The Big Picture

Today, large companies mine some of the most popular colored gemstones, making it vital to examine their impact on local communities.

Though specific numbers are hard to come by, most sources estimate between 80 and 90 percent of colored stones are mined by small groups or individuals digging their own mines and extracting stones with rudimentary tools or collecting them in riverbeds.

And yet today, big companies are mining some of the market’s most commercially important stones, like Colombian emeralds and Mozambican rubies.

Mozambique, in fact, has become the world’s most productive source for gem-quality ruby since the discovery of deposits there in 2009, according to GIA.

The stones, which now mostly originate from the Montepuez area in the northern province of Cabo Delgado, are mined at concessions held by Gemfields and Fura Gems.

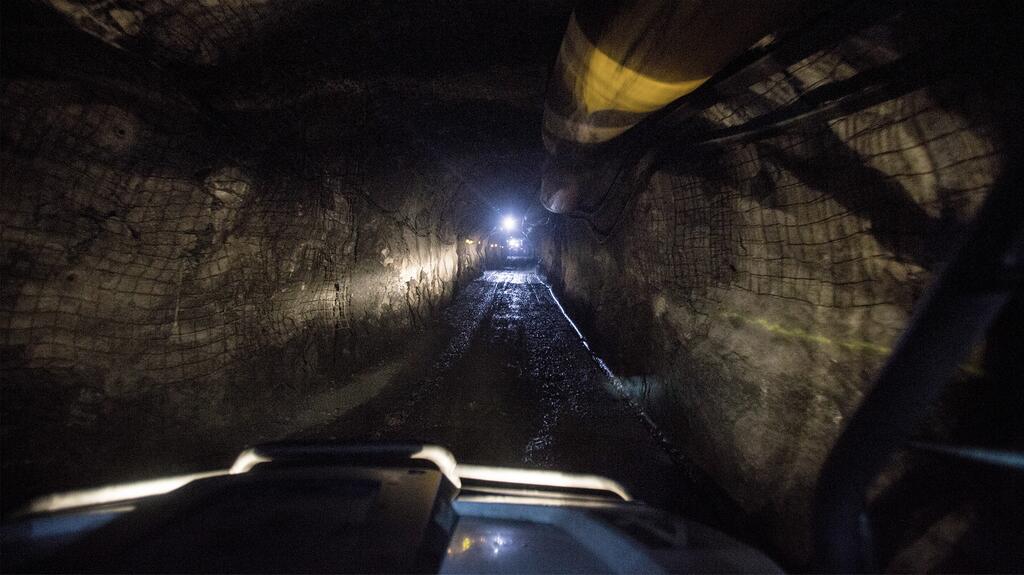

Meanwhile, in Colombia’s Boyacá department, Muzo Emerald is mining underground for the country’s much-coveted rich green gems in a historic area high in the Andes Mountains.

As the influence and production of these larger mining companies continues to increase, it will be important for said companies—and the industry at large—to monitor their impact on local communities.

A Recent Examination

One of the biggest events to bring the conversation about local impact to the fore in recent years, at least in the colored stone world, was the lawsuit filed against Gemfields in 2018.

A group of Mozambicans sued the London-based colored gemstone miner via law firm Leigh Day, alleging they were “shot, beaten, subjected to humiliating treatment and sexual abuse, unlawfully detained, and/or forced to carry out menial labor” by the security forces hired to guard the Montepuez mining site, which is 75 percent owned by Gemfields through its subsidiary, Montepuez Ruby Mining.

In a 2018 interview, Leigh Day attorney Matthew Renshaw told National Jeweler that, ultimately, the claimants alleged Gemfields “breached its duty to them by allowing these alleged human rights abuses to happen at the mine.”

Less than a year later, Gemfields agreed to a no-admission-of-liability settlement, in which the miner paid about $7.6 million to settle the case.

It maintained throughout that it wasn’t liable for what happened at the site while also recognizing that past instances of violence had occurred at Montepuez.

