best outcome for our customers.”

Currently, the lab-grown stones account for a small percentage of Stuller’s overall diamond business, but says Zale, “If we take the colored gemstone business as a guide, then it could be as much as 15 percent of the total diamond market.”

If this really is a new niche, then it is perhaps something for the industry to seriously consider.

Big Trouble in Little Goods

While Stuller and other responsible manufacturers ensure their goods are clearly disclosed and kept separate from mined diamonds, the constant penetration of small CVD diamonds, whose origins are incredibly difficult to verify, into the market is causing price deflation in the small-size rough market, says Guy Harari of online rough trading platform Bluedax.

It is not what the industry, which is already grappling with a lack of financing and shrinking margins, needs.

“After a very tough 2015, when demand for polished dropped drastically and the rough market came to a halt, the main rough producers understood that something needed to be done and in January (2016) they reduced the price of their goods," explains Harari. “Since then, rough prices have increased almost 15 percent on average and are now at the highest level since the beginning of the year.”

Says Harari, most of the profit in trading rough emanates from short-term credit and high premiums (the price non-sightholders pay in the secondary market to buy boxes from sightholders), which give a much better return on capital than manufacturing.“At (De Beers’) August sight, the average premiums we saw were 5.8 percent, compared with negative premiums during the same month last year.”

Add the entry of small CVD diamonds, a drop in demand for large, expensive goods and a lack of financing, and Harari believes that if demand for polished goods does not increase, the industry might once again see a fall in rough prices with manufacturers no longer purchasing rough.

This has a negative impact on the industry, he explains.

The first to get hurt are the mining companies, as lower revenue can result in the closure of “uneconomic mines.”

The second group affected are the manufacturers and polished sellers, who have to lower the prices of their existing stock to levels that do not allow them to make a profit because of the cheaper goods that will soon flood the market.

“The problem for the manufacturers is the margin,” he says. “When they are squeezed between the retailers and the mines, the price is not relevant as long as they can maintain their margins, which is becoming increasingly challenging.”

SEE: The Top 50 North American Retail Jewelry Chains

The lack of financing is especially troublesome for those in the middle of the pipeline.

London-based Standard Chartered PLC shut down its diamond and jewelry business in June 2016 following an earlier decision requiring clients, particularly those in Antwerp and India, to take out payment insurance or provide up to 100 percent collateral. The bank was badly burned by the Winsome Diamonds and Jewellery default, one of the largest in Indian history.

Antwerp Diamond Bank and Israel’s Bank Leumi have also exited the business, preferring to concentrate on sectors with more transparency and less perceived risk.

More recently, the First International Bank of Israel (FIBI) cut back on credit lines mainly to small and mid-sized companies, although its effect is less serious than some of the earlier closures, albeit part of a worrisome trend.

“FIBI is the smallest of the Israeli banks that finance the diamond sector,” says Israel Diamond Exchange president Yoram Dvash. “Their tightening of credit does not please us, but its effect is relatively small. The problem however is a global one and we must solve it on an international level. The World Federation of Diamond Bourses is working on this and I hope we will be able to change the approach of the banks worldwide to the diamond sector.”

As a manufacturer, Dvash understands changes need to be made.

And they are the same type of changes that many say are needed at the retail level as well, changes that put the focus on doing one thing really well instead of trying to be everything to everyone.

“The time when diamond companies could be supermarkets that sold everything is over. This is the age when each company must develop its own niche and … excel at it,” he says.

While the financial challenges persist, while spending on luxury goods drops and while--depending on how you look at it--the business is being challenged by the lab-grown sector, the fact that the industry is at last beginning to work together is extremely positive, and that is rare indeed.

The Latest

The “Khol” ring, our Piece of the Week, transforms the traditional Indian Khol drum into playful jewelry through hand-carved lapis.

The catalog includes more than 100 styles of stock, pre-printed, and custom tags and labels, as well as bar code technology products.

Launched in 2023, the program will help the passing of knowledge between generations and alleviate the shortage of bench jewelers.

The chocolatier is bringing back its chocolate-inspired locket, offering sets of two to celebrate “perfect pairs.”

The top lot of the year was a 1930s Cartier tiara owned by Nancy, Viscountess Astor, which sold for $1.2 million in London last summer.

The Swiss watchmaker has brought its latest immersive boutique to Atlanta, a city it described as “an epicenter of music and storytelling.”

Criminals are using cell jammers to disable alarms, but new technology like JamAlert™ can stop them.

In his new column, Smith advises playing to your successor's strengths and resisting the urge to become a backseat driver.

The index fell to its lowest level since May 2014 amid concerns about the present and the future.

The new store in Aspen, Colorado, takes inspiration from a stately library for its intimate yet elevated interior design.

The brands’ high jewelry collections performed especially well last year despite a challenging environment.

The collection marks the first time GemFair’s artisanal diamonds will be brought directly to consumers.

The initial charts are for blue, teal, and green material, each grouped into three charts categorized as good, fine, and extra fine.

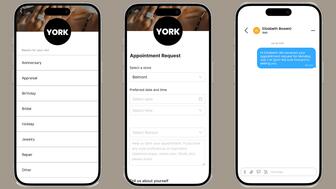

The new tool can assign the appropriate associate based on the client or appointment type and automate personalized text message follow-ups.

Buyers are expected to gravitate toward gemstones that have a little something special, just like last year.

Endiama and Sodiam will contribute money to the marketing of natural diamonds as new members of the Natural Diamond Council.

The retailer operates more than 450 boutiques across 45 states, according to its website.

The new members’ skills span communications, business development, advocacy, and industry leadership.

The jeweler’s 2026 Valentine’s Day campaign, “Celebrating Love Stories Since 1837,” includes a short firm starring actress Adria Arjona.

The new features include interactive flashcards and scenario-based roleplay with AI tools.

Family-owned jewelry and watch retailer Deutsch & Deutsch has stores in El Paso, Laredo, McAllen, and Victoria.

The Italian luxury company purchased the nearly 200-year-old Swiss watch brand from Richemont.

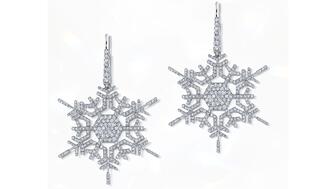

Micro-set with hundreds of diamonds, these snowflake earrings recreate “winter’s most elegant silhouette,” and are our Piece of the Week.

Ella Blum was appointed to the newly created role.

Sponsored by RapNet

Investment firm Enhanced Retail Funding, a division of Gordon Brothers, was the successful bidder.