Yantzer is remembered for the profound influence he had on diamond cut grading as well as his contagious smile and quick wit.

The 3 biggest stories of 2014

Earlier this year, it would have been hard to believe that anything could top the consolidation of the industry’s two largest players, Zale Corp. and Signet Jewelers Ltd., in terms of news for 2014.

Little did I know what lay ahead, as 2014 would be the year the issue of diamond over-grading would erupt and Hearts on Fire would head overseas.

Here are what I believe to be the three biggest stories of the year, in order of importance.

Enjoy, share feedback and, most of all, have a happy holiday and a healthy new year.

1. The grading report row reaches a boiling point.

I would say the first major over-grading headline of the year came out of Nashville when a flurry of local news coverage prompted multiple consumers to file lawsuits against an independent jeweler over EGL International-graded diamonds.

One of the attorneys involved later told me that he viewed the Tennessee town as the epicenter of the over-grading furor. It’s not an entirely inaccurate description, though I would compare those lawsuits more to the first domino in a line that was bound to fall at some point than to ground zero for an earthquake.

The lawsuits influenced Martin Rapaport’s decision to pull diamonds graded by any EGL laboratory (including EGL USA, even though it’s an entirely separate lab), which, in turn, spurred the EGL brand owners to bring in a new global manager, Menahem Sevdermish, and to say they were going to scrap the EGL International brand.

Sevdermish initially told JCK in early December that EGL International was “shutting down” but then told me later that same week that while the “EGL International” brand is going away, the fate of the physical lab itself is in the hands of the EGL brand owners. “Whether they are going to dismantle it altogether or whether they are going to do a different thing under new supervision and leadership--whatever they decide,” he said.

Sevdermish also said in that same early December interview that they would stop printing EGL International certificates “within weeks,” which is interesting because news since has surfaced that the EGL brand owners canceled EGL International’s (formerly EGL Israel) licensing agreement before that interview took place, in late November.

The cancellation supposedly means the lab no longer can issue grading reports using the EGL name. However, the gentleman who headed EGL International, Guy Benhamou, has said that

(Neither Sevdermish nor Benhamou responded to request for comment on this blog.)

Someone should call in Judge Judy on this one and some lawyers, for that matter, because it looks like everybody’s going to need them.

Meanwhile, back in the States, one of the attorneys representing three of the consumers who filed suit in Nashville has said that a big plaintiffs’ class-action law firm will be filing suit against EGL International and “major retailers” early next year. (As mentioned above, EGL USA is a completely separate lab and not involved in this lawsuit.)

This is a story we’ll continue to follow in 2015, though I think, above all, there’s one point to be made here. It’s something Sevdermish said in his interview with me with which I agree: There’s no way the EGL brand owners, or anyone else for that matter, can stop people who want to operate a lab and profit from over-grading diamonds.

Retailers need to make sure they are selling diamonds with grading reports that accurately represent the product, period.

2. Mergers and acquisitions.

Though everybody knew it was coming, the February announcement that Signet would be buying Zale Corp. still was big. These are the two largest specialty jewelers in the country, and their merger certainly will lead to even more consolidation.

Though Signet hasn’t given many specifics on its plans for Zale’s stores, I don’t see Signet keeping an under-performing Zales store that is located across the mall hall from a Kay Jewelers store where business is strong, or vice versa. This is another story that will continue making news in 2015.

A few weeks after shareholders agreed and the Signet-Zale deal was finalized, news broke that Chow Tai Fook Jewellery Group Ltd. was acquiring diamond brand Hearts on Fire for $150 million.

The acquisition gives Hearts on Fire solid financial backing and a foothold for expanding in the Chinese market while Chow Tai Fook gets a strong brand to promote and sell in its stores, in a culture that’s crazy for brands.

No sooner had I begun pondering the next big deal of the year (and recounting past horrors with champagne) when news broke that a private equity firm was buying the John Hardy brand for an undisclosed sum and appointing former American Eagle Outfitters chief Robert Hanson as CEO.

