Associate Editor Natalie Francisco highlights her favorite jewelry moments from the Golden Globes, and they are (mostly) white hot.

3 retail predictions for 2015

Analysts and independent jewelers offer their prognostications on the forces that will shape retail in the coming year.

New York--Jewelers and market observers anticipate a more competitive year in 2015, in what is already an ultra-competitive retail climate.

The high and low ends of the business will grow at the expense of the middle, and jewelers

will face continued competition from other categories, especially electronics.

At the same time, digital marketing will gain even more importance as a means to attract customers while brands will remain key to success, whether it’s a well-known name or a store making itself the brand.

Below, retail analysts and independent jewelers offer their prognostications for 2015.

1) The industry will continue to shrink while the importance of brands continues to grow.

Increased consolidation of chain jewelers could lead to mergers, acquisitions and liquidations among suppliers, according to Howard Feller, partner at MMG Advisors, an investment bank that specializes in retail- and fashion-related mergers and acquisitions.

The acquisition of Zale Corp. by Signet Jewelers, which put the Zale, Kay, and Jared chains under the same corporate umbrella, will have a ripple effect on suppliers, he says.

RELATED CONTENT: Signet-Zale: The culmination of consolidation

“The suppliers that survive will have more marketing power; other suppliers will liquidate or be acquired,” Feller said. “Smaller retail chains and individual stores might consolidate, too, and more private capital will come into the industry.”

He said that traditional wholesalers of gold and non-branded diamonds will feel the most pressure. “If they can’t get an adequate return, we’ll see a wave of consolidation, and more action by branded suppliers that have more runway. Organic growth will be hard to come by, so retailers and suppliers with strong balance sheets will try to grow through acquisitions,” he said.

In addition, Feller said he sees more emphasis on proprietary brands, like Vera Wang, the wedding dress designer who has a branded line of sterling silver jewelry sold at Kohl’s as well as a bridal line sold by Zales. Retailers, he said, want a name brand that will drive customers to their stores.

2) Digital definitely isn’t dying.

Digital marketing will become even more important in 2015, said Ellen Fruchtman of Toledo, Ohio-based Fruchtman Marketing. Retail jewelers will spend a minimum of 25 percent of their overall marketing budget in digital media, with many spending significantly more, she estimated.

“This will include items like online banner placements, paid search, and social marketing,” she said. “Less money will be

She said that stores in smaller markets will have a greater ability to compete based on their digital presence and ability to invest in this area, since the cost of entry is not as great. She added that more websites will be made mobile-responsive in 2015.

Fruchtman also predicted jewelers will look for marketing programs with measurable returns on investment, and will hold their staff accountable for higher closing ratios.

Retailers will spend more on jewelry education and training, as well as on software packages that can segment clientèle based on sales and product preferences.

“Custom jewelry will be the greatest growth area in 2015,” she said. “Consumers are looking for pieces that are unique to them, and this can be by far one of the most profitable segments of the business.”

3) Retailers will have to remain creative.

At the store level, retailers reported mixed results for this year and mixed expectations for 2015, but they seem to agree that most of the action will take place at the low and high ends of the price spectrum, and that it won’t be easy to increase profits.

“Our business was slow, the first part of the holiday season, and picked up at the end,” said Terry Dickens, co-owner of Herteen & Stocker Jewelers in Iowa City, Iowa. “Bigger diamonds are doing well, and diamond earrings are coming back after a couple of years away. At the low end, Endless Jewelry is doing very well.”

Several jewelers report that buying off the street has become a more important part of their strategy. Erik Runyan, owner of Erik Runyan Jewelers in Vancouver, Wash., said it’s a way of staying competitive and going after the loose diamond business.

“We had to learn to lose some of our pride and apprehension with regard to buying over the counter,” he said. “I was afraid it would soil the brand, but now I take advantage of any opportunity to buy items I can sell competitively. I didn’t have a single piece of vintage jewelry, a few years ago, but now it’s 10 to 15 percent of the store.

“Bridal kept us alive during the downturn, and I still try to market myself as a diamonds and bridal store. I sell finer diamonds with certificates: People are more knowledgeable and sophisticated every year because information is at everyone’s fingertips now.”

