Tariffs & Colored Gemstones: Relying on Stock, Considering the Ripple Effect

Though currently paused, high tariffs threaten many countries where gemstones are mined. Dealers are taking measures now to prepare.

Although the higher tariffs were only in effect for about 13 hours, Trump’s initial announcement rattled the jewelry industry, with rates between 10 and 50 percent (Lesotho) on imports from many countries where gemstones are mined.

While the pause is slated to remain in effect until July, a baseline tariff of 10 percent, which is applied in addition to existing duties, remains in effect for most countries.

China is excluded from the pause; it currently faces a slew of tariffs (in some cases exceeding 200 percent), with rates varying by product.

Colored gemstone dealers, especially those who source from several different countries, are not only adjusting to the new baseline tariff but also preparing for what may happen in July, when the 90 days is up.

In interviews with National Jeweler, some relayed feelings of cautious optimism regarding the potential for a trade agreement prior to the end of the pause, and industry associations said they already are lobbying for exemptions for gemstones.

Others worry about the ripple effect the tariffs will have overseas in countries where the gemstone trade supports entire communities.

“This has potentially really dramatic, devastating repercussions.”— Monica Stephenson, Moyo Gems and Anza Gems

For dealers like Monica Stephenson, co-founder of Moyo Gems, a collaboration with the female artisanal miners of Tanzania’s Umba Valley, and president of Anza Gems, the end of the pause won’t change the rates.

Stephenson sources exclusively from Tanzania and Kenya, and imports from both countries will still face a 10 percent tariff, the minimum in the slate of rates announced.

In a LinkedIn post, she wrote that, prior to the tariffs, she paid the Tanzanian government “about 7% (6 + 1% on the value of gems exported) plus export and other fees outside of the cost of shipping to the US (Kenya slightly less).”

She recently started having some gemstones cut in Thailand, but for the most part, Stephenson has her gems faceted in the U.S.

She said her company’s short and direct supply chain, with materials traceable to the source, makes her feel more prepared to adjust to geopolitical and economic turbulence.

As a business owner, knowing precisely where materials come from and being familiar with the export process can mean fewer complications when it comes to ensuring compliance.

Her initial plan is to continue have old stock of rough gems faceted, and she doesn’t anticipate raising prices for as long as she can process old material.

Jade supplier Mason-Kay Jade also is relying on its current stock.

Much of Burmese jadeite jade is sold through China, but, since the U.S. sanctions on Burmese gemstones were implemented in 2003 and 2008, the company has bought second-hand jadeite jade domestically.

The company purchases much of what is offered, as it is able to test the gemstones to confirm they are natural jadeite.

Other buyers often consider the jade to likely be treated—which Mason-Kay owner Jeff Mason called a “wise concern”—and will only pay for settings.

In an email sent to its partners regarding the tariffs, Mason-Kay said in part, “We are well stocked with natural jadeite jade at pre-tariff prices and will continue to provide you with our certified natural jadeite jade jewelry and loose goods, as well as jade testing and valuation services.

“Now is an excellent time to certify your jade jewelry for insurance or resale values.”

While it has recently started working with Guatemalan jadeite cutters, as more gem-quality jadeite has been discovered in the country, Mason-Kay Jade has worked with cutters in China for years.

While the “reciprocal” tariffs are on pause, China currently is embroiled in a trade war with the United States, and Chinese imports into the U.S. are heavily taxed.

While the current tariff rate has been widely reported as 145 percent, in reality, it’s more nuanced, with rates varying for different products.

The percentage applied to gemstones imported from China is not immediately clear.

As of press time, Mason said he was awaiting paperwork for recent shipments from China of what he called “lower-priced items,” like repairs and special orders, to see the exact rates for those.

“If the tariffs on China remain, and gemstones do not receive an exemption, we will seek other sources like Thailand, Taiwan, etc.,” Mason said.

“We prefer not to have to develop new cutters after establishing many good relationships with Chinese cutters for decades, but we will if we must.”

Mason thinks a trade agreement between the U.S. and China is likely, adding, “We are confident that our industry will be able to gain an exemption for gemstones, as very few actually come from within the borders of the U.S.”

The American Gem Trade Association has engaged a lobbyist in Washington, D.C., who specializes trade issues, AGTA CEO John Ford said in an email to National Jeweler.

“AGTA is actively engaged in seeking the end of the baseline tariffs on loose colored gemstones imported into the United States,” he wrote. “We are also very concerned and addressing the reciprocal tariffs issues.”

Stephenson, of Anza Gems, worries not only about how the tariffs will affect her business but also the mining communities she works with and the entire gem trading eco-system.

When National Jeweler spoke with her Wednesday, she was actively buying from the Moyo market, a buying event that happens three to four times a year in Tanzania.

