Chris Blakeslee has experience at Athleta and Alo Yoga. Kendra Scott will remain on board as executive chair and chief visionary officer.

Survey lends insight into tax time

The average small business owner spends 40 hours and as much as $5,000 each year doing their taxes, a pre-April 15 survey just released by the National Small Business Association shows.

Washington--April 15, the day colloquially dubbed Tax Day that serves as the deadline for filing returns, is only a few days away, unfortunately.

Paying taxes is a burden that small businesses owners and individuals alike must bear and, as Benjamin Franklin so wisely pointed out, it’s the only certain thing in life besides death.

Each year, an organization called the National Small Business Association, or NSBA, conducts a survey of its members that delves into how much time they spend on their federal taxes, what sections of the tax code they find most frustrating and how much it costs them. The NSBA is a Washington, D.C.-based nonpartisan advocacy group for small business owners in the United States, with 65,000 members in every state and representing all industries.

The results of the 2015 survey show that when asked how much time they spend each year dealing with their federal taxes--i.e., calculating payroll and other business-related taxes, filing reports, working with their accountant, estate planning, etc.--the greatest percentage of survey-takers, 23 percent, said 21 to 40 hours while the second-highest percentage, 22 percent, spend 120 hours or more.

For 47 percent of those surveyed, the preparation of their taxes costs them between $1,001-$5,000 (28 percent) or $5,001-$10,000 (19 percent)--and that’s not even including any amount the business owner might owe to the federal government.

The NSBA states in its summary of the survey results that the time and money spent preparing taxes--coupled with the fact that 85 percent of small business owners reported that on top of it all, they still have to pay an accountant to actually do the taxes--ought to be a “clear signal that the tax code is far too complex.”

Other insights for the survey include:

--Nearly half of small business owners file and pay on time (49 percent). The second-highest percentage reporting filing and paying under extension (27 percent);

--In terms of both administration and cost, survey-takers ranked payroll taxes as the most burdensome; and

--Sixty-seven percent said that federal taxes have a significant to moderate impact on the day-to-day operation of their business, while 59 percent said credit and deductions have a significant to moderate influence over decisions related to their company and employees.

This is the fifth year that the NSBA has conducted its Small Business Taxation Survey. It was distributed online between March 13 and 14 and surveyed more than 675 small business owners.

A total of 8 percent those surveyed reported being in the retail trade when asked to describe the industry or sector in which their business operates.

The entire report can be downloaded at NSBA.biz.

The Latest

Kimberly Miller has been promoted to the role.

The “Serenity” charm set with 13 opals is a modern amulet offering protection, guidance, and intention, the brand said.

How Jewelers of America’s 20 Under 40 are leading to ensure a brighter future for the jewelry industry.

“Bridgerton” actresses Hannah Dodd and Claudia Jessie star in the brand’s “Rules to Love By” campaign.

Founded by jeweler and sculptor Ana Khouri, the brand is “expanding the boundaries of what high jewelry can be.”

The jewelry manufacturer and supplier is going with a fiery shade it says symbolizes power and transformation.

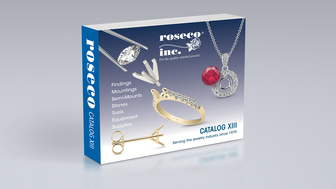

Roseco’s 704-page catalog showcases new lab-grown diamonds, findings, tools & more—available in print or interactive digital editions.

The singer-songwriter will make her debut as the French luxury brand’s new ambassador in a campaign for its “Coco Crush” jewelry line.

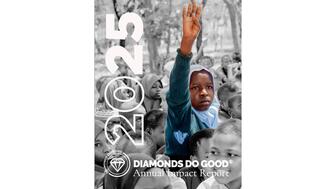

The nonprofit’s new president and CEO, Annie Doresca, also began her role this month.

As the shopping mall model evolves and online retail grows, Smith shares his predictions for the future of physical stores.

The trade show is slated for Jan. 31-Feb. 2 at The Lighthouse in New York City's Chelsea neighborhood.

January’s birthstone comes in a rainbow of colors, from the traditional red to orange, purple, and green.

The annual report highlights how it supported communities in areas where natural diamonds are mined, crafted, and sold.

Footage of a fight breaking out in the NYC Diamond District was viewed millions of times on Instagram and Facebook.

The supplier has a curated list of must-have tools for jewelers doing in-house custom work this year.

The Signet Jewelers-owned store, which turned 100 last year, calls its new concept stores “The Edit.”

Linda Coutu is rejoining the precious metals provider as its director of sales.

The governing board welcomed two new members, Claire Scragg and Susan Eisen.

Sparkle with festive diamond jewelry as we celebrate the beginning of 2026.

The master jeweler, Olympian, former senator, and Korean War veteran founded the brand Nighthorse Jewelry.

In its annual report, Pinterest noted an increase in searches for brooches, heirloom jewelry, and ‘80s luxury.

Executive Chairman Richard Baker will take over the role as rumors swirl that a bankruptcy filing is imminent for the troubled retailer.

Mohr had just retired in June after more than two decades as Couture’s retailer liaison.

Shekhar Shah of Real Gems Inc. will serve as president of the Indian Diamond & Colorstone Association in 2026.

This year’s good luck charm features the mythical horse Pegasus, and is our first Piece of the Week of the new year.

Articles about crime, engagement rings, and a necklace worn in the World Series generated the most interest among readers.