The jewelry collection belonged to “one of society's most glamorous and beautiful women of the mid-20th century,” said the auction house.

How the Colored Stone Market Is Making Up for No Tucson

Players in the market talk website upgrades, price impacts and bringing that desert feel to clients.

GJX and the Tucson Gem and Mineral Show have been canceled for 2021. AGTA GemFair Tucson also technically is a no-go right now.

As of press time, a handful of gem shows are slated to take place in April, while AGTA and its board are still reviewing their options about the timing and are expected to make a final decision soon.

According to a few wholesalers posting in a gemology forum on Facebook, demand from buyers to attend a spring show is there, driven by the need to restock after a strong holiday season.

But any potential shows must be cleared by local health officials in Tucson, and many of the shows face the added hurdle of being global events. It’s unclear how many people feel safe traveling between countries and would want to deal with what one Bangkok dealer referred to as the “expensive quarantine” that would be necessary to travel and attend a show.

For many, missing out on Tucson comes as a major disappointment—the weeks-long run of events allows ample time for networking, education and discovery, not to mention plenty of good times with colored stone colleagues.

Sad as many are about not making their annual voyage to the desert, some said the biggest loss is the lack of visibility, and missing out on the chance to establish new relationships and the trust needed in the business.

In other areas, like making sales, effects could be mitigated by changes made throughout the past year.

The Digital Sphere

The story of how colored stone companies fared in 2020 seems to mirror the jewelry industry overall—the pandemic wrecked some companies while others finished the year on a strong note.

Overall, it appears market has done OK, given the circumstances.

Gemworld’s Stuart Robertson put it into perspective: “We had a situation where this whole COVID-19 disruption started moving across the world from east to west, so it actually disrupted the supply chain in that same process.

“The long and the short simply is that the U.S. market did OK because there was no abundance of goods that would really drive the competition.”

Trade shows, for example, often offer lower prices due to the sheer quantity of goods around.

That wasn’t the case for most of 2020, Robertson pointed out.

Those who were able to remain active in business through the year realized how scarce goods were and were able to hold on prices, a move supported by the market.

He also said he’s seeing that trading activity is “adequate” for the current rate of demand, especially since the market hasn’t fully reopened yet, so missing out on Tucson isn’t likely to “collapse anybody’s business.”

The colored gemstone market isn’t any different from other sectors of the industry in having to adapt to an online business model. And the market seemed to support this, for the most part; people were willing to buy sight-unseen online at all points in the supply chain.

AGTA Board President Ruben Bindra, president of B&B Fine Gems, said in speaking to several retail and wholesale businesses in the United States, he heard varying results.

Wholesalers saw their business decline anywhere from 20 percent to 50 percent, while many retailers reported having a decent or even good year despite COVID restrictions, especially those offering high-end watches and fine jewelry.

Business was most brisk, it seems, for those who already had a digital presence at the start of the pandemic, or those who saw the writing on the wall and were able to pivot quickly.

“Some companies worked hard and adapted to new methods of marketing using several social media and other web-based platforms,” Bindra said. “Some were slow to adapt and have suffered more loss of revenue.”

That’s not to say it’s easy, by any means.

“The big challenge for our members is to maintain those important connections with suppliers, clients and each other,” said Gary Roskin, executive director of the International Colored Stone Association.

“The colored gemstone trade has relied so much on in-person trade shows, many find it challenging to direct their attention to chasing e-mail, WhatsApp, WeChat, and text messages, while at the same time getting decent images of product onto their website, if they have a website.”

And that’s all before products ship, which is a whole other issue now—getting product to clients to see in person amid mailing systems that, in most countries, have been overwhelmed during the pandemic.

To account for this, gemstone faceter John Dyer has been offering discounts on shipping and a return policy for clients since they aren’t getting to view the stones in person prior.

The pandemic also pushed his company to upgrade its website and overall online presence, a move many have had to make that, Dyer thinks, could help to mitigate the loss of trade shows.

“I think people who are better prepared for the whole non-show sales things will probably do better than the people who are not.”

He added that selling “at a distance” requires a significant investment—in know-how, in technology, and much more.

“It’s just like any new undertaking—there’s a lot to learn about it.”

But during a year like no other, there also arose a greater sense of community—for local businesses and restaurants, and, in the jewelry industry, a feeling that everyone was in it together, supported by loyal customers who weren’t asking for better terms or trying to negotiate prices like they usually might, Robertson said.

Support for small businesses and increased shopping via digital platforms has helped the market get through an up-and-down year and will likely have to keep doing so for a while.

‘Virtual’ Tucson

Since many used 2020 to upgrade their online capabilities, it makes sense they’re using similar channels to bring Tucson to others, so to speak, in 2021.

Around the time the industry would’ve been out in the desert, many dealers and brands promoted their own virtual versions of the gem shows.

The group that calls itself the Ethical Gem Suppliers, which organized Tucson’s first “Ethical Gem Fair” in 2020, hosted a trade-only virtual event from Feb. 10-13, offering the chance for online attendees to see suppliers’ stones, chat with dealers and hear their stories, and more.

For gemstone cutter Dyer, having no physical show meant not only the potential for lost sales but also the lack of opportunity to connect with buyers in a way that’s hard to capture in digital soundbites.

This year, Dyer is doing his own “virtual Tucson” for a few reasons: visibility for him and his products, to drive sales, and to help disseminate more information about gemstones.

