The estate of the model, philanthropist, and ex-wife of Johnny Carson has signed statement jewels up for sale at John Moran Auctioneers.

Business Pulse: Top Diamond Shapes, Sizes and Settings

National Jeweler/Jewelers of America’s latest Business Pulse survey show that rounds and halos still reign supreme.

New York--National Jeweler/Jewelers of America’s latest Business Pulse survey results confirm much of what is already known about the engagement ring market in the United States.

Round remains the most popular shape by a wide margin, the average center stone is about 1 carat in size and halo settings are still a favorite.

Conducted in mid- to late May, the Business Pulse asked jewelers to break down their engagement ring sales over the past year, with a total of about 150 retailers responding.

When asked what the most popular center stone shape was in their stores, the vast majority of respondents (94 percent) said round. Princess (3 percent) and cushion (2 percent) were the only other two shapes mentioned. (Numbers may not add up to 100 percent due to rounding.)

Gold, particularly white gold, was the most popular metal in respondents’ stores, and the halo was the most popular setting style, with 59 percent reporting it was the top pick among their customers.

Other styles that received a fair amount of mentions were vintage or vintage-inspired looks (12 percent) and solitaires (11 percent).

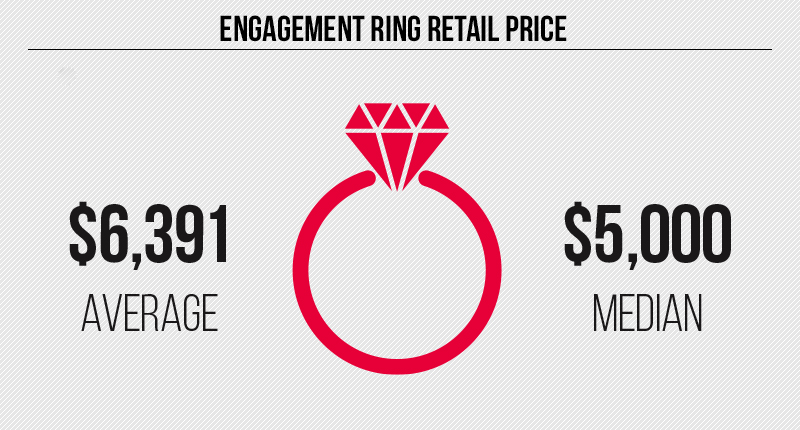

When it comes to how much their customers spend on engagement rings on average, the median figure was $5,000. The average was about $6,400, though the one survey-taker who reported an average spend of $90,000 in their store certainly helped lift that figure.

Both the median ($5,000) and the average ($6,391) recorded in the National Jeweler/JA survey are not far off the average U.S. engagement ring spend reported in The Knot’s latest Real Weddings Study, which was $5,871.

April flowers

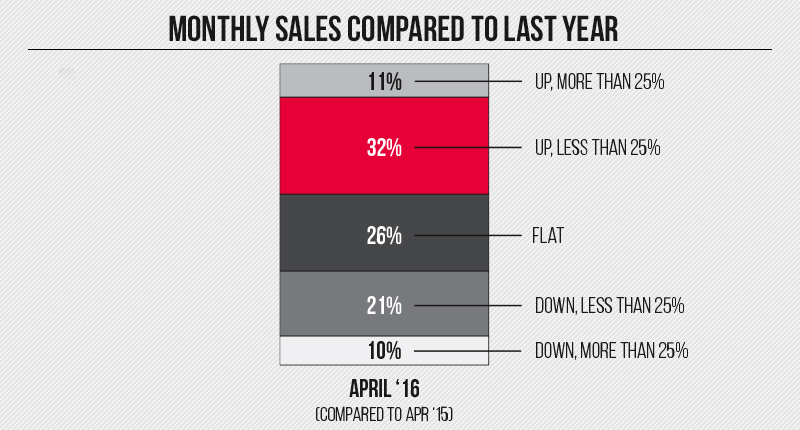

When asked to compare their store’s year-over-year sales performance for the month of April, 69 percent of survey-takers reported that business was either steady or improved when compared to the prior-year period, with the highest percentage (32 percent) reporting a sales increase of 1 to 25 percent.

Of the 31 percent who reported a drop in sales, 21 percent said they saw sales decline less than 25 percent year-over-year while 10 percent said they dropped more than 25 percent.

A total of 268 jewelers completed the business comparison portion of the survey.

National Jeweler/Jewelers of America conducted its Business Pulse survey from May 20 to 28, in conjunction with the Product Pulse survey, which asked jewelers about platinum sales.

The Latest

Are arm bands poised to make a comeback? Has red-carpet jewelry become boring? Find out on the second episode of the “My Next Question” podcast.

It will lead distribution in North America for Graziella Braccialini's new gold pieces, which it said are 50 percent lighter.

Launched in 2023, the program will help the passing of knowledge between generations and alleviate the shortage of bench jewelers.

The organization is seeking a new executive director to lead it into its next phase of strategic growth and industry influence.

The nonprofit will present a live, two-hour introductory course on building confidence when selling colored gemstones.

Western wear continues to trend in the Year of the Fire Horse and along with it, horse and horseshoe motifs in jewelry.

Criminals are using cell jammers to disable alarms, but new technology like JamAlert™ can stop them.

![A peridot [left] and sapphires from Tanzania from Anza Gems, a wholesaler that partners with artisanal mining communities in East Africa Anza gems](https://uploads.nationaljeweler.com/uploads/cdd3962e9427ff45f69b31e06baf830d.jpg)

Although the market is robust, tariffs and precious metal prices are impacting the industry, Stuart Robertson and Brecken Branstrator said.

Rossman, who advised GIA for more than 50 years, is remembered for his passion and dedication to the field of gemology.

Guthrie, the mother of “Today” show host Savannah Guthrie, was abducted just as the Tucson gem shows were starting.

Butterfield Jewelers in Albuquerque, New Mexico, is preparing to close as members of the Butterfield family head into retirement.

Paul Morelli’s “Rosebud” necklace, our Piece of the Week, uses 18-karat rose, green, and white gold to turn the symbol of love into jewelry.

The nonprofit has welcomed four new grantees for 2026.

Parent company Saks Global is also closing nearly all Saks Off 5th locations, a Neiman Marcus store, and 14 personal styling suites.

It is believed the 24-karat heart-shaped enameled pendant was made for an event marking the betrothal of Princess Mary in 1518.

The AGTA Spectrum and Cutting Edge “Buyer’s Choice” award winners were announced at the Spectrum Awards Gala last week.

The “Kering Generation Award x Jewelry” returns for its second year with “Second Chance, First Choice” as its theme.

Sourced by For Future Reference Vintage, the yellow gold ring has a round center stone surrounded by step-cut sapphires.

The clothing and accessories chain announced last month it would be closing all of its stores.

The “Zales x Sweethearts” collection features three mystery heart charms engraved with classic sayings seen on the Valentine’s Day candies.

The event will include panel discussions, hands-on demonstrations of new digital manufacturing tools, and a jewelry design contest.

Registration is now open for The Jewelry Symposium, set to take place in Detroit from May 16-19.

Namibia has formally signed the Luanda Accord, while two key industry organizations pledged to join the Natural Diamond Council.

Lady Gaga, Cardi B, and Karol G also went with diamond jewelry for Bad Bunny’s Super Bowl halftime show honoring Puerto Rico.

As star brand Gucci continues to struggle, the luxury titan plans to announce a new roadmap to return to growth.

The new category asks entrants for “exceptional” interpretations of the supplier’s 2026 color of the year, which is “Signature Red.”