The credit card companies’ surveys examined where consumers shopped, what they bought, and what they valued this holiday season.

Forevermark launches e-commerce, financing programs

At its 2015 Forevermark Forum, the De Beers diamond brand revealed two new programs designed to help its retail partners retain relationships with online shoppers and build up their diamond inventory.

New York—Forevermark has revealed two new programs designed to help its retail partners stay connected with online shoppers and build up their diamond inventory.

Presented at its 2015 forum, Forevermark’s first new venture is an e-commerce program, which the brand says is the first of its kind in the diamond industry and will allow retailers to retain a full margin on a sale.

Though more and more consumers are beginning their jewelry shopping online these days, it’s still only a small percentage that actually purchases purely online, with brick-and-mortar stores continuing to play an important role, Forevermark said. Its new e-commerce business looks to capture that consumer online and strengthen their relationship with local retailers.

Consumers now will be able to shop the brand’s full product offering online at Forevermark.com, and when they are purchasing will be given a choice of local jewelers based on geographic location. Customers then will then have the option of having the merchandise shipped directly to them at home or to the jeweler to see in-store.

Regardless of which they choose, the jeweler partner receives the full retail price, with Forevermark acting as the “facilitator,” as the brand refers to it, bringing the customers, jewelers and products together.

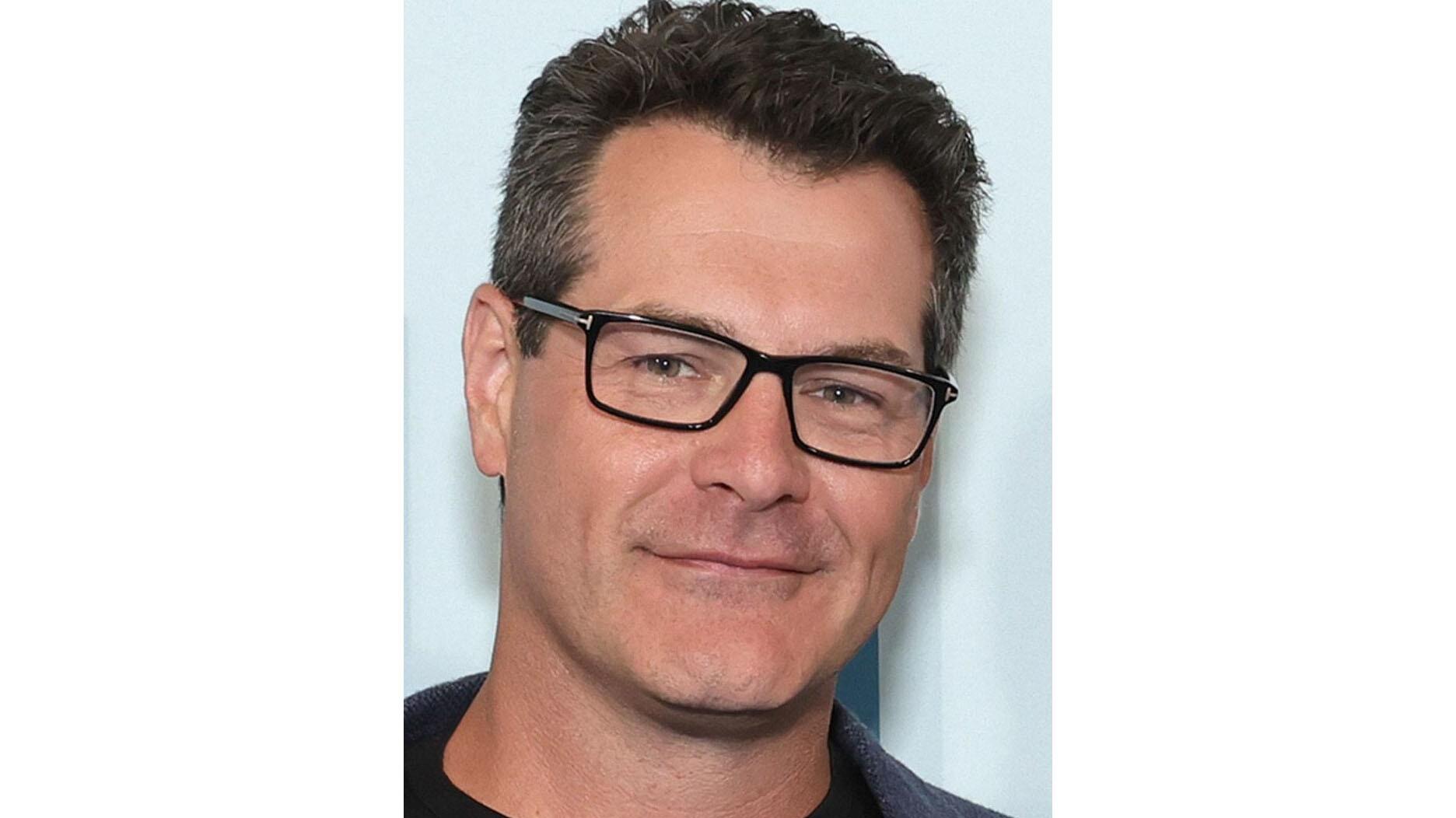

“The transaction is all done through the retailer,” Forevermark U.S. President Charles Stanley told National Jeweler. “So far as the consumer is concerned, they’re buying from that retailer. We think it’s important that the retailer retains the relationship with the customer,” so that the jeweler can help guide them to the right product.

The company said that it will pilot the e-commerce program in California in the spring.

Forevermark also unveiled a second program at the forum that also benefits its retail partners, a partnership with diamond investment advisory firm Diamond Asset Advisors for an exclusive leasing program for Forevermark diamonds.

“We were aware that our partners are faced with challenges in financing their diamond inventory in an environment of tighter banking regulations and increasing competition,” Stanley said.

The Diamond Asset Service Program, currently available for retail partners, allows jewelers to have the flexibility to build inventory based on a 100 percent loan-to-value basis, where they usually can only get a maximum of 50 percent, Stanley added, effectively giving them an unlimited ability to buy Forevermark diamonds on a 100-percent basis.

Retailers will pay a monthly interest rate and only have to

