President Trump said he has reached a trade deal with India, which, when made official, will bring relief to the country’s diamond industry.

Dissecting De Beers' 'distribution update'

After a sleepy couple of weeks, news wise, De Beers woke up the diamond world on Monday when it announced a series of changes, a "distribution update" if you will, to the way it sells its rough diamonds. See story...

After a sleepy couple of weeks, news wise, De Beers woke up the diamond world on Monday when it announced a series of changes, a "distribution update" if you will, to the way it sells its rough diamonds. See story here.

Probably the biggest change: De Beers announced that Diamond Trading Co. (DTC) sightholders--those vaunted companies that receive rough directly from De Beers at its 10 sights (sales of rough diamonds) held throughout the year--will be able to buy rough at Diamdel auctions beginning in October (more on this below).In addition, De Beers also announced that it will give non-sightholder companies the chance to apply for the sightholder status in the midst of the next contract period and that it is taking steps to make the sightholder application process less cumbersome. I'm sure the latter, especially, is a welcome change, as I have heard numerous complaints about the heavy volume of paperwork involved in applying.

After dissecting the alphabet soup-like release (SoC, ITO, DTC, CPQ, whew...), I sent a few questions to De Beers' spokeswoman Lynette Gould in London, who kindly took time to answer via e-mail.

Q. What percentage of De Beers' production goes to Diamdel? How much of Diamdel's allocation is currently sold at auction?

A. De Beers typically sells up to 10 percent of its annual production to Diamdel, which is basically De Beers' rough diamond sales and distribution arm for non-sightholders, companies that are also referred to as the "secondary market." Launched in the beginning of 2008, Diamdel is based in the diamond-trading center of Antwerp, Belgium, and conducts all of its auctions online.

The amount Diamdel sells at auction as a percentage of its total sales varies, but so far has ranged between 40 and 70 percent.

Q. What percentage will Diamdel's auction sales graduate to as the company "continues to transfer more of its allocation into the auction format?"

A. (Note from blog author: Very interesting response here.) If this pilot program is successful, Diamdel will move to an auction-only model.

Q. How many existing Diamdel customers are there currently, and how are they chosen?

A. Diamdel has more than 500 customers registered. They must successfully complete a registration process to be eligible for participation at auctions.

Q. There have been reports that Diamdel has, in the past, not been able to sell all of its goods, and that it has even canceled auctions due to lack

A. Diamdel has never cancelled an auction due to a lack of interest or inability to sell. On occasion, lots fall short of reserves, although, to date, this has happened on a very small percentage of lots and was most notable during the downturn.

Q. What was the impetus behind letting sightholders buy at auction?

A. Diamdel has proven expertise at auctioning and we believe the time is right for this expertise to be tested on a wider group of applicants with an expanded volume and range of goods hence the pilot.

Q. How does De Beers respond to concern that allowing sightholders into Diamdel auctions will make securing rough even more difficult for non-sightholders, particularly for in-demand goods?

A. Diamdel auctions have provided more customers with more opportunities to buy the rough they require to sustain their operations than the previous placed sales model created. The pilot will build upon this and provide greater volumes of a broader range of rough for purchase at auctions on a more consistent basis. Subject to the outcome of the pilot and availability, this proposed model will offer non-sightholders who consistently demonstrate strong demand for categories of rough at auction the potential to ultimately qualify for a sight.

The auctions themselves won't favor one type of business model over another.

(Note from blog author: Arguably, though, I have to say that auctions, by their very nature, favor bigger companies and/or people with more money, i.e., the sightholders.)

Q. What has been sightholder feedback on De Beers' plans to allow non-sightholders/Diamdel customers to compete for sights in the middle of the next contract period?

A. The majority of feedback we have received has been very positive. Sightholders see opportunities in these enhancements.

Q. Can you elaborate a bit on the Contract Proposal Questionnaire (CPQ) portion of the changes? How did it work before? And what is the purpose of this change?

A. The DTC will be streamlining the Supplier of Choice application process for the 2011-2015 contract period to make it quicker, simpler and more efficient. This will include submitting just one CPQ per applicant to cover multiple categories of goods. There will also be fewer questions requiring written answers in the new CPQ.

The Latest

The designer’s latest collection takes inspiration from her classic designs, reimagining the motifs in new forms.

The watchmaker moved its U.S. headquarters to a space it said fosters creativity and forward-thinking solutions in Jersey City, New Jersey.

Launched in 2023, the program will help the passing of knowledge between generations and alleviate the shortage of bench jewelers.

The company also announced a new partnership with GemGuide and the pending launch of an education-focused membership program.

IGI is buying the colored gemstone grading laboratory through IGI USA, and AGL will continue to operate as its own brand.

The Texas jeweler said its team is “incredibly resilient” and thanked its community for showing support.

Criminals are using cell jammers to disable alarms, but new technology like JamAlert™ can stop them.

The medals feature a split-texture design highlighting the fact that the 2026 Olympics are taking place in two different cities.

From tech platforms to candy companies, here’s how some of the highest-ranking brands earned their spot on the list.

The “Khol” ring, our Piece of the Week, transforms the traditional Indian Khol drum into playful jewelry through hand-carved lapis.

The catalog includes more than 100 styles of stock, pre-printed, and custom tags and labels, as well as bar code technology products.

The chocolatier is bringing back its chocolate-inspired locket, offering sets of two to celebrate “perfect pairs.”

The top lot of the year was a 1930s Cartier tiara owned by Nancy, Viscountess Astor, which sold for $1.2 million in London last summer.

Any gemstones on Stuller.com that were sourced by an AGTA vendor member will now bear the association’s logo.

The Swiss watchmaker has brought its latest immersive boutique to Atlanta, a city it described as “an epicenter of music and storytelling.”

The new addition will feature finished jewelry created using “consciously sourced” gemstones.

In his new column, Smith advises playing to your successor's strengths and resisting the urge to become a backseat driver.

The index fell to its lowest level since May 2014 amid concerns about the present and the future.

The new store in Aspen, Colorado, takes inspiration from a stately library for its intimate yet elevated interior design.

The brands’ high jewelry collections performed especially well last year despite a challenging environment.

The collection marks the first time GemFair’s artisanal diamonds will be brought directly to consumers.

The initial charts are for blue, teal, and green material, each grouped into three charts categorized as good, fine, and extra fine.

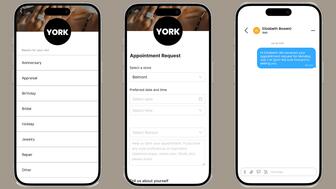

The new tool can assign the appropriate associate based on the client or appointment type and automate personalized text message follow-ups.

Buyers are expected to gravitate toward gemstones that have a little something special, just like last year.

Endiama and Sodiam will contribute money to the marketing of natural diamonds as new members of the Natural Diamond Council.

The retailer operates more than 450 boutiques across 45 states, according to its website.