The chocolatier is bringing back its chocolate-inspired locket, offering sets of two to celebrate “perfect pairs.”

Indian traders stop short of banning rough imports

India’s top diamond exporters said no to temporarily stemming the flow of rough into the country but have outlined a number of other measures the trade there will take to deal with oversupply and lagging demand worldwide.

Mumbai--Members of the Indian diamond industry came close Tuesday to doing something they have not done since the advent of the financial crisis in 2008: banning rough diamond imports.

In the end, though, the approximately 250 diamond exporters who gathered in Mumbai opted to go into what Gem & Jewellery Export Promotion Council (GJEPC) Chairman Vipul Shah described as “self-discipline mode” for the time being and adopt a number of measures to help the Indian diamond industry deal with the problems plaguing it.

They are: an oversupply of diamonds, decreased profitability, lack of bank financing and decreased demand for diamond jewelry worldwide, which many consider to be the issue at the core of the industry’s problems.

“Ultimately, it’s sales,” said Ronnie Vanderlinden, president of both New York diamond company Diamex Inc. and the Diamond Manufacturers & Importers Association of America. “Polished (diamond) sales are weak. Nobody wants to take more rough at the elevated prices.”

This is particularly true of many diamond manufacturers today, as they find themselves squeezed in the middle.

Rough prices have continued to increase in recent years even as polished prices have sunk and demand for diamond jewelry has slowed worldwide. Retailers, who also are faced with shrinking margins, want to pay less for polished stones so they can compete while the producers continue to charge more.

Exacerbating the situation in India are the stockpiles of diamonds many Indian companies accumulated when the economy began to recover and banks there were lending freely.

Now with retail sales around the world, including in the United States, slowing and lending tightening, Indian companies find themselves stuck with diamonds they can’t move and little desire to add to their stockpiles.

On Tuesday, among the list of measures noted by the GJEPC was partnering with diamond mining companies and other segments of the industry to promote diamond jewelry, an idea that works for Prakash Mehta, head of New York-based jewelry manufacturer Interings and president of the Indian Diamond & Colorstone Association.

When asked on Monday about the vote, Mehta said he didn’t think that banning rough imports into India for a short period of time would have much effect, noting that “so many things have to be done.”

To begin with, he said the industry needs to do more to increase sales for retailers, and to divert millennials’ attention from electronic gadgets to jewelry.

He said

The world’s No. 1 diamond producer in value terms, De Beers, recognizes as much.

The diamond miner has come under fire recently for charging too much for rough diamonds and not doing enough for its manufacturer customers that find themselves squeezed in the middle.

Over the weekend, in fact, an anonymous sender calling himself “just a simple sightholder” circulated an email to a long list of diamond companies. The email, which also was forwarded to National Jeweler and is posted online, called for sightholders at De Beers sight scheduled for next week to reject boxes that yield less than 10 percent profit.

“I say, let them (De Beers) deal with $300, $400, $500 million (in goods) that are not taken,” the email reads. “I want to see how they survive.”

In reaction, De Beers’s David Johnson said that the diamond miner does recognize the challenges facing many manufacturers and will be giving sightholders the option to defer--put off for a later date--an additional 25 percent of their allocation at next week’s sight, something the diamond miner did earlier this year as well.

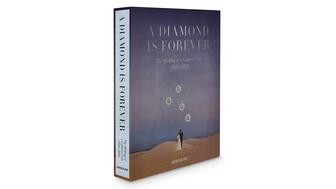

In addition, he said De Beers has undertaken a number of activities intended to stimulate demand for diamond jewelry, including Forevermark, bringing back “A Diamond is Forever,” and joining and helping to form the Diamond Producers Association.

While the DPA’s starting budget of $6 million a year pales in comparison to what De Beers used to spend on generic diamond marketing in the original A Diamond is Forever days, Johnson said the DPA does intend to conduct consumer research to understand how to reach millennial consumers and, in turn, how to focus marketing programs, whether they are led by the DPA or individual businesses.

“It’s the sort of thing that could grow,” Johnson said of the DPA.

The Latest

The top lot of the year was a 1930s Cartier tiara owned by Nancy, Viscountess Astor, which sold for $1.2 million in London last summer.

The Swiss watchmaker has brought its latest immersive boutique to Atlanta, a city it described as “an epicenter of music and storytelling.”

Launched in 2023, the program will help the passing of knowledge between generations and alleviate the shortage of bench jewelers.

In his new column, Smith advises playing to your successor's strengths and resisting the urge to become a backseat driver.

The index fell to its lowest level since May 2014 amid concerns about the present and the future.

The new store in Aspen, Colorado, takes inspiration from a stately library for its intimate yet elevated interior design.

Criminals are using cell jammers to disable alarms, but new technology like JamAlert™ can stop them.

The brands’ high jewelry collections performed especially well last year despite a challenging environment.

The collection marks the first time GemFair’s artisanal diamonds will be brought directly to consumers.

The initial charts are for blue, teal, and green material, each grouped into three charts categorized as good, fine, and extra fine.

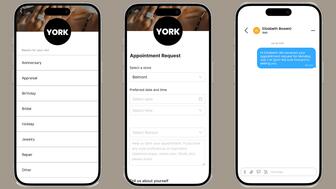

The new tool can assign the appropriate associate based on the client or appointment type and automate personalized text message follow-ups.

Buyers are expected to gravitate toward gemstones that have a little something special, just like last year.

Endiama and Sodiam will contribute money to the marketing of natural diamonds as new members of the Natural Diamond Council.

The retailer operates more than 450 boutiques across 45 states, according to its website.

The new members’ skills span communications, business development, advocacy, and industry leadership.

The jeweler’s 2026 Valentine’s Day campaign, “Celebrating Love Stories Since 1837,” includes a short firm starring actress Adria Arjona.

The new features include interactive flashcards and scenario-based roleplay with AI tools.

Family-owned jewelry and watch retailer Deutsch & Deutsch has stores in El Paso, Laredo, McAllen, and Victoria.

The Italian luxury company purchased the nearly 200-year-old Swiss watch brand from Richemont.

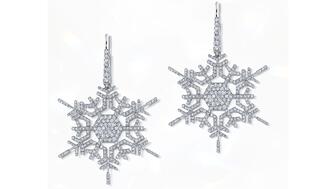

Micro-set with hundreds of diamonds, these snowflake earrings recreate “winter’s most elegant silhouette,” and are our Piece of the Week.

Ella Blum was appointed to the newly created role.

Sponsored by RapNet

Investment firm Enhanced Retail Funding, a division of Gordon Brothers, was the successful bidder.

It explores the history of the iconic tagline and the company’s strategy to redefine the role of diamonds in society.

Retail veteran Sindhu Culas has stepped into the role.

Taylor Burgess, who has been at Stuller since 2013, was promoted to the newly created role.