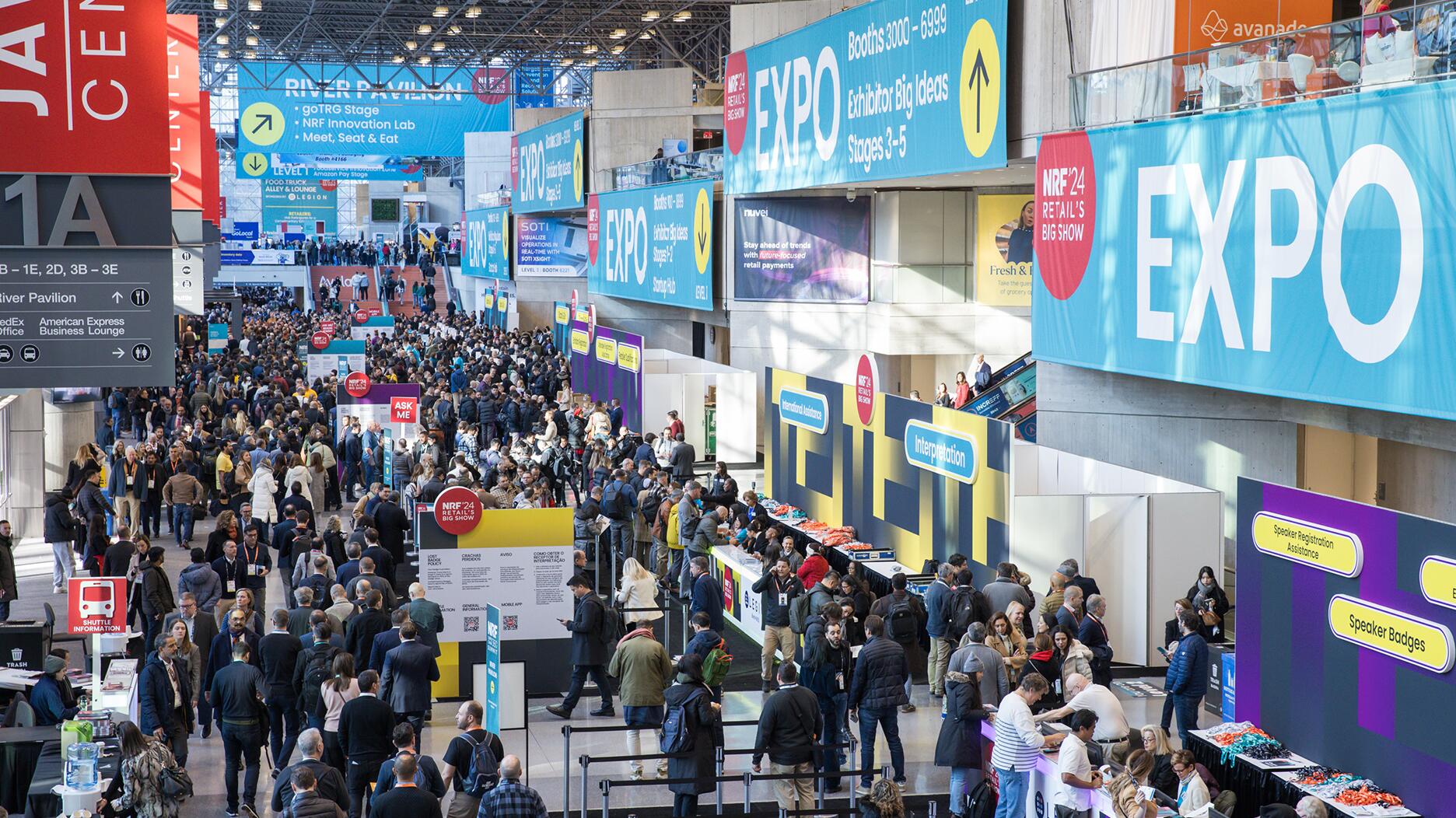

5 Things to Know About Consumers in 2024

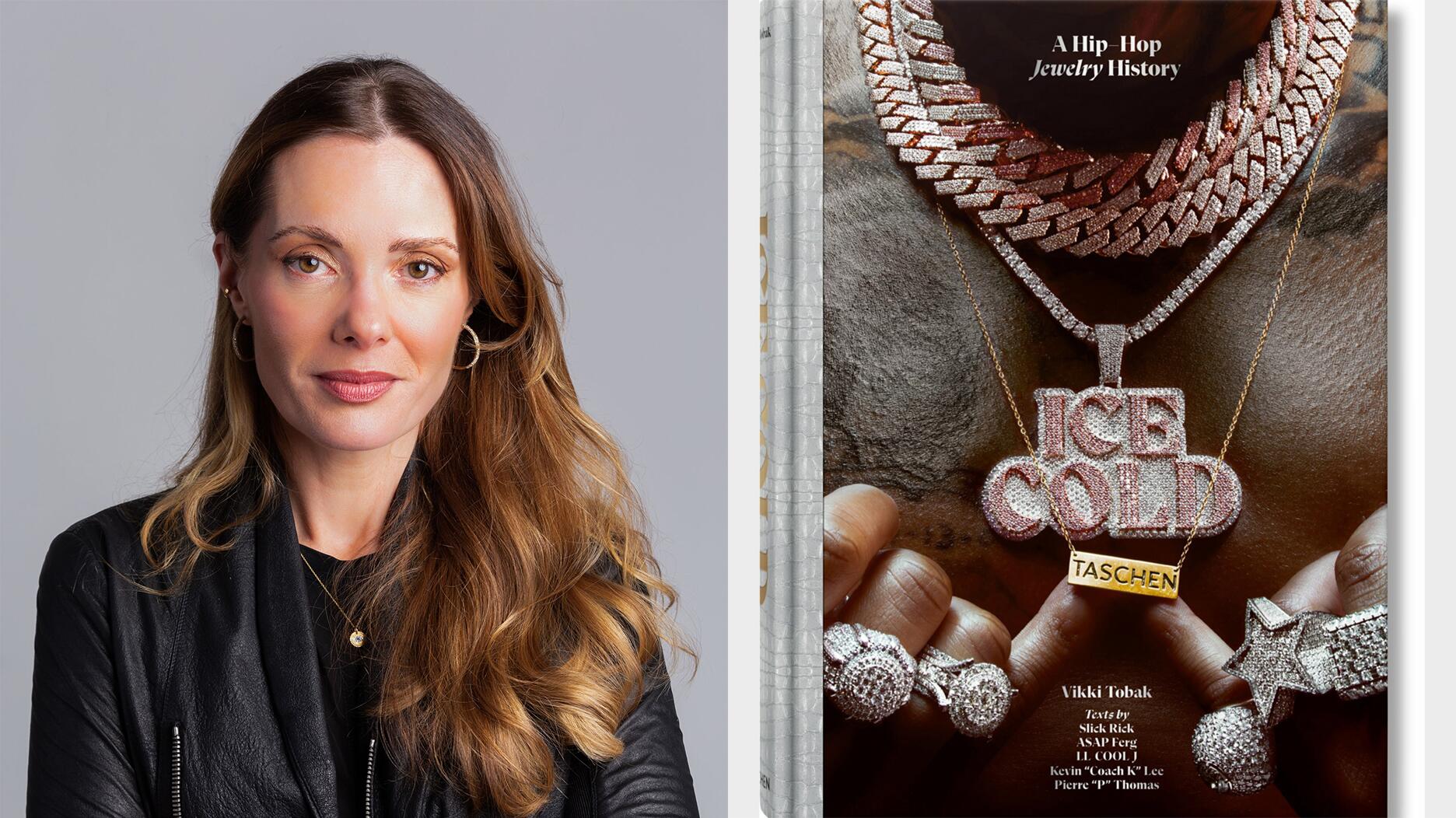

Associate Editor Lenore Fedow shares takeaways from the NRF’s annual show and its “State of Retail & the Consumer” event.

During the show, NRF Chief Economist Jack Kleinhenz held a press briefing about the state of the economy, inviting analyst Brian Nagel of Oppenheimer and Kenneth Kim, a senior economist at KPMG, to share their insights and predictions for the year ahead.

Late last month, NRF also held its “State of Retail & the Consumer” event online, sharing its forecast for 2024.

From the effects of inflation to the upcoming generational transfer of wealth, these are the key insights into consumer behavior.

Consumers surprised many economists last year.

For insight into the year ahead, Kleinhenz and his panelists looked back on 2023, an eventful year that, economically speaking, turned out better than many had expected.

“When we look back to 2023, it was full of a lot of inconsistencies and uncertainties,” said Kleinhenz.

“Clearly, inflation was our tension, but there were other important developments,” he said, including regional bank failures and the Federal Reserve raising rates despite “very poor” consumer confidence, as well as geopolitical issues.

