Also, a federal judge has ordered that companies that paid tariffs implemented under the IEEPA are entitled to refunds.

Find Out Which Jewelry and Watch Brands Boast the Highest Resale Value

The RealReal is sharing insights on the brands most in demand on the secondhand market.

New York—Unsurprisingly, as Americans lost jobs or moved during the pandemic last year, they were consigning more goods via companies like The RealReal.

From the first half to second half of 2020, the average monthly volume of new consigners on the luxury resale site rose 28 percent.

Of those, the largest percentage, 35 percent, were in the Gen Z or millennial demographic, according to the company’s annual resale report, which shares insights from the year prior and makes predictions for the current year.

French brands garner consigners the most bang for their buck, the report shows, providing the highest resale value of all items consigned, meaning the closest to the item’s original retail price.

The top fine jewelry brand per resale value in 2020 was Van Cleef & Arpels, which ranked as the second highest brand in terms of resale value across all categories.

The No. 3 brand overall was Louis Vuitton, No. 4 was Hermès, and at No. 5 was Chanel.

While these brands may have fine jewelry, high jewelry and/or watch collections, they boast large handbag and other accessory sales, so their results can’t be attributed to the jewelry and watch categories alone.

However, other jewelry- and watch-specific companies also made The RealReal’s top 10 list.

No. 6 was Rolex, followed by Patek Philippe at No. 7. Cartier, meanwhile, ranked No. 9.

The RealReal noted that Patek Philippe made the largest jump on the list this year, moving up three spots.

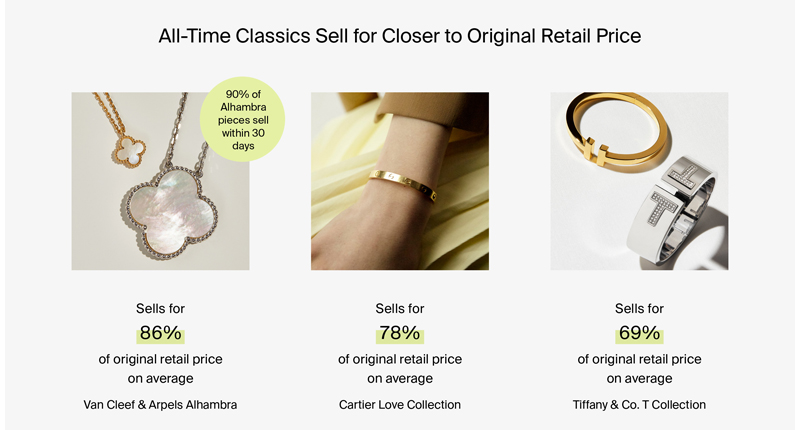

As the graphic above illustrates, proven, classic jewelry and watch items that are widely recognizable are in highest demand at the secondhand seller.

Van Cleef & Arpels’ “Alhambra” collection sells for 86 percent of its original retail price on average, and 90 percent of pieces sell within 30 days.

The Cartier “Love” collection sells for 78 percent of its original retail price on average, while the Tiffany & Co. “T” range earns 69 percent of its original retail price.

But contemporary independent brands are also gaining recognition amid the company’s savvy network of consigners and shoppers (53 percent of consigners also shop at The RealReal).

Suzanne Kalan’s average sale price has increased 25 percent year-over-year. Mizuki’s has increased 15 percent year-over-year, and Temple St. Clair’s has increased 12 percent year-over-year.

Foundrae is one of the company’s hottest contemporary fine jewelry brands, the report shows.

One-hundred percent of Foundrae pieces sell within the first 30

The RealReal Director of Fine Jewelry & Watches Patricia Stevens noted: “While timeless collections from marquis brands perpetually hold strong value over time, this year we’re also seeing shoppers gravitate toward fun pieces that spark joy and stand out on-screen in video calls.

“This is driving increased value for bold emerging and costume jewelry brands, as well as significant growth for whimsical pieces from emerging ready-to-wear designers.”

Watches are proving to be particularly investment worthy during the pandemic as well.

From the first half of 2020 to the second half, the average timepiece sale price rose 26 percent.

The RealReal said its best-selling watch brand, Rolex, strengthened its edge over other brands the most in 2020, selling 1.1 times faster than the year before.

