IGI is buying the colored gemstone grading laboratory through IGI USA, and AGL will continue to operate as its own brand.

A litigious follow-up

When I arrived at work on Friday morning, a headline relating to the big news that has the industry buzzing--the pending merger of Signet and Zale--caught my eye immediately. “Signet to Buy Zale, Law Firms Cry Foul” it read, with the corresponding article going on to list five, just to “name a few,” law firms that are “investigating” the deal.

Though I did not find a quote quite like this anywhere else, all of the releases were basically the same, and all issued a call to action, so to speak, asking shareholders who want additional information concerning their legal rights to contact the law firm.

Zale, for its part, said it had no comment on any of these law firms’ statements. But a few people I spoke with in the industry confirmed what I had suspected: that these types of investigations are not at all uncommon today.

There was an interesting post on this topic published in March 2013 on a Harvard Law School blog. The article, which came from Cornerstone Research and was an analysis of a report by Cornerstone’s principal researcher and a Stanford Law School professor on M&A litigation in 2012 deals, states that “continuing a recent trend, shareholders challenged the vast majority of M&A (merger and acquisition) deals in 2012.”

The more money there is at stake, the more challenges there are. A total of 93 percent of deals valued at more than $100 million were challenged, with an average of 4.8 lawsuits per deal, according to the research. This number climbed to 96 percent and an average of 5.4 lawsuits for deals valued at more than $500 million. The proposed Signet-Zale merger is worth more than double this amount at $1.4 billion.

In most of these lawsuits, which generally take the form of class actions (hence the firms’ calls for anyone with questions about their “legal rights” to contact them), the arguments include failure to conduct a sale that was competitive enough or conflicts of interest, which can include executive retention or change-of-control payments to executives, according to the research.

On the first point, it is

One possible angle the attorneys could try to take is that Terry Burman, the former Signet CEO who was appointed to head Zale’s board in May 2013, had a deal in place before he even agreed to become Zale’s chairman, Gassman said. Lawyers will want to know if Golden Gate Capital, the company that issued Zale a $150 million lifeline in 2010 and owns a 22 percent stake in the company, is paying Burman a “finder’s fee” for obtaining a premium-to-market price, he said.

But, the general consensus seems to be that none of these investigations will amount to much; or, as Gassman put it, “I’d tell the lawyers to go home and try to find dirt on some other deal.”

Perhaps a few will result in lawsuits, but it seems likely those will get settled rather quickly. The authors of the Cornerstone article said that of the lawsuits relating to 2012 M&A deals for which they were able to determine the outcome, 64 percent settled an average of 42 days after they were filed. The plaintiffs voluntarily dismissed 33 percent of the suits and the remaining 3 percent were dismissed by the courts.

Anyone familiar with litigation knows that 42 days is an incredibly short time to settle a lawsuit, considering many suits--think the De Beers class-action--drag on for years. But it doesn’t seem likely that this will be the case here, and the merger should go through and close as expected by the end of 2014.

The Latest

The Texas jeweler said its team is “incredibly resilient” and thanked its community for showing support.

The medals feature a split-texture design highlighting the fact that the 2026 Olympics are taking place in two different cities.

Launched in 2023, the program will help the passing of knowledge between generations and alleviate the shortage of bench jewelers.

From tech platforms to candy companies, here’s how some of the highest-ranking brands earned their spot on the list.

The “Khol” ring, our Piece of the Week, transforms the traditional Indian Khol drum into playful jewelry through hand-carved lapis.

The catalog includes more than 100 styles of stock, pre-printed, and custom tags and labels, as well as bar code technology products.

Criminals are using cell jammers to disable alarms, but new technology like JamAlert™ can stop them.

The chocolatier is bringing back its chocolate-inspired locket, offering sets of two to celebrate “perfect pairs.”

The top lot of the year was a 1930s Cartier tiara owned by Nancy, Viscountess Astor, which sold for $1.2 million in London last summer.

Any gemstones on Stuller.com that were sourced by an AGTA vendor member will now bear the association’s logo.

The Swiss watchmaker has brought its latest immersive boutique to Atlanta, a city it described as “an epicenter of music and storytelling.”

The new addition will feature finished jewelry created using “consciously sourced” gemstones.

In his new column, Smith advises playing to your successor's strengths and resisting the urge to become a backseat driver.

The index fell to its lowest level since May 2014 amid concerns about the present and the future.

The new store in Aspen, Colorado, takes inspiration from a stately library for its intimate yet elevated interior design.

The brands’ high jewelry collections performed especially well last year despite a challenging environment.

The collection marks the first time GemFair’s artisanal diamonds will be brought directly to consumers.

The initial charts are for blue, teal, and green material, each grouped into three charts categorized as good, fine, and extra fine.

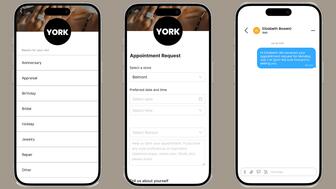

The new tool can assign the appropriate associate based on the client or appointment type and automate personalized text message follow-ups.

Buyers are expected to gravitate toward gemstones that have a little something special, just like last year.

Endiama and Sodiam will contribute money to the marketing of natural diamonds as new members of the Natural Diamond Council.

The retailer operates more than 450 boutiques across 45 states, according to its website.

The new members’ skills span communications, business development, advocacy, and industry leadership.

The jeweler’s 2026 Valentine’s Day campaign, “Celebrating Love Stories Since 1837,” includes a short firm starring actress Adria Arjona.

The new features include interactive flashcards and scenario-based roleplay with AI tools.

Family-owned jewelry and watch retailer Deutsch & Deutsch has stores in El Paso, Laredo, McAllen, and Victoria.