Emmanuel Raheb discusses the rise of “GEO” and the importance of having well-written, quality content on your website.

Gemfields Reports $60M Loss in 2018

A new tax levied in Zambia played a significant part in putting the colored stone miner in the red for the full year.

London—Gemfields recorded a net loss in 2018, hurt in part by a new tax levied in Zambia and a costly court case.

In its full year ended Dec. 31, which was first full fiscal year for the company since the July 2017 takeover of its biggest investor, Pallinghurst, Gemfields reported revenue of $206.1 million, a 252 percent increase over 2017. This was the first time it crossed the $200-million mark, the colored gemstone miner noted.

EBITDA also increased, from $30.5 million to $58.9 million.

Even with revenue hitting a new high, the company recorded a $60.4 million loss for the fiscal year, hurt by the fair-value loss on the Sedibelo platinum mines, in which Gemfields holds a 6.5 percent stake, a $22.6 million impairment charge applied to Kagem because of newly implemented tax changes in Zambia and a costly court case.

Starting Jan. 1, the Zambian government introduced a 15 percent export duty on gemstones and metals to help reduce the country’s debt. When combined with the existing 6 percent mineral royalty already levied on gemstones, it increases Gemfields’ total tax on revenue at Kagem to 21 percent.

Also last fiscal year, a group of Mozambicans filed a lawsuit against the London-based colored gemstone miner over alleged human rights abuses at the company’s Montepuez ruby mine. In January, Gemfields agreed to pay $7.6 million on a no-admission-of-liability basis to settle the lawsuit.

Gemfields’ share price reflected the challenges it faced at its operations throughout the year, falling 40 percent by the end of the year.

RELATED CONTENT: Fallout from Nirav Modi Scandal Hits GemfieldsIn its annual results release, Chairman Brian Gilbertson said the company’s biggest challenge in the coming months will lie in Zambia. In addition to the higher taxes, he noted that the mineral royalty is no longer tax-deductible for corporations.

Because of the new taxes enacted, Gemfields has recognized an impairment loss of $22.6 million in respect to Kagem, its emerald mine there that faces other market headwinds as well.

Production in the “premium” category at Kagem reached 224,000 carats, representing a 400 percent increase in the category’s production in the 12-month period to June 2017 (Gemfields included pre-acquisition figures for the full-year t June 30, 2017, where possible to allow for better comparability).

Kagem also set new records for ore production and total carats produced. However, as production soared, the emerald market struggled.

As a result, the four emerald auctions during the year generated revenues of $60.3 million, which Gemfields called “tolerable” given the financial and regulatory oversight challenges facing Indian customers.

Higher-quality emerald auctions held during the year yielded a slight increase in average per-carat price, achieving $65.55 compared with $63.63 per carat in the 12-month period ended June 2017.

The per-carat average for commercial-quality emeralds was flat, achieving $3.54 per carat on average in 2018 compared with $3.53 per carat in the year up to June 2017.

Gemfields also faces challenges in Ethiopia, where it was mining emeralds.

In July 2018, a mob overran its mining operations and a month later looted the site. Its 110-person team there has been reduced to a handful, the company said, as it works to find a way to restart bulk sampling.

RELATED CONTENT: Gemfields Opens $15M Automated Sort House in MozambiqueMeanwhile, Gemfields’ operations in Mozambique, where it mines ruby and corundum, generated revenues of $127.1 million from the two Montepuez auctions of mixed-quality rubies held during the year, with the June auction seeing record results of $71.8 million.

In 2018, the mining area produced a total of 2.9 million carats of ruby and corundum.

