Guthrie, the mother of “Today” show host Savannah Guthrie, was abducted just as the Tucson gem shows were starting.

Industry Optimistic About Year Ahead, JCK Survey Says

The JCK Jewelry Industry Confidence Index is at 86 this year, but the challenge of online competition remains.

Las Vegas—A strong majority of jewelers are feeling good about the year ahead, according to the second annual “JCK State of the Jewelry Industry Report.”

The JCK Jewelry Industry Confidence Index, a numerical reflection of industry sentiment, is at 86, meaning that 86 percent of respondents said they were optimistic about business for the next 12 months.

That is down slightly compared with 88 percent last year.

Yancy Weinrich, senior vice president of JCK organizer Reed Exhibitions who oversees the JCK and Luxury shows, shared the research at a session held Saturday morning in Las Vegas.

JCK partnered with research firm MRI-Simmons to conduct the survey, asking jewelry industry professionals to pinpoint challenges and track trends in order to gain insight on the future of the industry.

The most commonly identified challenge was online competition (67 percent) followed by the overall economic climate (56 percent), lack of general consumer demand (50 percent), and lack of millennial demand (40 percent).

Competing with Online Players

When asked how they planned to tackle the problem of online competition, the greatest percentage of respondents said they would build connections via social media (17 percent).

The survey found that 96 percent of respondents use social media marketing, with 89 percent stating social media will play a greater role in their marketing in 2019.

About 72 percent of those surveyed forecast that social media marketing would be the most successful business practice in 2019.

Facebook and Instagram were the most popular for customer engagement, tied at 74 percent, with Pinterest (24 percent) in the next slot, followed by Twitter (16 percent) and LinkedIn (11 percent).

Social media was the most popular advertising platform among respondents, though 61 percent of survey-takers said they also use other forms of online advertising, including: paid search (64 percent), online display ads (57 percent), digital ad networks (50 percent), and native or content-based ads (33 percent).

Around 37 percent of respondents said they would reach out to social influencers to boost their brand.

RELATED CONTENT: Micro-influencers Are the Next Big Thing, Says ReportOther answers to the question of how to combat online competition included trying non-traditional advertising (13 percent), improving the in-store buying experience (13 percent) or changing up inventory buying habits (12 percent).

Only 3 percent of respondents said they would invest in new technology to combat online competition.

Managing Inventory

Survey-takers were asked about how they manage their stock, and the survey showed that 65 percent of businesses

A majority of respondents (59 percent) did not use a Customer Relations Management (CRM) system.

Of the 41 percent that did use a CRM system, they said it improved sales (57 percent) and increased profits and revenue (49 percent).

Lab-Grown Diamonds

The survey also asked about lab-grown diamonds, a polarizing, hot topic throughout the industry, to get a sense of consumer views.

Lab-grown diamonds topped the list of types of jewelry that produced the most consumer concerns (61 percent) followed closely by “conflict” diamonds (60 percent) and responsibly sourced jewels (37 percent).

Affordability topped the list of reasons customers were interested in lab-grown diamonds (86 percent) followed by “eco-friendly” positioning (36 percent), “conflict-free” positioning (33 percent), and an interest in the technology behind the stones (15 percent).

The top reason customers were not interested in lab-grown diamonds was that natural stones were considered more “real” (47 percent), with a preference for natural diamonds (46 percent) coming in at a close second, followed by concerns that lab-grown diamonds will not hold their value (39 percent) and the price not being low enough (17 percent).

The trend of women buying their own jewelry also is expected to continue, with 67 percent of women buying jewelry for themselves spending more than $500. The average price point is $1,240.

Other trends expected to stay strong include stacked rings and heart-themed jewels while purple jewels and beads are on the way out, according to the survey.

Custom pieces and colored stones buoyed 2017-2018 sales, while sales of charms were on the decline.

For 2018-2019, colored gemstones and fashion and bridge jewelry are anticipated to be top sellers, while watches could be on the decline.

The Latest

Butterfield Jewelers in Albuquerque, New Mexico, is preparing to close as members of the Butterfield family head into retirement.

Paul Morelli’s “Rosebud” necklace, our Piece of the Week, uses 18-karat rose, green, and white gold to turn the symbol of love into jewelry.

Launched in 2023, the program will help the passing of knowledge between generations and alleviate the shortage of bench jewelers.

The nonprofit has welcomed four new grantees for 2026.

Parent company Saks Global is also closing nearly all Saks Off 5th locations, a Neiman Marcus store, and 14 personal styling suites.

It is believed the 24-karat heart-shaped enameled pendant was made for an event marking the betrothal of Princess Mary in 1518.

Criminals are using cell jammers to disable alarms, but new technology like JamAlert™ can stop them.

The AGTA Spectrum and Cutting Edge “Buyer’s Choice” award winners were announced at the Spectrum Awards Gala last week.

Sourced by For Future Reference Vintage, the yellow gold ring has a round center stone surrounded by step-cut sapphires.

The clothing and accessories chain announced last month it would be closing all of its stores.

The “Zales x Sweethearts” collection features three mystery heart charms engraved with classic sayings seen on the Valentine’s Day candies.

The event will include panel discussions, hands-on demonstrations of new digital manufacturing tools, and a jewelry design contest.

Namibia has formally signed the Luanda Accord, while two key industry organizations pledged to join the Natural Diamond Council.

Lady Gaga, Cardi B, and Karol G also went with diamond jewelry for Bad Bunny’s Super Bowl halftime show honoring Puerto Rico.

Jewelry is expected to be the No. 1 gift this year in terms of dollars spent.

As star brand Gucci continues to struggle, the luxury titan plans to announce a new roadmap to return to growth.

The new category asks entrants for “exceptional” interpretations of the supplier’s 2026 color of the year, which is “Signature Red.”

The White House issued an official statement on the deal, which will eliminate tariffs on loose natural diamonds and gemstones from India.

Entries for the jewelry design competition will be accepted through March 20.

The Ohio jeweler’s new layout features a curated collection of brand boutiques to promote storytelling and host in-store events.

From heart motifs to pink pearls, Valentine’s Day is filled with jewelry imbued with love.

Prosecutors say the man attended arts and craft fairs claiming he was a third-generation jeweler who was a member of the Pueblo tribe.

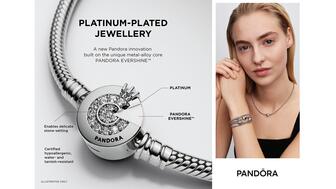

New CEO Berta de Pablos-Barbier shared her priorities for the Danish jewelry company this year as part of its fourth-quarter results.

Our Piece of the Week picks are these bespoke rings the “Wuthering Heights” stars have been spotted wearing during the film’s press tour.

The introduction of platinum plating will reduce its reliance on silver amid volatile price swings, said Pandora.

It would be the third impairment charge in three years on De Beers Group, which continues to grapple with a “challenging” diamond market.