“Unlike consignment, they will control the Forevermark diamond inventory without any risk of it being called back. It gives them great flexibility to build up their inventory so they can meet seasonal demand and/or buy into, say, larger diamonds that they otherwise couldn’t afford.”

The Latest

Kimberly Miller has been promoted to the role.

The “Serenity” charm set with 13 opals is a modern amulet offering protection, guidance, and intention, the brand said.

How Jewelers of America’s 20 Under 40 are leading to ensure a brighter future for the jewelry industry.

“Bridgerton” actresses Hannah Dodd and Claudia Jessie star in the brand’s “Rules to Love By” campaign.

Founded by jeweler and sculptor Ana Khouri, the brand is “expanding the boundaries of what high jewelry can be.”

The jewelry manufacturer and supplier is going with a fiery shade it says symbolizes power and transformation.

Roseco’s 704-page catalog showcases new lab-grown diamonds, findings, tools & more—available in print or interactive digital editions.

The singer-songwriter will make her debut as the French luxury brand’s new ambassador in a campaign for its “Coco Crush” jewelry line.

As the shopping mall model evolves and online retail grows, Smith shares his predictions for the future of physical stores.

The trade show is slated for Jan. 31-Feb. 2 at The Lighthouse in New York City's Chelsea neighborhood.

January’s birthstone comes in a rainbow of colors, from the traditional red to orange, purple, and green.

The annual report highlights how it supported communities in areas where natural diamonds are mined, crafted, and sold.

Footage of a fight breaking out in the NYC Diamond District was viewed millions of times on Instagram and Facebook.

The supplier has a curated list of must-have tools for jewelers doing in-house custom work this year.

The Signet Jewelers-owned store, which turned 100 last year, calls its new concept stores “The Edit.”

Linda Coutu is rejoining the precious metals provider as its director of sales.

The governing board welcomed two new members, Claire Scragg and Susan Eisen.

Sparkle with festive diamond jewelry as we celebrate the beginning of 2026.

The master jeweler, Olympian, former senator, and Korean War veteran founded the brand Nighthorse Jewelry.

In its annual report, Pinterest noted an increase in searches for brooches, heirloom jewelry, and ‘80s luxury.

Executive Chairman Richard Baker will take over the role as rumors swirl that a bankruptcy filing is imminent for the troubled retailer.

Mohr had just retired in June after more than two decades as Couture’s retailer liaison.

Shekhar Shah of Real Gems Inc. will serve as president of the Indian Diamond & Colorstone Association in 2026.

This year’s good luck charm features the mythical horse Pegasus, and is our first Piece of the Week of the new year.

Articles about crime, engagement rings, and a necklace worn in the World Series generated the most interest among readers.

As part of the leadership transition, Sherry Smith will take on the role of vice president of coaching strategy and development.