The credit card companies’ surveys examined where consumers shopped, what they bought, and what they valued this holiday season.

Hearts on Fire sale shows the importance of brands

The proposed $150 million sale of Hearts on Fire to Chinese retailer and manufacturer Chow Tai Fook underscores what many believe is the future of retail: It will be all about the brands.

New York--The proposed $150 million sale of Hearts on Fire to Chinese retailer and manufacturer Chow Tai Fook underscores what many believe is the future of retail: It will be all about the brands.

Under the terms of the deal, Hearts on Fire’s management team, including CEO Glenn Rothman, will remain in place, and the company will continue to operate out of its Boston headquarters, a standalone business within Chow Tai Fook Jewellery Group Ltd.

But Chow Tai Fook will own 100 percent of Hearts on Fire, giving the retailer the opportunity to introduce an already established brand to the consumers who shop at its thousands of retail stores in China.

“This is, in my mind, testimony to the increasing power and value of branding in our business, with this buyer taking it global to monetize it in the developing world, where an increasing population of aspirational consumers are hungry for products that recognize their rising status,” said Dione Kenyon, president of the Jewelers Board of Trade, which tracks consolidations and mergers in the jewelry industry.

Prior to the announcement of the proposed acquisition, there had been rumblings about the future of Hearts on Fire, including a possible sale, for the past several months.

In an interview with National Jeweler Wednesday, Chief Marketing Officer Caryl Capeci said that in October at Hearts on Fire University, Rothman told retailers Hearts on Fire wanted to expand into China, a goal of the company’s since opening its first stores in Taiwan 10 years ago.

Hearts on Fire set out to raise capital and, in the process, connected with Chow Tai Fook. “We couldn’t pass up an opportunity to explore more. For Glenn and Susan and the brand, it made perfect sense,” she said.

Being owned by Chow Tai Fook gives Hearts on Fire access to its more than 2,000 retail stores in Asia, and means it is backed by one of the largest retailers in the world. Chow Tai Fook also is a manufacturer of finished jewelry, has a total of four diamond cutting and polishing factories--two in South Africa, one in Botswana and one in China--and is a De Beers sightholder, a Rio Tinto select diamantaire and a strategic partner of Alrosa, giving Hearts on Fire access to a steady supply of rough diamonds.

As announced on Wednesday, within six months of the transaction’s closing, Hearts on

In the U.S. market, Hearts on Fire is pulling back on its strategy of opening standalone stores (the brand currently has two here, one in Las Vegas and one in King of Prussia, Pa.) to focus on independent retailers.

Capeci said they have about 350 retail locations in the United States and are looking to open more as they streamline their focus and the new partnership with Chow Tai Fook fuels interest in the brand.

“We know we are going to be growing. The next couple of years is going to quite an incredible cycle of growth,” she said.

Hearts on Fire, however, doesn’t have a firm number of doors it is looking to open in the United States.

Details regarding the future of Hearts on Fire’s manufacturing still are being worked out, Capeci said. The company currently has vendors in the United States and in Asia.

What is known at this point is that Hearts on Fire will keep its engagement ring manufacturing in the United States because they need to be able to deliver rings to the retailers here within two weeks while the jewelry sold in China will be made in China.

The branding game

For Chow Tai Fook, the proposed Hearts on Fire purchase is a chance to snag a well-established brand in the jewelry industry.

Jewelry is an industry where both tight margins that leave little room for marketing and, for diamonds specifically, getting consumers to connect with a story beyond the Four Cs make branding more difficult, said Howard Feller.

Feller is a partner at MMG, an investment bank specializing in fashion and fashion-related mergers and acquisitions and advisory services. Earlier this year, MMG worked on the deal that will bring a Marchesa-branded line of fine jewelry to Macy’s this holiday season.

“Anything they (companies) can do to take the risk out of putting an untested brand in the store, they’ll do,” he said.

With its planned purchase of Hearts on Fire, Chow Tai Fook becomes the industry’s latest major player to snatch up a brand.

In 2013, Swatch Group paid $1 billion for the venerable Harry Winston name and network of retail stores worldwide.