So, what will 2015 bring? Changes for Tiffany & Co. or David Yurman? It’s hard to say, though I would conjecture that the era of consolidation and acquisitions for the jewelry industry is far from over.

3. Wearable technology steps into the spotlight.

There’s Ringly, the ring that connects to the wearer’s smartphone to notify them about meetings, text messages, phone calls and more; Galatea’s new Momento collection of pearl jewelry that play back recorded messages; and, of course, the Apple Watch.

This is hardly an exhaustive list but it does prove a point: wearable technology--devices that can monitor the wearer’s activity level or let him/her hear a message from their mother whenever they want, among many other functions--is here to stay.

And these pieces are being created using fine materials. Galatea’s Momento collection, for example, uses freshwater and Tahitian pearls set in 14-karat gold with prices starting at $350 while the Apple Watch comes in 18-karat gold and, as one retailer already has shown us, can be upgraded.

Spoiler alert/early Christmas present: I have a writer working on a wearable technology spread right now for the February edition of our new digital magazine (another one of the year’s great headlines.)

In the meantime, happy holidays everyone! See you in 2015.

The Latest

The store closures are part of the retailer’s “Bold New Chapter” turnaround plan.

Through EventGuard, the company will offer event liability and cancellation insurance, including wedding coverage.

Criminals are using cell jammers to disable alarms, but new technology like JamAlert™ can stop them.

Chris Blakeslee has experience at Athleta and Alo Yoga. Kendra Scott will remain on board as executive chair and chief visionary officer.

The credit card companies’ surveys examined where consumers shopped, what they bought, and what they valued this holiday season.

Kimberly Miller has been promoted to the role.

How Jewelers of America’s 20 Under 40 are leading to ensure a brighter future for the jewelry industry.

The “Serenity” charm set with 13 opals is a modern amulet offering protection, guidance, and intention, the brand said.

“Bridgerton” actresses Hannah Dodd and Claudia Jessie star in the brand’s “Rules to Love By” campaign.

Founded by jeweler and sculptor Ana Khouri, the brand is “expanding the boundaries of what high jewelry can be.”

The jewelry manufacturer and supplier is going with a fiery shade it says symbolizes power and transformation.

The singer-songwriter will make her debut as the French luxury brand’s new ambassador in a campaign for its “Coco Crush” jewelry line.

The nonprofit’s new president and CEO, Annie Doresca, also began her role this month.

As the shopping mall model evolves and online retail grows, Smith shares his predictions for the future of physical stores.

The trade show is slated for Jan. 31-Feb. 2 at The Lighthouse in New York City's Chelsea neighborhood.

January’s birthstone comes in a rainbow of colors, from the traditional red to orange, purple, and green.

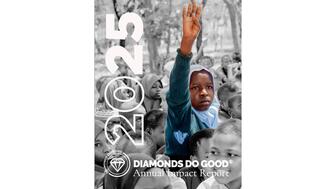

The annual report highlights how it supported communities in areas where natural diamonds are mined, crafted, and sold.

Footage of a fight breaking out in the NYC Diamond District was viewed millions of times on Instagram and Facebook.

The supplier has a curated list of must-have tools for jewelers doing in-house custom work this year.

The Signet Jewelers-owned store, which turned 100 last year, calls its new concept stores “The Edit.”

Linda Coutu is rejoining the precious metals provider as its director of sales.

The governing board welcomed two new members, Claire Scragg and Susan Eisen.

Sparkle with festive diamond jewelry as we celebrate the beginning of 2026.

The master jeweler, Olympian, former senator, and Korean War veteran founded the brand Nighthorse Jewelry.

In its annual report, Pinterest noted an increase in searches for brooches, heirloom jewelry, and ‘80s luxury.

Executive Chairman Richard Baker will take over the role as rumors swirl that a bankruptcy filing is imminent for the troubled retailer.