Chris Blakeslee has experience at Athleta and Alo Yoga. Kendra Scott will remain on board as executive chair and chief visionary officer.

SEC Pulls the Plug on Diamond-Related Cryptocurrency Scam

A Florida cryptocurrency company allegedly took more than $30 million from investors, promising big returns by reselling fancy colored diamonds.

Washington, D.C.—The U.S. Securities and Exchange Commission has put the brakes on an alleged diamond-related cryptocurrency scam, the regulator announced Tuesday.

The U.S. District Court for the Southern District of Florida granted the SEC’s request for an emergency court order halting an alleged Ponzi scheme that took in than $30 million from over 300 investors in the United States and Canada, promising big returns by reselling diamonds.

According to the SEC complaint, Jose Angel Aman of Argyle Coin, a Florida-based cryptocurrency company, and his partners, Harold Seigel and Jonathan H. Seigel (who are father and son), told investors that investing in their cryptocurrency company was risk-free because it was backed by fancy colored diamonds.

Aman’s LinkedIn profile states that he has worked in the fancy colored diamond industry for more than 25 years and attended the American Institute of Diamond Cutting.

Aman is also allegedly the owner of Diamante Atelier, a jewelry store on Worth Street, an exclusive block in Palm Beach, Florida featuring high-end stores like Gucci and Hublot.

A storefront for Diamante Atelier, which shares an address with Argyle Coin, is not visible on Google Maps. The website for the store is disabled and a call placed Tuesday did not go through.

The SEC claims that instead of using investor funds to develop the business, Aman and Jonathan H. Siegel misappropriated more than $10 million. Aman, the complaint alleges, used some of the money for personal expenses, including rent on his home and horseback-riding lessons for his son.

The remainder of the investor funds were used to pay “purported returns” to investors in Aman’s other companies, which allegedly were operating similar schemes.

Argyle Coin is just one piece of the puzzle, according to the complaint, which states that Aman and Seigel were involved in “operating a multi-layer Ponzi scheme,” offering unregistered securities through two other companies.

From May 2014 through December 2018, Aman operated Natural Diamonds Investment Co., in which Jonathan H. and Harold, who is host of a weekly Canadian radio show called “The World Financial Report,” had an interest.

Similar to the Argyle Coin pitch, the companies told investors that it would invest in rough fancy colored diamonds, cut and polish them and then sell them for a profit, according to the complaint.

Investors were told the initial return would be 24 percent and full return of the principal would be realized within two years, according to court documents.

When funds were running low

A search of Florida state’s Division of Corporation website also shows “Jose A Aman” as the officer of Falcon Financial Diamond Group Inc., Fancy Diamonds Private Investments LLC, H. Seigel Fine Auctions Inc., and Natural Diamonds Investment Co., though these were not listed in the SEC complaint.

“As alleged, Aman operated a complicated web of fraudulent companies in an effort to continually loot retail investors and perpetuate the Ponzi schemes as well as divert money to himself,” Eric I. Bustillo, director of the SEC’s Miami Regional Office, said in a statement.

Argyle Coin did not have diamonds to back up investors’ money, according to court documents. Aman allegedly pawned dozens of diamonds and pocketed proceeds of more than $750,000.

Natural Diamonds, Eagle, Argyle Coin, Aman and the Seigels have been charged with violations of the securities registration provisions.

Aman and his companies are facing an additional charge of violating the anti-fraud provisions of the federal securities laws.

The SEC is seeking to levy financial penalties as well as repayment of “ill-gotten gains and prejudgment interest”.

The accounts of Natural Diamonds, Eagle and Argyle Coin had a combined negative balance of about $120,000 as of March 31, as per court documents.

The SEC has been cracking down on fraudulent cryptocurrency companies, looking to protect consumers as the process of codifying regulations drags on.

“As with any other type of potential investment, if a promoter guarantees returns, if an opportunity sounds too good to be true, or if you are pressured to act quickly, please exercise extreme caution and be aware of the risk that your investment may be lost,” cautioned SEC Chairman Jay Clayton in the regulator’s formal statement on cryptocurrency.

The SEC isn’t the first to accuse to Aman and his associates of fraud.

