From tech platforms to candy companies, here’s how some of the highest-ranking brands earned their spot on the list.

What's next for De Beers class-action suit?

After the whirlwind of news that was the last two weeks I feel compelled to circle back around and delve deeper into one of the big headliners: the decision on the De Beers class-action lawsuit. As many of you probably...

After the whirlwind of news that was the last two weeks I feel compelled to circle back around and delve deeper into one of the big headliners: the decision on the De Beers class-action lawsuit.

As many of you probably heard, on July 13 the U.S. Court of Appeals for the Third Circuit rejected the 2006 settlement De Beers reached with diamond buyers who sued the diamond giant based on allegations of price fixing, a violation of U.S. antitrust laws. Under the settlement, De Beers had established a $295 million fund to be distributed to millions of diamond buyers separated into two classes. Under the settlement, direct purchasers--companies that bought directly from De Beers or De Beers' mining competitors-were to share a pot of $22.5 million. Indirect purchasers, a group that includes retailers and consumers, were to divide up the remaining $272.5 million.

The court's latest decision likely leaves those with interest in this case (including interested consumers and retailers) with two main questions: Why was the settlement rejected? And, when will I ever get my money?

I'll attempt to answer these questions below, with input from Howard Bashman, the Pennsylvania attorney who filed the successful objection, and another class attorney in the case, Joe Tabacco of Berman DeVallerio in San Francisco.

Why?

In filing his objection, the point Bashman made--which the Third Circuit Appeals Court in Philadelphia agreed with--is that under antitrust laws in some states, you can only sue if you're the direct purchaser of a product or service.

So, Bashman argued, it was unfair for indirect purchasers from certain states to receive a portion of the settlement, since antitrust recovery is limited to only direct purchasers in the states where they reside. (As a point of note, according to the suit, the states are divided on the issue: about 25 allow indirect purchasers to recover in antitrust suits and 25 don't.)

"In this settlement, everyone got to recover no matter what state you're in," Basman says. "The consequences are people like my client are going to get less."

Bashman represents a single individual in this case, a woman from Texas, one of the states that allows indirect purchasers to sue in antitrust cases. Bashman is based in Willow Grove, Pa.

This is a short, simple explanation of the 75-page ruling in the case, which you can read in its entirety by clicking here.

Look at pages 29-31 for a breakdown

While much has been written and said about the attorneys involved in this case, particularly those for the objectors, I think two points need to be made here. One, like the delay or not, Bashman brought forward a valid point of law or the court never would have agreed with his objection. Two, the court ruling points out that this type of sweeping settlement has never been attempted in an antitrust case before. The lawyers in this case were trying something new that seems to have failed, at least for now.

What happens now?

Bashman said the attorneys in the case have until July 27 to ask the appeals court to reconsider their decision. If they chose not to, or if the appeals court denies the request, it returns to the trial court.

There, any number of things could happen. What Bashman would like to see is a new settlement organized on a state-by-state basis and limited to indirect purchasers who live in states with antitrust laws that allow them to sue, potentially meaning more money for those individuals.

Or, as Gemological Institute of America (GIA) diamond expert Russell Shor speculated in the July 16 GIA Insider e-newsletter, the case could splinter into separate lawsuits.

Will I ever get my money?

It's pretty widely known at this point that while the big diamond guys--the direct purchaser class --could net a substantial sum, the recovery for smaller players isn't going to be as much. But these days, money is money and I don't know many retailers that would turn down a check for any amount, no matter how miniscule.

Tabacco said the appeals court decision could delay the distribution of funds by four to 12 months or longer.

Stay tuned...

The Latest

The “Khol” ring, our Piece of the Week, transforms the traditional Indian Khol drum into playful jewelry through hand-carved lapis.

The catalog includes more than 100 styles of stock, pre-printed, and custom tags and labels, as well as bar code technology products.

Launched in 2023, the program will help the passing of knowledge between generations and alleviate the shortage of bench jewelers.

The chocolatier is bringing back its chocolate-inspired locket, offering sets of two to celebrate “perfect pairs.”

The top lot of the year was a 1930s Cartier tiara owned by Nancy, Viscountess Astor, which sold for $1.2 million in London last summer.

Any gemstones on Stuller.com that were sourced by an AGTA vendor member will now bear the association’s logo.

Criminals are using cell jammers to disable alarms, but new technology like JamAlert™ can stop them.

The Swiss watchmaker has brought its latest immersive boutique to Atlanta, a city it described as “an epicenter of music and storytelling.”

The new addition will feature finished jewelry created using “consciously sourced” gemstones.

In his new column, Smith advises playing to your successor's strengths and resisting the urge to become a backseat driver.

The index fell to its lowest level since May 2014 amid concerns about the present and the future.

The new store in Aspen, Colorado, takes inspiration from a stately library for its intimate yet elevated interior design.

The brands’ high jewelry collections performed especially well last year despite a challenging environment.

The collection marks the first time GemFair’s artisanal diamonds will be brought directly to consumers.

The initial charts are for blue, teal, and green material, each grouped into three charts categorized as good, fine, and extra fine.

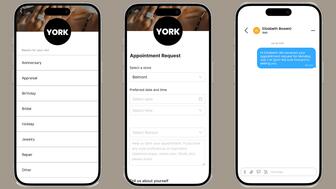

The new tool can assign the appropriate associate based on the client or appointment type and automate personalized text message follow-ups.

Buyers are expected to gravitate toward gemstones that have a little something special, just like last year.

Endiama and Sodiam will contribute money to the marketing of natural diamonds as new members of the Natural Diamond Council.

The retailer operates more than 450 boutiques across 45 states, according to its website.

The new members’ skills span communications, business development, advocacy, and industry leadership.

The jeweler’s 2026 Valentine’s Day campaign, “Celebrating Love Stories Since 1837,” includes a short firm starring actress Adria Arjona.

The new features include interactive flashcards and scenario-based roleplay with AI tools.

Family-owned jewelry and watch retailer Deutsch & Deutsch has stores in El Paso, Laredo, McAllen, and Victoria.

The Italian luxury company purchased the nearly 200-year-old Swiss watch brand from Richemont.

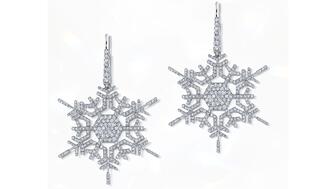

Micro-set with hundreds of diamonds, these snowflake earrings recreate “winter’s most elegant silhouette,” and are our Piece of the Week.

Ella Blum was appointed to the newly created role.