London-based investment firm Pemberton Asset Management acquired the auction house for an undisclosed amount.

Is the Gray Market Slowing Down?

Yes, say watch retailers and a market analyst, but it will never go away completely.

New York--The main complaint about “gray market” watches—new watches sold by unauthorized dealers—is that they make it harder for authorized dealers to turn a profit on luxury watches.

Some quality brands are harder to find from non-authorized dealers than others, and discounts vary, but in many cases, a gray market watch can be bought for 25 to 35 percent less than what an authorized dealer would ask.

These aren’t fakes; they’re the real thing, although they are often close-outs or less desirable models. But if a customer tells an authorized dealer, “I can get this $40,000 watch online for $30,000,” that dealer will have to choose between negotiating or losing the sale.

The gray market probably never will go away entirely. Indeed, some retailers say it must be tolerated; otherwise the manufacturer would have to find less acceptable methods of disposing of surplus product, such as simply destroying it.

Retailers who sell authorized pieces, however, do have some advantages, which they should stress to the customer. Mainly, they sell peace of mind. They can assure the customer that the warranty is ironclad. They can provide expert information on watch technology, functions, and provenance, and the watch’s value as a collector’s item.

Navigating the Gray Area

Many watches found on the gray market in the United States were meant for sale overseas, but were sold to distributors who sold them to unauthorized distributors in North America. In this way, an individual consumer can buy a high-end piece by a big-name maker not only at a discount, but considerably faster than he or she could get it from an authorized dealer.

That consumer will often know that he’s buying a gray market watch. Authorized dealers, as a rule, don’t discount high-end watches significantly.

There’s nothing illegal about buying a watch from an unauthorized dealer. To the consumer, the downside only appears if and when the watch needs servicing. Gray market watches have no manufacturer’s warranty, and it’s easy for authorized distributors to identify watches that they didn’t sell.

“As the mainstream market continues to improve, and as some of the larger producers make efforts to ensure their product isn’t getting into gray market channels, the gray market is likely to get tighter in the future.” – Jon Cox, Kepler CheuvreuxGray market distributors offer their own warranties, of course, but those are hit-or-miss. Skilled watch repairers are hard to find,

Moreover, repairers who aren’t working with an authorized distributor will often be unable to access genuine spare parts. They might be able to put a watch back in working order, but if it now carries a generic part or two, its value as a collector’s item will be severely compromised.

Of course, consumers can get a factory repair from the original maker, but will pay for it. Thus, buying gray is a gamble—but many consumers believe it’s an acceptable risk.

A Way to Unload Old Goods

Some industry insiders concede that the gray market fills a need, and that it isn’t entirely a bad thing.

Selling to unauthorized vendors is a way for distributors to get rid of product that isn’t selling through at the retail price, and/or product that’s being discontinued, to make room for new goods.

The very finest and latest watches are usually better protected, and hard to find outside of authorized channels. In many cases, the manufacturer must choose between tolerating the gray market, or reclaiming and destroying unsold product.

Many market observers also agree that the gray market is to some degree a problem of the manufacturers’ making—and that it’s becoming less of a problem.

Watchmakers seem to have realized that they’ve oversupplied the market, and have become more careful about not turning out more product than will sell through.

“With increased demand overall for luxury watches and the previous efforts by small independent retailers, who often use the gray market to offload unwanted inventory, to reduce inventory, the gray market has probably slowed down,” says Jon Cox, head of Swiss equities and European consumer equities at the Zürich-based research firm Kepler Cheuvreux. “You can see this by ordering trends. It takes longer to get the product through the gray market, while the discount to official prices has been cut.

Cox continues, “As the mainstream market continues to improve, and as some of the larger producers make efforts to ensure their product isn’t getting into gray market channels, the gray market is likely to get tighter in the future.”

However, it’s unlikely ever to disappear.

“The market benefits an industry, which remains overwhelmingly wholesale, with watch producers mostly using independent retailers to sell product,” he said. “The watch producers can’t control every stage of distribution, and some turn a blind eye to the gray market, because it frees up space at independent retailers to order new product.”

Cox noted that Richemont, which owns brands including Roger Dubuis, A Lange & Söhne and Vacheron Constantin, has drastically reduced the availability of its pieces on the gray market by buying back their Asian overstocks—but they’re an exception.

Tony Wasserman, vice president of sales and marketing for Old Northeast Jewelers in St. Petersburg, Florida, which carries Glashütte, Omega, Grand Seiko, TAG Heuer, Ulysse Nardin and many others, said all major brands, and all major types of watches, are legally available on the gray market, but he agrees that the inflow of such product seems to be slowing down.

Old Northeast is one of the most prominent authorized dealers of high-end watches in the southern U.S., and Wasserman admits that it’s sometimes hard to get a good margin on watches at retail because of the readiness of gray market product.

“It’s nothing new,” he said. “It’s being done globally, because of inordinate pressure to increase sales. It has slowed down, though.”

It was rampant in the U.S. in the past two years, and its effect on authorized retailers was obvious.

