Lucara Secures $220M in Financing to Take Mine Underground

The company has received credit-approved commitments from five financial institutions for the expansion of its Karowe Diamond Mine.

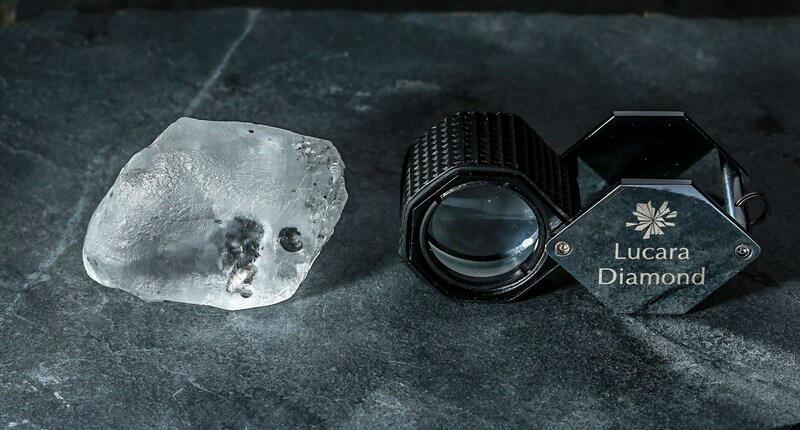

Karowe is responsible for producing some of the most significant diamonds recovered in recent years, including the 1,109-carat “Lesedi La Rona,” which Graff bought for $53 million, and a 1,758-carat diamond that Louis Vuitton is turning into jewelry.

The credit-approved senior debt facilities include two tranches: $170 million to go toward the development of the underground mine and $50 million to support the ongoing operation of the open pit.

The underground expansion has an estimated capital cost of $514 million and is expected to take five years. The balance of development capital for the project is expected to come from cash flow from the mine’s ongoing open-pit operations.

In a statement announcing the financing, Lucara President and CEO Eira Thomas called securing the financing “an important achievement for Lucara and a strong endorsement of our underground expansion plans.”

The five lenders on the $220 million financing facility for Lucara are: ING Bank N.V., Natixis, the London branch of Societe Generale, Africa Finance Corp., and Afreximbank. Thomas described them as having “significant mining and metals track records and experience in Africa.”

Closing on the facilities is subject to completion of definitive documentation and the satisfaction of certain terms and conditions, including Know Your Customer (KYC) checks.

The target closing date for the financing package is mid-2021, with financing expected to be in place by the second half of the year.

Lucara made the financing announcement the day before it released its first-quarter 2021 results.

Revenues totaled $53.1 million, or $579 per carat sold, for the miner in Q1. Net income was $3.4 million.

That is a significant improvement over Q1 2020, when the onset of the pandemic limited sales to $34.1 million and caused Lucara to record a loss of $3.2 million.

First-quarter 2021 results also are up when compared with 2019, when Lucara reported revenues of $48.7 million, or $512 per carat sold. Net income for the latter, however, was higher at $7.4 million.

The company said overall, the diamond market started 2021 in its healthiest position in five years following strong holiday seasons in the United States and China, and careful rough supply management by producers, which has helped to recalibrate polished inventories.

“Lucara has bounced back in the first quarter of the year, demonstrating its resiliency at a time of continued uncertainty in respect to the ongoing COVID-19 pandemic,” Thomas said.

“Our outlook for the diamond market remains strong, and with close to 20 years of future mining now ahead of us at Karowe, Lucara is highly levered to an improving diamond price environment, particularly in respect to large, high-value gem diamonds.”

During the quarter, Lucara announced the recovery of two top white, gem-quality diamonds weighing 341 and 378 carats from the mine’s South Lobe. Both stones were completely intact.

In April, the miner announced it was extending its agreement with HB Antwerp to cut and polish all the larger (10.8 carats and up) diamond recovered from Karowe. The extension takes the agreement through December 2022.

Karowe’s large, high-value diamonds account for 60-70 percent of Lucara’s annual revenues.

The Latest

McCormack looked to the 19th century’s “golden age” of astronomy when designing her new celestial-themed collection.

Nelson will be honored as the inaugural grant winner at the Gem Awards gala on Friday.

The new smart design software allows jewelers to configure, price, and confirm a custom engagement ring in real time for in-store customers.

Every jeweler faces the same challenge: helping customers protect what they love. Here’s the solution designed for today’s jewelry business.

The MJSA Education Foundation’s scholarships support students pursuing jewelry careers.

The largest white diamond to come to market in the U.K. in more than a decade, the VVS1, I-color stone is expected to top $1 million.

Skelly shares her plans for reimagining the fine jewelry retailer she re-acquired after it faltered last year.

With refreshed branding, a new website, updated courses, and a pathway for growth, DCA is dedicated to supporting retail staff development.

The collection takes inspiration from the emotional space between people, moments, and experiences.

In 2026, the jewelry retailer is celebrating a milestone only a small percentage of family-owned businesses survive to see.

The group of jewelers held a jewelry raffle in support of the Children’s Hospital of Richmond at VCU.

The jewelry giant released preliminary results for the fourth quarter and full year on Monday, with final results slated to come next week.

The retailer also gave an update on its vendor partnerships.

The award-winning actress is the “epitome of modern allure,” the brand said.

The “Bloom” collection draws from the flower power movement of the 1960s and ‘70s with inlay pendants offered in eight colorways.

The unique piece was one of the custom works offered at the foundation's recent silent art auction, which garnered nearly $15,000 in total.

Bulgari named Gyllenhaal as its brand ambassador for his embodiment of artistic depth, intellectual curiosity, and warmth.

Awards were given to four students, one apprentice, and an emerging jeweler.

The top jewelry lot of the late model’s estate sale, hosted by John Moran Auctioneers, was an Oscar Heyman & Brothers for Cartier necklace.

Moses, who started at GIA’s Santa Monica lab in 1976, will leave the Gemological Institute of America in May.

Increased competition, falling lab-grown diamond and moissanite prices, and the rising cost of gold took a toll on the moissanite maker.

The earrings, our Piece of the Week, feature pink tourmalines as planets orbiting around an aquamarine center set in 18-karat rose gold.

“The Price of Freedom” campaign video for International Women’s Day confronts the quiet violence of financial control.

Also, a federal judge has ordered that companies that paid tariffs implemented under the IEEPA are entitled to refunds.

The ever-growing collection, which just expanded with the addition of Olga of Kyiv, features cameos of 12 women from history.

We asked a jewelry historian, designer, bridal director, and wedding expert what’s trending in engagement rings. Here’s what they said.

The annual event will be held in Orlando, Florida, from Sept. 14-17.