Family-owned jewelry and watch retailer Deutsch & Deutsch has stores in El Paso, Laredo, McAllen, and Victoria.

For the jeweler: A new growth opportunity

In today’s ultra-competitive retail environment, sales, margin and market share are increasingly hard to come by, columnist Jan Brassem writes. That’s why retailers shouldn’t be afraid to step outside their ‘comfort zone’ and consider acquisition as a way to grow their business.

What’s happening to cause all these large and well-publicized jewelry mergers lately? First, was Signet Jewelers, with approximately 1,400 stores primarily under the Kay Jewelers and Jared the Galleria of Jewelry brands acquiring Zale Corp. and their 1,600 U.S., Canada and Puerto Rico-based stores. Signet now owns approximately 3,000 U.S. jewelry stores and, adding its 500 stores in the United Kingdom, it will be the largest jeweler in the world, a rank currently held by Hong Kong-based jewelry retailer Chow Tai Fook.

Following that transaction was the 2,000-store Chow Tai Fook chain acquiring Boston-based Hearts on Fire. Then came the sale of Hong Kong-based, Bali-made brand John Hardy. Before these were the Ben Bridge and Helzberg purchase by Berkshire Hathaway and the Fred Meyer purchase by Kroger Co. You get the picture.

More consolidating transactions will certainly follow. It will be hard to keep up.

Having spent almost thirty years in the jewelry mergers and acquisition (M&A) field, the current consolidation is not a shocker. It is simply a normal component of an industry moving through the classic maturity phase of the product life cycle. It comes as no surprise that in today’s jewelry industry, where executives constantly are seeking sales, margin and market share growth, opportunities now are harder to find.

Signet, Berkshire Hathaway and Kroger simply are trying to continue their growth in sales and profitability.

What should an ambitious jeweler do in this difficult environment? From my, and my partners’, experience he/she should consider leaving their comfort zone of worrying about diamond prices and store layout and become a strategic thinker. Start by developing an acquisition growth initiative just like Signet and Kroger did, but obviously on a smaller scale.

Businessmen that have pursued “external” growth through M&A, of course, are not always successful. Without an effective advisory team, a careful plan and a detailed strategy, failure is virtually assured.

Conversely, for those jewelers who have figured out how to buy a company carefully and profitably, their success can add the acquired sales and profit to their bottom line. All this, of course, can lead to increased market share, diversification and a refreshed customer base. As Bruce Nolop wrote in the Harvard Business Review, “Acquisitions are faster, cheaper and less risky than ‘internal,’ (or organic), expansion …”

Donald M. DePamphilis’ classic Mergers, Acquisitions, and Other Restructuring Activities, a book we refer to

Successful--some say extremely successful--jewelers who grew their bottom line through acquisition over the last 20 years or so are plentiful. Here are a few examples: Daniel’s (grew to 64 stores located in California), Greenberg’s (grew to 9 stores in Nebraska, Iowa and South Dakota), Harry Ritchie Jewelers (grew to 16 stores in Washington, Oregon, California, and Idaho), and Rogers Jewelers (grew to 9 stores in Kentucky, West Virginia, Indiana, and Tennessee). There are, of course, more.

My partners and I, with input from Nolop’s assessments, have developed a simple and basic four-tip initial primer, of sorts, to help you get the ball rolling on your acquisition growth strategy. With your first-class team of professional advisors to reduce pitfalls and obstacles, the primer should point you in the right direction to start a rewarding and challenging journey. So jewelers, start your engines.

First Round. Instead of starting by acquiring a sizeable organization, and maximizing your risk, acquire a bunch of smaller ones. “You’ll ensure that each one will be a manageable size and you’ll have a sufficient number to hedge the risk,” and adapt to changing conditions, says Harvard’s Nolop.

Do It Yourself. Don’t assign the acquisition process to an in-house team. Since you are the best judge of the various risks, rewards and strategic fit of at least the first acquisition, do that one yourself. Use the professional team and your in-house managers only as your advisors. Make the critical decisions yourself.

“Ease of Fit.” Expect quick, short-term results, with less risk, by acquiring companies that fit neatly into your market but at a difficult geographic location. This will allow you, writes Nolop, to cross-sell and reduce costs by combining inventory and staff.

Don’t Be a “Bottom Feeder.” Don’t acquire firms that are performing poorly in areas of your strength. For example, if your strength is in wedding rings, don’t acquire a firm where weddings ring sales are a weakness, thereby wasting time and resources. Take advantage of your strength(s) and grow on those, not on someone else’s weaknesses.

Don’t forget, acquiring jewelers are expected to move away from their comfort zone into the brain-numbing matrix curves and SWOP analysis, metric averages and implementation plans and be recognized as a sophisticated businessman. From my experience in working with them, the acquisition process transforms veteran jewelers into dynamic and enthusiastic strategic thinkers with a new and exciting outlook on life. Please stand by.

The Latest

The Italian luxury company purchased the nearly 200-year-old Swiss watch brand from Richemont.

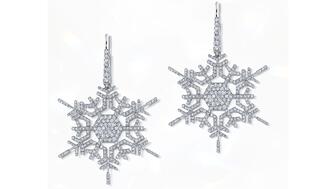

Micro-set with hundreds of diamonds, these snowflake earrings recreate “winter’s most elegant silhouette,” and are our Piece of the Week.

Criminals are using cell jammers to disable alarms, but new technology like JamAlert™ can stop them.

Ella Blum was appointed to the newly created role.

Sponsored by RapNet

Investment firm Enhanced Retail Funding, a division of Gordon Brothers, was the successful bidder.

How Jewelers of America’s 20 Under 40 are leading to ensure a brighter future for the jewelry industry.

It explores the history of the iconic tagline and the company’s strategy to redefine the role of diamonds in society.

Retail veteran Sindhu Culas has stepped into the role.

Taylor Burgess, who has been at Stuller since 2013, was promoted to the newly created role.

Was 2025 a good year for jewelers? Did lab-grown diamonds outsell natural? Find out on the first episode of the “My Next Question” podcast.

Whether you recognize their jewels or are just discovering them now, these designers’ talent and vision make them ones to watch this year.

Buyers are expected to gravitate toward gemstones that have a little something special, just like last year.

Plus, JSA’s Scott Guginsky discusses the need for jewelers to take more precautions as the gold price continues to climb.

Morris’ most cherished role was being a mother and grandmother, her family said.

“Vimini” is the first chapter of the “Bulgari Eternal” collection that merges archival pieces with modern creations.

The third edition will be held in Half Moon Bay, California, in April.

The grant is in its first year and was created to recognize an exceptional fine jewelry designer whose star is on the rise.

Data built on trust, not tracking, will be key to success going forward, as the era of “borrowed attention” ends, Emmanuel Raheb writes.

Heath Yarges brings two decades of experience to the role.

Pete’s boundless curiosity extended beyond diamond cut and he was always eager to share his knowledge with others, no matter the topic.

Cartier, Van Cleef & Arpels, Buccellati, and Vhernier had another successful holiday season, Richemont reported this week.

Our Piece of the Week is Lagos’ “Bee” brooch that was seen on the red carpet for the first time on Sunday.

Trevor Jonathan Wright led a crew in a string of armed robberies targeting South Asian-owned jewelry stores on the East Coast.

The program recognizes rising professionals in the jewelry industry.

A new lifestyle section and a watch showcase have been added to this year’s event.