Moses, who started at GIA’s Santa Monica lab in 1976, will leave the Gemological Institute of America in May.

The Year the Shows Went Dark

COVID-19 has quieted the usually bustling world of trade shows and events in 2020. Where do we go from here?

From there, it was a snowball effect, which rolled right through one of the biggest weeks on the trade show calendar, Las Vegas market week: JCK Las Vegas/Luxury, AGTA GemFair Las Vegas, Couture and the Las Vegas Antique Jewelry & Watch Show were all canceled.

Among additional U.S. shows, the MJSA Expo, at first postponed, has now been pushed back to March 2021, while the Independent Jewelers Organization (IJO) canceled its summer show and is now saying March of 2021 will be its next meetup.

As the main audience for the industry’s trade shows, much depends on retailers in terms of when trade shows can or will get back to normal.

“I think we all have to allow the retailers to work on getting their customers back into stores, doing their curbside deliveries and online sales, building that back up.

“Then down the road, we can look at where we’re at with things, based more on retailers being in decent condition,” says longtime trade show organizer Howard Hauben, who started Couture and then Centurion, which takes place in late winter in the Southwest.

“If the retailer is in decent condition, so is the vendor, and if the vendor is in decent condition, then the venues that vendors and retailers use to get together become more of interest.”

Whether industry events still scheduled for fall 2020 will happen and in what capacity is unknown.

Public health advisories could easily change between now and then. As everyone has learned, trying to predict anything beyond the next couple of weeks is futile.

“There are many who are saying, don’t put the cart before the horse and be sure there’s a high level of confidence among your attendees and exhibitors that they can do this before you can really think about providing an event,” Hauben says.

Despite the difficulties inherent in organizing large-scale events in the age of COVID-19, it’s not hard to understand why organizers want them to happen.

“I think we all have to allow the retailers to work on getting their customers back into stores. Then down the road, we can look at where we’re at with things.” — Howard Hauben, Centurion

Foremost among them: Many exhibition and trade show companies don’t have insurance coverage for communicable diseases, says David DuBois, president and CEO of the International Association of Exhibitions and Events, and are concerned about the bottom line.

Trade shows are also of economic importance.

Business events inject more than $1 trillion annually into the global economy and create millions of jobs, according to the Events Industry Council’s Global Economic Significance of Business Events study.

Still, numerous questions remain about the return of business for retailers and vendors, and with that, how soon they will be ready to go to trade shows again.

New Concerns

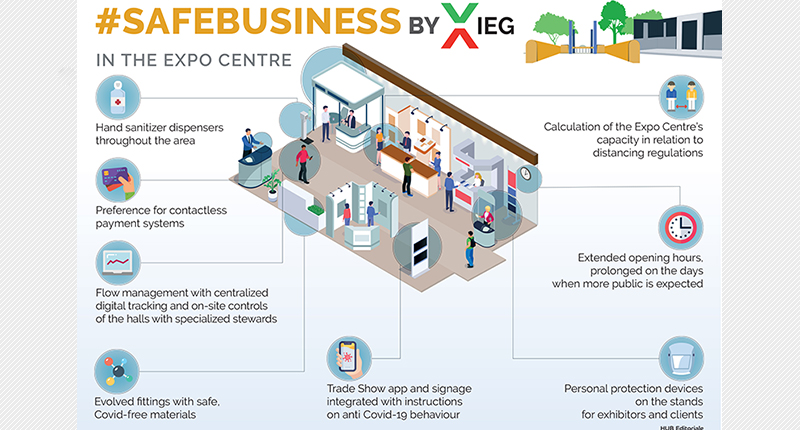

One of the most immediate concerns organizers are addressing is the health and safety measures needed to make exhibitors and attendees feel safe.

The International Association of Exhibitions and Events is creating a list of guidelines and best practices for large business events, working together with two other organizations, the Exhibition Services and Contractors Association and the International Association of Venue Managers, to align their lists.

