Chris Blakeslee has experience at Athleta and Alo Yoga. Kendra Scott will remain on board as executive chair and chief visionary officer.

Why shouldn’t jewelry retailers sell the iWatch?

Columnist Jan Brassem says if and when it comes out, there’s no reason Apple’s highly anticipated iWatch shouldn’t be carried and sold by traditional retail jewelers.

The Swiss were prepared to throw in the towel and hand over a major portion of the centuries-old symbol of Swiss pride and history to the Japanese. In certain respects, Swiss watch companies, the industry and even the nation itself were fiscal train wrecks. Thankfully, Nicolas Hayek -- a brilliant Swiss consultant -- saved the day and created a turnaround strategy that resulted in one of the most spectacular industrial comebacks in history.

Will history repeat itself with the slew of smartwatches recently developed along with the near future launch of the much touted, and anticipated, Apple iWatch?

“The iWatch may turn the global watch industry ‘upside down’, just like Seiko did in the ‘60’s”, said Chhimi Lama, a senior watch professional at the Tourneau legendary watch pavilion on New York City’s Madison Avenue. Will some, or most, of the demand for the successful watch brands, many with a tradition spanning centuries of mechanical excellence and breathtaking design, become passé?

All of this brings up the many variables of the emerging wearable technology market, with its huge potential. You don’t have to be a Harvard graduate to see that technology companies quickly jumped on the smartwatch category, the “lowest hanging fruit” of the wearable technology market. But wait, we’re getting ahead of ourselves.

A short history of the smartwatch

Like rush hour at LaGuardia Airport, the race by tech companies, i.e. Samsung, Pebble, Addme (China), Sony, Meta1, Google, Shenzhen (China), Microsoft, Motorola, Fossil, Android (some of these, and a host of others, are still in prototype development), to enter the emerging “wearable technology” industry was no surprise. The smartwatch market seems to have been driven by an almost perfect blend of consumerism and technology: the Bluetooth and the smart phone.

Simply, smartwatches do their jobs by communicating with the smartphone in your pocket. By leveraging this connection via Bluetooth, the smartwatch can receive all kinds of information that wasn’t possible just a few years ago. Obviously, the Bluetooth is the critical element. You get the idea.

Today’s smartwatch, however, lacks a commonly recognized label. Some are mini-PDAs

Today’s smartwatches receive text messages and Facebook updates from your iPhone, email contacts, run apps and, yes, even tell time. The biggest advantage of a smartwatch is that, instead of having to whip your iPhone out of your pocket 150 times a day (if you don’t believe that, count it sometime), you can take a quick glance at your wrist to see why your phone is buzzing.

Says Bill Geiser, an industry pioneer, and developer of the soon to be released Meta1 smartwatch, “Smartwatches don't just tell time -- they save you time.”

None of those now available, however, are designed to meet the consumer’s fashion appeal. They’re generally square and boxy, especially compared to the beautiful fashion watch brands found in Tourneau. Says Geiser, “Most of the smartwatches are generally designed by tech engineers and computer geeks. It’ll be just a matter of time before they are designed with more fashion eye appeal.”

Clearly, with more than ten (at last count) smartwatches fighting for customers of the emerging wearable technology category (tech venues like the SXSW Show in Texas were jam-packed) an industry overhaul could be on the horizon.

The shakeout should be accelerated when Cupertino, Calif.-based Apple launches its highly anticipated iWatch. As reported in the New York Post by Jonathon Trugman recently, Apple’s “10-ton gorilla” is awakening. Samsung’s Gear, the current smartwatch sales leader, and something of a marketing flop, should be forewarned.

When Apple makes products, generally industry-transforming products, it makes them carefully to sell in large quantities and to make immense profits. (Think iPhone, iPad, iPod, etc.) The smartwatch has been around for a while and enough time has passed for Apple, as is their custom, to view the competitive landscape and adjust and refine for their competitors’ expensive mistakes. Apple considers consumer fashion, in contrast to the current players’ dithering design approach, a critical ingredient to success.

Apple is rumored -- only a rumor, mind you -- to start production of the iWatch in the fourth quarter of 2014, a projection that carries some weight thanks to confidential reports from Asia. Two models of the iWatch are expected, a 1.3-inch or 1.5-inch face with a rumored retail price around $1,000 or less.

Once launched, and if history is a judge, Apple’s remarkable products could change the lives of people all over the world, including ours.

Please tell Tourneau to start reserving showcase space.

The current U.S. jewelry industry

Newsflash: based on a 2014 multifaceted jewelry industry study by the world-renown McKinsey & Co., (Linda Dauriz, et al.), the global jewelry industry “seems poised for a glittering future.” Annual global sales in 2013 totaled $155 billion and are expected to “grow at a healthy annual clip of 5 to 6 percent totaling $235 billion by 2020.”

Although jewelry is primarily a local industry, in my view anyway, this will change. Following a break in jewelry consumption brought on by the recession, the consumer’s appetite for jewelry has returned and appears to be as voracious as ever.

