Van Cleef & Arpels Necklace From 1929 Sells for $3.6M at Auction

The rare piece went home with a Sotheby’s executive.

Following a six-minute battle among seven bidders, it sold to Catharine Becket, Sotheby’s head of Magnificent Jewels, for $3.6 million, three times its highest pre-sale estimate of $1.2 million.

Another executive, Geoff Hess, Sotheby’s head of watches in the Americas, also recently purchased a piece at auction—a Patek Phillipe from the sale of Sylvestor Stallone’s private collection earlier this month.

The necklace, pictured at the top of the article, was created in 1929.

It provided the framework to showcase geometric-shaped diamonds characteristic of the Art Deco movement, and it’s likely only a few examples were ever made.

“Our clients seek jewels not just for adornment but as pieces of history and artistry, encapsulating the essence of their designers and eras, none more so than the Art Deco Van Cleef & Arpels diamond tie necklace, which sold for a staggering $3.6 million,” said Quig Bruning, Sotheby’s head of jewels for Americas and EMEA.

“Its appearance on the auction block perfectly demonstrates our unique ability to offer jewels of unparalleled rarity, exclusivity, and of the best quality."

The “Magnificent Jewels” sale, held Friday, totaled $30 million with 90 percent of lots sold and 62 percent of sold lots achieving prices above their high estimate.

Eight out of the 10 most valuable jewels in the sale sold above $1 million, said Sotheby’s.

Another Art Deco piece, an Egyptian-inspired colored stone and diamond bracelet from 1925 went for more than $1 million, well above its estimate of $250,000 to $350,000.

It sold to U.K.-based luxury retailer Symbolic and Chase.

A strong appetite for sapphires was apparent, Sotheby’s said.

Friday’s auction included an assortment of Kashmir sapphires, which the auction house said continue to drive strong prices.

A sapphire and diamond ring by Marcus & Co. featuring a 10.31-carat cushion-cut sapphire sold for nearly $2 million, or $192,047 per carat, against an estimate of $500,000 to $700,000.

A ring featuring a 16.68-carat Madagascar sapphire fetched three times its estimate of $60,000 to $80,000, selling for $312,000.

Also, a Cartier ring with a 14.51-carat sugarloaf cabochon sapphire sold for $1.8 million or $124,052 per carat. Its pre-sale estimate was $800,000 to $1.2 million.

While more than half of lots in the Magnificent Jewels sale went for more than expected, one did not.

The “Lavender Dream,” a pinkish purple diamond, which was estimated to go for $1 million to $1.5 million, was not sold.

Sotheby’s sold 85 percent of the white diamonds offered in Friday’s sale.

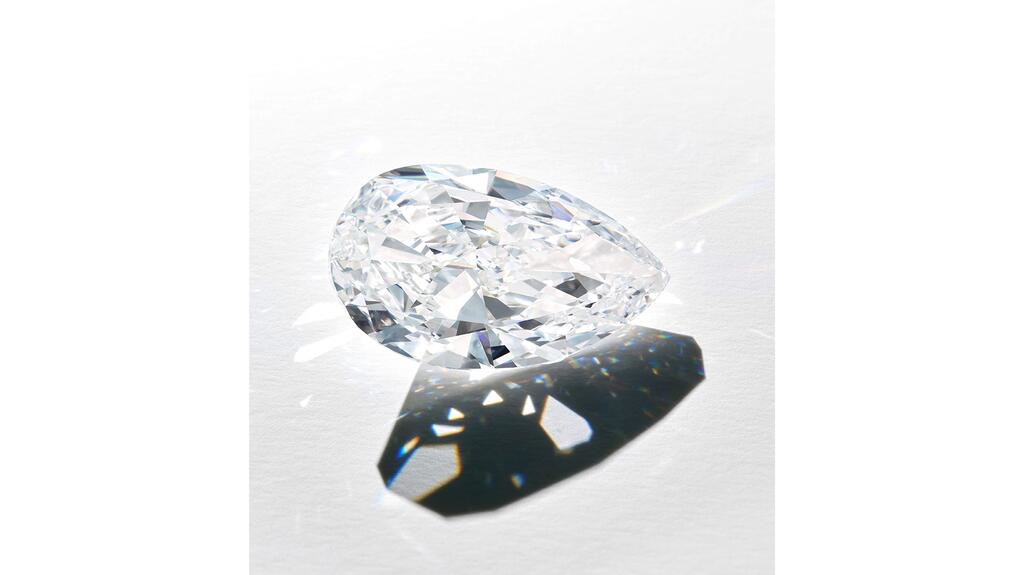

Of those, a Type IIa, internally flawless 53.04-carat diamond of D color was the leading lot. The pear-shaped loose stone sold for $3.5 million, within its estimate of $3 million to $5 million.