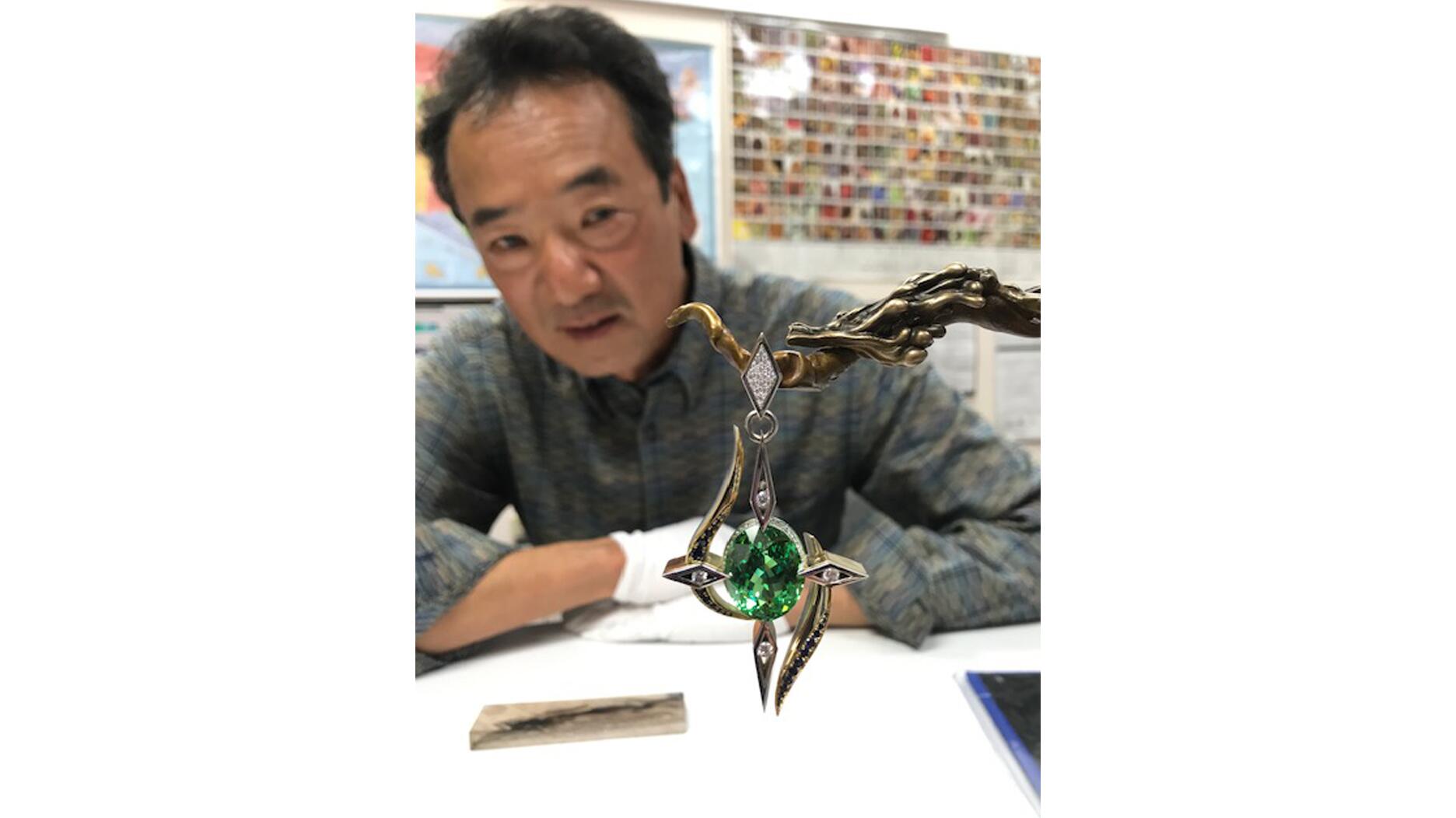

Faberge, meanwhile, reported record revenues of $13.4 million in 2018 and saw triple-digit growth in online sales.

The Latest

Each received around four years for burglarizing a jewelry store and a coffee shop in Simi Valley, California, last May.

Catherine Aulick, a GIA graduate, received the ninth and final Gianmaria Buccellati Foundation Award for Excellence in Jewelry Design.

Every jeweler faces the same challenge: helping customers protect what they love. Here’s the solution designed for today’s jewelry business.

We asked a jewelry historian, designer, bridal director, and wedding expert what’s trending in engagement rings. Here’s what they said.

Beth Gerstein discusses the vibe of the new store, what customers want when fine jewelry shopping today, and the details of “Date Night.”

Are arm bands poised to make a comeback? Has red-carpet jewelry become boring? Find out on the second episode of the “My Next Question” podcast.

With refreshed branding, a new website, updated courses, and a pathway for growth, DCA is dedicated to supporting retail staff development.

The Swiss watchmaker is battling declining sales amid a rapid retail expansion, according to a Financial Times report.

The campaign celebrates Giustina Pavanello Rahaminov, the co-founder’s wife and matriarch of the family-owned brand, for her 88th birthday.

Rachel Bennett, a senior jeweler who has been with Borsheims since 2004, earned the award.

After the Supreme Court struck down the IEEPA tariffs, President Trump imposed a 10 percent tax on almost all imports via a different law.

The industry veteran, who was with The Edge Retail Academy for 14 years, joins her husband at the company he founded in 2022.

The vintage signed jewelry retailer chose Miami due to growing client demand in the city and the greater Latin American region.

Former Flight Club executive Jin Lee will bring his experience from the sneaker world to the pre-owned watch marketplace.

The April event will feature a new VIP shopping day requiring a special ticket.

Bulgari chose the British-Albanian singer-songwriter for her powerful and enduring voice in contemporary culture, the jeweler said.

In a 6-3 ruling, the court said the president exceeded his authority when imposing sweeping tariffs under IEEPA.

Smith encourages salespeople to ask customers questions that elicit the release of oxytocin, the brain’s “feel-good” chemical.

JVC also announced the election of five new board members.

The brooch, our Piece of the Week, shows the chromatic spectrum through a holographic coating on rock crystal.

Raised in an orphanage, Bailey was 18 when she met her husband, Clyde. They opened their North Carolina jewelry store in 1948.

Material Good is celebrating its 10th anniversary as it opens its new store in the Back Bay neighborhood of Boston.

The show will be held March 26-30 at the Miami Beach Convention Center.

The estate of the model, philanthropist, and ex-wife of Johnny Carson has signed statement jewels up for sale at John Moran Auctioneers.

It will lead distribution in North America for Graziella Braccialini's new gold pieces, which it said are 50 percent lighter.

The organization is seeking a new executive director to lead it into its next phase of strategic growth and industry influence.