The chocolatier is bringing back its chocolate-inspired locket, offering sets of two to celebrate “perfect pairs.”

Whose fault is it anyway?

I was on the phone Tuesday morning with someone in the industry who mentioned that he had recently seen a live stage version of Whose Line Is It Anyway?, a British radio-cum-TV improvisational sketch comedy show that also had a run in the United States.

For those who haven’t seen it, the show involves four performers who participate in various improv games that are then scored by a host, though the points don’t mean anything and there aren’t any real prizes.

While no one except its creators know the exact origin of the show’s name, my guess would be it was called Whose Line Is it Anyway? because improve can get chaotic, leaving performers to look at each other and wonder, whose turn is it to keep this sketch going?

The diamond industry currently finds itself running up against a similar question mark when it comes to pricing. Rough prices are higher than they should be, polished demand is sluggish and many manufacturers in the middle can’t make money.

Shortly after my piece on the Indian diamond industry ran Tuesday, a colleague forwarded me an excellent guest blog by Sanjay Kothari, the former multi-term chairman of India’s Gem & Jewellery Export Promotion Council (GJEPC), that was published on a site called GemKonnect. GemKonnect is headed by Vinod Kuriyan, a journalist who has covered the industry for a long time and is extremely knowledgeable.

For those of you who are unaware, Kothari’s post goes a long way toward explaining why the price of rough diamonds has continued to go up even as polished prices have dropped and global demand for diamond jewelry has slowed.

Kothari writes that while many seek to blame the diamond mining companies, much of what ails the industry has to do with the “shortsighted business models” of the diamond cutting and polishing companies.

They, as Kothari writes and others have told me, have been buying overpriced rough and selling it at, in Kothari’s words, “laughably low prices” without caring. They just want to show turnover so they can continue getting credit from the banks, which they then sink into other industries (real estate, the stock market, etc.) that make them money.

So whose fault is that, then?

Like Kothari, I don’t put the lion’s share of the blame on De Beers, or any of the other mining companies for that matter.

What is something, anything, worth, be it a handbag, a car or a diamond? The answer is, whatever people are willing to pay for it.

Diamond cutting and polishing companies are

De Beers is a business. De Beers is not your friend.

What’s more, De Beers is not the De Beers of years gone by. The Oppenheimer family sold their stake in the diamond mining company in 2012 and De Beers is now one piece of a large public company, Anglo American. Anglo, like every public company on the planet, answers to its shareholders and De Beers is its most profitable subsidiary. Anglo’s going to do what it can to keep it that way.

That being said, I also agree with Kothari that the mining companies aren’t completely blameless in this scenario. They, like the cutters and polishers, are risking the long-term health of the industry for short-term gain.

Kothari offers a very common sense solution to the problem though it involves something that is not, shall we say, one of the diamond industry’s strong suits: working together.

Kothari suggests having all players in the industry pitch in to promote diamonds, thus helping alleviate the drop in demand; having all the mining companies cut back on mine output; and having diamond manufacturers cut back on the amount of rough they buy.

It seems that everyone in this situation shares a bit of the blame, so it’s only right that everyone step up to keep the show going.

The Latest

The top lot of the year was a 1930s Cartier tiara owned by Nancy, Viscountess Astor, which sold for $1.2 million in London last summer.

Any gemstones on Stuller.com that were sourced by an AGTA vendor member will now bear the association’s logo.

Launched in 2023, the program will help the passing of knowledge between generations and alleviate the shortage of bench jewelers.

The Swiss watchmaker has brought its latest immersive boutique to Atlanta, a city it described as “an epicenter of music and storytelling.”

The new addition will feature finished jewelry created using “consciously sourced” gemstones.

In his new column, Smith advises playing to your successor's strengths and resisting the urge to become a backseat driver.

Criminals are using cell jammers to disable alarms, but new technology like JamAlert™ can stop them.

The index fell to its lowest level since May 2014 amid concerns about the present and the future.

The new store in Aspen, Colorado, takes inspiration from a stately library for its intimate yet elevated interior design.

The brands’ high jewelry collections performed especially well last year despite a challenging environment.

The collection marks the first time GemFair’s artisanal diamonds will be brought directly to consumers.

The initial charts are for blue, teal, and green material, each grouped into three charts categorized as good, fine, and extra fine.

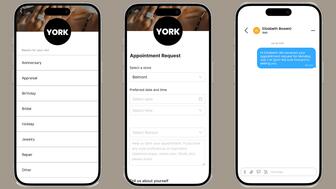

The new tool can assign the appropriate associate based on the client or appointment type and automate personalized text message follow-ups.

Buyers are expected to gravitate toward gemstones that have a little something special, just like last year.

Endiama and Sodiam will contribute money to the marketing of natural diamonds as new members of the Natural Diamond Council.

The retailer operates more than 450 boutiques across 45 states, according to its website.

The new members’ skills span communications, business development, advocacy, and industry leadership.

The jeweler’s 2026 Valentine’s Day campaign, “Celebrating Love Stories Since 1837,” includes a short firm starring actress Adria Arjona.

The new features include interactive flashcards and scenario-based roleplay with AI tools.

Family-owned jewelry and watch retailer Deutsch & Deutsch has stores in El Paso, Laredo, McAllen, and Victoria.

The Italian luxury company purchased the nearly 200-year-old Swiss watch brand from Richemont.

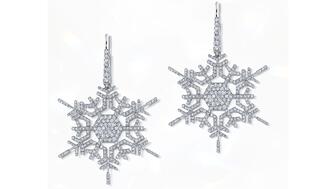

Micro-set with hundreds of diamonds, these snowflake earrings recreate “winter’s most elegant silhouette,” and are our Piece of the Week.

Ella Blum was appointed to the newly created role.

Sponsored by RapNet

Investment firm Enhanced Retail Funding, a division of Gordon Brothers, was the successful bidder.

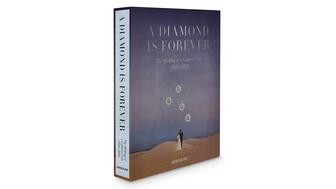

It explores the history of the iconic tagline and the company’s strategy to redefine the role of diamonds in society.