“If a consumer can easily buy a product for not much more than wholesale, you’re not going to sell the same product at retail,” Wasserman said. “If a distributor counts gray goods as sales, they increase their sales but they don’t do much for their bottom line. It’s like getting rid of cars at the end of a model year.”

“The watch business has become a global market. I would liken it to how the diamond market has been affected by the internet … Consumers walk into your store with the four Cs on their smart phones, and they know of eight other places where they can buy what they want for such-and-such a price.” – Tony Wasserman, Old Northeast JewelersGray market watches are easy to find, he said. They’re available on eBay and on various dedicated watch websites. And gray market pieces sometimes find their way into brick-and-mortar retailers like Costco and Walmart.

(Costco famously won a decade-long battle with Swatch Group-owned brand Omega over gray market watches in 2015. Walmart, meanwhile, made headlines this past Black Friday when watches from Cartier, Rolex, Omega and IWC were spotted for sale on its website. Cartier pointed out that Walmart is not an authorized retailer but stopped short of publicly asking the retailer to stop selling the watch.)

“This affects us on a daily basis,” he added. “You can shop online and find someone in Germany who’ll give you a better price. The watch business has become a global market. I would liken it to how the diamond market has been affected by the internet. Diamonds used to be a blind price commodity. Now, consumers walk into your store with the four Cs on their smart phones, and they know of eight other places where they can buy what they want for such-and-such a price.

The only jewelry that has margins, now, is non-branded, he said.

“There was a time, with watches, when the customer didn’t have the wherewithal to shop 30 places for an item. The jeweler could sell it at a price. Now, even brands that aren’t known as ‘discount brands’ are being discounted at the retail level. If a brand is over-distributed, and several retailers in your area are selling it, you’re going to discount it to get it out of your showcase.”

Wasserman said some customers come to his store for repairs, claiming they bought the watch new and boxed. They did, but the warranty is void since it didn’t come from an authorized dealer.

Many customers, he said, aren’t aware that the unauthorized dealer might have bought the piece with a warranty, but that warranty doesn’t pass to the final owner.

“If we sell through a distributor in North America, we track the serial number,” he said. “If you call me about a watch with a serial number, we can track whom we sold it to.”

Some Gray Product Is Inevitable

Jeffrey Hess, CEO of Duber Time, a St. Petersburg-based distributor who also owns two Old Northeast Jewelers stores in the area, admits that that he has closeouts from time to time, but adds that he’s careful about ensuring that they are indeed old pieces, and that the amounts on the streets are minimal.

“We understand that many brands have older, unpopular merchandise that will be discounted,” he said. “Since we are authorized dealers for so many brands, we can appreciate the brands that do it in a discreet and careful manner. The brands that are less discreet are quickly jettisoned from our store.” Hess refused to give the names of the worst offenders.

“Grand Seiko, just for one, takes great care of its authorized dealers on the close-out market. They’ll buy your product back from you,” he said. “Some brands, though, seem to manufacture for the close-out market. We see the same watches turn up constantly. Sure, they’ll sell a few pieces to their authorized distributors at the regular price, but then they’ll sell to the close-out guys at 30 cents on the dollar. If they were American companies, they’d be in court all day.”

Another problem the authorized retailer faces, Hess noted, is the tendency of customers to spend 60 to 90 minutes in a store, looking at high-end watches, making their purchase decision and then finding that item online at a discount.

Paul Altieri, CEO of Bob’s Watches in Huntington Beach, California, specializes in pre-owned watches.

He calls the internet the “biggest disruptor” of the watch industry, adding that most brands don’t have a strategy for protecting authorized retailers from gray goods.

“It’s a matter of time until the major watch brands find a way to offer their products online,” he said. “That will surely have a negative impact on the gray market dealers. There’s a huge upside to brands selling online through established marketplaces.”

The Latest

The workshop will give attendees the chance to try out and ask questions about three different diamond verification instruments.

The footage shows two of the jewelry heist suspects descending from the second floor of the museum and then escaping via scooter.

As the holiday season quickly approaches, consider stocking one category that sometimes gets overlooked: earrings.

The luxury conglomerates faced a challenging Q3 amid geopolitical and economic tensions.

The struggling diamond mining company, which owns the historic Cullinan mine, has launched a rights issue to raise about $25 million.

The book details the journey of watches as symbols of hard-earned success in hip-hop for artists like 2Pac, Jay-Z, and more.

You deserve to know what you are selling–to protect your customers as well as your business and your reputation.

Alexis Vourvoulis, who most recently worked at Tiffany & Co., brings more than two decades of jewelry experience to her new role.

The superstar’s August engagement put the stamp of approval on an already hot engagement ring trend.

Retailers should offer classic styles with a twist that are a perfect fit for layered looks, experts say.

The nearly 7-carat fancy vivid purplish pink diamond could sell for around $9 million.

The retailer’s new collection of engagement rings and fashion jewelry is set with natural diamonds that are traceable via blockchain.

Five dollars buys one vote toward an industry professional you want to see dressed up as a hero, or a villain, this Halloween.

Recently acquired by KIL Promotions, the November edition of the public show in San Mateo, California, will be held Nov. 7-9.

The stone’s two zones, one pink and one colorless, may have formed at two different times, the lab said.

