Pandora Puts Money Where Its Mouth Is Via Sustainability Bonds

The performance-based bond terms would give investors a bigger payout if Pandora’s stated sustainability goals are not met in time.

The company is selling a €500 million ($531 million) senior unsecured sustainability-linked bond with a five-year maturity.

This performance-based bond is designed to motivate Pandora to reach its stated sustainability goals within that time frame.

When the bond matures in 2028, Pandora will have to pay more to its investors if the goals have not been met.

The first two goals focus on specific emission reductions, both its own emissions and those in its value chain, with deadlines in 2025 and 2030.

As for its own emissions, Pandora said it plans to implement energy-saving measures and expand its use of renewable energy, in part by installing more solar panels at all of its facilities, including retail stores.

Sourcing renewable electricity will be the driving force behind reaching its target, said Pandora.

The third goal is to reach 100 percent use of recycled gold and silver by 2025.

In 2022, Pandora reported using 61 percent recycled gold and silver when crafting its jewelry, up from 54 percent in 2021.

The topic of recycled metals, and where they fit in terms of responsible sourcing, has been a point of discussion for jewelers in recent years.

Sustainable jewelry consultant Christina T. Miller recently held a webinar on recycled gold, delving into areas like its place in responsible sourcing practices and how it’s marketed.

“Because gold is a financial asset and often interchangeable with currency, the demand for newly mined gold is not impacted by the increased use of recycled gold,” said Miller on her website.

The notes will be issued March 10 with a price of 99.46 percent each and a fixed coupon (interest rate payments) of 4.5 percent per year. They will be listed on Euronext Dublin.

The net proceeds from the sale will go toward general corporate purposes and Pandora’s planned refinancing.

The majority of the funds will be used to repay its existing bank loan, said a Pandora spokesperson, leaving its net debt level unchanged.

In its recent full-year results, the company outlined its plans to open a total of 140 to 190 new stores between last year and this year, and expand its lab-grown diamond jewelry line, Diamonds by Pandora.

Pandora said investor demand for the bonds reached heights of €2 billion after a two-day marketing exercise.

“The successful issuance of our first ever Eurobond underpins our strong financial characteristics and marks an important milestone in our journey, allowing us to further diversify our funding structure,” said Pandora Chief Financial Officer and Executive Vice President Anders Boyer.

Two major credit agencies gave the bonds somewhat favorable ratings, Pandora said.

Moody’s gave the bonds a Baa2 rating, which it considers to be “a moderate credit risk,” while Standard & Poor’s rated the bonds at BBB, which it describes as “adequate capacity to meet financial commitments, but more subject to adverse economic conditions.”

Both of these ratings are in line with the issuers’ ratings of Pandora, said the company.

Danske Bank and Nordea served as the joint global coordinators while BNP Paribas, Danske Bank, Morgan Stanley and Nordea were the joint active bookrunners on the transaction. Nordea was also a ratings and sustainability advisor to Pandora.

Editor's Note: This story has been updated post-publication to correct the price of the notes and clarify Pandora's plans to reduce emissions.

The Latest

Carlos Jose Hernandez and Joshua Zuazo were sentenced to life without the possibility of parole in the 2024 murder of Hussein “Sam” Murray.

Yood will serve alongside Eduard Stefanescu, the sustainability manager for C.Hafner, a precious metals refiner in Germany.

The New Orleans jeweler is also hosting pop-up jewelry boutiques in New York City and Dallas.

How Jewelers of America’s 20 Under 40 are leading to ensure a brighter future for the jewelry industry.

Set in a Tiffany & Co. necklace, it sold for $4.2 million, the highest price and price per carat paid for a Paraíba tourmaline at auction.

Take luxury gifting to new heights this holiday season with the jeweler’s showstopping 12-carat sphene ring.

This year's theme is “Unveiling the Depths of the Ocean.”

Roseco’s 704-page catalog showcases new lab-grown diamonds, findings, tools & more—available in print or interactive digital editions.

In its annual report, Pinterest noted an increase in searches for brooches, heirloom jewelry, and ‘80s luxury.

Starting Jan. 1, customers can request the service for opal, peridot, and demantoid garnet.

The 111-year-old retailer celebrated the opening of its new location in Salem, New Hampshire, which is its third store in the state.

The filmmaker’s personal F.P. Journe “FFC” prototype was the star of Phillips’ recent record-setting watch auction in New York.

The new location in the Design District pays homage to Miami’s Art Deco heritage and its connection to the ocean.

Inflations, tariffs, and politics—including the government shutdown—were among consumers’ top concerns last month.

“Longtime favorite” presenters, as well as first-time speakers, will lead talks and workshops at the annual event in Tucson next year.

Silas Smith of Meridian Metalworks won the challenge with his pendant that blends Australian and American landscapes.

The sale of the 31.68-carat, sunset-hued stone was part of Sotheby’s first series of events and auctions in Abu Dhabi.

Most customers who walk into your store this month have made up their minds. Your job is to validate their choice, Emmanuel Raheb writes.

The collection features characters and motifs from Ukrainian folklore, including an enchanted mirror and a magic egg.

MatrixGold 3.11, the newest version of the jewelry design program, offers more flexibility, precision, and creative control.

The pavilion will be part of the 2026 JA New York Spring show, scheduled for March 15 to 17.

Kadet, a 1994 National Jeweler Retailer Hall of Fame inductee, helped grow the family-owned retailer in the Chicago area and beyond.

Billed as the world’s smallest wearable, Lumia Health’s new smart earrings have a health tracker subtly embedded in the back.

Don’t let those with December birthdays feel blue. Help them celebrate their month with blue zircon, turquoise, and tanzanite.

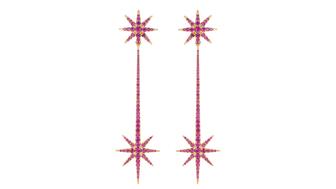

The new pink sapphire version of the piece dances with its wearer in the brand’s “Icons After Dark” holiday campaign.

A choice that’s generated a lot of commentary, Pantone says “Cloud Dancer” marks a fresh start and encourages relaxation and creativity.

The manufacturer’s holiday campaign features a gift guide filled with trending designs and jewelry that can be personalized.