In an interview for this article, Gemfields CEO Sean Gilbertson tells National Jeweler he believed the settlement was the best option to maintain its relationship with the local community. He also noted the legal costs involved in taking the case to trial likely would have been greater than the settlement.

In addition to the settlement amount, Gemfields committed more than $500,000 to long-term sustainable benefits, like skills training to help foster growth and employment in the local community, and provided human rights training to Mozambican authorities.

It also agreed to create an independent Operational Grievance Mechanism (OGM) to ensure anyone can come forward with complaints about the mine. An independent panel will consider the evidence and determine compensation, where applicable.

The grievance mechanism is up and running, Gilbertson says. As of press time, a few cases had been filed but, he says, it’s still too early to see how effective it is.

Gemfields is also slated to plant a farm to help with food security in the forthcoming season.

The additional aspects of the settlement—the OGM and the community projects—aren’t usual in such a case and were a credit to Gemfields’ response, Leigh Day said at the time.

But the firm ran into some issues when it tried to distribute the money to the claimants, and there was some delay in getting those additional projects going.

The way they were implemented, or, rather, the delays in their implementation, since the settlement was “quite disappointing,” Renshaw said in a recent interview with National Jeweler, though he doesn’t blame Gemfields or its subsidiary, Montepuez Ruby Mining, for that.

“It’s a difficult operating environment where the local authorities expect to have a significant measure of control over things,” he says, noting some difficulties in compensation distribution to the claimants due to government authorities stopping the firm from liaising with clients or preventing support groups on the ground from doing their work.

Human rights advocate David Matsinhe, Southern Africa researcher at Amnesty International and adjunct professor of African Studies at Carleton University in Canada, noted similar issues, saying government officials were accusing the beneficiaries of channeling the money to a recent insurgency and expelled the local company that was assisting with distribution of funds.

In the time since the lawsuit, Gemfields has implemented a more formal internal process for reporting incidents, creating “preventative systems” to ensure everything about the way they handle an incident or allegation is recorded.

More recently, the company helped establish the Gemstones and Jewellery Community Platform from the Coloured Gemstones Working Group, a joint initiative involving industry heavy hitters such as Muzo, Kering, Richemont, and LVMH.

The platform offers free resources and tools to enable individuals and companies to learn more about and implement responsible business practices.

This year, Gemfields launched the “G-Factor for Natural Resources,” a measure promoting greater transparency around the level of natural resource wealth shared with the governments of host countries in primary and direct taxes, as well as dividends in countries where the government is a shareholder.

Each company engaged in the extraction and sale of natural resources across any category would calculate the “G-Factor” on their own.

The move is an interesting one, as it comes at a time when there is increased focus on ensuring host countries—and their citizens—are getting as much as they can out of a country’s mineral wealth.

Mozambique, specifically, has been the topic of many news stories over the past few years, as local and international journalists ask: Are the country’s newly discovered rubies really benefiting its citizens?

Mozambican investigative journalist Estacio Valoi has reported extensively on this topic as the ruby mining area changed hands from locals—a local man, in fact, is credited with first finding the stones—to large-scale mining.

Several of his stories have focused on clashes between informal miners and security forces for the mining companies in Montepuez, the disappointment of local miners who were pushed out as big companies moved in, and what he sees as the failure of the government to protect the Mozambican people and help them benefit from the country’s resources.

Valoi tells National Jeweler via WhatsApp that the situation on the ground has improved a little since the settlement but noted that Montepuez’s mining area still has issues.

“You have to take the community along with you, right from day one.”—Dev Shetty, Fura Gems

Matsinhe also said Mozambicans continue to be unhappy because they’ve lost livelihoods without being able to mine since the big companies have moved into the area. They’ve lost access to other natural resources in the mining area too, such as water and bamboo used to build houses.

The conversation has since evolved into a much bigger one as the larger Cabo Delgado province, in which Montepuez is situated, has seen a violent insurgency by Islamist militants continue to escalate, pushing many people from their homes and leaving thousands dead.

