After the Supreme Court struck down the IEEPA tariffs, President Trump imposed a 10 percent tax on almost all imports via a different law.

ASM and the COVID-19 Impact

The pandemic slowed activity for a majority of the market and left the most vulnerable sectors of the colored stone supply chain in a dire situation.

When the COVID-19 pandemic hit—closing borders, stopping travel, holding up shipping and canceling trade shows—it drastically hampered trading.

It has affected all segments of the industry, from mining to cutting and manufacturing, to wholesale and retail, and brought the market to a halt.

For the most vulnerable segments of the supply chain—like the miners who depend on what they dig up each day to bring food home to their families—the effects of COVID-19 have been far-reaching and devastating, creating a situation that’s not going to go back to “normal” anytime soon.

Can’t Mine, Can’t Eat

The pandemic brought activity to a standstill for many artisanal and small-scale (ASM) colored gemstone miners, be it mining, selling their goods, or both.

With travel restrictions in place, international buyers couldn’t fly into source countries to purchase rough material.

Cristina Villegas, director of the mines to markets program at Pact, a non-governmental international development organization, says she’s heard time and again from miners in Tanzania: we eat what we mine.

Whatever they have mined and can sell on any given day pays for their food. When they can’t mine or sell, they don’t eat.

Rachel Dery, who works with her family’s company, Roger Dery Gem Design, witnessed this first-hand earlier this year as she remained in Africa while COVID-19 spread across the globe.

Dery traveled to Tanzania in February, just two weeks after the Tucson gem shows were over.

Unable to return home as the United States’ case count rose, she spent five months in East Africa as the coronavirus shut down countries.

She says there were no buyers for any goods, and both small-scale miners who also farm part-time and the owners of mid-size mines who depend on mining as their primary source of income suffered.

“It’s just a simple equation of, no buyers equals no money equals no food.”

COVID-19 took longer to reach and accelerate in Africa. According to the United Nations, the continent didn’t record its first case until mid-February, and it took 100 days to reach 100,000 cases.

Because of this, it took a while for the pandemic to begin impacting gem markets there, Dery says.

But by late April/early May, they couldn’t spend any more, especially with so few buyers, and everything came to a standstill.

Mine owners no longer had the money to feed their workers or invest in operations that had become more complicated overnight.

Monica Gichuhi, director of the Africa Gem Exhibition and Conference and a veteran in the ASM sector, says government restrictions on mining during the pandemic made it difficult for workers already operating on ultra-slim margins to keep going.

“When you’re telling them to keep their social distance, asking them to use PPE (personal protective equipment), that makes it hard for them. For them, it adds cost to an exercise where they make marginal profits from their activities.”

These issues led to a lack of cash flow, making miners who were already vulnerable become even more so during the pandemic.

Due to the nature of artisanal mining, this trickled down to the communities.

“When there’s an artisanal pit happening somewhere, the people who depend on and are supported by that activity is a multiplied effect,” Gichuhi says.

“You’re not talking about one miner, one family. You’re talking about a community that depends on that ecosystem to survive. A mine will have people who dig, people who bring the water, people who do the sorting, the cleaning, the grading, the transportation.”

“It’s just a simple equation of, no buyers equals no money equals no food.” – Rachel Dery, Roger Dery Gem Design

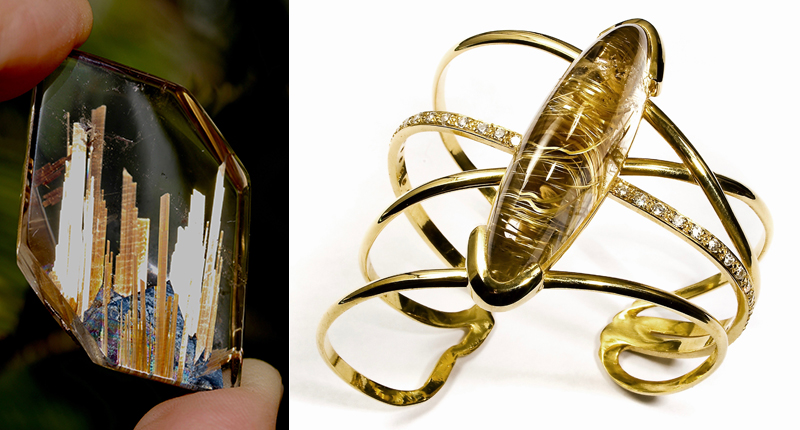

Brian Cook, who operates a rutilated quartz mine in Brazil and sources stones around the country, says mining activity fell off there too because of the pandemic.

In the Carnaíba and Socotó mining districts in Bahia, known for producing some of the intense green emeralds Brazil is famous for, government mandates forced mines across the entire area to shut down.