Hollywood glamour meets Milanese sophistication in the design of Pomellato’s new store in Beverly Hills, California.

The New York City store showcases a chandelier with 1,500 carats of lab-grown diamonds designed by an FIT student.

The Museum of Arts and Design's new exhibition features 75 pieces by the designer, best known for her work in the “Black Panther” films.

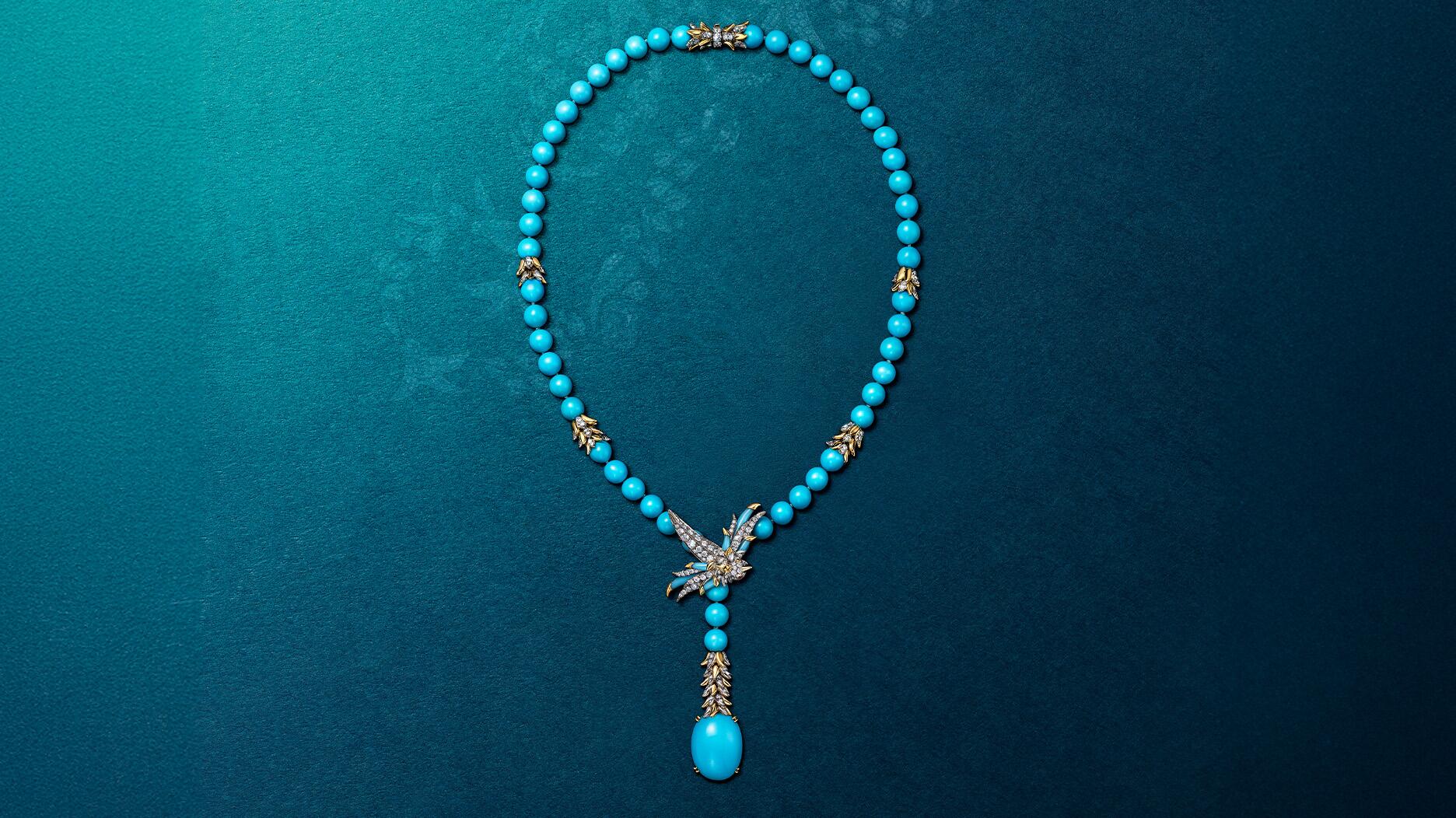

Making its auction debut, "The Glowing Rose" is expected to fetch $20 million at the November jewelry sale in Geneva.

They were attacked on Oct. 15, as approximately 40 miners without licenses marched on the mine’s gate.

It took the masked thieves less than 10 minutes to steal eight irreplaceable jewels from two display cases in the museum’s Apollo Gallery.

Gemologist Lauren Gayda has previously worked at The Clear Cut, Taylor & Hart, and Effy Jewelry.

In 2026, the jewelry retailer will celebrate a milestone only a small percentage of family-owned businesses survive to see.

The new showcase dedicated to Italian jewelry design is set for Oct. 29-30.

Take a gaze at the sky with this pair of platinum diamond-set star earrings with blue lace agate drops.

Jeffrey Zimmer's decades of leadership at Reeds Jewelers are defined by integrity, a love of sourcing gemstones, and a heart for community.