There are broader issues at play here—including corruption, high poverty levels, and disputes over access to land and jobs, fueled by tensions among ethnic groups. But some local news stories and reports have indicated they believe resentment and anger over being pushed out of mining areas has led some to join the militants, a possibility Matsinhe acknowledges as well.

Gemfields Gilbertson, however, says he finds it hard to believe people are traveling so far from Montepuez—it’s more than 200 miles, at least, to the areas most embattled—to take part.

Both Gemfields and Fura say the insurgency has yet to impact their operations in Mozambique, but both are monitoring the situation.

LSM vs. ASM

No matter where a large-scale miner is operating, informal mining is likely going on there as well, says Gabbi Harvey, who’s in charge of business development for Muzo Emerald.

This is the case even when mining in an area like Colombia’s Muzo region, where operations have been underway for centuries.

The mineral-rich area of Boyacá has seen plenty of violence associated with the fight for its emeralds; these disputes were referred to as the “green wars” at their most violent in the 1970s and 1980s.

Low levels of economic development, a lack of public and social services, high unemployment rates and poverty levels, and a vast informal labor market are still very much a part of the region’s story.

For its corporate social responsibility strategy, Muzo Emerald focuses not only on the mine but on the town of Muzo, with a plan designed to engage all actors in the area.

The company behind the mining operations created a strategy in 2014 that included establishing schools, a cocoa agroforestry system and agricultural association, higher education scholarships, and more.

In 2019, it launched The Muzo Foundation, operating under three tenets of education, food security and productive projects, and institutional strengthening and leadership.

Fura and Gemfields follow similar strategies, believing that the best way to operate—both for a mine’s longevity and from a social responsibility perspective—is to not only hire locals at their operations but to go beyond employment to bridge the gap with the community.

“You have to take the community along with you, right from day one,” Fura CEO Dev Shetty says.

Fura employs mostly local citizens at its operations, an important part of which is training and education.

Since many of them are more familiar with artisanal mining, they need a change of mindset to understand mining on a large-scale basis, Shetty says.

What’s more, miners have to align the community’s needs with their goals, making sure to set reasonable ones and managing expectations about how long certain projects could take.

At its Coscuez mine in Boyacá, Colombia, people were already mining for emeralds in the tunnels when Fura Gems took ownership of the mine.

As it took over operations in the area, it had to cease all mining except its own, but Shetty says the local community’s understanding of the transition and processes made it easier for Fura.

For months, Fura worked on baseline studies to understand the local area, and offered detailed presentations for and Q&A sessions with locals to explain operations and address concerns.

Fura was eventually able to hire those previous miners as mine employees.

“Every company that seeks to set up a business operation somewhere, especially in areas occupied by people, has an obligation under human rights law … to ensure that human rights are protected.”—David Matsinhe, Amnesty International

Moving into Mozambique was different for Fura because there were no major settlements in its licenses, Shetty says, but it included four villages in its local CSR program.

At Gemfields’ Montepuez mining site, one out of the seven villages in the Montepuez Ruby Mining concession area was relocated; the others remain where they were when it started operating there.

For the one that was resettled, Montepuez Ruby Mining spent $10 million on the construction of a new village to re-house Nthoro families.

The new village and its associated farmlands cover an area of nearly 6,000 acres—105 homes with water and electricity, a primary school, market, church, mosque, police station, cemetery, and landfill site.

The process took years and also resulted in quite a few news stories and reports questioning whether or not human rights were taken into account along the way.

Gilbertson responds to criticisms of the village resettlement by noting that legally, no company can engage in involuntary resettlement. The only way to resettle locals, according to the International Finance Corp.’s Performance Standard 5, is with “free, prior, and informed consent.”

“That’s not a joke to get, by the way. It’s a serious process,” Gilbertson says. “It takes extensive consultation, both with the administrative people, the local communities, the villages themselves, government authorities, and you also need district approval and national-level approval to get that done. And we did all of that in respect to … Nthoro.”