RELATED CONTENT: The beauty of the deal

Two of the world’s largest and most successful luxury goods companies, LVMH Moët Hennessy Louis Vuitton and Kering (formerly PPR), are comprised of long-established brands in various industries, with some of their most recent acquisitions coming in jewelry.

LVMH bought Bulgari, a brand with hundreds of years of history, for $5.17 billion in 2011 and Kering purchased a majority stake in Pomellato last year.

Judith Ripka also is no longer solo. In April, a brand management firm called Xcel Brands Inc., which also owns Isaac Mizrahi New York and Liz Claiborne New York, paid $22 million to add the jewelry company to its portfolio.

In addition to speaking to the growing importance of brands, Feller said Chow Tai Fook’s acquisition of Hearts on Fire also gives the company a foothold in the U.S. market.

While the Chow Tai Fook stores are in Asia, owning Hearts on Fire would give the Hong Kong-based company a chance to learn more about the U.S. market and how brands work here. Chow Tai Fook could apply these lessons in Asia or even use them for future acquisitions in the United States, Feller said.

Chow Tai Fook said it has no plans for acquiring any more companies in the U.S. market, at least not right now.

“Our main focus remains on our existing business in greater China, and currently we are not considering any more acquisitions of U.S. companies in the jewelry industry,” Kent Wong, managing director of Chow Tai Fook Jewellery Group Ltd., said in an email. “However we are open to every opportunity that might benefit the company’s long-term development and enhance shareholder returns.”

The Latest

Kimberly Miller has been promoted to the role.

The “Serenity” charm set with 13 opals is a modern amulet offering protection, guidance, and intention, the brand said.

How Jewelers of America’s 20 Under 40 are leading to ensure a brighter future for the jewelry industry.

“Bridgerton” actresses Hannah Dodd and Claudia Jessie star in the brand’s “Rules to Love By” campaign.

Founded by jeweler and sculptor Ana Khouri, the brand is “expanding the boundaries of what high jewelry can be.”

The jewelry manufacturer and supplier is going with a fiery shade it says symbolizes power and transformation.

Roseco’s 704-page catalog showcases new lab-grown diamonds, findings, tools & more—available in print or interactive digital editions.

The singer-songwriter will make her debut as the French luxury brand’s new ambassador in a campaign for its “Coco Crush” jewelry line.

