Parent company Saks Global is also closing nearly all Saks Off 5th locations, a Neiman Marcus store, and 14 personal styling suites.

Supreme Court Agrees to Hear Online Sales Tax Case

The high court has agreed to take up a petition to reconsider Quill, the 1992 ruling that governs how internet sales tax is collected today.

Washington--The U.S. Supreme Court has agreed to take up a petition to reconsider Quill, the 1992 ruling that governs how taxes from online sales are collected today.

The justices announced their decision to take up the case of internet sales tax on Friday, the SCOTUS blog shows.

Officially filed as South Dakota v. Wayfair Inc., the case for internet sales tax “fairness,” as it is known among proponents, made its way to the highest court in the land via South Dakota.

In 2016, legislators in the Midwestern state passed a law requiring companies that make more than $100,000 in sales or have more than 200 transactions per calendar year remit sales tax, whether they have a physical presence in South Dakota or not.

Legislators argued the state is missing out on millions in revenue from online sales and that it’s time to revisit Quill, the nearly-26-year-old decision that prohibits states from imposing sales tax requirements on vendors with no physical presence there.

Online retailers NewEgg, Wayfair and Overstock.com challenged the law in the state’s Supreme Court and won, with the court stating in its decision, “However persuasive the state’s arguments on the merits of revisiting the issue, Quill has not been overruled. Quill remains the controlling precedent on the issue of Commerce Clause limitations on interstate collection of sales and use taxes.”

In October, South Dakota Attorney General Marty J. Jackley petitioned the U.S. Supreme Court to take up the case, which it agreed to Friday.

The court is expected to hear oral arguments in April, with a decision expected by late June.

The lack of sales tax collection on online purchases is an important issue for brick-and-mortar retailers, particularly those who depend on high-dollar sales like jewelers.

Jewelers of America has been fighting on behalf of its members for changes to the legislation governing online sales tax collection for a decade and was one of 10 retail trade associations that filed an amicus brief with the Supreme Court in support of South Dakota’s petition.

JA President and CEO David J. Bonaparte called Friday’s decision a “major milestone” in the association’s long-standing fight to “level the playing field” between online and brick-and-mortar retailers.

“Now that the court has agreed to hear the case, we are optimistic that it will recognize that Quill does not reflect the retail landscape that exists today,” he said.

But Overstock.com, the only retailer of the three involved in the case that sells jewelry, sees it differently.

“States do not have the power to conscript individuals or organizations that do not have a physical presence within their state to do the state’s job of collecting sales tax,” said Jonathan Johnson, a member of Overstock.com’s board of directors. “It’s a straightforward notion. And disregard for the precedent would have severe consequences for businesses and individuals.”

He added that even if the Supreme Court decides to overturn Quill, Congress would still need to intercede in order to change federal law.

While that is true, Chris Fetzer of Haake Fetzer, the firm that lobbies on behalf of JA in Washington, said what can be expected if the Supreme Court rules to overturn Quill is states that have not already done so will move to pass laws to require retailers to collect and remit sales and use taxes, regardless of whether or not they have a physical presence in the state.

“Quill,” he observed, “would no longer be the law of the land.”

Congressional action wouldn’t be necessary in that case, but Congress would still have a role because only it can pass a federal framework for sales and use tax collection. Otherwise, Fetzer said, retailers would be required to adhere to a patchwork framework on a state-by-state basis of potentially disparate laws.

It is also worth noting that Rep. Bob Goodlatte (R-Va.), chairman of the House Judiciary Committee and a longtime opponent of online sales tax legislation, announced in November that he will not seek re-election, and so he will not be in Congress anymore come January 2019.

The Latest

It is believed the 24-karat heart-shaped enameled pendant was made for an event marking the betrothal of Princess Mary in 1518.

The AGTA Spectrum and Cutting Edge “Buyer’s Choice” award winners were announced at the Spectrum Awards Gala last week.

Launched in 2023, the program will help the passing of knowledge between generations and alleviate the shortage of bench jewelers.

The “Kering Generation Award x Jewelry” returns for its second year with “Second Chance, First Choice” as its theme.

Sourced by For Future Reference Vintage, the yellow gold ring has a round center stone surrounded by step-cut sapphires.

The clothing and accessories chain announced last month it would be closing all of its stores.

Criminals are using cell jammers to disable alarms, but new technology like JamAlert™ can stop them.

The “Zales x Sweethearts” collection features three mystery heart charms engraved with classic sayings seen on the Valentine’s Day candies.

The event will include panel discussions, hands-on demonstrations of new digital manufacturing tools, and a jewelry design contest.

Registration is now open for The Jewelry Symposium, set to take place in Detroit from May 16-19.

Namibia has formally signed the Luanda Accord, while two key industry organizations pledged to join the Natural Diamond Council.

Lady Gaga, Cardi B, and Karol G also went with diamond jewelry for Bad Bunny’s Super Bowl halftime show honoring Puerto Rico.

Jewelry is expected to be the No. 1 gift this year in terms of dollars spent.

As star brand Gucci continues to struggle, the luxury titan plans to announce a new roadmap to return to growth.

The new category asks entrants for “exceptional” interpretations of the supplier’s 2026 color of the year, which is “Signature Red.”

Entries for the jewelry design competition will be accepted through March 20.

The Ohio jeweler’s new layout features a curated collection of brand boutiques to promote storytelling and host in-store events.

From heart motifs to pink pearls, Valentine’s Day is filled with jewelry imbued with love.

Prosecutors say the man attended arts and craft fairs claiming he was a third-generation jeweler who was a member of the Pueblo tribe.

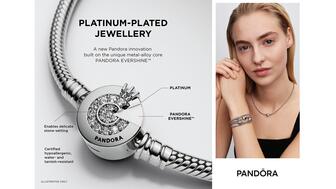

New CEO Berta de Pablos-Barbier shared her priorities for the Danish jewelry company this year as part of its fourth-quarter results.

Our Piece of the Week picks are these bespoke rings the “Wuthering Heights” stars have been spotted wearing during the film’s press tour.

The introduction of platinum plating will reduce its reliance on silver amid volatile price swings, said Pandora.

It would be the third impairment charge in three years on De Beers Group, which continues to grapple with a “challenging” diamond market.

The Omaha jewelry store’s multi-million-dollar renovation is scheduled to begin in mid-May and take about six months.

The “Paradise Amethyst” collection focuses on amethyst, pink tourmaline, garnet, and 18-karat yellow gold beads.

The retailer credited its Roberto Coin campaign, in part, for boosting its North America sales.