From tech platforms to candy companies, here’s how some of the highest-ranking brands earned their spot on the list.

Rocks On: Emeralds

The most popular of the beryl family and a stone that’s been beloved for ages, the emerald continues to be in demand as supply keeps up and pricing heads toward a more stable structure.

New York--It’s not surprising that the emerald’s popularity has continued for centuries.

The most famous member of the beryl family been known to comfort and soothe people since it was first discovered. It’s beautiful, intense and radiant green has become a common descriptor applied to the lushest landscapes and reflects the optimism of springtime.

The gemstone’s color is so beloved, in fact, that fine inclusions don’t diminish the value of a high quality emerald, according to the International Colored Gemstone Association. An emerald in a deep green with inclusions still is much more valuable than a nearly flawless emerald with paler color.

These inclusions often are described as looking like moss or foliage and sometimes are called jardin, French for garden and another reference that ties this beloved gemstone to the spring season.

As the stone’s popularity continues in today’s market, the trade is trying to find a way to address some of the bigger issues surrounding emeralds.

The inaugural International Emerald Symposium, designed to bring together all areas of the market, took place from Oct. 13 to 15 in Bogota, Colombia. It featured a range of local and overseas emerald experts from governments as well as the private sector to provide input on the current state of the global emerald market and the obstacles it faces.

The symposium addressed challenges such as resource management, manufacturing, treatments, certification, nomenclature, technology, consumer education and branding. Fedesmeraldas, the symposium’s organizing body, said that it expects the event to bring a “harmonization of the global emerald industry,” similar to what the global diamond business attempts to do through its various bodies and annual meetings.

A hot gem

As emerald continues its reign as one of the top stones in the colored gem world, demand for the stone remains strong.

GIA industry analyst Russell Shor said during a recent trip to Hong Kong, he noticed a lot of demand for the gemstone from the market there, part of a resurgence in interest in the stone.

About seven to eight years ago, emeralds were a little stagnant in the market, but Shor said they’ve come back pretty strongly. “For a long time, green was just out as a fashion color, and now it’s back in, not surprisingly,” he said.

This could have something to do with color institute Pantone naming emerald its color of the year in 2013, putting the color

Omi Gems’ Niveet Nagpal said his company also continues to see strong demand for the stone.

“If there was a better supply of emeralds in finer quality, without an increase in price, we would probably be able to increase our emerald business substantially,” he told National Jeweler. “The demand is definitely there.”

Another thing that Shor thinks could be helping? Gemfields’ promotions of the gemstone.

While the miner is showcasing the stones it mines and jewelry created specifically for it, Shor said that marketing bump still could be helping to bring the stone in front of the consumer again, in the same way that De Beers’ commercials lifted the diamond market back in the day.

He also noted that strong demand for emeralds is having a halo effect for other green gems such as peridot and tourmaline.

Supply stream

Today, the main source for emeralds, and the place that continues to supply what are generally known as the finest quality stones, is Colombia. Shor said there’s still a “reasonable” supply originating from this nation.

There’s also the Kagem deposit in Zambia, which is currently mined by Gemfields. Gemfields, for its part, also is moving into Colombia. The colored gemstone miner announced last month that it is acquiring the Coscuez emerald mine in the Boyacá state that has been in operation for more than 25 years, as well as licenses and contracts covering approximately 20,000 hectares, or 77 square miles, in Boyacá and other areas of Colombia.

“Between these two (Colombia and Zambia), the supply situation, even for [higher] quality emeralds, is pretty good,” Shor said.

Yet Nagpal notes that while the supply is there, it can be erratic for his company, which deals mostly in Colombian emeralds and sometimes Zambian.

He said, “There are very few major mining companies in Colombia right now. If one of them hits a pocket of nice material, we see some nice emeralds in the market, but sometimes months can go by without any new rough and then supply becomes difficult.”

Behind Colombia and Zambia is Brazil, which ranks third in terms of emerald supply.

There also are mines Zambia and India, as well as in places such as Pakistan and Afghanistan, where one “might suspect that supply could be intermittent because of conflict in the area,” Shor told National Jeweler.

In 2014, Andy Lucas, GIA manager of field gemology in Carlsbad, went on a trip to Afghanistan’s remote emerald mines in the Panjshir Valley, finding, according to an article published by GIA, that emeralds from Afghanistan can have such an excellent color that they “rival any source.”

