In a market defined by more selective consumers, Sherry Smith shares why execution will be independent jewelers’ key to growth this year.

Making Gold Demand, Price Predictions for 2017

The World Gold Council and Thomson Reuters both weigh in on what they expect in the market for the yellow metal this year.

London--While 2016 had its ups and downs, the year proved to be a good one for gold.

The metal’s price grew about 10 percent during the year, according to the World Gold Council, noting that it averaged $1,250.80 per ounce in 2016. It also has gained more than 5 percent since the Federal Reserve increased interest rates in mid-December.

For 2017, Thomson Reuters is forecasting an average price of $1,259 per ounce for gold, which would be a slight increase over the 2016 average that the WGC reported.

The strength of the U.S. dollar likely will remain a headwind to further price increases, at least in the first half of 2017, according to Ross Strachan of Thomson Reuters. Additionally, there aren’t many indications that Asian demand, which declined substantially last year, will pick up again just yet.

However, as the year progresses, there is a likelihood of flows of capital into safe-haven investments, possibly spurred by election results in some European countries and the increasing chances of another country leaving the European Union, he said. This will push up the price of gold.

While it doesn’t make price predictions, the WGC did say it believes that gold demand will remain high in 2017, noting a number of factors that will come into play this year.

According to the WGC, there are six major trends that will support demand for the metal this year.

1. Heightened political and geopolitical risks. There’s a lot of uncertainty in global politics right now--key elections will be held this year in the Netherlands, France and Germany, and the U.K. has to negotiate its exit from the European Union.

In the United States, there are some positive expectations about President Donald J. Trump’s economic proposals but there also are some concerns, especially in regards to trade between countries and “geopolitical tensions triggered by the new administration,” the WGC said.

Gold proves to be a strong investment during times of systemic crisis, the council said, adding that it expects gold investment demand to remain firm in 2017.

2. Currency depreciation. It’s likely that monetary policy will split between the U.S. and other parts of the world this year,with the Federal Reserve expected to tighten its policy while uncertainty looms with what other central banks will do. The divergence is likely to lead to fears of currency deprecation.

Since gold has outperformed all major currencies as a means

3. Rising inflation expectations. Nominal interest rates (interest rates before inflation) in the U.S. are expected to increase this year but so is inflation, which could support gold demand for three reasons.

First, gold historically is seen as a valuable investment to hedge against inflation and decreased value of currency. Secondly, higher inflation will keep real interest rates low and keep gold more attractive. The final reason is because inflation makes bonds and other fixed income assets less appealing to long-term investors and, as such, more will turn to investments such as gold.

4. Inflated stock market valuations. Stock markets rebounded significantly during the last part of 2016 and stocks in the U.S. are reaching historic highs.

Generally, investors have used bonds to protect their capital from stock market correction as stock valuations increase but this becomes less of an option as rates rise and the risk of correction becomes even greater. In a time of such great systemic risks, gold’s role as a portfolio diversifier becomes especially relevant.

5. Long-term Asian growth. Gold demand is so closely related to increasing wealth in Asian economies; demand for gold has increased as countries have become richer. The WGC said that macroeconomic trend in Asia will support continued economic growth through the next few years, driving gold demand.

While changing consumer tastes have affected jewelry demand in the Chinese market, its investment market continues to boom. In India, the demonization program is expected to have a negative effect on economic growth and gold demand in the short-term, but “the transition to transparency and formalization of the economy will lead to stronger Indian growth in the longer term, thus benefitting gold,” the WGC said.

6. Opening of new markets. Gold has become more mainstream and accessible to more investors and this trend is expected to continue in 2017.

For example, at the end of last year, the Accounting and Auditing Organisation of Islamic Financial Institutions worked with the WGC to launch the Shari’ah Standard for Gold, opening up the Muslim world to gold investment, a move that one fund manager at an investment firm called a “game changer.”

The Latest

The family-owned jeweler’s new space is in a former wholesale produce market.

Ivel Sanchez Rivera, 52, has been arrested and charged in connection with the armed robbery of Tio Jewelers in Cape Coral, Florida.

Criminals are using cell jammers to disable alarms, but new technology like JamAlert™ can stop them.

The supplier’s online program allows customers to search and buy calibrated natural and lab-grown diamond melee, including in fancy shapes.

The new show will take place Jan. 23-25, 2026.

Associate Editor Natalie Francisco highlights her favorite jewelry moments from the Golden Globes, and they are (mostly) white hot.

How Jewelers of America’s 20 Under 40 are leading to ensure a brighter future for the jewelry industry.

Yantzer is remembered for the profound influence he had on diamond cut grading as well as his contagious smile and quick wit.

Chris Blakeslee has experience at Athleta and Alo Yoga. Kendra Scott will remain on board as executive chair and chief visionary officer.

The credit card companies’ surveys examined where consumers shopped, what they bought, and what they valued this holiday season.

Kimberly Miller has been promoted to the role.

The “Serenity” charm set with 13 opals is a modern amulet offering protection, guidance, and intention, the brand said.

“Bridgerton” actresses Hannah Dodd and Claudia Jessie star in the brand’s “Rules to Love By” campaign.