Runyan also noted the importance of brands, but one very specific brand: his own.

“Strong relationships with branded lines are waning,” he said. “I’m focusing on what Erik Runyan stands for, in quality and our standing in the community. We’re using our name and products as a value-add, rather than adding value with someone else’s brand.”

John O’Rourke, president and CEO of Montica Jewelry in Coral Gables, Fla., said he, too, is buying off the street more.

He also offers a “perpetual upgrade” policy, by which you can trade your diamond in for what you paid for it. Montica is leveraging its name and trying to position itself as a byword at the high end, he added.

“There’s more competition these days,” says O’Rourke, “and it’s coming not just from other jewelers, but from the electronics industry. Young people with money to spend will go to a Best Buy or an Apple Store. Another challenge is that there’s been so much discounting since 2008, so it’s hard to incentivize a customer with a promotion.

“Ninety percent of our business comes from 10 percent of our customers, so we’re going to grow that percentage,” he said.

O’Rourke transformed a section of his store’s showroom into a diamond room.

“Customers see that, and see that we’re in the diamond business. Our new tagline is ‘The Diamond Destination.’ By changing our logo and tagline, and showing customers that diamond area, we’re automatically pushing a higher price point, and conveying to the customer that they’ve found the right store.”

The Latest

Yantzer is remembered for the profound influence he had on diamond cut grading as well as his contagious smile and quick wit.

The store closures are part of the retailer’s “Bold New Chapter” turnaround plan.

Criminals are using cell jammers to disable alarms, but new technology like JamAlert™ can stop them.

Through EventGuard, the company will offer event liability and cancellation insurance, including wedding coverage.

Chris Blakeslee has experience at Athleta and Alo Yoga. Kendra Scott will remain on board as executive chair and chief visionary officer.

The credit card companies’ surveys examined where consumers shopped, what they bought, and what they valued this holiday season.

How Jewelers of America’s 20 Under 40 are leading to ensure a brighter future for the jewelry industry.

Kimberly Miller has been promoted to the role.

The “Serenity” charm set with 13 opals is a modern amulet offering protection, guidance, and intention, the brand said.

“Bridgerton” actresses Hannah Dodd and Claudia Jessie star in the brand’s “Rules to Love By” campaign.

Founded by jeweler and sculptor Ana Khouri, the brand is “expanding the boundaries of what high jewelry can be.”

The jewelry manufacturer and supplier is going with a fiery shade it says symbolizes power and transformation.

The singer-songwriter will make her debut as the French luxury brand’s new ambassador in a campaign for its “Coco Crush” jewelry line.

The nonprofit’s new president and CEO, Annie Doresca, also began her role this month.

As the shopping mall model evolves and online retail grows, Smith shares his predictions for the future of physical stores.

The trade show is slated for Jan. 31-Feb. 2 at The Lighthouse in New York City's Chelsea neighborhood.

January’s birthstone comes in a rainbow of colors, from the traditional red to orange, purple, and green.

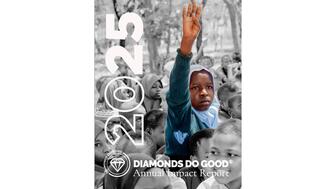

The annual report highlights how it supported communities in areas where natural diamonds are mined, crafted, and sold.

Footage of a fight breaking out in the NYC Diamond District was viewed millions of times on Instagram and Facebook.

The supplier has a curated list of must-have tools for jewelers doing in-house custom work this year.

The Signet Jewelers-owned store, which turned 100 last year, calls its new concept stores “The Edit.”

Linda Coutu is rejoining the precious metals provider as its director of sales.

The governing board welcomed two new members, Claire Scragg and Susan Eisen.

Sparkle with festive diamond jewelry as we celebrate the beginning of 2026.

The master jeweler, Olympian, former senator, and Korean War veteran founded the brand Nighthorse Jewelry.

In its annual report, Pinterest noted an increase in searches for brooches, heirloom jewelry, and ‘80s luxury.