Nevertheless, he said, his current assessment was that the economy is doing “pretty well.”

“Consumers really kept the economy maneuvering through all of these different issues. And they were expected to do just the opposite of what they did. With the Fed tightening and high interest rates and concerns about recession, you would’ve thought the consumer would’ve stepped back a bit, but, indeed, they didn’t.”

As economists give their 2024 predictions, it may not be wise to bet against the consumer again.

We’ll see “moderate but steady” growth this year.

In its recent forecast, shared during the March event, the NRF said it expects retail sales will increase in 2024 between 2.5 and 3.5 percent to $5.23 trillion to $5.28 trillion in 2024.

Echoing Kleinhenz’s comments on the panel, NRF CEO Matthew Shay credited the strength of the consumer.

“The resiliency of consumers continues to power the American economy, and we are confident there will be moderate but steady growth through the end of the year,” said Shay in a statement.

“Successful retailers offer consumers products and services when, where, and how they want to shop with prices they want to pay.”

The NRF’s 2024 sales forecast is slightly lower than the 3.6 percent retail sales growth recorded in 2023. It is in line with the 10-year pre-pandemic average annual sales growth of 3.6 percent.

Non-store and online sales, which are included in the total, are expected to grow between 7 and 9 percent year-over-year to a range of $1.47 trillion to $1.50 trillion. In 2023, non-store and online sales totaled $1.38 trillion.

NRF said it expects full-year GDP growth of around 2.3 percent, lower than the 2.5 percent the United States saw in 2023, but strong enough to sustain job growth.

Inflation also is expected to moderate to 2.2 percent on a year-over-year basis, said NRF, due to a cooling economy, a more balanced labor and product market, and retreating housing costs.

Kleinhenz added, “The economy is primarily supported by consumers who have shown much greater resilience than expected, and it’s hard to be bearish on the consumer. The question for 2024 ultimately is, will consumer spending maintain its resilience?”

To better understand consumer spending, look to the jobs reports.

A theme among the panelists’ conversations at Retail’s Big Show was that consumers often say one thing but do another, meaning that even when consumer confidence was down in 2023, spending continued.

Oppenheimer’s Nagel noted that he doesn’t use consumer confidence surveys as a predictor of consumer spending anymore, instead turning to other metrics.

“I know it sounds oversimplified, but the vast majority of spending decisions in the United States are driven by jobs,” he said.

“If the consumer has a job, if they feel comfortable keeping that job, if they can get another job, that’s what drives their spending.”

Kim of KPMG also noted the disconnect between consumer sentiment and consumer behavior.

To Kim, the primary reason for the disconnect was consumers being “shocked” by how high gas prices and food prices climbed.

“It was certainly a shock and that’s why the consumer sentiment and attitudes were soured by the [amount] consumers’ households were paying for everyday goods and services,” he said.

That might seem like it would result in lower spending, but it didn’t, he said, because of the job market.

“People had the wherewithal to continue to pay for goods and services because the economy’s creating new jobs. Companies were hiring so people were spending.”

He added that consumer attitudes and consumer spending aren’t always so misaligned, but COVID “really turned the economy upside down, not just in the U.S., but throughout the world.”

Economist Kleinhenz concluded, “My belief is the strength of consumer spending through 2024 is still going to be supported by job growth.”

In its retail sales forecast, the NRF said it expects about 100,000 fewer jobs on average per month compared with 2023 and for the unemployment rate to average 4 percent for the full year.

Be aware of the upcoming generational wealth transfer.

While inflation has many consumers struggling to make ends meet, some lucky younger shoppers may soon come into money.

Economists have been discussing the massive wealth transfer occurring in the United States, with older generations leaving their money and assets to younger generations.

Wealth management firm Cerulli Associates has forecast that wealth transferred through 2045 will total $84.4 trillion, with $72.6 trillion in assets left to heirs while $11.9 trillion will be donated to charities.

More than $53 trillion is expected to be transferred from baby boomers, representing 63 percent of all transfers, likely to their Gen X, millennial, and Gen Z heirs.

Those in the Silent Generation and the remaining members of the Greatest Generation will transfer an estimated $15.8 trillion, which will primarily take place over the next decade, said Cerulli Associates.

Notably, this transfer of wealth likely won’t extend to the average-income shopper in a meaningful way.

About $35.8 trillion (42 percent) of the overall total volume of transfers is expected to come from high-net-worth and ultra-high-net-worth households, which together only make up 1.5 percent of all households, said the firm.