As for the lawsuit that came out of its Mozambiquan operations, Gilbertson says this: “I’ve been involved since day one with Gemfields. We’ve had no allegations of this nature in Zambia. But all of a sudden, we had these allegations in relation to the development of the mine in Mozambique. There’s obviously a disparity there.

“If we were, as people like to see, some evil enterprise that just behaves appallingly, why is it that these allegations didn’t come about in Zambia?”

The miner’s conflicts in Mozambique stem from the clash between its operations and those who used to be working in the area, whether Mozambican or international miners who relocated to Montepuez. And it’s an issue that’s been there from the start.

Gilbertson says Gemfields’ ruby mine in Mozambique has attracted more artisanal miners in part because the ruby-bearing gravels at Montepuez are only 3-15 meters below the surface in loose gravels, which means they’re easier to get to via digging, as opposed to its Kagem emerald mine in Zambia, where the stones are found in hard rock.

Additionally, a large-scale miner’s community relations and how it interacts with those around their mining operation can also depend on external factors: governance, infrastructure, and the operating conditions of the source country.

In Mozambique, a sovereign nation, members of the police and its defense forces “are entitled to come and go entirely as they see fit,” Gilbertson says.

“Generally speaking, the operating conditions in Zambia, when we arrived, were more well established,” he says.

“You had much better local governance in administrative departments, better infrastructure. It was just a better operating environment. When we arrived in Cabo Delgado, which is often credited as being the forgotten province of Mozambique, things were just not as developed. It’s a more difficult operating environment.”

Gemfields has run into issues in Ethiopia in recent years as well. The company owns a 75 percent stake in Web Gemstone Mining plc, which holds an emerald exploration license in southern Ethiopia.

“I think Ethiopia has staggering potential … If some of the difficulties and the political issues can be resolved, the growth that can be delivered in Ethiopia is absolutely unbelievable … But the reality is that, at the moment, it is not a safe operating country.”

Gemfields’ operations there were overrun and looted in mid-2018, just months after the Montepuez lawsuit was filed, but Gilbertson says trying to connect the two instances is “utter and total garbage,” noting that Gemfields was only at the feasibility studies stage when a separatist movement pushed into the area and led a group of people to attempt to take control of the resource.

“When we go and market the Colombian emerald project, we are branding Colombia.”—Dev Shetty, Fura Gems

The Value Add

In addition to projects like schools and farms, the presence of large-scale mining companies can contribute other unseen benefits, the companies contend, like helping a host country receive fair market value for their gemstones, which is one of the biggest challenges for those in the ASM space.

“When it comes to small-scale mining, we never want to take away from what that is … but the mentality around small-scale mining, from my experience with Tanzanite One and then Gemfields, is that the miners aren’t given the true value of the gemstone,” Muzo’s Harvey says.

There’s also job stability.

Consider, for example, how the large-scale mining companies were able to handle the pandemic.

It’s not that COVID-19 didn’t affect them—Fura and Gemfields both had to shut down their mines, and the latter wasn’t able to hold any “traditional” auctions in 2020.

While Gemfields did implement some salary cuts, both miners were able to forgo any layoffs.

Meanwhile, the artisanal mining sector, as most in the industry know, was one of the hardest hit by the pandemic. Miners were faced with either not being able to mine or, if they could, not being able to sell their stones. (National Jeweler addressed their struggles in its 2020 “State of the Majors” issue, in a story titled “ASM and the COVID-19 Impact.”)

There are also the taxes and duties paid by the large mining companies to local governments, the big miners point out.

With Gemfields, 100 percent of gemstone auction revenues are paid to the mining company in the country of origin—in which the host governments are partners—to ensure said country receives the full value of its stones.

Fura’s Shetty adds that large mining companies bring another invaluable aspect to the table for source countries: branding.

“When we go and market the Colombian emerald project, we are branding Colombia.”

Obligations, Legal or Otherwise

Complying with human rights due diligence seems like it would be the most obvious tenet of social responsibility.

But it’s not only what mining companies should do—it’s what they are required to do, Amnesty International’s Matsinhe says.