A pendant necklace by Graff featuring a 16.06-carat emerald-cut diamond sold for slightly above its $1 million high-end estimate, going for $1.02 million or $63,512 per carat.

Two oval-shaped diamond rings also sold—one signed by Graff, featuring a 21.54-carat stone of D color and VVS2 clarity, which sold for $1.4 million (est. $1 million to $2 million), and the other a 6.73-carat diamond of the same color and VS1 clarity, which went for $540,000 against a high estimate of $200,000.

A three-strand necklace featuring natural pearls, cultured pearls, and diamonds achieved $552,000.

The piece was estimated to sell for $50,000 to $70,000.

The necklace once belonged to philanthropist Mary Ethel Weinmann, the youngest daughter of Count and Countess Andre de Limur and the great granddaughter of Charles Crocker, one of the “Big Four” who built the Central Pacific Railroad, part of the first transcontinental railroad.

A natural pearl and diamond necklace signed Tiffany & Co. sold for $300,000 against a pre-sale estimate of $40,000 to $60,000.

Also, a pair of drop-shaped natural pearls and diamond ear clips by Harry Winston sold for $396,000 (est. $200,000 to 300,000).

More than 1,200 bids were placed at Magnificent Jewels, and the sale saw nearly a third of new registrants, Sotheby’s said, which it attributes to its reduced buyer’s premium—a standardized 20 percent.

“Coming off the back of four single-owner sales which achieved 100 percent sell-through rates and successful sales in Geneva, the results of our New York sale prove that the market remains vibrant and dynamic,” said Quig Bruning, Sotheby’s head of jewels for Americas and EMEA, of Friday’s results.

“Moreover, we’re encouraged to see that two-thirds of jewels have sold above their high estimates since our lower buyer’s premium came into effect on May 20, confirming that a fairer fee structure is the definition of client-first, and not only encourages more buyers to participate at auction, but also reiterates that Sotheby's is open to all.”

The auction house recorded participation from 30 countries in North America, Europe, and across Asia, including Hong Kong, mainland China, Singapore, and Taiwan.

The Latest

Moses, who started at GIA’s Santa Monica lab in 1976, will leave the Gemological Institute of America in May.

Increased competition, falling lab-grown diamond and moissanite prices, and the rising cost of gold took a toll on the moissanite maker.

The earrings, our Piece of the Week, feature pink tourmalines as planets orbiting around an aquamarine center set in 18-karat rose gold.

Every jeweler faces the same challenge: helping customers protect what they love. Here’s the solution designed for today’s jewelry business.

“The Price of Freedom” campaign video for International Women’s Day confronts the quiet violence of financial control.

Also, a federal judge has ordered that companies that paid tariffs implemented under the IEEPA are entitled to refunds.

The ever-growing collection, which just expanded with the addition of Olga of Kyiv, features cameos of 12 women from history.

With refreshed branding, a new website, updated courses, and a pathway for growth, DCA is dedicated to supporting retail staff development.

We asked a jewelry historian, designer, bridal director, and wedding expert what’s trending in engagement rings. Here’s what they said.

The annual event will be held in Orlando, Florida, from Sept. 14-17.

The “Outlander” star modeled for the digital cover of the magazine’s spring issue, which features a story on her relationship with jewelry.

This year’s annual congress, which will mark the confederation’s 100th anniversary, will take place this fall in Italy.

Beverly Hills was chosen as the location for the brand’s first store, designed as a “private residence for modern monarchs.”

Kering, Apple, and other retailers have reportedly temporarily closed stores in the Middle East region in light of the recent conflicts.

Beth Gerstein discusses the vibe of the new store, what customers want when fine jewelry shopping today, and the details of “Date Night.”

Nearly half of buyers are prioritizing silver and fashion collections this season, organizers said.

The “Live Now. Polish Later.” campaign features equestrians wearing the brand’s jewels while galloping across the icy plains of Kazakhstan.

The precious metals provider has promoted Jennifer Ashworth to the role.

Nelson will be honored as the inaugural grant winner at the Gem Awards gala on March 13.

Experts from India weigh in the politics, policies, and market dynamics for diamantaires to monitor in 2026 and beyond.

The American precious metals refiner’s day-to-day operations remain the same post-acquisition.

These aquamarine jewels channel the calming energy of the March birthstone.

The “Innovative Design” category and award will debut in the Spectrum division of this year’s AGTA Spectrum & Cutting Edge Awards.

Diamond jewelry was the star of the event formerly known as the SAG Awards.

Consumers were somewhat less worried about the future, though concerns about rising prices and politics remained.

Foerster is this year’s Stanley Schechter Award recipient.

Sponsorships and tickets to the annual fundraising event, set for May 31, are available now.