Founded by jeweler and sculptor Ana Khouri, the brand is “expanding the boundaries of what high jewelry can be.”

The jewelry manufacturer and supplier is going with a fiery shade it says symbolizes power and transformation.

The singer-songwriter will make her debut as the French luxury brand’s new ambassador in a campaign for its “Coco Crush” jewelry line.

The nonprofit’s new president and CEO, Annie Doresca, also began her role this month.

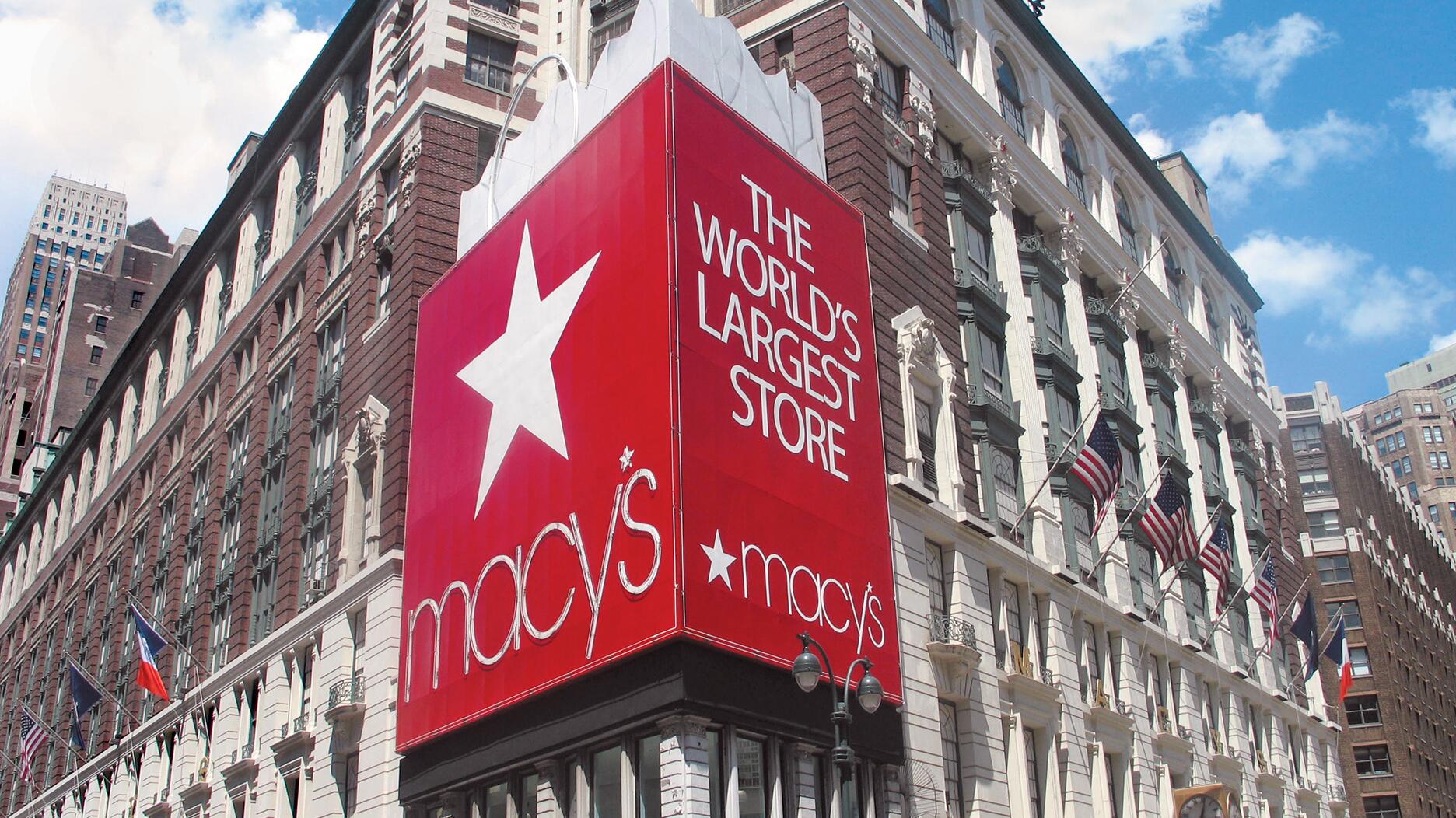

As the shopping mall model evolves and online retail grows, Smith shares his predictions for the future of physical stores.

The trade show is slated for Jan. 31-Feb. 2 at The Lighthouse in New York City's Chelsea neighborhood.

January’s birthstone comes in a rainbow of colors, from the traditional red to orange, purple, and green.

The annual report highlights how it supported communities in areas where natural diamonds are mined, crafted, and sold.

Footage of a fight breaking out in the NYC Diamond District was viewed millions of times on Instagram and Facebook.

The supplier has a curated list of must-have tools for jewelers doing in-house custom work this year.

The Signet Jewelers-owned store, which turned 100 last year, calls its new concept stores “The Edit.”

Linda Coutu is rejoining the precious metals provider as its director of sales.

The governing board welcomed two new members, Claire Scragg and Susan Eisen.