Within the guidelines the association has developed are things like six-foot social distancing, sanitation stations and even the possibility of one-way aisles denoted by arrows on the floor.

Adding an extra layer of complexity is the Global Biorisk Advisory Council, a division of the International Sanitary Supply Association, which must review, edit and endorse the guidelines from the three organizations before they are published.

The council has also launched its Star program, a facility accreditation program on cleaning, disinfection, and infectious disease prevention, which many venues, hotels and airlines are working toward.

“We have to build safety, security and confidence,” DuBois says. “And these are some of the ways we’re doing it.”

In the jewelry industry, the global Reed Exhibitions leadership team is developing best practices across its network of shows.

Since JCK Las Vegas and Luxury’s next in-person events won’t be until June 2021, the company will continue to monitor health and safety guidelines until then, says Sarin Bachmann, group vice president of JCK and Luxury.

Emerald Expositions, which organizes Couture, the JA New York shows and the antique jewelry shows, is also busy developing best practices.

As of May, the company was researching Environmental Protection Agency standards of sanitation and guidelines from the Occupational Safety and Health Administration on air quality and finding ways to apply those to its trade shows.

It also will work with its host venues to implement necessary protocols though, like rival Reed, it has limited visibility as to what large gatherings will look like in the future and says it will continue to monitor the situation.

“There is so much uncertainty right now, and there is no way to speculate on what the coming months will bring; none of us has a crystal ball unfortunately,” says Emerald Executive Vice President Gannon Brousseau.

This unavoidable lack of predictive data is hampering event planning in the short term.

“With the delivery of a vaccine still unknown, the majority of people are not comfortable getting back to ‘normal,’ or whatever semblance of normal we get back to, so planning events this summer or fall has basically slowed to a crawl,” says David Audrain, executive director for the Society of Independent Show Organizers.

In the long term, it’s creating new questions for an industry already facing its share of obstacles.

From an exhibitor standpoint, one potential change jewelry designer Stephen Webster sees needing is lengthening shows to allow for social distancing and screening of attendees and exhibitors.

“With something like a trade show, I suppose you could look at it and say, does it need to be over a longer period?” Webster says.

“If there is still an appetite [for trade shows] … then I suppose there’s not much you can do other than offer longer hours, because you’re not physically going to be able to process the same volume of people in the same period of time in the same spaces.”

From a buyer’s perspective, Holly Wesche, owner of Wesche Jewelers in Melbourne, Florida, and current chair of Jewelers of America’s board of directors, says many of her retail peers have indicated they’re taking a hard look at their travel plans for the remainder of 2020.

They’re doing so for two reasons, she says: one being the health and safety issues that could continue through the fall, and the second a more (ever)green concern—money.

“Whether you were closed for five weeks, six weeks, eight weeks, 10 weeks, whether you got PPP [Paycheck Protection Program] money or not, all of our revenue was seriously impacted. Everyone I know who’s prudent is taking a good hard look at their expenses.”

Existing Concerns, Amplified

The pandemic has also intensified a conversation the industry was already having about the sheer number of jewelry trade shows and their format.

It’s become expensive to travel and stay in Vegas. Rising costs have also been one of the reasons people have stopped attending Baselworld, which is no more.

There’s also talk around trade show size and the return on investment that comes—or doesn’t—with wearing out one’s Fitbit at a big show.

Now more than ever, retailers are analyzing how many shows they’re attending and how much it’s costing them.

“There is so much uncertainty right now, and there is no way to speculate on what the coming months will bring; none of us has a crystal ball.” — Gannon Brousseau, Emerald Expositions

Wesche says her team is more productive and makes smarter buying decisions at smaller, more targeted shows like CBG, where they can sit down and review everything with their vendors.

She says she could see the store sticking to the smaller shows and then “once in a blue moon”—perhaps every two years—attending some of the larger trade shows.

But, what about the argument that it’s harder to make new discoveries at smaller shows?

Wesche says from her perspective, it’s easy to find what’s new and trending online, and she often gets word-of-mouth recommendations on hot new designers and lines from her peers.

