Chris Blakeslee has experience at Athleta and Alo Yoga. Kendra Scott will remain on board as executive chair and chief visionary officer.

3 Indicted in $6.5M Diamond Investment Scheme

A federal grand jury in Dallas has indicted three men on various charges stemming from their alleged involvement in a scheme to defraud investors.

Dallas--Three Texas men have been indicted by a federal grand jury on various charges stemming from their alleged involvement in a diamond investment fraud scheme run between March 2011 and November 2013.

According to the U.S. Attorney’s Office for the Northern District of Texas, three defendants--Craig Allen Otteson, 64, Jay Bruce Heimburger, 58, and Christopher Arnold Jiongo, 55--surrendered to federal authorities on Sept. 9 and made their first court appearances that afternoon.

They were all released on bond.

The 10-count indictment charges each defendant with one count of conspiracy to commit wire fraud and three counts of wire fraud. Otteson and Heimburger also are each charged with six counts of mail fraud.

According to the indictment, Otteson acted as the managing member and chief compliance officer of Stonebridge Advisors LLC in Dallas, which was involved as the managing partner of Worldwide Diamond Ventures LP, a company that bought and resold diamonds on the international market but filed for bankruptcy in the Northern District of Texas in October 2013.

The indictment alleges that initially the defendants attempted to raise funds for Worldwide Diamond by offering the sale of additional limited partnerships--with a minimum amount of $100,000--in the company, but were unable to raise sufficient capital funds this way.

Then, in March 2011, the defendants attempted to raise additional necessary funds by offering “Non-Recourse Promissory Notes” (diamond notes), hiring three outside companies to market and sell the diamond notes to investors in Texas, Pennsylvania and California. Each $50,000 diamond note had a nine-month maturity date and an 8 percent rate of return.

The defendants promised investors that all of their funds would only be used to purchase and resell diamonds but defrauded them by concealing that they used nearly $2.5 million of the capital to make unauthorized loans to third parties.

Between March 2011 and May 2013, a total of 77 investors sunk approximately $6.5 million into the company.

If convicted, Otteson, Heimburger and Jiongo face a maximum statutory penalty of 20 years in federal prison and a $250,000 fine. The indictment also includes a “forfeiture allegation” requiring them, upon conviction, to forfeit the proceeds obtained as a result of the fraud.

The attorney’s office did not respond to a request for more information on what was next for Otteson, Heimburger and Jiongo.

The Latest

The credit card companies’ surveys examined where consumers shopped, what they bought, and what they valued this holiday season.

Kimberly Miller has been promoted to the role.

How Jewelers of America’s 20 Under 40 are leading to ensure a brighter future for the jewelry industry.

The “Serenity” charm set with 13 opals is a modern amulet offering protection, guidance, and intention, the brand said.

“Bridgerton” actresses Hannah Dodd and Claudia Jessie star in the brand’s “Rules to Love By” campaign.

Founded by jeweler and sculptor Ana Khouri, the brand is “expanding the boundaries of what high jewelry can be.”

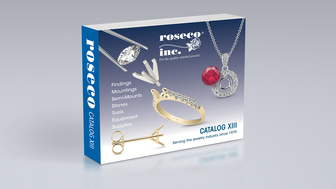

Roseco’s 704-page catalog showcases new lab-grown diamonds, findings, tools & more—available in print or interactive digital editions.

The jewelry manufacturer and supplier is going with a fiery shade it says symbolizes power and transformation.

The singer-songwriter will make her debut as the French luxury brand’s new ambassador in a campaign for its “Coco Crush” jewelry line.

The nonprofit’s new president and CEO, Annie Doresca, also began her role this month.

As the shopping mall model evolves and online retail grows, Smith shares his predictions for the future of physical stores.

The trade show is slated for Jan. 31-Feb. 2 at The Lighthouse in New York City's Chelsea neighborhood.

January’s birthstone comes in a rainbow of colors, from the traditional red to orange, purple, and green.

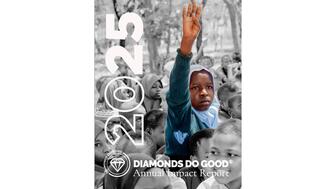

The annual report highlights how it supported communities in areas where natural diamonds are mined, crafted, and sold.

The supplier has a curated list of must-have tools for jewelers doing in-house custom work this year.

The Signet Jewelers-owned store, which turned 100 last year, calls its new concept stores “The Edit.”

Linda Coutu is rejoining the precious metals provider as its director of sales.

The governing board welcomed two new members, Claire Scragg and Susan Eisen.

Sparkle with festive diamond jewelry as we celebrate the beginning of 2026.

The master jeweler, Olympian, former senator, and Korean War veteran founded the brand Nighthorse Jewelry.

In its annual report, Pinterest noted an increase in searches for brooches, heirloom jewelry, and ‘80s luxury.

Executive Chairman Richard Baker will take over the role as rumors swirl that a bankruptcy filing is imminent for the troubled retailer.

Mohr had just retired in June after more than two decades as Couture’s retailer liaison.

Shekhar Shah of Real Gems Inc. will serve as president of the Indian Diamond & Colorstone Association in 2026.

This year’s good luck charm features the mythical horse Pegasus, and is our first Piece of the Week of the new year.

Articles about crime, engagement rings, and a necklace worn in the World Series generated the most interest among readers.