Associate Editor Natalie Francisco highlights her favorite jewelry moments from the Golden Globes, and they are (mostly) white hot.

5 modern forces that shaped the industry, part II

In part two of a two-part series, columnist Jan Brassem examines the final three factors he says disrupted and transformed the jewelry industry over the past 35 years.

As discussed in Part I, I’d like to briefly summarize five unique industry forces (there are more, of course) that, in my view, transformed the U.S. jewelry industry from what it was in my “good old days” to what it is today.

I’ll use my non-jewelry education, combined with 37 years of industry experience, to take look a look back through the rear window. The first two dynamics, gold price gyrations and the tech industry’s jewelry store “fly-by,” were presented in Part I.

3. The industry in consolidation

We’ve all been reading about the acquisition of the Zale Corp. by Signet Jewelers. Signet now operates more than 3,600 jewelry stores under various corporate names.

Although the Zale acquisition was one of the most publicized financial transactions, it was by no means the only one. There have been plenty of transactions recently although few are well publicized. As a matter of fact, financial transactions in the jewelry industry are now at an all-time high.

The forms of cooperation, such as acquiring a company, merging with another, developing an alliance, etc. are endless. They are as effective a tool as brand strategy or product merchandising--just a little more complicated.

In my day acquisitions, mergers or any “restructuring,” were not common, at least not as it is now. Jewelers have only recently started to realize that in the current climate of globalization, technological advances, segmented markets and increased competition, growth through a strategy of merger and acquisition, or other sophisticated transactions, can be faster and cheaper than organic expansion.

Thirty years ago, sagacious jewelers usually sold their firms because they realized, after spending decades in the store, it was time to retire and enjoy the remaining years in Florida, or wherever. Usually, there were no relatives in the business, no succession.

The one exception, if I remember correctly, was one of our customers, a progressive buying group on the West Coast. The group had 17 stores with 10 store owners/buyers. Today they have almost 120 stores, including the “old” members.

Today’s jewelers have moved away from their comfort zone. Instead of buying diamonds and considering showroom décor--things they have been doing for years--they are trying to recognize the brain-numbing matrix curves and SWOP analysis, metric averages and implementation plans.

As I’ve written before, today’s jewelry owner will no longer be known as a jeweler, but transformed into a sophisticated businessman.

4. Marketing channel pandemonium

In the “good old days,” there were only a few retail marketing channels that would carry a jewelry line.

Some of these are no longer viable (Best Products and Service Merchandise come to mind.) Other channels, like jewelry wholesalers--also called jewelry distributors, which carried watches as well as jewelry supplies--closed their doors too. (Bernstein Biggard and Norvell Marcum were household names then.)

Other channels such as department stores, like Macy’s, were as popular then as they are now. Ironically, even in those days, Zale Corp. was experiencing some financial distress as was J.C. Penney. Even then, Tiffany was the leader of the pack in terms of quality and elegance. I assume in profitability too.

Now comes the exciting part.

Enter Home Shopping Network Inc., a/k/a HSN, quickly followed by QVC and several other me-too, HSN-type operators. Their arrival showed the industry and the jewelry buyer that expensive jewelry could be shipped by mail, or FedEx, with only minimal risk of theft.

Although it took at least 10 years to develop, the maturation and marketing sophistication of the Internet changed the jewelry industry forever. Now every retailer--jewelry and non-jewelry, large or small, domestic or international--had the ability to sell their products online as well as through their brick-and-mortar facility. Having a web site, as the saying goes, allows anyone to sell jewelry from their basement in pajamas.

These distribution channels naturally morphed into companies that marketed via web sales only. Blue Nile, through careful sourcing and merchandising, captured a solid market share of the diamond wedding ring business.

Today’s consumer, compared to my “what’s-a-computer?” generation, is now technologically sophisticated. Many were using computers before their first day of school. The computer became their training wheels, so to speak. They are the “Internet Generation.”

It would take a thick marketing volume detailing, with extensive U.S. and international market research, which strategies are necessary to sell to this new Internet-savvy customer amid this tumultuous distribution environment. If you haven’t designed a strategy by now, start strategizing.

5. Global competition and opportunity

Rapid urbanization and growing wealth are helping to create new markets for jewelry in nations such as Brazil,

India, China and Russia (known as the BRIC countries, although Russia is temporarily off the list.)