Most of those impacted were artisanal and small-scale miners.

The mine shutdowns were just one more issue on top of a pile of other concerns for the colored gemstones mining sector.

“There is definitely a slowdown in mining activity because there are fewer buyers, both domestic and foreign. But that’s on top of the fact that, in the rutilated quartz area I am working, the resource is becoming more difficult to get to—deeper, farther, more expensive to mine,” Cook says.

For those who were trying to buy, issues arose from the staggered lifting of restrictions, says Eric Braunwart.

Braunwart sources rough for his company, Columbia Gem House, from several countries, each of which reopened at a different pace, as did cutting centers around the world, slowing the movement of goods through the supply chain.

In the latter, the closing of facilities amid lockdowns also meant stone cutters were without work, he adds.

Lockdowns in India left cutters in Jaipur and Gujarat, many of whom are migrant laborers traveling to the cities to find work, without a job and unable to go home because they were quarantined in the city.

“They were in dire straits also,” Braunwart says.

In East Africa, Dery and Hannah Wang’ombe, CEO of the Association for Women in Energy and Extractives in Kenya, or AWEIK, say COVID-19 could force workers out of mining permanently.

Wang’ombe says during the height of the pandemic, many AWEIK member miners left the sector to find other incomes, chief among them farming, but some also turned to selling wares and household items at local markets.

She’s heard many times from the women in her association how the situation has drained them. They put a lot of time and effort into mining with little to no return on investment.

Wang’ombe says she won’t be surprised if many of the women who turned to other jobs don’t come back, or return only part-time as they balance mining with, say, farming or selling wares.

Dery adds: “I think I’ve learned this over and over again the past five months: they work to live. Whatever puts food on the table, that’s what they’re going to go with.”

She says the return of miners will depend on what other work they were able to find; if it’s more profitable than mining, then they won’t be coming back.

But it’s not only the current group of miners Dery’s worried about—it’s the next generation as well.

“Here, I think there will be fewer people who will follow in their parents’ footsteps with mining. This is a whole period of time that will be imprinted in their brain and make them think, never mind, mining is not profitable for my family.”

70 Percent Off

Prices of colored stones rise and fall as supply and demand fluctuate, but the pandemic put added pressure on certain tiers.

The supply of high-quality goods remains low but demand is there. As such prices are “reaching new heights,” says Clement Sabbagh, a gemstone wholesaler and current president of the International Colored Gemstone Association.

Sheahan Stephen, a sapphire dealer sourcing from Sri Lanka who works closely with miners there, notes the same and says he expects pricing for very fine material to continue its steady rise.

He’s also seen prices increase for mid-tier goods because movement of new material from some countries, such as those in East Africa, is restricted.

“Because there’s been a lack of flow from the mine, rough material is not hitting the market so it’s basically only material that’s been available for the last four months that’s sitting around,” Stephen says.

“The price of that product, second-grade goods, is substantially elevated over what it used to be.”

But he expects prices there to level off as colored gemstones, and people, begin to move again.

Meanwhile, there are reports of artisanal miners, many of whom are already dealing in lower-priced goods, having to accept rock-bottom prices for their rough in their desperation to generate even a trickle of cash flow.

“I think the supply chain is struggling on all levels right now, but I think in the long term, we’re being pushed and guided into being more responsible and being more transparent.” – Brian Cook, Nature’s Geometry

Gichuhi says with so much supply and so few places to sell it, dealers will start “shortchanging” miners.

This is something Paul Kamlongera has heard too.

Kamlongera is a researcher for the Delve database project, a global online data platform focusing on the ASM sector.

Delve researchers have been collecting data through phone-based interviews with mining-site-level stakeholders to understand how the pandemic is impacting them.

Kamlongera talked to colored stone stakeholders in his native Malawi.

Through his research, he learned in the few instances in which buyers surface, they are “highly exploitative,” paying as little as 30 percent of the regular, pre-coronavirus price.

All the colored gemstone miners Delve researchers talked to—a total of several dozen in four source countries—reported similar declines.

Some worry how long prices for lower-tier goods could take to go back up.

“I think it could be a long time,” Villegas says. “Probably at least six months, to be honest.”

In the meantime, Pact is working to develop remote buying in Tanzania, entrusting a local broker to purchase from miners on behalf of international buyers.

For others, a solution, or potential solution, is digital selling.

Though it has taken off for diamonds and finished jewelry at many points in the supply chain, the market for rough colored gemstones is different.

There’s risk in buying a colored gemstone without seeing the rough in person and being able to evaluate quality or predict how it will look as a cut stone.

But it’s a risk some are willing to take, given the timeline for a return to regular travel and trade shows is murky at best.