Fast-Tracking Digital Plans

A lot of bad has come out of the pandemic, none of which readers need to be reminded about.

But there have also been some silver linings—enhanced technology and virtual opportunities are allowing organizers and vendors to reach their clients in a new way.

Fabienne Lupo, chairwoman and managing director of the Fondation de la Haute Horlogerie (organizer of Watches & Wonders Geneva, the show formerly known as SIHH), says the pandemic will “accelerate the digital transformation of our businesses.”

This has already rung true in many aspects: meetings, both internally and externally, are being held via platforms like Zoom and Microsoft Teams, appointments and trunk shows are presented virtually, and most of the industry’s conferences have moved online for 2020.

So it stands to reason trade shows would follow suit.

When the decision was made to cancel the 2020 Watches & Wonders event, Lupo says FHH knew immediately it would have to “reinvent itself” to have any kind of presence this year.

The association fast-tracked development of an online platform that launched at the same time the physical event would’ve taken place in Geneva.

Lupo says WatchesandWonders.com has been very successful so far, offering anyone who’s interested access to the latest from several Swiss watchmakers.

“For sure, the pandemic has accelerated this ‘phygital’ approach for the shows.”

But while the industry “has to be digital,” Lupo believes shows and exhibitions are still necessary to allow people to touch and feel the product, as well as learn and network.

Audrain, from the Society of Independent Show Organizers, predicts the industry will see more tools enabling exhibitors and attendees to focus their time more effectively on the meetings, products and services they’re most interested in.

DuBois, with the International Association of Exhibitions and Events, says he’s noticed an influx of virtual event tools.

When interviewed in late spring, he estimated two dozen new technology companies had launched virtual trade show or meeting platforms in the prior 60 days, during the peak of the pandemic in the United States.

There are even those that allow an attendee to have an avatar walking the “show floor.”

DuBois says his own association will adopt a hybrid approach this coming winter for its Expo! Expo! event, dubbed as the “show for shows.”

The association will offer a virtual component for attendees who aren’t ready to be there in person, begging the question: Will jewelry and watch shows take a similar approach, going partially or even completely virtual?

As jewelry industry show veteran Hauben mentioned, it remains to be seen when jewelry retailers will feel not only that business is back, but back to a place where they need and want to attend trade shows again.

For some, a virtual aspect might be just the ticket.

Hauben, for his part, remains skeptical.

“It’s exciting to think that lots of people would show up digitally and do business,” he says. “I have my doubts as to how compelling that is to everyone.”

But the important part, all reiterate, is the feeling these new tools won’t replace the physical events the trade is used to, just complement them.

“Whether you were closed for five weeks, six weeks, eight weeks, 10 weeks, whether you got PPP money or not, all of our revenue was seriously impacted. Everyone I know who’s prudent is taking a good hard look at their expenses.” — Holly Wesche, Wesche Jewelers

Reed Exhibitions’ Bachmann says the postponement or cancellation of so many jewelry and watch events this year has underlined both the importance of in-person events and the industry’s ability to connect virtually.

Reed is launching a JCK Virtual program in August, offering the industry a chance to reconnect, set virtual appointments and product reviews, and attend education sessions, Bachmann says.

Retailer Wesche says a couple of vendors are looking for new ways to do business with clients, and it’s likely she will do Zoom meetings with them to see new jewelry.

There’s a caveat with these online meetups, she notes—it’s likely to work best for vendors with which a business has a longstanding relationship and knows their quality.

From an exhibitor’s perspective, trade shows already were having to change and adapt, and due to the pandemic might have to further “have a rethink” about what they’re offering exhibitors, says Webster.

Still, the London-based designer sees a definite place for shows in the post-COVID-19 world, especially those that offer more focused environments for exhibitors.

“I think a lot of it is to do with the vendors as well as the show, where people can decide for themselves how they best want to use that time at a show; I don’t think it’s all about writing orders.”