China, of course, with its 1.4 billion population and insatiable appetite for anything jewelry, is a hot market, says Lyle Rose, our firm’s senior partner in Hong Kong.

One challenge for retailers in emerging markets is illegal imports. Another issue for American jewelry retailers in new markets is establishing brand awareness. Jewelers might need to conduct brand awareness campaigns and advertise heavily to grow in areas with a wide-open retail market environment.

There is presently a cross-border acquisition frenzy by foreign firms acquiring U.S. firms. It is felt that, in the long run, an acquisition strategy will accelerate the buyer’s market penetration and minimize the cost. For example, Boston’s Hearts on Fire was acquired by China’s largest retail jewelry firm, Chow Tai Fook.

The best example of the escalating global activity in the jewelry industry is the growth of international jewelry trade shows. In the “good old days” there were but a handful, led by the JCK and JA New York shows in the U.S., the Baselworld show in Europe and the Hong Kong show.

Today, there are many more all over the world, in places including the Middle East, Turkey, China and even Vietnam.

When all is said and done, what is the prognostication for our industry, at least through 2020?

McKinsey and Co., the foremost consulting and advisory firm in the world, writes the following: “It seems likely that the jewelry market of 2020 will be highly dynamic, truly globalized and intensely competitive.”

Those jewelry companies that can best anticipate and capitalize on industry-changing trends--particularly the five described in these two columns--will shine brighter than the rest.

The Latest

Yantzer is remembered for the profound influence he had on diamond cut grading as well as his contagious smile and quick wit.

The store closures are part of the retailer’s “Bold New Chapter” turnaround plan.

Criminals are using cell jammers to disable alarms, but new technology like JamAlert™ can stop them.

Through EventGuard, the company will offer event liability and cancellation insurance, including wedding coverage.

Chris Blakeslee has experience at Athleta and Alo Yoga. Kendra Scott will remain on board as executive chair and chief visionary officer.

The credit card companies’ surveys examined where consumers shopped, what they bought, and what they valued this holiday season.

How Jewelers of America’s 20 Under 40 are leading to ensure a brighter future for the jewelry industry.

Kimberly Miller has been promoted to the role.

The “Serenity” charm set with 13 opals is a modern amulet offering protection, guidance, and intention, the brand said.

“Bridgerton” actresses Hannah Dodd and Claudia Jessie star in the brand’s “Rules to Love By” campaign.

Founded by jeweler and sculptor Ana Khouri, the brand is “expanding the boundaries of what high jewelry can be.”

The jewelry manufacturer and supplier is going with a fiery shade it says symbolizes power and transformation.

The singer-songwriter will make her debut as the French luxury brand’s new ambassador in a campaign for its “Coco Crush” jewelry line.

The nonprofit’s new president and CEO, Annie Doresca, also began her role this month.

As the shopping mall model evolves and online retail grows, Smith shares his predictions for the future of physical stores.

The trade show is slated for Jan. 31-Feb. 2 at The Lighthouse in New York City's Chelsea neighborhood.

January’s birthstone comes in a rainbow of colors, from the traditional red to orange, purple, and green.

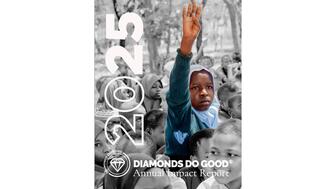

The annual report highlights how it supported communities in areas where natural diamonds are mined, crafted, and sold.

Footage of a fight breaking out in the NYC Diamond District was viewed millions of times on Instagram and Facebook.

The supplier has a curated list of must-have tools for jewelers doing in-house custom work this year.

The Signet Jewelers-owned store, which turned 100 last year, calls its new concept stores “The Edit.”

Linda Coutu is rejoining the precious metals provider as its director of sales.

The governing board welcomed two new members, Claire Scragg and Susan Eisen.

Sparkle with festive diamond jewelry as we celebrate the beginning of 2026.

The master jeweler, Olympian, former senator, and Korean War veteran founded the brand Nighthorse Jewelry.

In its annual report, Pinterest noted an increase in searches for brooches, heirloom jewelry, and ‘80s luxury.