“From a Zambian perspective, it’s time for the local miners maybe to embrace e-commerce and look at how they can sell their gemstones without having to travel to the shows,” says Patricia Mweene, the jewelry designer behind Inonge Zita and a driving force in developing the country’s gemstone cutting and manufacturing industries.

She knows it’s not easy for the small-scale miners in rural areas, who might not have regular access to a reliable internet connection or electricity and rely on face-to-face interactions for business.

But one thing Mweene noticed popping up in Zambia even before the pandemic hit was the increasing popularity of what she refers to as “e-commerce agents,” local entrepreneurs who help people who want to buy or sell online but don’t have access to the internet or a credit card.

These internet-access facilitators could present an opportunity for miners who are looking for buyers.

Gichuhi says in all her time working with miners, their questions always come back to where they can sell.

Since COVID-19 forced the cancellation of the Africa Gem Exhibition and Conference in Zambia this year, which would’ve helped connect artisanal miners with gem dealers and jewelers from around the world, Gichuhi says she knew they needed to find a way to bring the market to them.

She worked with Susan Wheeler, a jewelry designer and founder of The Responsible Jewelry Transformative, as well as the Federation of Small Scale Mining Associations of Zambia and other partners to launch a digital platform for rough stones called Virtu Gem.

Several larger traditional dealers have been skeptical—and critical—about doing business online.

“But instead of doubting each other,” Gichuhi says, “we are hoping we can form partner collaborations that can eliminate doubt and create trust in the supply chain to really reinforce this way of doing business. If it’s going to take more than one year for people to travel and do business, this might be how [the miners] will get back to trade.”

The Federation of Small Scale Mining Associations of Zambia helps ensure the gemstones being bought and sold on the platform are from credible mines with licensed federation members and will have no issues being exported.

In addition to giving miners a revenue stream, 20 percent of sales made via Virtu Gem goes back to the federation to buy food and protective gear for miners.

The platform appeals to buyers who see the benefit in a custom cut as well as those looking for a purpose-driven purchase, the latter of which is a rapidly growing area of interest for designers and consumers alike.

“I think the supply chain is struggling on all levels right now, but I think in the long term, we’re being pushed and guided into being more responsible and being more transparent,” says Cook, the mine owner. “That movement was already gaining steam, and I think this pandemic is even going to accelerate that progress.”

This includes the empowerment of local organizations and associations in source countries to self-govern and develop new ways of doing business.

The Virtu Gem platform, for example, is a self-regulating mechanism, and Pact aims to have the Tanzania Women Miners Association run the remote buying model it’s testing out for its Moyo Gems project.

Villegas says the ASM sector gaining more autonomy can be a silver lining of the situation but only if the industry keeps “leaning into” these reform initiatives.

Her fear is because the jewelry sector has been hit so hard by decreases in consumer spending and shuttered retail stores, reform in the ASM sector might lose some momentum.

She’s worried fewer people will buy stones through programs like Moyo, or companies won’t be able to give as much money to programs supporting artisanal miners.

Trickle-Down Effects

No one can tell what the long-term effects of the pandemic will be yet, nor the rate at which things will return to “normal.”

But there seems to be a consensus it could take a while, especially to trickle up the supply chain to the miners.

“The issue with the pandemic is that everybody is suffering,” Gichuhi says.

Gem dealers haven’t been able to move as much product. Cutters don’t have access to material or, depending on where they’re located, can’t cut because factories aren’t operating. Retailers have had to close.

Kamlongera, the researcher for the Delve project, says: “In the long term, the [gemstone mining] communities will be in dire poverty.”

They’re already in a critical situation, he says, but it will get worse.

“There’s enormous existing infrastructure in some of these countries. They can accomplish a lot, whether it’s COVID response or trying to make change in the longer term by looking at what’s there, recognizing it and building upon it. I just want to keep encouraging action, versus ignoring the problem or being overwhelmed by the problem.” – Cristina Villegas, Pact

Those who only mine rely on revenue to buy food, and those who farm during the rainy season rely on mine money to invest in their farms, he explains, so it not only affects food security this year but also next year’s agricultural yields.

There are other concerns, he adds, like theft threatening communities’ security if poverty gets worse or whether there will be an increase in child labor when things normalize as miners try to maximize output.

For Stephen, the U.S.-based sapphire dealer, the long-term effects of the pandemic on the gemstone sector’s supply chain are directly linked to the strength of business in major markets like North America and Europe.

“I think long-term forecasting, as far as what direction things are going to go in, really will depend on our economy here, how many businesses are going to be able to sustain through the current pandemic.”

And it doesn’t look promising, he says.

As of this writing, several U.S. states are reinstating restrictions as COVID-19 case numbers rise.