Still, it’s worth noting that a new group of people may have more money to spend.

During the panel at the NRF’s Big Show, the topic of the “wealth effect” came up, which is an economic behavioral theory that suggests consumers spend more when their wealth increases, like through inheriting money, even if their income doesn’t.

“I tend to think that the wealth effect is definitely a driver of spending,” said Nagel, particularly discretionary spending on luxuries such as jewelry and travel. “That combined with jobs very much contributes to spending.”

Kim added, “Hopefully, you have a good relationship with your parents or otherwise it’s going to be going to your grandkids. There’s going to be the biggest intergenerational transfer of wealth.”

The rise of Buy Now, Pay Later means more spending, but possibly also more debt.

Buy Now, Pay Later (BNPL) services, like Klarna and Afterpay, have been growing in popularity in recent years.

Shoppers have been making use of these new-age layaway services, particularly over the 2023 holiday season.

Consumers spent an all-time high of $16.6 billion online using BNPL services during the holidays, a 14 percent increase year-over-year, according to an Adobe Analytics report.

In 2023, consumers spent a total of $75 billion online with these services, also up 14 percent year-over-year.

In a high interest rate environment, this may pose a problem for those unable to pay on time.

“From an overall macro standpoint, the economy is still doing well, but there are pockets of consumers who are struggling,” said Kim.

Delinquency rates are going up, he said, as is the number of people who are a month behind on their credit card, mortgage, and car loan payments, though not at the levels seen around the 2008 financial crisis.

“There are segments of the population that are struggling with the higher interest rates with the extended payment plans. Hopefully, rates will at least be set lower in 2024 and give them some relief,” said Kim.

The Latest

The deal gives the retailer control over the distribution of Roberto Coin jewelry in the U.S., Canada, Caribbean, and Central America.

Show your mother some love with a piece of fine jewelry.

The company’s Easton location will remain open.

Tradeshow risks are real. Get tips to protect yourself before, during and after and gain safety and security awareness for your business.

Brian D. Fleming of Carla Corporation was elected to serve a one-year term in the role.

Sponsored by the Las Vegas Antique Jewelry and Watch Show

M.S. Rau is set to open a seasonal gallery in the high-end resort town early next month.

Meet Ben Claus—grand prize winner of For the Love of Jewelers 2023 Fall Design Challenge.

The branded jewelry market is thriving, said Richemont Chairman Johann Rupert.

The six designers, all participants in the show’s Diversity Action Council mentorship program, will exhibit in Salon 634.

The highlight of his collection is the coveted Patek Philippe Grandmaster Chime, which could sell for up to $5 million.

The “Venetian Link” series modernizes the classic Veneziana box chain in its bracelets and necklaces.

The Seymour & Evelyn Holtzman Bench Scholarship will provide tuition assistance to two low-income students.

The Swiss watchmaker said the company’s plans to use a new version of the Hallmark crown on jewelry would confuse consumers.

The executive talked about the importance of self-purchasers and how fuel cell electric vehicles are going to fuel demand for platinum.

The Indian jeweler’s new store in Naperville, Illinois marks its 350th location, part of its ongoing global expansion plans.

It will award a graduating high school student with about $10,000 toward a GIA diploma and an internship with the Seattle-based jeweler.

Wheat Ridge, Colorado police took a 50-year-old man into custody Wednesday following a two-month search.

PGI partnered with four new and seven returning designers for its annual platinum capsule collection.

Nicolosi, president and CEO of The Kingswood Company, previously sat on WJA’s board from 2011 to 2018.

Karina Brez’s race-ready piece is a sophisticated nod to the horse-rider relationship.

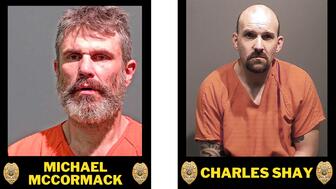

The men are allegedly responsible for stealing millions in jewelry and other valuables in 43 burglaries in 25 towns across Massachusetts.

“Horizon” invites individuals to explore the limitless possibilities that lie ahead, said the brand.

The jeweler credits its recent “Be Love” campaign and ongoing brand revamp for its 17 percent jump in sales.

The co-founder of Lewis Jewelers was also the longtime mayor of the city of Moore.

Elvis Presley gifted this circa 1967 gold and diamond watch to Dodie Marshall, his co-star in “Easy Come, Easy Go.”