Consequently, changes in both U.S. consumer behavior and industry configuration are underway.

Globalization, consolidation and the growth of jewelry brands will focus the consumer on a narrow style range. (The recent consolidation of Zale-Signet, representing about 3,200 stores in the United States, is a good example of industry consolidation.)

Tiffany & Co. and Cartier are becoming leading global jewelry brands. Jewelry web sites continue to be important and a growing distribution channels.

Almost as important, the Jewelry Consumer Opinion Council (JCOC) performed a recent study showing that “consumer interest in so-called wearable technology, smartwatches and bracelets designed to make life easier, is growing.” According to the study, 72% of those questioned had heard of wearable technology and 44% they would buy wearable technology jewelry.

An Apple iWatch distribution strategy--the traditional jewelry retailer

How will Apple distribute their innovative iWatch? If Apple were to continue its current distribution channel, through 1,000-plus Best Buy stores and its 225 Apple stores, the company would be missing a significant opportunity.

Visiting a Best Buy store, you may find the iWatch next to a stainless steel refrigerator. No watch image or expert there. Visiting an Apple store, if one is near, you may have to call for an appointment if you have a tech question.

Dare I say it? There’s a solution here. There are 30,000-plus jewelry stores, large and small, in the U.S. Many, if not most, have watch departments and experts, with watch skill sets. Why not use these stores as U.S. Apple iWatch distributors (with proper training on the product from Apple, of course)?

Apple will have an immediate, dedicated and experienced iWatch sales force of 30,000-plus dealers.

But there’s more. The jewelry industry is expected to grow at a healthy 5 to 6 percent for the next five to six years. The Apple iWatch could capture this growth by using the jewelry store channel.

The U.S. jeweler profits as well. His store, or chain, immediately becomes part of the celebrated tech industry which, to this day, has passed him by. The jeweler will end up carrying a world-class product that should offer more sales dollars than most of the watches he carries. Finally, he has the opportunity to sell add-ons to the iWatch customer or their relatives/friends, such as diamond stud earrings for the girlfriend of a male iWatch purchaser. Store owners could also offer their own promotions: buy an iWatch and get 10 percent off another purchase. The ideas are endless.

The Apple iWatch jewelry store distribution strategy could end up being a valuable win-win opportunity. Everyone benefits.

The Latest

The credit card companies’ surveys examined where consumers shopped, what they bought, and what they valued this holiday season.

Kimberly Miller has been promoted to the role.

How Jewelers of America’s 20 Under 40 are leading to ensure a brighter future for the jewelry industry.

Founded by jeweler and sculptor Ana Khouri, the brand is “expanding the boundaries of what high jewelry can be.”

The jewelry manufacturer and supplier is going with a fiery shade it says symbolizes power and transformation.

The singer-songwriter will make her debut as the French luxury brand’s new ambassador in a campaign for its “Coco Crush” jewelry line.

Roseco’s 704-page catalog showcases new lab-grown diamonds, findings, tools & more—available in print or interactive digital editions.

The nonprofit’s new president and CEO, Annie Doresca, also began her role this month.

As the shopping mall model evolves and online retail grows, Smith shares his predictions for the future of physical stores.

The trade show is slated for Jan. 31-Feb. 2 at The Lighthouse in New York City's Chelsea neighborhood.

January’s birthstone comes in a rainbow of colors, from the traditional red to orange, purple, and green.

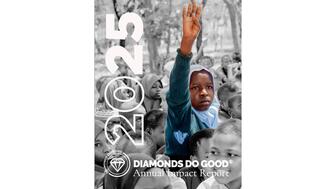

The annual report highlights how it supported communities in areas where natural diamonds are mined, crafted, and sold.

Footage of a fight breaking out in the NYC Diamond District was viewed millions of times on Instagram and Facebook.

The supplier has a curated list of must-have tools for jewelers doing in-house custom work this year.

The Signet Jewelers-owned store, which turned 100 last year, calls its new concept stores “The Edit.”

Linda Coutu is rejoining the precious metals provider as its director of sales.

The governing board welcomed two new members, Claire Scragg and Susan Eisen.

Sparkle with festive diamond jewelry as we celebrate the beginning of 2026.

The master jeweler, Olympian, former senator, and Korean War veteran founded the brand Nighthorse Jewelry.

In its annual report, Pinterest noted an increase in searches for brooches, heirloom jewelry, and ‘80s luxury.

Executive Chairman Richard Baker will take over the role as rumors swirl that a bankruptcy filing is imminent for the troubled retailer.

Mohr had just retired in June after more than two decades as Couture’s retailer liaison.

Shekhar Shah of Real Gems Inc. will serve as president of the Indian Diamond & Colorstone Association in 2026.

This year’s good luck charm features the mythical horse Pegasus, and is our first Piece of the Week of the new year.

Articles about crime, engagement rings, and a necklace worn in the World Series generated the most interest among readers.

As part of the leadership transition, Sherry Smith will take on the role of vice president of coaching strategy and development.