“I wired my money and [my export broker] is buying on my behalf right now so we are continuing to support our miners globally,” she said.

“I’m going to be chasing down my customs broker to get more information on what it’s going to take to actually get that package imported to the U.S. at this point.”

The organizers of the buying events relay the market dates to the miners, many of whom are in remote regions, in advance, so this particular market day was scheduled before Trump announced the tariffs.

“To suddenly pull back on that would be pretty devastating for the local economy,” Stephenson said. “We felt it was really important to go ahead and proceed with the scheduled market day and, as far as I know, we’re going to also proceed with a market day in late summer as well.”

Stephenson noted the complicated nature of the colored gemstone supply chain and said that, because substantial transformation (cutting) might happen in a different country than where a gem was mined, the tariffs also will impact cutters, brokers, manufacturers, and all others who help facilitate these transactions.

For the mining communities with a subsistence economy whose members depend on this eco-system, “This has potentially really dramatic, devastating repercussions,” she said.

Stephenson also added that while U.S. jewelry companies can, over time, develop top-of-the-line production domestically, the raw materials still are going to have to come from other countries, making these global communities vital to the supply chain.

However, some jewelers are still looking to increase their domestic sourcing wherever possible.

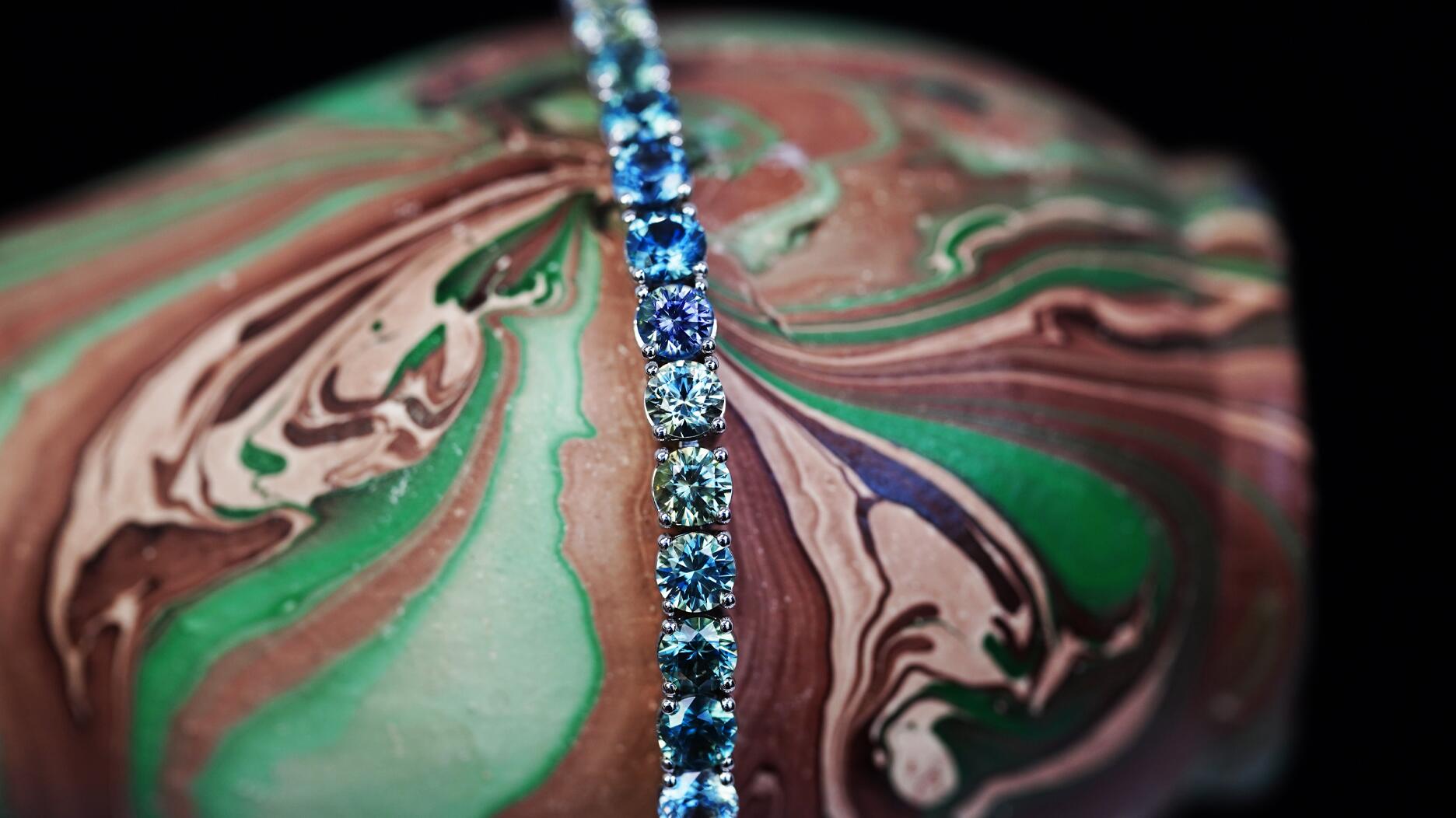

Rachel Hill, owner of Montana sapphire supplier Americut Gems Inc., said in the days following the initial announcement of the tariffs, she was contacted by retail customers who said they were anticipating an increase in customer interest in the gemstone.