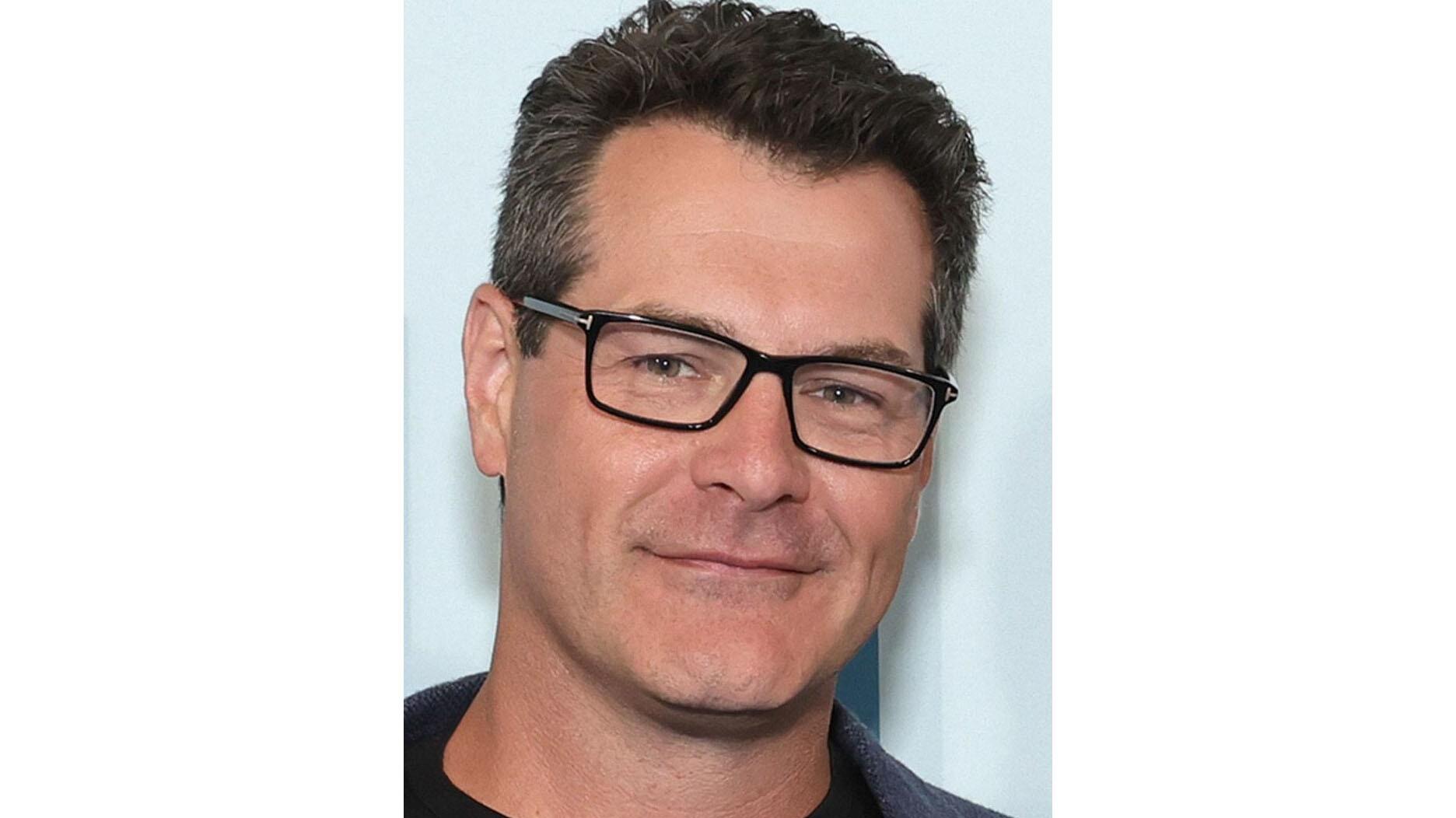

As the shopping mall model evolves and online retail grows, Smith shares his predictions for the future of physical stores.

The trade show is slated for Jan. 31-Feb. 2 at The Lighthouse in New York City's Chelsea neighborhood.

January’s birthstone comes in a rainbow of colors, from the traditional red to orange, purple, and green.

The annual report highlights how it supported communities in areas where natural diamonds are mined, crafted, and sold.

Footage of a fight breaking out in the NYC Diamond District was viewed millions of times on Instagram and Facebook.

The supplier has a curated list of must-have tools for jewelers doing in-house custom work this year.

The Signet Jewelers-owned store, which turned 100 last year, calls its new concept stores “The Edit.”

Linda Coutu is rejoining the precious metals provider as its director of sales.

The governing board welcomed two new members, Claire Scragg and Susan Eisen.

Sparkle with festive diamond jewelry as we celebrate the beginning of 2026.

The master jeweler, Olympian, former senator, and Korean War veteran founded the brand Nighthorse Jewelry.

In its annual report, Pinterest noted an increase in searches for brooches, heirloom jewelry, and ‘80s luxury.

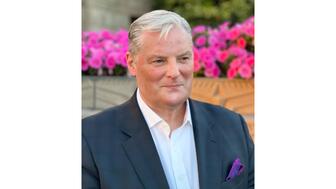

Executive Chairman Richard Baker will take over the role as rumors swirl that a bankruptcy filing is imminent for the troubled retailer.

Mohr had just retired in June after more than two decades as Couture’s retailer liaison.

Shekhar Shah of Real Gems Inc. will serve as president of the Indian Diamond & Colorstone Association in 2026.

This year’s good luck charm features the mythical horse Pegasus, and is our first Piece of the Week of the new year.

Articles about crime, engagement rings, and a necklace worn in the World Series generated the most interest among readers.

As part of the leadership transition, Sherry Smith will take on the role of vice president of coaching strategy and development.