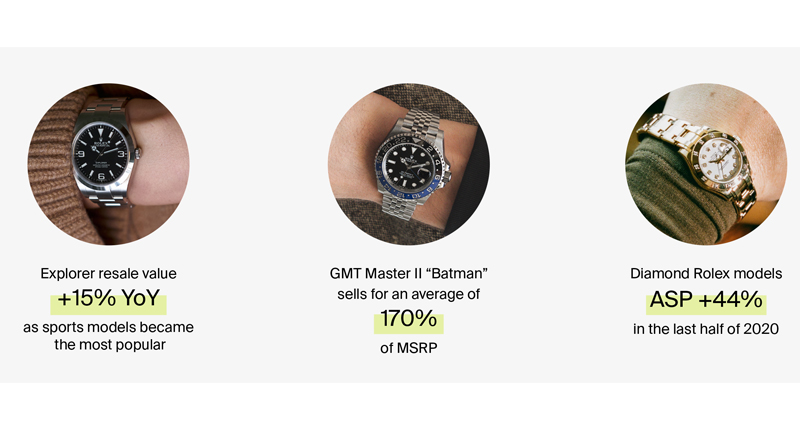

Sports models were the most popular, with the “Explorer” resale value increasing 15 percent year-over-year.

The GMT Master II “Batman” sells for an average 170 percent of its original retail price, and the average sale price for diamond Rolex styles rose 44 percent in the second half.

While Rolex retains the crown, several other watch brands are on the rise.

In men’s watches, Franck Muller had the greatest average sale price growth, increasing 63 percent year-over-year.

The Audemars Piguet “Royal Oak” had the greatest resale value growth, increasing 24 percent year-over-year, and Panerai saw the biggest jump in how fast its models sell, selling 1.3 times faster than it did the year before.

For women, the greatest average sale price increase went to Louis Vuitton, which grew 40 percent year-over-year.

The largest resale value growth belonged to the Cartier “Tank” models, which increased 25 percent year-over-year. Patek Philippe, meanwhile, sold 1.5 times faster than the year before.

The RealReal Chief Operating Officer Rati Levesque commented, “The pandemic has had a lasting impact on the resale market. Through the challenges of the past year, many used the extra time at home to slow down, tune out the noise of everyday life and reflect on what matters. Data and insights from our 20 million members show a mindset shift toward investing in, and living by, what we truly value.

“Values-oriented Gen-Z and millennial consignors dominate luxury resale and represent the largest volume of new consignors. Meeting shopper demand for elevated essentials—from investment pieces to the new capsule wardrobe to late-’90s-to-early-’00s vintage—will yield rising returns for sellers. As we enter a new year, the record number of consignors joining the circular economy are a bright spot paving the way to a more sustainable fashion future.”

The Latest

The ever-growing collection, which just expanded with the addition of Olga of Kyiv, features cameos of 12 women from history.

We asked a jewelry historian, designer, bridal director, and wedding expert what’s trending in engagement rings. Here’s what they said.

Every jeweler faces the same challenge: helping customers protect what they love. Here’s the solution designed for today’s jewelry business.

The annual event will be held in Orlando, Florida, from Sept. 14-17.

The “Outlander” star modeled for the digital cover of the magazine’s spring issue, which features a story on her relationship with jewelry.

This year’s annual congress, which will mark the confederation’s 100th anniversary, will take place this fall in Italy.

With refreshed branding, a new website, updated courses, and a pathway for growth, DCA is dedicated to supporting retail staff development.

Beverly Hills was chosen as the location for the brand’s first store, designed as a “private residence for modern monarchs.”

Kering, Apple, and other retailers have reportedly temporarily closed stores in the Middle East region in light of the recent conflicts.

Beth Gerstein discusses the vibe of the new store, what customers want when fine jewelry shopping today, and the details of “Date Night.”

Nearly half of buyers are prioritizing silver and fashion collections this season, organizers said.

The “Live Now. Polish Later.” campaign features equestrians wearing the brand’s jewels while galloping across the icy plains of Kazakhstan.

The precious metals provider has promoted Jennifer Ashworth to the role.

Nelson will be honored as the inaugural grant winner at the Gem Awards gala on March 13.

Experts from India weigh in the politics, policies, and market dynamics for diamantaires to monitor in 2026 and beyond.

The American precious metals refiner’s day-to-day operations remain the same post-acquisition.

These aquamarine jewels channel the calming energy of the March birthstone.

The “Innovative Design” category and award will debut in the Spectrum division of this year’s AGTA Spectrum & Cutting Edge Awards.

Diamond jewelry was the star of the event formerly known as the SAG Awards.

Consumers were somewhat less worried about the future, though concerns about rising prices and politics remained.

Foerster is this year’s Stanley Schechter Award recipient.

Sponsorships and tickets to the annual fundraising event, set for May 31, are available now.

Chicago police and members of the U.S. Marshals Service tracked down the 35-year-old suspect earlier this week in St. Louis.

Owners of the Ekapa Mine reportedly filed for liquidation about a week after a mudslide trapped five workers who have yet to be found.

A 10-year alliance has also begun to address the shortage of bench jewelers through scholarships, enhanced programs, and updated equipment.

The “Splendente” collection has evolved to feature hardstone letter pendants, including our Piece of the Week, the onyx “R.”