What Happens in Fall 2020?

A few jewelry shows were still on the 2020 calendar in the U.S. at press time.

The Select Jewelry Show is planning a show in Dallas from Sept. 13 to 14 and at Mohegan Sun in Connecticut from Nov. 1 to 2.

The Continental Buying Group originally moved its June event in Las Vegas to Sept. 11-13 but since has postponed again to Oct. 6-8 and relocated to Orlando’s Hyatt Regency Grand Cypress, though show organizers acknowledge that could change, too.

CBG doesn’t expect to make a final decision on its show until mid-August.

NY Now and the Atlanta Jewelry Show both postponed their events to October.

For now, show organizers are all making decisions as they go and working in tandem with venues to ensure everything is in place.

Regarding health and safety measures, several organizers say they’re working with the staff at all properties to assure the layout meets guidelines, and, while the list is still subject to change, are implementing a number of measures including temperature checks, controlled occupancy, distribution of personal protective equipment and hand sanitizer stations.

What will happen after Dec. 31 is anyone’s guess.

Wesche predicts the future for next year’s trade show schedule depends on a few factors: if there’s a second wave of COVID-19, as several experts expect, the strength of business in the second half of the year, and how firmly vendors and clients embrace the use of technology to maintain relationships.

For now, the maddening, if necessary, watchwords are “wait and see.”

The Latest

Increased competition, falling lab-grown diamond and moissanite prices, and the rising cost of gold took a toll on the moissanite maker.

The earrings, our Piece of the Week, feature pink tourmalines as planets orbiting around an aquamarine center set in 18-karat rose gold.

Every jeweler faces the same challenge: helping customers protect what they love. Here’s the solution designed for today’s jewelry business.

“The Price of Freedom” campaign video for International Women’s Day confronts the quiet violence of financial control.

Also, a federal judge has ordered that companies that paid tariffs implemented under the IEEPA are entitled to refunds.

The ever-growing collection, which just expanded with the addition of Olga of Kyiv, features cameos of 12 women from history.

With refreshed branding, a new website, updated courses, and a pathway for growth, DCA is dedicated to supporting retail staff development.

We asked a jewelry historian, designer, bridal director, and wedding expert what’s trending in engagement rings. Here’s what they said.

The “Outlander” star modeled for the digital cover of the magazine’s spring issue, which features a story on her relationship with jewelry.

This year’s annual congress, which will mark the confederation’s 100th anniversary, will take place this fall in Italy.

Beverly Hills was chosen as the location for the brand’s first store, designed as a “private residence for modern monarchs.”

Kering, Apple, and other retailers have reportedly temporarily closed stores in the Middle East region in light of the recent conflicts.

Beth Gerstein discusses the vibe of the new store, what customers want when fine jewelry shopping today, and the details of “Date Night.”

The “Live Now. Polish Later.” campaign features equestrians wearing the brand’s jewels while galloping across the icy plains of Kazakhstan.

The precious metals provider has promoted Jennifer Ashworth to the role.

Nelson will be honored as the inaugural grant winner at the Gem Awards gala on March 13.

Experts from India weigh in the politics, policies, and market dynamics for diamantaires to monitor in 2026 and beyond.

The American precious metals refiner’s day-to-day operations remain the same post-acquisition.

These aquamarine jewels channel the calming energy of the March birthstone.

The “Innovative Design” category and award will debut in the Spectrum division of this year’s AGTA Spectrum & Cutting Edge Awards.

Diamond jewelry was the star of the event formerly known as the SAG Awards.

Consumers were somewhat less worried about the future, though concerns about rising prices and politics remained.

Foerster is this year’s Stanley Schechter Award recipient.

Sponsorships and tickets to the annual fundraising event, set for May 31, are available now.

Chicago police and members of the U.S. Marshals Service tracked down the 35-year-old suspect earlier this week in St. Louis.

Owners of the Ekapa Mine reportedly filed for liquidation about a week after a mudslide trapped five workers who have yet to be found.