Located in NorthPark Center, the revamped store is nearly 2,000 square feet larger and includes the first Tudor boutique in Dallas.

Product Pulse: How Strong is Your Bridge Jewelry Business?

The category as a percentage of overall sales has either stayed the same or increased for the majority of retailers in recent years, our latest survey found.

New York--The latest category-specific survey from National Jeweler/Jewelers of America shows that bridge jewelry as a percentage of overall sales has either stayed the same or increased for retailers in recent years.

The Product Pulse survey on bridge jewelry was conducted online in late August/early September; approximately 120 jewelers responded.

It defined bridge jewelry as pieces that “bridge” the gap between costume and fine, often crafted using gold vermeil/gold fill and/or sterling silver with “semi-precious” gemstones.

Nearly half (48 percent) of jewelers said that bridge jewelry sales have stayed about the same as a percentage of their overall sales in recent years, while another 43 percent said they have increased.

Only 10 percent said they were decreasing.

More than half of retailers (53 percent) said that bridge jewelry accounts for 10 percent or less of their overall sales, while 19 percent indicated it was between 11 percent and 15 percent of the total and another 11 percent put it somewhere between 16 and 20 percent.

Thirteen percent of respondents said bridge jewelry made up between 21 and 30 percent of total sales, and another 4 percent indicated it was between 31 and 40 percent.

Only 1 percent had bridge jewelry sales at more than 40 percent of overall sales.

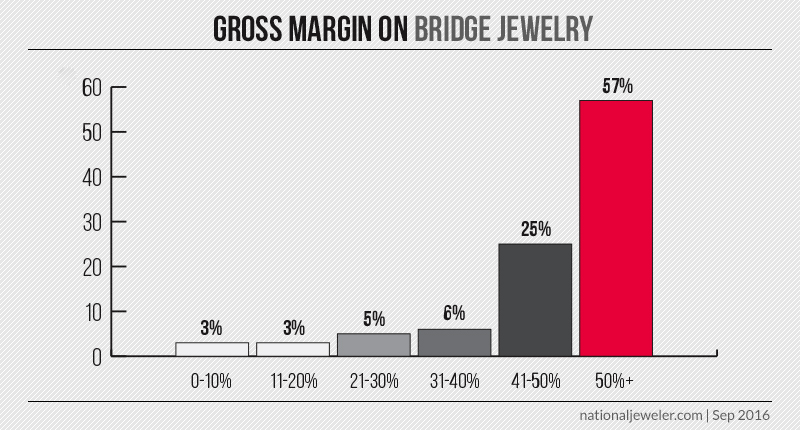

In terms of the overall gross margin from bridge jewelry, the most respondents (57 percent) said that the category has more than a 50 percent margin for them, while one in four said it was between 41 and 50 percent.

Only 6 percent said it was between 31 percent and 40 percent margin, while 5 percent said bridge jewelry had a margin between 21 percent and 30 percent and the remaining 6 percent saw a 20-percent-or-less margin.

When asked why they started carrying bridge jewelry, many survey takers said they did it when the price of gold began to go up in order to have jewelry at the price points consumers wanted.

“We started as soon as gold started rising in price so that we could still offer affordable jewelry,” one respondent wrote.

Another said that they made the move into bridge “to give our customers a wider price range to select from and try out some trendy fashions.”

The possibility of a higher margin from bridge jewelry also helped, as one retailer said they began carrying jewelry in the category 18 months ago “to compensate and boost sagging sales overall.”

Among the

Outside of specific brand names, many jewelers just stated that what does best for them in this category is sterling silver jewelry set with gems or diamonds.

The Latest

The nonprofit has made updates to the content in its beginner and advanced jewelry sales courses.

BIJC President Malyia McNaughton will shift roles to lead the new foundation, and Elyssa Jenkins-Pérez will succeed her as president.

Gain access to the most exclusive and coveted antique pieces from trusted dealers during Las Vegas Jewelry Week.

As a nod to the theme of JCK Las Vegas 2025, “Decades,” National Jeweler took a look back at the top 10 jewelry trends of the past 10 years.

The company plans to halt all consumer-facing activity this summer, while Lightbox factory operations will cease by the end of the year.

Following weekend negotiations, the tax on Chinese goods imported into the United States will drop by 115 percent for the next 90 days.

Supplier Spotlight Sponsored by GIA

“Artists’ Jewelry: From Cubism to Pop, the Diane Venet Collection” is on view at the Norton Museum of Art through October.

The deadline to submit is June 16.

Moti Ferder stepped down Wednesday and will not receive any severance pay, parent company Compass Diversified said.

Lichtenberg partnered with luxury platform Mytheresa on two designs honoring the connection between mothers and daughters.

The miner announced plans to recommence open-pit mining at Kagem.

Michel Desalles allegedly murdered Omid Gholian inside World of Gold N Diamond using zip ties and then fled the country.

Associate Editor Lauren McLemore shares her favorite looks from a night of style inspired by Black dandyism.

Sponsored by Instappraise

CEO Beth Gerstein discussed the company’s bridal bestsellers, the potential impact of tariffs, and the rising price of gold.

The brand’s first independent location outside of Australia has opened in Beverly Hills, California.

Cathy Marsh will lead the jewelry company’s efforts in the upper Midwest and western United States.

The company has multiple strategies for dealing with tariffs, though its CEO said moving manufacturing to the U.S. is not one of them.

Connecting with your customers throughout the year is key to a successful holiday marketing push.

Its commercial-quality emerald sale held last month totaled more than $16 million, up from about $11 million in September 2024.

National Jeweler Editor-in-Chief Michelle Graff joined Michael Burpoe to talk tariffs, consumer confidence, and the sky-high price of gold.

Designer Lauren Harwell Godfrey made the piece as an homage to the 2025 gala’s theme, “Superfine: Tailoring Black Style.”

Expanded this year to include suppliers, JA’s 2025 list honors 40 up-and-coming professionals in the jewelry industry.

Located in Fort Smith, it’s the Mid-South jeweler’s first store in Northwest Arkansas.

The episode about the family-owned jeweler will premiere May 17.