Their shape also make for a good retention rate, so less stone is lost when they are cut.

Changing markets

The challenge for any colored gemstone, Shor said, always has been consistent supply and pricing.

Until recently, the gemstone market was dominated by a few large players who could afford to hold onto goods until they could achieve the strong pricing they wanted. But what Shor thinks the market might be moving toward is a more “corporate” approach, where the companies believe in keeping a regular supply and cash flow rather than holding on to stones.

For jewelry manufacturers and designers, this means that they have a better chance of knowing that they can get emeralds when they need them. This also means a structure with a relatively predictable pricing model and stable supply, providing for any potential increase in demand.

“Colored stone pricing can be a bit arbitrary,” Shor said. “The market seems to be heading for more stable pricing and supply, and that is a good thing for everybody.”

Nagpal said that for emeralds specifically, prices have risen quite a bit over the past few years. But he added that they seem to have tapered off at the moment due to the market still digesting the higher prices, as well as the strong U.S. dollar.

He also reiterated some of Shor’s thoughts, noting that the supply chain has been changing as big corporate mining companies start to control an increasingly larger share of the emeralds entering the marketplace.

“There should be more stability and an increase in consumer marketing of emeralds, but how this will ultimately affect the jewelry industry is difficult to predict,” Nagpal said.

The Latest

The “Khol” ring, our Piece of the Week, transforms the traditional Indian Khol drum into playful jewelry through hand-carved lapis.

The catalog includes more than 100 styles of stock, pre-printed, and custom tags and labels, as well as bar code technology products.

Launched in 2023, the program will help the passing of knowledge between generations and alleviate the shortage of bench jewelers.

The chocolatier is bringing back its chocolate-inspired locket, offering sets of two to celebrate “perfect pairs.”

The top lot of the year was a 1930s Cartier tiara owned by Nancy, Viscountess Astor, which sold for $1.2 million in London last summer.

Any gemstones on Stuller.com that were sourced by an AGTA vendor member will now bear the association’s logo.

Criminals are using cell jammers to disable alarms, but new technology like JamAlert™ can stop them.

The Swiss watchmaker has brought its latest immersive boutique to Atlanta, a city it described as “an epicenter of music and storytelling.”

The new addition will feature finished jewelry created using “consciously sourced” gemstones.

In his new column, Smith advises playing to your successor's strengths and resisting the urge to become a backseat driver.

The index fell to its lowest level since May 2014 amid concerns about the present and the future.

The new store in Aspen, Colorado, takes inspiration from a stately library for its intimate yet elevated interior design.

The brands’ high jewelry collections performed especially well last year despite a challenging environment.

The collection marks the first time GemFair’s artisanal diamonds will be brought directly to consumers.

The initial charts are for blue, teal, and green material, each grouped into three charts categorized as good, fine, and extra fine.

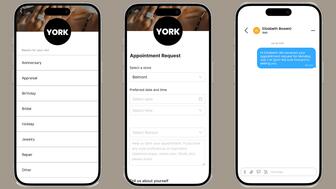

The new tool can assign the appropriate associate based on the client or appointment type and automate personalized text message follow-ups.

Buyers are expected to gravitate toward gemstones that have a little something special, just like last year.

Endiama and Sodiam will contribute money to the marketing of natural diamonds as new members of the Natural Diamond Council.

The retailer operates more than 450 boutiques across 45 states, according to its website.

The new members’ skills span communications, business development, advocacy, and industry leadership.

The jeweler’s 2026 Valentine’s Day campaign, “Celebrating Love Stories Since 1837,” includes a short firm starring actress Adria Arjona.

The new features include interactive flashcards and scenario-based roleplay with AI tools.

Family-owned jewelry and watch retailer Deutsch & Deutsch has stores in El Paso, Laredo, McAllen, and Victoria.

The Italian luxury company purchased the nearly 200-year-old Swiss watch brand from Richemont.

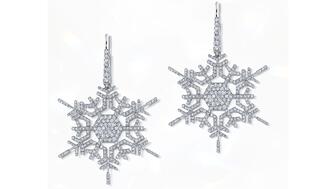

Micro-set with hundreds of diamonds, these snowflake earrings recreate “winter’s most elegant silhouette,” and are our Piece of the Week.

Ella Blum was appointed to the newly created role.