A case was filed in the Palm Beach County Circuit Court earlier this month by investors Don and Ann Geddes.

Harold Seigel advised the couple to invest $200,000 in a 50-carat parcel of pink rough diamonds said to be owned by Eagle Financial, estimated to be worth $8.5 million, according to court documents.

The Geddes were allegedly told that their investment was guaranteed by International Insurance NV, an off-shore company based in Curacao.

When it was time for the Geddes to get their money, Seigel reportedly convinced them to invest their return into Argyle Coin.

“Harold Seigel and Argyle Coin represented that the Geddes would receive ‘argyle coins’ with a value of $10 per coin when they knew that the argyle coins had zero value and/or did not exist,” court documents state.

There are a number of similar lawsuits filed in Palm Beach County Circuit Court, including a suit filed by the Rounds, longtime listeners of Seigel’s show who once trusted his counsel but are now suing for the return of about $2 million, the Palm Beach Daily News reports.

In a statement emailed to National Jeweler, attorney Kevin O’Reilly, who is representing Aman and the Seigels, said: “Jose Aman, Natural and Eagle have been cooperating with the corporate monitor appointed in the Rounds case. Further, they intend to fully cooperate with the SEC to get this matter resolved amicably.”

The Florida Office of Financial Regulation will be assisting the SEC with this case, spokesperson Jamie Mongiovi said.

The Latest

The credit card companies’ surveys examined where consumers shopped, what they bought, and what they valued this holiday season.

Kimberly Miller has been promoted to the role.

How Jewelers of America’s 20 Under 40 are leading to ensure a brighter future for the jewelry industry.

The “Serenity” charm set with 13 opals is a modern amulet offering protection, guidance, and intention, the brand said.

“Bridgerton” actresses Hannah Dodd and Claudia Jessie star in the brand’s “Rules to Love By” campaign.

Founded by jeweler and sculptor Ana Khouri, the brand is “expanding the boundaries of what high jewelry can be.”

Roseco’s 704-page catalog showcases new lab-grown diamonds, findings, tools & more—available in print or interactive digital editions.

The jewelry manufacturer and supplier is going with a fiery shade it says symbolizes power and transformation.

The singer-songwriter will make her debut as the French luxury brand’s new ambassador in a campaign for its “Coco Crush” jewelry line.

The nonprofit’s new president and CEO, Annie Doresca, also began her role this month.

As the shopping mall model evolves and online retail grows, Smith shares his predictions for the future of physical stores.

The trade show is slated for Jan. 31-Feb. 2 at The Lighthouse in New York City's Chelsea neighborhood.

January’s birthstone comes in a rainbow of colors, from the traditional red to orange, purple, and green.

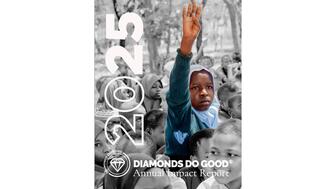

The annual report highlights how it supported communities in areas where natural diamonds are mined, crafted, and sold.

The supplier has a curated list of must-have tools for jewelers doing in-house custom work this year.

The Signet Jewelers-owned store, which turned 100 last year, calls its new concept stores “The Edit.”

Linda Coutu is rejoining the precious metals provider as its director of sales.

The governing board welcomed two new members, Claire Scragg and Susan Eisen.

Sparkle with festive diamond jewelry as we celebrate the beginning of 2026.

The master jeweler, Olympian, former senator, and Korean War veteran founded the brand Nighthorse Jewelry.

In its annual report, Pinterest noted an increase in searches for brooches, heirloom jewelry, and ‘80s luxury.

Executive Chairman Richard Baker will take over the role as rumors swirl that a bankruptcy filing is imminent for the troubled retailer.

Mohr had just retired in June after more than two decades as Couture’s retailer liaison.

Shekhar Shah of Real Gems Inc. will serve as president of the Indian Diamond & Colorstone Association in 2026.

This year’s good luck charm features the mythical horse Pegasus, and is our first Piece of the Week of the new year.

Articles about crime, engagement rings, and a necklace worn in the World Series generated the most interest among readers.