Lucara Secures $220M in Financing to Take Mine Underground

The company has received credit-approved commitments from five financial institutions for the expansion of its Karowe Diamond Mine.

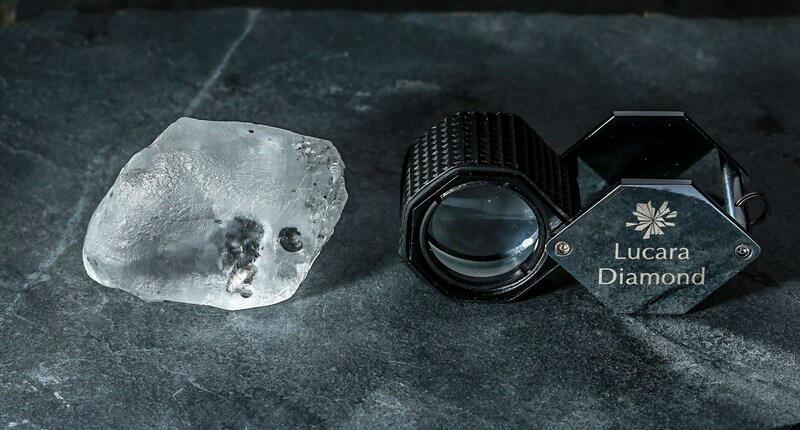

Karowe is responsible for producing some of the most significant diamonds recovered in recent years, including the 1,109-carat “Lesedi La Rona,” which Graff bought for $53 million, and a 1,758-carat diamond that Louis Vuitton is turning into jewelry.

The credit-approved senior debt facilities include two tranches: $170 million to go toward the development of the underground mine and $50 million to support the ongoing operation of the open pit.

The underground expansion has an estimated capital cost of $514 million and is expected to take five years. The balance of development capital for the project is expected to come from cash flow from the mine’s ongoing open-pit operations.

In a statement announcing the financing, Lucara President and CEO Eira Thomas called securing the financing “an important achievement for Lucara and a strong endorsement of our underground expansion plans.”

The five lenders on the $220 million financing facility for Lucara are: ING Bank N.V., Natixis, the London branch of Societe Generale, Africa Finance Corp., and Afreximbank. Thomas described them as having “significant mining and metals track records and experience in Africa.”

Closing on the facilities is subject to completion of definitive documentation and the satisfaction of certain terms and conditions, including Know Your Customer (KYC) checks.

The target closing date for the financing package is mid-2021, with financing expected to be in place by the second half of the year.

Lucara made the financing announcement the day before it released its first-quarter 2021 results.

Revenues totaled $53.1 million, or $579 per carat sold, for the miner in Q1. Net income was $3.4 million.

That is a significant improvement over Q1 2020, when the onset of the pandemic limited sales to $34.1 million and caused Lucara to record a loss of $3.2 million.

First-quarter 2021 results also are up when compared with 2019, when Lucara reported revenues of $48.7 million, or $512 per carat sold. Net income for the latter, however, was higher at $7.4 million.

The company said overall, the diamond market started 2021 in its healthiest position in five years following strong holiday seasons in the United States and China, and careful rough supply management by producers, which has helped to recalibrate polished inventories.

“Lucara has bounced back in the first quarter of the year, demonstrating its resiliency at a time of continued uncertainty in respect to the ongoing COVID-19 pandemic,” Thomas said.

“Our outlook for the diamond market remains strong, and with close to 20 years of future mining now ahead of us at Karowe, Lucara is highly levered to an improving diamond price environment, particularly in respect to large, high-value gem diamonds.”

During the quarter, Lucara announced the recovery of two top white, gem-quality diamonds weighing 341 and 378 carats from the mine’s South Lobe. Both stones were completely intact.

In April, the miner announced it was extending its agreement with HB Antwerp to cut and polish all the larger (10.8 carats and up) diamond recovered from Karowe. The extension takes the agreement through December 2022.

Karowe’s large, high-value diamonds account for 60-70 percent of Lucara’s annual revenues.

The Latest

Raised in an orphanage, Bailey was 18 when she met her husband, Clyde. They opened their North Carolina jewelry store in 1948.

Smith encourages salespeople to ask customers questions that elicit the release of oxytocin, the brain’s “feel-good” chemical.

Material Good is celebrating its 10th anniversary as it opens its new store in the Back Bay neighborhood of Boston.

Launched in 2023, the program will help the passing of knowledge between generations and alleviate the shortage of bench jewelers.

The show will be held March 26-30 at the Miami Beach Convention Center.

The estate of the model, philanthropist, and ex-wife of Johnny Carson has signed statement jewels up for sale at John Moran Auctioneers.

Are arm bands poised to make a comeback? Has red-carpet jewelry become boring? Find out on the second episode of the “My Next Question” podcast.

Criminals are using cell jammers to disable alarms, but new technology like JamAlert™ can stop them.

It will lead distribution in North America for Graziella Braccialini's new gold pieces, which it said are 50 percent lighter.

The organization is seeking a new executive director to lead it into its next phase of strategic growth and industry influence.

The nonprofit will present a live, two-hour introductory course on building confidence when selling colored gemstones.

Western wear continues to trend in the Year of the Fire Horse and along with it, horse and horseshoe motifs in jewelry.

Rossman, who advised GIA for more than 50 years, is remembered for his passion and dedication to the field of gemology.

Guthrie, the mother of “Today” show host Savannah Guthrie, was abducted just as the Tucson gem shows were starting.

Butterfield Jewelers in Albuquerque, New Mexico, is preparing to close as members of the Butterfield family head into retirement.

Paul Morelli’s “Rosebud” necklace, our Piece of the Week, uses 18-karat rose, green, and white gold to turn the symbol of love into jewelry.

The nonprofit has welcomed four new grantees for 2026.

Parent company Saks Global is also closing nearly all Saks Off 5th locations, a Neiman Marcus store, and 14 personal styling suites.

It is believed the 24-karat heart-shaped enameled pendant was made for an event marking the betrothal of Princess Mary in 1518.

The “Kering Generation Award x Jewelry” returns for its second year with “Second Chance, First Choice” as its theme.

Sourced by For Future Reference Vintage, the yellow gold ring has a round center stone surrounded by step-cut sapphires.

The clothing and accessories chain announced last month it would be closing all of its stores.

The “Zales x Sweethearts” collection features three mystery heart charms engraved with classic sayings seen on the Valentine’s Day candies.

The event will include panel discussions, hands-on demonstrations of new digital manufacturing tools, and a jewelry design contest.

Registration is now open for The Jewelry Symposium, set to take place in Detroit from May 16-19.

Namibia has formally signed the Luanda Accord, while two key industry organizations pledged to join the Natural Diamond Council.

Lady Gaga, Cardi B, and Karol G also went with diamond jewelry for Bad Bunny’s Super Bowl halftime show honoring Puerto Rico.