They wanted to know if Americut Gems’ supply could meet the demand and shared concerns about whether or not the company could handle the increased traffic expeditiously.

Regardless of whether or not the supplier can keep up, Hill noted that isn’t a complete solution to the global issue.

“Unfortunately, domestic precious stone mining as a solution to the tariff problem is very limited. For the most part, it begins and ends with sapphires mined in Montana,” she said.

“I think there’s a lot of flexing going on right now but eventually, when the dust settles—and you could call it wishful thinking—I think we will be OK. I think we can navigate.” – Benjamin Hakimi, Colorline

Benjamin Hakimi of Colorline in New York deals in sapphires and rubies sourced from various Asian and African countries.

His company is keeping an eye on the tariffs on Sri Lanka (originally proposed at 44 percent), Madagascar (47 percent), Thailand (36 percent) and Mozambique (16 percent), although each has been dropped to 10 percent as part of the 90-day pause.

“It’s one thing to have [tariffs] on finished jewelry that is manufactured in Thailand, or worse China, but we’re bringing in raw material, and it’s going to create employment at different levels,” he said, referring to the cutters, setters, polishers and bench jewelers employed in the U.S.

While even the 10 percent tariff is still higher than what the company was paying before, Hakimi said he is hopeful that ongoing negotiations with “friendly” nations, like Thailand, will be successful, and the rates won’t increase beyond that.

He continued, “I think there’s a lot of flexing going on right now but eventually, when the dust settles—and you could call it wishful thinking—I think we will be OK. I think we can navigate.”

The Latest

Bulgari named Gyllenhaal as its brand ambassador for his embodiment of artistic depth, intellectual curiosity, and warmth.

Awards were given to four students, one apprentice, and an emerging jeweler.

The top jewelry lot of the late model’s estate sale, hosted by John Moran Auctioneers, was an Oscar Heyman & Brothers for Cartier necklace.

Every jeweler faces the same challenge: helping customers protect what they love. Here’s the solution designed for today’s jewelry business.

Moses, who started at GIA’s Santa Monica lab in 1976, will leave the Gemological Institute of America in May.

Increased competition, falling lab-grown diamond and moissanite prices, and the rising cost of gold took a toll on the moissanite maker.

The earrings, our Piece of the Week, feature pink tourmalines as planets orbiting around an aquamarine center set in 18-karat rose gold.

With refreshed branding, a new website, updated courses, and a pathway for growth, DCA is dedicated to supporting retail staff development.

“The Price of Freedom” campaign video for International Women’s Day confronts the quiet violence of financial control.

Also, a federal judge has ordered that companies that paid tariffs implemented under the IEEPA are entitled to refunds.

The ever-growing collection, which just expanded with the addition of Olga of Kyiv, features cameos of 12 women from history.

We asked a jewelry historian, designer, bridal director, and wedding expert what’s trending in engagement rings. Here’s what they said.

The annual event will be held in Orlando, Florida, from Sept. 14-17.

The “Outlander” star modeled for the digital cover of the magazine’s spring issue, which features a story on her relationship with jewelry.

This year’s annual congress, which will mark the confederation’s 100th anniversary, will take place this fall in Italy.

Beverly Hills was chosen as the location for the brand’s first store, designed as a “private residence for modern monarchs.”

Kering, Apple, and other retailers have reportedly temporarily closed stores in the Middle East region in light of the recent conflicts.

Beth Gerstein discusses the vibe of the new store, what customers want when fine jewelry shopping today, and the details of “Date Night.”

Nearly half of buyers are prioritizing silver and fashion collections this season, organizers said.

The “Live Now. Polish Later.” campaign features equestrians wearing the brand’s jewels while galloping across the icy plains of Kazakhstan.

The precious metals provider has promoted Jennifer Ashworth to the role.

Nelson will be honored as the inaugural grant winner at the Gem Awards gala on March 13.

The American precious metals refiner’s day-to-day operations remain the same post-acquisition.

These aquamarine jewels channel the calming energy of the March birthstone.

The “Innovative Design” category and award will debut in the Spectrum division of this year’s AGTA Spectrum & Cutting Edge Awards.

Diamond jewelry was the star of the event formerly known as the SAG Awards.

Consumers were somewhat less worried about the future, though concerns about rising prices and politics remained.