“Right now, and especially in the U.S., I just see so many businesses having to make decisions—do we want to struggle through this, or do we want to just break even right now and move on with our lives?” Stephen says.

Braunwart says he expects markets to keep opening, closing and then reopening as case numbers fluctuate. The uncertainty and uneven recovery will continue to make trading difficult.

He also believes the crisis will create a long-term challenge for the industry because the “patterns of purchase will change dramatically.”

More buyers searching for unique products and custom cuts means more expertise will be needed, Braunwart says, which he believes will, in turn, mean less jewelry hitting the market.

This will slow mining and cutting activities as “the lower volume works its way through and takes a while to settle out to a new level.”

Dery’s big takeaway from her five months spent in Tanzania during the pandemic is this: “I already knew there was a gap in the socioeconomic status of us—the people who buy the gems—and the people who mine the gems, but I think COVID-19 has only caused that gap to get bigger.

“And I think it’s going to be bigger before this is done because … everything’s going to take time to go back to normal.”

Watching the toll the pandemic has taken on the supply chain has some wondering what can be done to protect it against future crises.

Both Stephen and Sabbagh mention the importance of building strong relationships and strategic partnerships to help get through a time when mobility is so limited.

For Mweene, the designer, the various jewelry industry sectors in Zambia need to start working together.

She says when she first started her brand, she joined various industry bodies but found they didn’t communicate enough.

“In Africa, everyone operates in silos. There’s a need for an industry body,” she says, like India’s GJEPC, so the miners can talk to the cutters and the mining engineers, for example, to build the industry.

“I think if they had been talking to each other, they would’ve been in a much better position actually to cope with COVID.”

And for Villegas, helping build programs on the ground and empowering local miners and associations can go a long way toward ensuring their success.

“There’s enormous existing infrastructure in some of these countries,” she says. “They can accomplish a lot, whether it’s COVID response or trying to make change in the longer term by looking at what’s there, recognizing it and building upon it.

“I just want to keep encouraging action, versus ignoring the problem or being overwhelmed by the problem.”

The Latest

The industry veteran, who was with The Edge Retail Academy for 14 years, joins her husband at the company he founded in 2022.

The vintage signed jewelry retailer chose Miami due to growing client demand in the city and the greater Latin American region.

With refreshed branding, a new website, updated courses, and a pathway for growth, DCA is dedicated to supporting retail staff development.

Former Flight Club executive Jin Lee will bring his experience from the sneaker world to the pre-owned watch marketplace.

The April event will feature a new VIP shopping day requiring a special ticket.

Bulgari chose the British-Albanian singer-songwriter for her powerful and enduring voice in contemporary culture, the jeweler said.

Launched in 2023, the program will help the passing of knowledge between generations and alleviate the shortage of bench jewelers.

In a 6-3 ruling, the court said the president exceeded his authority when imposing sweeping tariffs under IEEPA.

Smith encourages salespeople to ask customers questions that elicit the release of oxytocin, the brain’s “feel-good” chemical.

JVC also announced the election of five new board members.

The brooch, our Piece of the Week, shows the chromatic spectrum through a holographic coating on rock crystal.

Raised in an orphanage, Bailey was 18 when she met her husband, Clyde. They opened their North Carolina jewelry store in 1948.

Material Good is celebrating its 10th anniversary as it opens its new store in the Back Bay neighborhood of Boston.

The show will be held March 26-30 at the Miami Beach Convention Center.

The estate of the model, philanthropist, and ex-wife of Johnny Carson has signed statement jewels up for sale at John Moran Auctioneers.

Are arm bands poised to make a comeback? Has red-carpet jewelry become boring? Find out on the second episode of the “My Next Question” podcast.

It will lead distribution in North America for Graziella Braccialini's new gold pieces, which it said are 50 percent lighter.

The organization is seeking a new executive director to lead it into its next phase of strategic growth and industry influence.

The nonprofit will present a live, two-hour introductory course on building confidence when selling colored gemstones.

Western wear continues to trend in the Year of the Fire Horse and along with it, horse and horseshoe motifs in jewelry.

Rossman, who advised GIA for more than 50 years, is remembered for his passion and dedication to the field of gemology.

Guthrie, the mother of “Today” show host Savannah Guthrie, was abducted just as the Tucson gem shows were starting.

Butterfield Jewelers in Albuquerque, New Mexico, is preparing to close as members of the Butterfield family head into retirement.

Paul Morelli’s “Rosebud” necklace, our Piece of the Week, uses 18-karat rose, green, and white gold to turn the symbol of love into jewelry.

The nonprofit has welcomed four new grantees for 2026.

Parent company Saks Global is also closing nearly all Saks Off 5th locations, a Neiman Marcus store, and 14 personal styling suites.