“Every company that seeks to set up a business operation somewhere, especially in areas occupied by people, has an obligation under human rights law … to ensure that human rights are protected, to ensure that these mechanisms for mitigating, preventing, and providing remedies in case other violations or abuses occur [because of] its mining operations.”

The United Nations has a set of “Guiding Principles on Business and Human Rights” that provides a risk management process for companies to follow, using four steps: assessing actual and potential human rights impacts; integrating and acting on the findings; tracking responses; and communicating about how any adverse impacts are addressed.

While widely seen as the global standard for business responsibility, the U.N. principles also address the obligations of states to “protect against human rights abuses within their territory and/or jurisdiction by third parties, including business enterprises,” and to “set out clearly the expectation that all business enterprises domiciled in their territory and/or jurisdiction respect human rights throughout their operations.”

But, in Matsinhe’s view, it’s often up to the companies to make sure the people around them are being treated fairly.

“They must not wait for these governments to enforce these laws because that will never happen,” he says. “Mining companies must do better than governments, implementing laws and international standards.”

The Latest

The jewelry collection belonged to “one of society's most glamorous and beautiful women of the mid-20th century,” said the auction house.

Emmanuel Raheb discusses the rise of “GEO” and the importance of having well-written, quality content on your website.

Each received around four years for burglarizing a jewelry store and a coffee shop in Simi Valley, California, last May.

Every jeweler faces the same challenge: helping customers protect what they love. Here’s the solution designed for today’s jewelry business.

Catherine Aulick, a GIA graduate, received the ninth and final Gianmaria Buccellati Foundation Award for Excellence in Jewelry Design.

We asked a jewelry historian, designer, bridal director, and wedding expert what’s trending in engagement rings. Here’s what they said.

Beth Gerstein discusses the vibe of the new store, what customers want when fine jewelry shopping today, and the details of “Date Night.”

With refreshed branding, a new website, updated courses, and a pathway for growth, DCA is dedicated to supporting retail staff development.

Are arm bands poised to make a comeback? Has red-carpet jewelry become boring? Find out on the second episode of the “My Next Question” podcast.

The Swiss watchmaker is battling declining sales amid a rapid retail expansion, according to a Financial Times report.

The campaign celebrates Giustina Pavanello Rahaminov, the co-founder’s wife and matriarch of the family-owned brand, for her 88th birthday.

Rachel Bennett, a senior jeweler who has been with Borsheims since 2004, earned the award.

After the Supreme Court struck down the IEEPA tariffs, President Trump imposed a 10 percent tax on almost all imports via a different law.

The industry veteran, who was with The Edge Retail Academy for 14 years, joins her husband at the company he founded in 2022.

The vintage signed jewelry retailer chose Miami due to growing client demand in the city and the greater Latin American region.

Former Flight Club executive Jin Lee will bring his experience from the sneaker world to the pre-owned watch marketplace.

Sakamoto, who died in mid-January following a sudden illness, is remembered for his humility and his masterful, architectural designs.

The April event will feature a new VIP shopping day requiring a special ticket.

Bulgari chose the British-Albanian singer-songwriter for her powerful and enduring voice in contemporary culture, the jeweler said.

In a 6-3 ruling, the court said the president exceeded his authority when imposing sweeping tariffs under IEEPA.

Smith encourages salespeople to ask customers questions that elicit the release of oxytocin, the brain’s “feel-good” chemical.

JVC also announced the election of five new board members.

The brooch, our Piece of the Week, shows the chromatic spectrum through a holographic coating on rock crystal.

Raised in an orphanage, Bailey was 18 when she met her husband, Clyde. They opened their North Carolina jewelry store in 1948.

Material Good is celebrating its 10th anniversary as it opens its new store in the Back Bay neighborhood of Boston.

The show will be held March 26-30 at the Miami Beach Convention Center.

The estate of the model, philanthropist, and ex-wife of Johnny Carson has signed statement jewels up for sale at John Moran Auctioneers.