It’s not the same content every day—one clip might feature Dyer talking about how he cuts gemstones, while other might include some of the nitty-gritty about his profession that viewers could find interesting.

Other days, Dyer’s virtual streaming show might mirror what he’d normally do in Tucson: go through his inventory and talk about the stones on display.

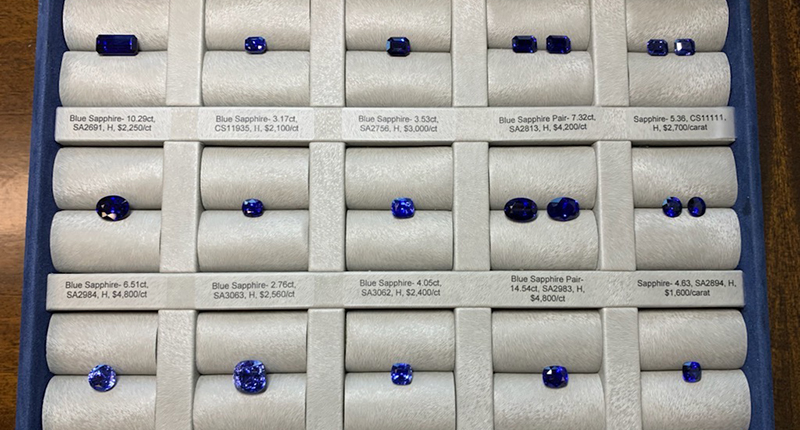

Omi Gems is also doing “Virtual Tucson” as a way to connect with the colored stone community through calls, texts, Zoom meetings, email campaigns and custom website landing pages featuring “trays” of gemstones to recreate the excitement of Tucson.

“Tucson gem shows are very unique as they are as much about people getting together and sharing a passion for gemstones as much as it is about business,” Omi President and head designer Niveet Nagpal said.

“We are reaching out to clients just to say hello and let them know about new gemstones or pieces we are excited about.”

Looking Ahead

With the remainder of 2021 is up in the air, it could be that Tucson 2022 ends up being the first time during an in-person event that the colored stone market is in full swing, Robertson said.

In the meantime, digital upgrades are making a dynamic gemstone sector even more so, adding new facets to a sector that’s largely operated through traditional means up to now.

An added benefit is online selling can allow for sales to be more evenly distributed throughout the year, instead of spiking around shows and then falling off the cliff for the rest of the year, Dyer noted.

It’s likely many trade members will find a balance with both, and there appears to be plenty of optimism for the colored stone market in the year(s) ahead.

The Latest

The update came as Anglo took its third write-down on the diamond miner and marketer, which lost more than $500 million in 2025.

Emmanuel Raheb discusses the rise of “GEO” and the importance of having well-written, quality content on your website.

Every jeweler faces the same challenge: helping customers protect what they love. Here’s the solution designed for today’s jewelry business.

Each received around four years for burglarizing a jewelry store and a coffee shop in Simi Valley, California, last May.

We asked a jewelry historian, designer, bridal director, and wedding expert what’s trending in engagement rings. Here’s what they said.

Experts from India weigh in the politics, policies, and market dynamics for diamantaires to monitor in 2026 and beyond.

With refreshed branding, a new website, updated courses, and a pathway for growth, DCA is dedicated to supporting retail staff development.

Beth Gerstein discusses the vibe of the new store, what customers want when fine jewelry shopping today, and the details of “Date Night.”

Are arm bands poised to make a comeback? Has red-carpet jewelry become boring? Find out on the second episode of the “My Next Question” podcast.

The Swiss watchmaker is battling declining sales amid a rapid retail expansion, according to a Financial Times report.

The campaign celebrates Giustina Pavanello Rahaminov, the co-founder’s wife and matriarch of the family-owned brand, for her 88th birthday.

Rachel Bennett, a senior jeweler who has been with Borsheims since 2004, earned the award.

After the Supreme Court struck down the IEEPA tariffs, President Trump imposed a 10 percent tax on almost all imports via a different law.

The industry veteran, who was with The Edge Retail Academy for 14 years, joins her husband at the company he founded in 2022.

The vintage signed jewelry retailer chose Miami due to growing client demand in the city and the greater Latin American region.

Former Flight Club executive Jin Lee will bring his experience from the sneaker world to the pre-owned watch marketplace.

Sakamoto, who died in mid-January following a sudden illness, is remembered for his humility and his masterful, architectural designs.

Bulgari chose the British-Albanian singer-songwriter for her powerful and enduring voice in contemporary culture, the jeweler said.

In a 6-3 ruling, the court said the president exceeded his authority when imposing sweeping tariffs under IEEPA.

Smith encourages salespeople to ask customers questions that elicit the release of oxytocin, the brain’s “feel-good” chemical.

JVC also announced the election of five new board members.

The brooch, our Piece of the Week, shows the chromatic spectrum through a holographic coating on rock crystal.

Raised in an orphanage, Bailey was 18 when she met her husband, Clyde. They opened their North Carolina jewelry store in 1948.

Material Good is celebrating its 10th anniversary as it opens its new store in the Back Bay neighborhood of Boston.

The show will be held March 26-30 at the Miami Beach Convention Center.

The estate of the model, philanthropist, and ex-wife of Johnny Carson has signed statement jewels up for sale at John Moran Auctioneers.