In a 6-3 ruling, the court said the president exceeded his authority when imposing sweeping tariffs under IEEPA.

Product Pulse: How Strong is Your Bridge Jewelry Business?

The category as a percentage of overall sales has either stayed the same or increased for the majority of retailers in recent years, our latest survey found.

New York--The latest category-specific survey from National Jeweler/Jewelers of America shows that bridge jewelry as a percentage of overall sales has either stayed the same or increased for retailers in recent years.

The Product Pulse survey on bridge jewelry was conducted online in late August/early September; approximately 120 jewelers responded.

It defined bridge jewelry as pieces that “bridge” the gap between costume and fine, often crafted using gold vermeil/gold fill and/or sterling silver with “semi-precious” gemstones.

Nearly half (48 percent) of jewelers said that bridge jewelry sales have stayed about the same as a percentage of their overall sales in recent years, while another 43 percent said they have increased.

Only 10 percent said they were decreasing.

More than half of retailers (53 percent) said that bridge jewelry accounts for 10 percent or less of their overall sales, while 19 percent indicated it was between 11 percent and 15 percent of the total and another 11 percent put it somewhere between 16 and 20 percent.

Thirteen percent of respondents said bridge jewelry made up between 21 and 30 percent of total sales, and another 4 percent indicated it was between 31 and 40 percent.

Only 1 percent had bridge jewelry sales at more than 40 percent of overall sales.

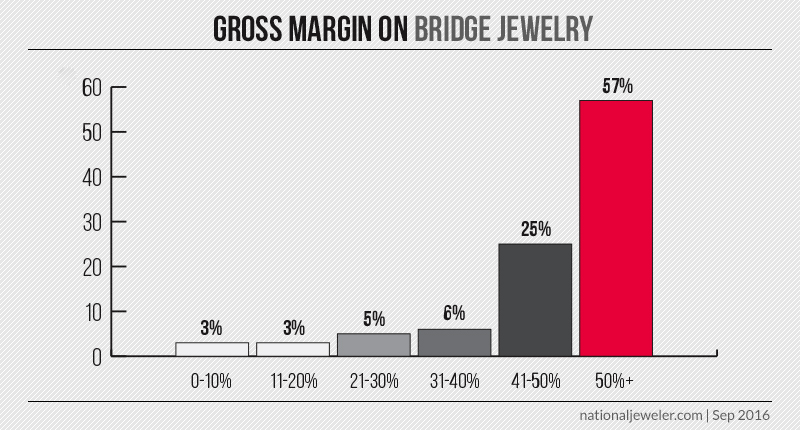

In terms of the overall gross margin from bridge jewelry, the most respondents (57 percent) said that the category has more than a 50 percent margin for them, while one in four said it was between 41 and 50 percent.

Only 6 percent said it was between 31 percent and 40 percent margin, while 5 percent said bridge jewelry had a margin between 21 percent and 30 percent and the remaining 6 percent saw a 20-percent-or-less margin.

When asked why they started carrying bridge jewelry, many survey takers said they did it when the price of gold began to go up in order to have jewelry at the price points consumers wanted.

“We started as soon as gold started rising in price so that we could still offer affordable jewelry,” one respondent wrote.

Another said that they made the move into bridge “to give our customers a wider price range to select from and try out some trendy fashions.”

The possibility of a higher margin from bridge jewelry also helped, as one retailer said they began carrying jewelry in the category 18 months ago “to compensate and boost sagging sales overall.”

Among the

Outside of specific brand names, many jewelers just stated that what does best for them in this category is sterling silver jewelry set with gems or diamonds.

The Latest

Smith encourages salespeople to ask customers questions that elicit the release of oxytocin, the brain’s “feel-good” chemical.

JVC also announced the election of five new board members.

Launched in 2023, the program will help the passing of knowledge between generations and alleviate the shortage of bench jewelers.

The brooch, our Piece of the Week, shows the chromatic spectrum through a holographic coating on rock crystal.

Raised in an orphanage, Bailey was 18 when she met her husband, Clyde. They opened their North Carolina jewelry store in 1948.

Material Good is celebrating its 10th anniversary as it opens its new store in the Back Bay neighborhood of Boston.

Criminals are using cell jammers to disable alarms, but new technology like JamAlert™ can stop them.

The show will be held March 26-30 at the Miami Beach Convention Center.

The estate of the model, philanthropist, and ex-wife of Johnny Carson has signed statement jewels up for sale at John Moran Auctioneers.

Are arm bands poised to make a comeback? Has red-carpet jewelry become boring? Find out on the second episode of the “My Next Question” podcast.

It will lead distribution in North America for Graziella Braccialini's new gold pieces, which it said are 50 percent lighter.

The organization is seeking a new executive director to lead it into its next phase of strategic growth and industry influence.

The nonprofit will present a live, two-hour introductory course on building confidence when selling colored gemstones.

Western wear continues to trend in the Year of the Fire Horse and along with it, horse and horseshoe motifs in jewelry.

![A peridot [left] and sapphires from Tanzania from Anza Gems, a wholesaler that partners with artisanal mining communities in East Africa Anza gems](https://uploads.nationaljeweler.com/uploads/cdd3962e9427ff45f69b31e06baf830d.jpg)

Although the market is robust, tariffs and precious metal prices are impacting the industry, Stuart Robertson and Brecken Branstrator said.

Rossman, who advised GIA for more than 50 years, is remembered for his passion and dedication to the field of gemology.

Guthrie, the mother of “Today” show host Savannah Guthrie, was abducted just as the Tucson gem shows were starting.

Butterfield Jewelers in Albuquerque, New Mexico, is preparing to close as members of the Butterfield family head into retirement.

Paul Morelli’s “Rosebud” necklace, our Piece of the Week, uses 18-karat rose, green, and white gold to turn the symbol of love into jewelry.

The nonprofit has welcomed four new grantees for 2026.

Parent company Saks Global is also closing nearly all Saks Off 5th locations, a Neiman Marcus store, and 14 personal styling suites.

It is believed the 24-karat heart-shaped enameled pendant was made for an event marking the betrothal of Princess Mary in 1518.

The AGTA Spectrum and Cutting Edge “Buyer’s Choice” award winners were announced at the Spectrum Awards Gala last week.

The “Kering Generation Award x Jewelry” returns for its second year with “Second Chance, First Choice” as its theme.

Sourced by For Future Reference Vintage, the yellow gold ring has a round center stone surrounded by step-cut sapphires.

The clothing and accessories chain announced last month it would be closing all of its stores.